Top 10 at 10-ish: Great White win for Andromeda, but things aren’t so great for EMS

Yes, I know it's late... but there's no point crying over spilt latte. Pic via Getty Images.

Stockhead’s Top 10 at 11, published at ~10.30am each trading day, highlights the best (and worst) performing ASX stocks in morning trade using live data.

It’s a short, sharp update to help frame the trading day by showing the biggest movers in percentage terms.

The market opens at 10am (eastern time) and the data is taken at 10:15am, once every ASX stock has started trading.

WINNERS

Stocks highlighted in yellow have made market-moving announcements (click headings to sort).

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MRQ | Mrg Metals Limited | 0.003 | 50% | 566,586 | $4,371,837 |

| RDN | Raiden Resources Ltd | 0.0245 | 29% | 39,387,934 | $39,050,110 |

| BME | Blackmountainenergy | 0.027 | 29% | 8,320,269 | $3,847,708 |

| ADN | Andromeda Metals Ltd | 0.034 | 21% | 18,681,330 | $87,080,236 |

| IGN | Ignite Ltd | 0.072 | 20% | 8,200 | $5,374,931 |

| BPP | Babylon Pump & Power | 0.006 | 20% | 1,647,492 | $12,288,857 |

| TKL | Traka Resources | 0.006 | 20% | 1,000,000 | $4,356,646 |

| MHK | Metalhawk. | 0.13 | 18% | 111,238 | $8,664,811 |

| EPY | Earlypay Ltd | 0.175 | 17% | 254,740 | $43,489,304 |

| LAM | Laramide Res Ltd | 0.7 | 17% | 212 | $762,691 |

Andromeda Metals (ASX:ADN) is up this morning on news of an updated Definitive Feasability Study for its Great White halloysite kaolin project.

The Great White Project Net Present Value (NPV) increased by 65% to $1,010 million, and average annual earnings before interest tax depreciation and amortisation (EBITDA) increased by 59% to $130 million.

“The 2023 DFS represents the outcome of a rigorous commercial and business strategy review for commercialising our construction ready project, to meet rising market demand,”says Bob Katsiouleris, CEO and managing director of Andromeda.

“As we move to finalising debt funding, the 2023 DFS will underpin our funding strategy for the remaining capital required to move towards anticipated construction and into production.”

Raiden Resources is back in the headlines this morning, adding to yesterday’s 58% jump that came after news that the company has found swarms of outcropping and interpreted pegmatites of up to 30m width at surface at Raiden’s Andover South project, right next door to one of the market’s larger current darlings, Azure Minerals (ASX:AZS).

Black Mountain Energy (ASX:BME) is piling on the kilos today, on news that the company’s now cash-richer by around $10.6 million, following the sale of 100% of its acreage and its title and interest in the MIA 64 FEE 2H well in the Permian basin.

It’s a very savvy deal for BME, as it’s only owned the site for about eight months, and only paid about $2 million for it. Since then, the company has quickly progressed its technical understanding, participated in the drilling of a first appraisal well into the 3rd Bone Spring interval (estimated cost of approximately US$1.4m) and has now realised a strong cash offer of US$6,873,308 (around $10.7 million) before tax.

LOSERS

Stocks highlighted in yellow have made market-moving announcements (click headings to sort).

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| EMS | Eastern Metals | 0.04 | -23% | 150,018 | $3,460,071 |

| OPN | Oppenneg | 0.011 | -21% | 50,000 | $15,633,515 |

| NC6 | Nanollose Limited | 0.059 | -14% | 4,285 | $10,273,159 |

| TRE | Toubaniresourcesinc | 0.125 | -14% | 83,333 | $14,818,855 |

| JDO | Judo Cap Holdings | 1.095 | -13% | 1,066,019 | $1,398,482,638 |

| IFL | Insignia Financial | 2.56 | -12% | 1,851,082 | $1,928,160,884 |

| MOH | Moho Resources | 0.009 | -10% | 1,000,000 | $2,595,778 |

| RLG | Roolife Group Ltd | 0.009 | -10% | 50,000 | $7,205,581 |

| VMT | Vmoto Limited | 0.185 | -10% | 162,453 | $59,499,259 |

| RRR | Revolverresources | 0.14 | -10% | 22,571 | $18,034,111 |

Eastern Metals (ASX:EMS) has fallen significantly this morning, after results from its four-hole reverse circulation (RC) drilling program completed on the company’s Tara exploration licence, near the Currawalla mine shaft.

The results aren’t great, leaving ESM to ponder the next steps for the project.

“Drilling at Tara enabled us to test a hypothesis, and whilst REEs are present in lower concentrations than anticipated, the anomalous base metal results highlight the prospectivity of EL9180 and the Cobar Basin,” Eastern Metals CEO, Ms Ley Kingdom, said.

“Given the market’s current focus on REEs, we have investigated the high TREO assay results. Eastern Metals intends to further its understanding of REEs in its tenements, but our immediate focus is to acquire a JORC resource at Browns Reef in conjunction with systematic data acquisition to generate exploration targets over our broader tenement holding.”

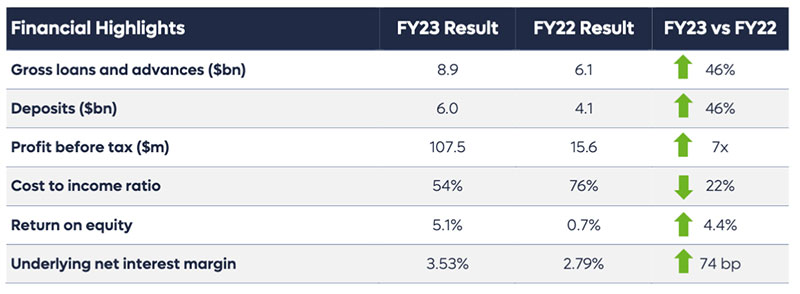

Judo Cap (ASX:JDO) has dropped this morning as well, despite its report this morning showing, at first glance, some fairly happy news.

And Insignia Financial (ASX:IFL) is falling this morning, after releasing its results showing a $191 million underlying net profit after tax, which is down 15% on pcp.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.