Top 10 at 11: ASX springs to life as HitIQ leads the small cap charge

ASX springs back to life on Thursday. Pic: Getty Images

Morning, and welcome to Stockhead’s Top 10 (at 11… ish), highlighting the movers and shakers on the ASX in early-doors trading.

With the market opening at 10am sharp eastern time, the data is taken at 10.15am in the east, once trading kicks off in earnest.

In brief, this is what the market has been up to this morning.

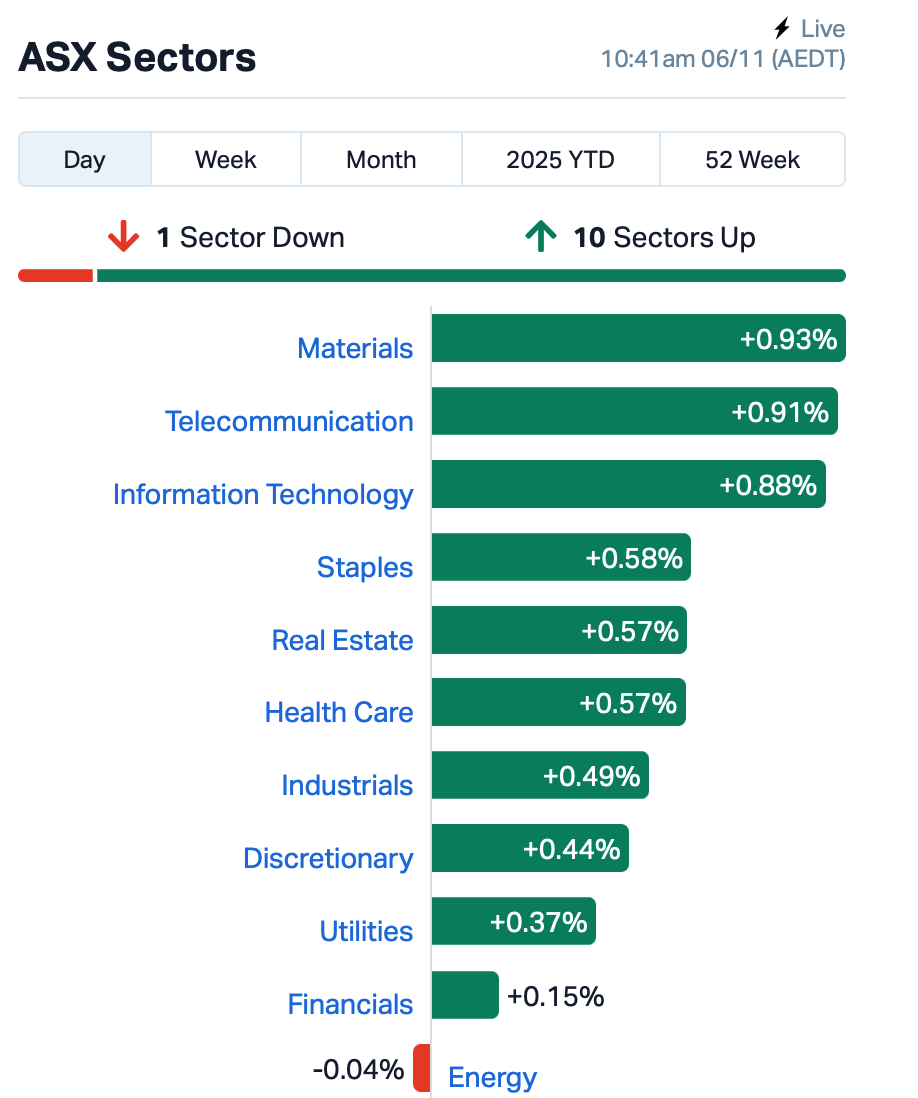

The ASX kicked off Thursday with a spring in its step, up about 0.58% at the time of writing and glowing green across 10 out of 11 sectors.

It’s the kind of broad rally that feels like the market just remembered things aren’t all that bad after all.

Wall Street set the tone overnight with another “buy the dip” bounce, helped by data showing the US economy still running hot but not yet overheating.

US bond yields ticked higher, but no one seemed to care; the mood was too good.

Even Bitcoin perked up again, now trading above US$104k after flirting with double-digit lows, as if to say, “Relax, I’m not dead. Again. I mean, how many times do I have to tell you guys?”

Back home, gold stocks are shining this morning, riding the upbeat market mood.

Investors also tuned in to NAB’s announcement, where it posted a steady and solid full year results.

NAB posted a 1% lift in underlying profit for FY25, helped by stronger momentum in the second half and a 7% rise in deposits.

And in the small-cap land, things are also looking lively, with a couple of early standouts punching above their weight.

SMALL CAP WINNERS

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NTM | Nt Minerals Limited | 0.003 | 50% | 500,000 | $2,421,806 |

| AYM | Australia United Min | 0.004 | 33% | 137,770 | $5,527,732 |

| HLX | Helix Resources | 0.002 | 33% | 50,000 | $8,019,436 |

| HCL | Highcom Ltd | 0.295 | 31% | 466,583 | $23,103,601 |

| HIQ | Hitiq Limited | 0.019 | 27% | 268,524 | $7,304,737 |

| FRX | Flexiroam Limited | 0.022 | 22% | 1,935,783 | $27,313,175 |

| ZNO | Zoono Group Ltd | 0.056 | 22% | 897,439 | $18,685,741 |

| XPN | Xpon Technologies | 0.017 | 21% | 3,109,648 | $6,864,989 |

| NYM | Narryermetalslimited | 0.040 | 18% | 10,000 | $5,985,863 |

| MRD | Mount Ridley Mines | 0.055 | 17% | 20,923,711 | $56,103,038 |

In the news…

HitIQ (ASX:HIQ) has scored a major win, with Monash University choosing its PROTEQT mouthguard technology for a new $799k Australian Research Council-funded brain injury study.

The project will combine real-time impact data from HITIQ’s instrumented mouthguards with biomarker analysis to set clearer thresholds for concussion and brain injury risk.

Monash has already committed to buying 400 units worth $200,000 in January 2026, giving the deal both scientific and commercial weight.

Zoono Group (ASX:ZNO) has signed an exclusive five-year deal with South Africa’s biggest packaging group, Mpact, to use its antimicrobial technology on corrugated food packaging for fruit exports like grapes and berries.

The agreement, worth at least NZ$5.1 million in minimum orders, builds on Zoono’s expansion in the UK and Europe with partner OSY. Its technology extends the shelf life of fresh produce.

SMALL CAP LAGGARDS

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AKN | Auking Mining Ltd | 0.006 | -20% | 8,691,297 | $6,150,232 |

| IMC | Immuron Limited | 0.068 | -20% | 4,661,902 | $22,895,074 |

| ENT | Enterprise Metals | 0.004 | -20% | 12,023,008 | $7,470,753 |

| SFG | Seafarms Group Ltd | 0.002 | -20% | 14,961 | $12,091,498 |

| NAE | New Age Exploration | 0.003 | -17% | 1,024,406 | $9,923,996 |

| PLC | Premier1 Lithium Ltd | 0.005 | -17% | 16,229,056 | $2,208,363 |

| RNX | Renegade Exploration | 0.004 | -13% | 2,116,487 | $8,279,187 |

| AM5 | Antares Metals | 0.009 | -10% | 117,200 | $5,148,529 |

| LEG | Legend Mining | 0.009 | -10% | 347,650 | $29,144,772 |

| CMO | Cosmometalslimited | 0.020 | -9% | 690,731 | $9,553,428 |

Auking Mining (ASX:AKN) says the sale of the Cloncurry Gold Project to Orion Resources has been delayed after Orion couldn’t complete payment on the planned settlement date due to an unresolved vendor condition.

The parties are now working on a short extension to finalise the deal.

Separately, AuKing confirmed it won’t proceed with its proposed $16.2 million acquisition of Orion after the ASX ruled that additional shareholder and regulatory approvals would be required.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.