Top 10 at 11: ASX dips as US economy contracts in March quarter

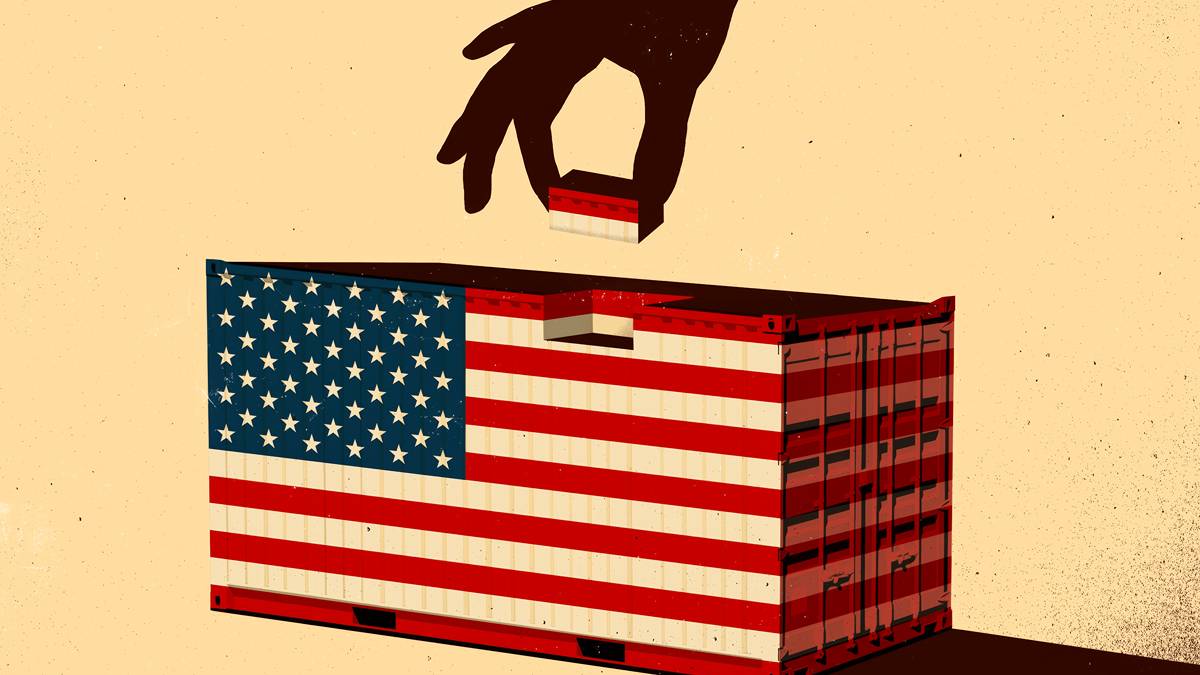

The ASX is struggling after a surge in US imports put the squeeze on US GDP, lopping 5pc off the March quarter read. Pic: Getty Images

Morning, and welcome to Stockhead’s Top 10 (at 11… ish), highlighting the movers and shakers on the ASX in early-doors trading.

With the market opening at 10am sharp eastern time, the data is taken at 10:15, once trading kicks off in earnest.

In brief, this is what the markets have been up to this morning.

The ASX is struggling in early morning trading, pushing against a riptide created by weakness in the US economy overnight.

The US economy contracted by 0.3% in the first quarter of the year, as US President Trump’s domestic and foreign policies took effect.

Economists were expecting a 0.4% gain, but an unexpected 41.3% rise in imports subtracted from overall GDP, taking 5% off the headline reading.

Despite that, the blue-chip Dow rose 0.4% and the S&P500 0.2%, but the Nasdaq fell 0.1%.

In the month of April, the Nasdaq stood out with a 0.9% gain while the Dow has fallen 3.2% overall and the S&P500 0.8%.

European shares rose, helped along by a 1.2% uptick in healthcare stocks.

The FTSE300 lifted 0.5% but was down 1.5% for the month, while the UK FTSE100 gained 0.4%, but was down 1.0% over April.

The ASX has had a wobbly start to the morning, down just 0.08% at time of writing, with 5 sectors down and 6 up.

Interestingly, Info Tech is leading the gainers on the bourse today, up 2.04% despite the Nasdaq’s minor losses in the US overnight.

Resource stocks are pulling in the other direction, with the materials sector down 1.35% at present.

Now, onto our top 10 small cap winners (and laggards) for the morning…

WINNERS

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.0015 | 50% | 287767 | $4,109,881 |

| EEL | Enrg Elements Ltd | 0.0015 | 50% | 4910073 | $3,253,779 |

| PAB | Patrys Limited | 0.003 | 50% | 170000 | $4,114,895 |

| ADN | Andromeda Metals Ltd | 0.019 | 36% | 19800137 | $48,002,188 |

| CAV | Carnavale Resources | 0.005 | 25% | 176000 | $16,360,874 |

| ADG | Adelong Gold Limited | 0.006 | 20% | 331500 | $6,987,431 |

| FRX | Flexiroam Limited | 0.006 | 20% | 81250 | $7,586,993 |

| NES | Nelson Resources. | 0.003 | 20% | 10676742 | $5,429,819 |

| SPX | Spenda Limited | 0.006 | 20% | 1066666 | $23,076,077 |

| TMK | TMK Energy Limited | 0.003 | 20% | 629590 | $25,555,958 |

Making news this morning…

Andromeda Metals (ASX:ADN) has taken a big step down the path to commercialisation for its high purity alumina, successfully refining kaolin from the Great White Project to a purity of 99.9985%. Those numbers place it in the highest tiers of HPA, suitable for battery, semiconductor, ceramic and future tech applications. Demand for the critical mineral is predicted to outstrip supply by 48% by 2028.

LAGGARDS

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SFG | Seafarms Group Ltd | 0.001 | -33% | 45000 | $7,254,899 |

| 1TT | Thrive Tribe Tech | 0.0015 | -25% | 65424 | $4,063,446 |

| SPN | Sparc Tech Ltd | 0.165 | -21% | 294918 | $20,133,319 |

| ADY | Admiralty Resources. | 0.004 | -20% | 440614 | $13,147,397 |

| BPH | BPH Energy Ltd | 0.008 | -20% | 281286 | $12,182,328 |

| BLG | Bluglass Limited | 0.013 | -19% | 2038005 | $29,448,965 |

| AUR | Auris Minerals Ltd | 0.005 | -17% | 3995 | $2,859,756 |

| ARN | Aldoro Resources | 0.4 | -16% | 305205 | $84,270,788 |

| RNX | Renegade Exploration | 0.003 | -14% | 2000832 | $4,509,272 |

| VR1 | Vection Technologies | 0.0155 | -14% | 4536824 | $27,549,994 |

Seafarms Group (ASX:SFG) has found itself under a bit of a cloud after several of its current and former directors were served with an originating application seeking discovery of documents from entities associated with Jan Cameron.

The Cameron Group is investigating several announcements made on the ASX in 2020, 2021 and 2022, attempting to form a view on whether they were reasonable representations of future matters and therefore un-actionable.

The affidavit indicates the Group has no intention to bring a claim against Seafarms itself, and it is not a named party in the application.

Sparc Technologies (ASX:SPN) share slipped after the company raised $2.7m through a placement and share placement plan, offering shares at $0.15 each compared to its current market price of $0.175.

BluGlass (ASX:BLG) fell for similar reasons, raising $2.3m in a placement and launching a share placement offer to raise up to $6m in additional funding. The shares are being offered at a 2.5% discount to the company’s 5-day VWAP.

At Stockhead, we tell it like it is. While Andromeda Metals is a Stockhead advertiser, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.