This weekend is looking TRÈS volatile

Pic via Getty Images

Let’s look at all the ways these markets keep ratcheting up the VOLATILITY…

- The NASDAQ 100 leads Wall Street on the volatile front and continues to bloom unpredictability, as the market whipsawed and pulled back a bit in the early hours on Wednesday

- Currencies: Yen crosses are tres volatile as they approach intervention levels and now the Euro bears out there reckon it’s time for parity with the USD

- Volatility spike: US, European, Aussie, local, regional and global equities

- Bitcoin: always tres volatile

- Then again: Volatility is extremely low in the commodity sphere, because prices are largely shot to ship

- La France: Toujours tres volatile… but this time also gone tres nuts and peut-être tirer le pays dans le pied

In Europe this week, la volatility in stock indices has amped right up on the back of a très worrying combo of French politics and French debt situation that the EU is currently facing.

The CAC 40 dropped 1% to close at 7,531 on Thursday, making a hat-trick of lost sessions.

There’s a lot to worry about.

Fear of inflation trouble resurfaced ahead of key global inflation reports, including the US PCE inflation and preliminary inflation figures for France, Spain, and Italy.

For now there’s angst around the upcoming Biden-Trump debate. But most of all – the first round of French parliamentary elections.

Overnight, the true experts on volatility – the crazy cats running the Bank of England – decided to raise the stakes and heighten the fear by chiming in with a warning that this weekend’s French elections could ignite all sorts of global financial instability and loopy market volatility.

The BoE has form and balls when it comes to pointing out how everyone else could mess up their good work. There’s little mention of what impact the UK’s upcoming general election on July 4 might have.

Still, there’s more than 80 countries – more than half the world’s population –heading to the polls this year.

“Policy uncertainty associated with upcoming elections globally has increased,” the Bank’s financial stability report said. Questions over a country’s political direction could amplify geopolitical risks, increase government borrowing costs, and lead to further global fragmentation, in a way that was “relevant to UK financial stability”, it said.

But of course, it’s the French we should be freaking out about.

The BoE warning comes as the latest opinion polls put the populist National Rally (RN) party of far-right leader Marine Le Pen within historic distance of securing a parliamentary majority.

Her Trump card is Jordan Bardella, a brave, bold and media-savvy 28-year-old with a gift for going viral. Bardella boasts 1.42 million buds on TikTok, while French President Emmanuel Macron has about 4.5 million.

@jordanbardellaSanté ! ♬ son original – Jordan Bardella

But Bardella’s doing something no-one’s ever done. Made Macron look old.

Le Monde would like to show how the left-leaning French President Emmanuel Macron has the support of left-leaning Frenchies after he called le snap general election following the success of far-right-leaning French parties in the EU elections earlier this month.

But even from this distance it just doesn’t look like there’s enough fire in the belly of the left to stop the inevitable…

Fired up protestors vs right-wing French nationalism…

The French right-wing success in the European elections isn’t too much of a surprise. Yet, the EU is gobsmacked.

And so are financial markets, says XM Australia CEO Peter McGrath:

“What is widely perceived as an attempt by Macron to reassert his authority in the French parliament after his party lost its majority at the previous election in 2022… the move appears to have backfired.”

The first round of the election is to be held on June 30 followed by a final round a week later.

According to the polls, the governing party – President Macron’s Renaissance – is set to lose power although the final outcome of the election is uncertain.

“Financial markets have responded with alarm at the possibility of the far-right National Rally (RN), led by Marine Le Pen, forming a government,” McGrath told Stockhead.

“Macron was probably hoping that the mere threat of Marine Le Pen’s National Rally or Rassemblement National (RN) party coming into power after it won the most French seats in the European Parliament would have been a wake up call for other parties, as well as the French public, to unite against the far right.

“But that didn’t happen.”

With only a few days to go until the first round of voting on June 30, the Ensemble coalition led by Macron’s Renaissance Party is looking shot.

They’re way out back in a dismal third according to in the opinion polls, overtaken by the newly formed alliance of left-wing parties called the New Popular Front (Nouveau Front Populaire – NFP).

Meanwhile, RN has widened its lead, with most polls putting it ahead with at least 35% of the vote.

However, that may not necessarily translate to enough seats for RN to obtain an absolute majority in the 577-member National Assembly where 289 seats are required to control the legislative agenda in France’s lower house. This then raises a host of possibilities as to who could form a government.

Talks between RN and an even more hardline far-right party, Reconquete, which belongs to Le Pen’s rival, Eric Zemmour, crumbled soon after the announcement of le snap elections.

Since then, RN’s 28-year-old firebrand Jordan Bardella has done his best to show how not interested he is in sharing power with anyone, certainly not the other parties.

He wants the absolute majority. And while that might not work for justice, it could work for markets.

Euro trashing

The euro fell for two days in a row against the dollar and the CAC 40 was down more than 6% in the days following the election announcement.

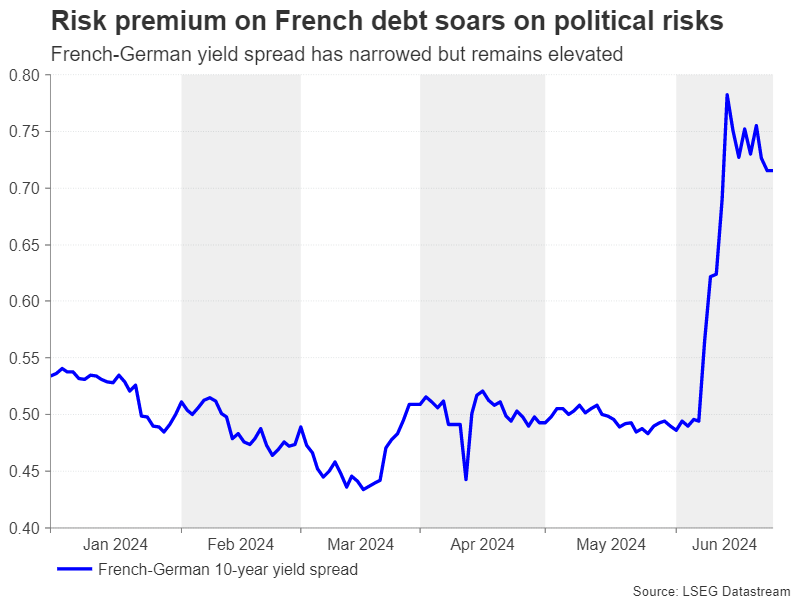

Meanwhile the chasm between French and German 10-year government bond yields – a decent measurement of risk premium on French government bonds – reached its highest point since February 2017.

A high share of foreign holdings makes French government bonds vulnerable, and a further rise in spreads could have wider implications for the euro.

France has a high percentage of foreign investors in its general government debt (% of total).

Foreign holders of French debt

Going Right-stream

This can be seen as being both a positive and negative move.

RN is clearly trying to appeal to mainstream voters to secure the majority it needs and in doing so, it has had to tone down some of its more controversial, let’s-make-France-assez bein-again ideas.

This is good news for the markets as it reduces the risk of an ex-UK PM Liz Truss-style debt crisis and what’d be a confrontational relationship with the European Union.

RN’s likely candidate for the post of finance minister has said the party would abide by the EU’s fiscal rules, while Bardella appears to have rowed back on a pledge to undo Macron’s pension reforms, which raised the retirement age to 64.

The party’s tried to be quick about softening its stance on many of its radical policies helped to calm investors’ fears, with the yield spread between French and German 10-year bonds declining somewhat from the post-European election spike.

McGrath says the euro has also been steadier but remains within its short-term downward trajectory amid the uncertainty about the outcome of the elections.

“If an RN majority was more certain, the euro might be under less pressure right now as Le Pen and Bardella seem to be taking the party in a similar direction as Italy’s Giorgia Meloni has done with her far-right Brothers of Italy party when she won the country’s election.”

Is the left the threat?

If RN wins the most seats but falls short of a majority, it’s still possible it would try to form some sort of a coalition with other parties, potentially with the right-wing Les Republicains, despite ruling it out for now.

The bigger fear is if the left-wing NFP comes a close second and manages to strike a deal with other smaller parties.

Its policies include increasing public sector pay by 10%, lowering the retirement age to 62 and boosting healthcare and education.

Although they plan to finance these by hiking taxes, experts reckon the amount raised wouldn’t cover the planned 150 billion euro outlay.

Markets don’t like it.

France already has a very high debt level of more than 100% of GDP and ran a budget deficit of 5.5% in 2023, in excess of the EU’s 3% limit.

“Any new government that triggers alarm bells about higher spending would likely spark another panic in the markets, sending French yields sharply higher and stocks lower.”

France’s leading stock index, the CAC 40, shed more than 7% as the political turmoil unfolded before rebounding somewhat.

Can Macron’s party hold onto power?

A less disastrous scenario for the markets is if Macron’s Ensemble coalition were to agree to a pact with the NFP simply to keep out the far right – this could be its only option of being in government given Macron’s plummeting approval ratings.

An alliance between the left and centrists parties would probably produce a more moderate government. But even if such a coalition can be agreed, it might not last long or struggle to pass much legislation.

In the event of a hung parliament, the president can play a role in pushing parties to reach a deal.

The president can also exercise his influence by picking the next prime minister, especially when there’s no clear winner and so the post does not necessarily go to someone from the largest party.

But with so many fractures across France’s political spectrum, it’s hard to see parties putting their differences aside for the sake of avoiding political instability.

Political paralysis

Under the French constitution, new parliamentary elections cannot take place for another year after the last one. So, if no parties are able to form a government, there would likely be political paralysis for at least a whole year or until Macron’s term expires in 2027.

If push comes to shove, Macron may decide to stand down before then, even though he has said he would not do so.

“For currencies and financial markets in general, there is nothing more dreaded than uncertainty,” McGrath says.

“So the prospect of a prolonged period of uncertainty in the Eurozone’s second largest economy does not bode well for the euro.”

And making matters worse: growing fears about the rise of far right parties elsewhere in the EU.

In Germany, the ruling centrist coalition is hanging by a thread.

Currency Volatility: Euro bears eye dollar parity

Meanwhile, despite some signs of stabilisation in the continent, the euro remains in the upper end of its volatility range against major currencies.

McGrath notes that against the US dollar, the single currency has ‘already taken quite a tumble’, slipping from the $1.0900 level to lows of around $1.0670.

“With the final results of the election not due until after the second round on July 7, the euro could continue drifting downwards, possibly towards the April low of $1.0599.”

McGrath says the heightened political risks that have rekindled fears of a fresh debt crisis and are already weighing on business sentiment, endangering the Eurozone’s feeble economic recovery.

“Any sustained deterioration in business confidence could add to the euro’s woes, I’d say, as the European Central Bank might be more inclined to cut interest rates aggressively.”

Whilst steeper rate cuts would be positive for risk assets, it would be bearish for the euro.

“In the worst-case scenario where an extreme right or extreme left party takes power with an agenda of unfunded spending, or even a messy situation where the ruling coalition is unable to ‘cohabit’ with President Macron, the euro could face the prospect of parity again with the dollar.

“Then there’s the volatility in yen pairs, which has been elevated for the past few days as they have been trading within breathing distance from levels that the Japanese authorities were willing to defend in the recent past.”

Sideline Volatility: Commodities

Commodity prices have been extremely volatile, with investors interpreting significant market exuberance in metal markets as a sign of a new commodity super cycle, says Kiran Ahmed – lead economist at Oxford Economics.

“However, we do not think fundamentals justify calls for a new bullish cycle across the commodities complex. Markets have mostly got ahead of themselves, and price corrections loom for some metals like copper.”

Meanwhile, oil volatility actually seems pretty low given that there’s war, chaos, confusion and that oil’s made a comparatively steady advance this month. Just go buy some petrol to see.

OPEC+ have extended production cuts into 2025, while Saudi Arabia and several key producers prolonged their voluntary cuts into Q3, says Ahmed.

“But demand uncertainties and robust supply from Western producers are partly offsetting the OPEC+ cuts, keeping prices relatively bearish. That said, we still expect some commodities to offer significant returns over the rest of the year and see bullish structural fundamentals ahead for natural gas and gold prices.”

Gold and silver have been showing some pretty mild and mid-to-low style low volatility amid a quiet period on the geopolitical front.

Risky Volatility

Turning to risky assets, volatility in US stocks has amped up, too, suggesting that investors could be slowly positioning for a pullback.

In Paris, the CAC 40 Index fell 82 points or 1.1% on Thursday. Leading the losses – the blue chip majors like Stellantis NV (-4.31%), Edenred (-4.11%) and L’Oréal (-3.51%).

In London, the FTSE 100 Index fell 46 points or 0.55%. Burberry (-6.55%), GlaxoSmithKline (-4.69%) and British American Tobacco (-3.11%) the worst of the majors.

Bitcoin volatility has just skyrocketed following the BTC dive below the $60,000 psych-mark for the first time since May 3.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.