This horror week of housing data will haunt homeowners until circa 2023

Via Getty

A McMansion of fresh housing data dropped this week to haunt the hearts of Australian homeowners.

Let’s run through it naked and screaming together!

Terrifying Treasurer Jim Chalmers reckons inflation is going to peak a sliver off 8% by Christmas, with those rising interest rates already weighing on the property market and household spend.

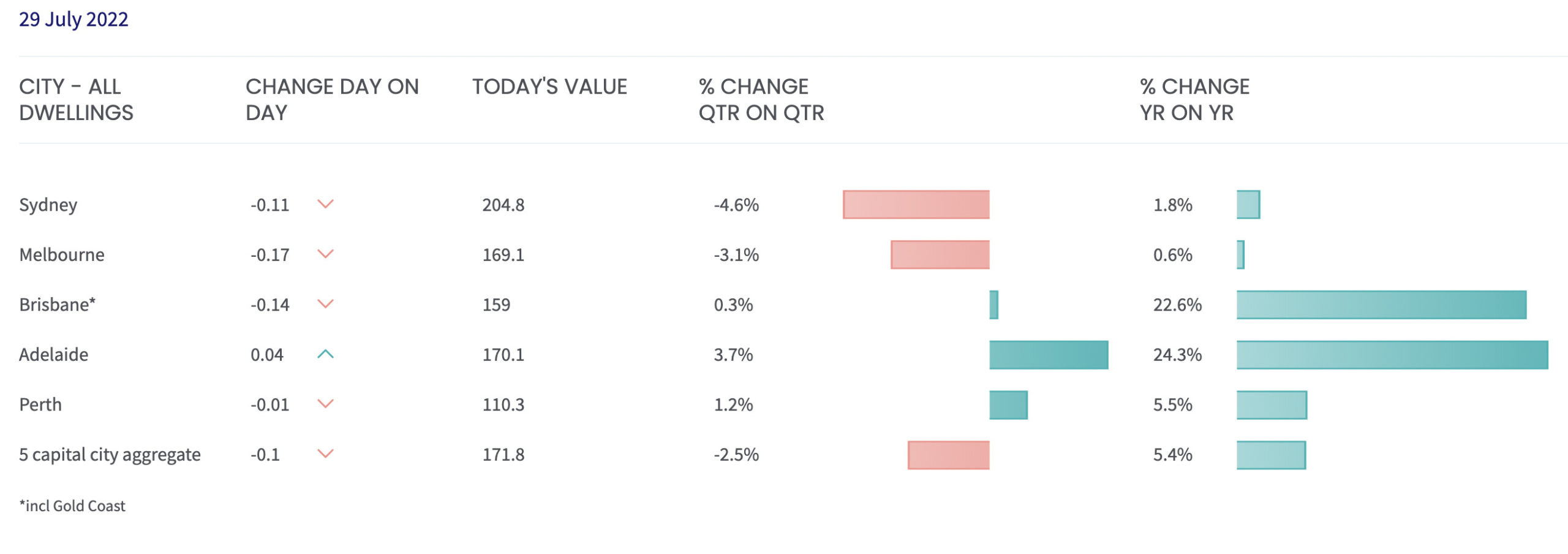

Dolorous property group Domain says the average cost of a home in Australian capitals is down by almost a full per cent and CoreLogic reports barely 3 out of 5 Aussie auctions ended with a sale in the June quarter.

The agonising REA Group says Aussie property prices will be 5% cheaper by Christmas and its predatory property data firm PropTrack also flagged prices could sink into the abyss as much as 15% in 2023.

The deterioration in property market conditions is starting to reverse the polarity as we like geeks like to say, with economists like Marcel Theliant from Capital Economics starting to fear the impact of a weaker housing market on cash rate decision-making, rather than the just the other way round.

As awful as ’82

The average price of a Sydney home has fallen a whisker off 2% over the last month CoreLogic says, and that’s the fastest rate of decline since 1982 – a bad year for house prices, but a memorable one for music.

In fact the value of Sydney housing is down -3.8% since the RBA’s May 5 rate hike.

Melbourne and Bris Vegas have dropped sharply too, as the new inflation-hating interest rate cycle kicked in.

Now the data for the June quarter also shows auction clearance rates for Sydney have crashed and burned.

“The latest results continue to highlight tougher selling conditions as interest rates rise and consumer sentiment remains low,” CoreLogic research director Tim Lawless said.

CoreLogic blames a “triple whammy” of tepid buyer commitment, fast rising interest rates and persistent inflation.

Lawless says the gloom has now spread to the auction market, sending clearance rates lower over the June quarter.

Despite some 31,500 auctions held across the country in the three months to June – the second highest on record for the quarter – the clearance rate was substantially lower, representing just the latest black mark against the national residential property market.

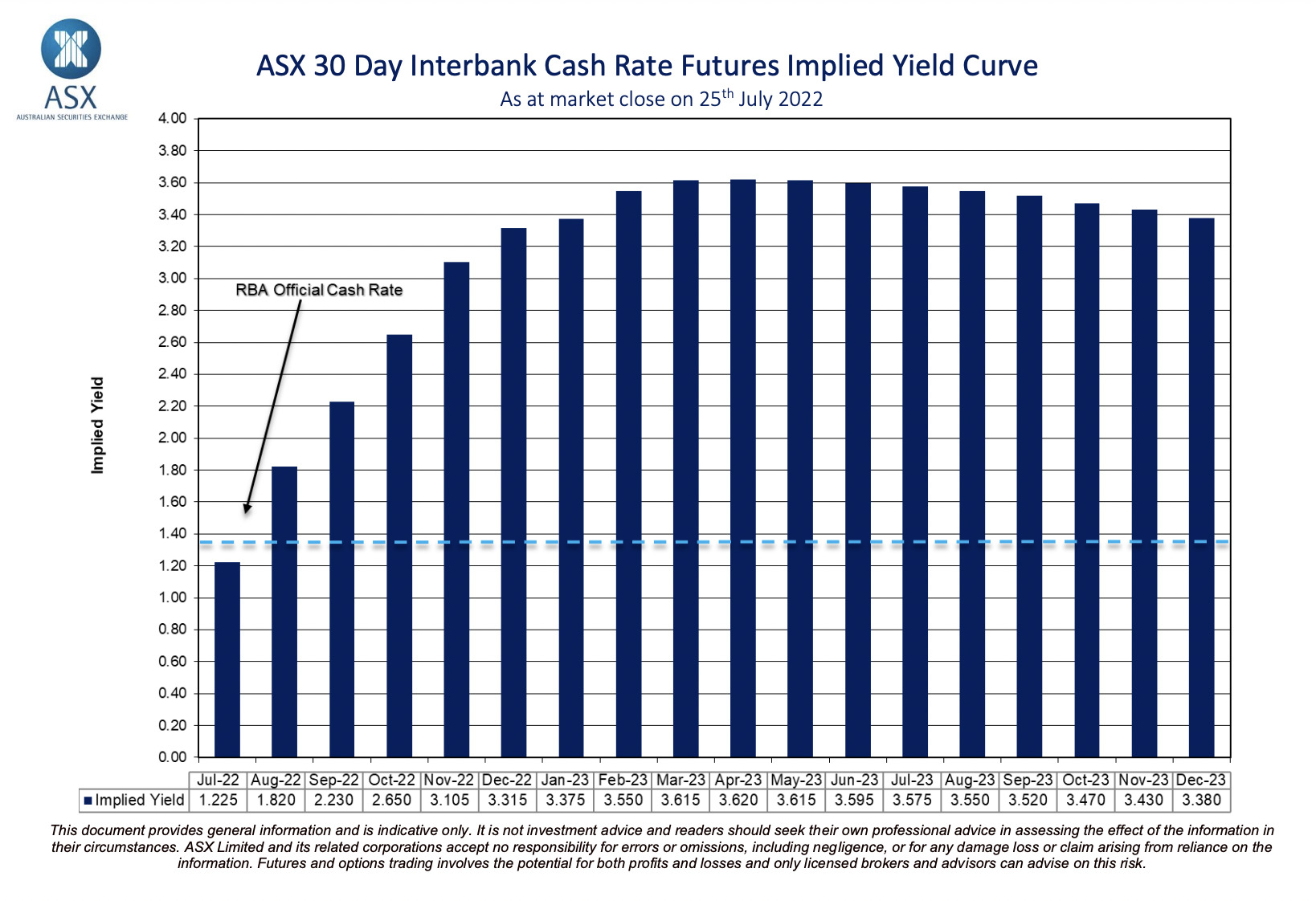

ANZ Research think the Reserve Bank of Australia (RBA) will take the cash rate target to a restrictive setting of above 3 per cent by late 2022, more than 12 months earlier than previously forecast. For now, ANZ Research has the cash rate remaining at 3.35 per cent through 2023 and 2024.

Financial markets have gotten even more bullish on Australian interest rates, now tipping the Reserve Bank to lift the official cash rate (OCR) to 3.315% by December before peaking at 3.62% by April next year:

If true, this would lift Australia’s average discount variable mortgage rate to 6.8% by December and 7.1% by March 2023, assuming any increase in the OCR is passed onto mortgage holders.

This would mean that by December, Australia’s average discount variable mortgage rate will have basically doubled in only seven months from its level at the end of April (before the RBA wrapped its tightening fingers round the throat of the rate cycle.)

So hair-raising rates will reverse: Capital Economics

Marcel Thieliant, senior Australia & New Zealand economist at Capital Economics, says the worsening housing downturn will not only slow GDP growth below the consensus 1.8% next year, but it will “necessitate the RBA to eventually reverse course and cut interest rates.”

“Falling house prices make it more risky and less attractive to build new homes. Indeed, our forecast that real house prices will eventually fall the most on record suggests that dwellings investment could slump even more sharply than we’re anticipating.”

Released this week, Domain’s June 2022 Quarterly House Price Report has capital city residential property prices falling for the first time in two years.

According to the Domain report, the median house price for a home is now $1.065m, with values almost one per cent down on the previous quarter’s record high.

CoreLogic’s daily hedonistic data shows house prices across the eight capital cities will have fallen by at least 1% m/m in July following a 0.6% m/m seasonally-adjusted fall in June.

“The outlook for overall economic activity,” Marcel says, “of course also depends on how households respond to falling real incomes, soaring mortgage payments and falling housing wealth.”

“Given that our forecasts for consumption growth are well above consensus, the risks to those forecasts are clearly tilted to the downside.”

Appalling auction rates

According to CoreLogic over Q2 2022, circa 60% of reported auctions were successful, down about 15% from the same period last year (75.7%).

That’s the lowest clearance rate for any quarterly period since September 2020 (59.2 %).

“The latest results continue to highlight tougher selling conditions as interest rates rise and consumer sentiment remains low,” Lawless said.

“In the first three months of the year clearances rates held up at about 70% but just as we’ve seen the rate of growth in values slow since peaking in early to mid-2021 the same trajectory has impacted the auction market.

“The trend towards lower clearance rates has been most visible in Sydney and Melbourne, where housing values are now falling and advertised stock levels are back to above average levels.

“However clearance rates are also trending lower in stronger markets like Brisbane and Adelaide.”

Capital City auction clearance rates June qtr:

- Adelaide (75%)

- Canberra (68%)

- Melbourne (61.1%)

- Brisbane (58.7%)

- Sydney (57.2%)

- Perth (46.4%)

- Tasmania (41.7%)

(*Chris: both Perth and Tassie came in under 50%, but auctions are only a wee portion of listing campaigns in these regions.)

In terms of auction volume, Melbourne was the busiest auction market, with 13,818 homes taken to auction, followed by Sydney (11,119).

“The combined capital city clearance rate hit a record peak of 80.0% in March 2021 and has been gradually declining ever since.”

“Seasonally the number of auctions held in winter normally trends lower, however it’s possible this could be amplified this year as the housing market moves into a downturn,” Lawless said.

“Potentially we could see more vendors choosing to sell by private treaty rather than auction as fewer competitive bidders make the auction process less effective at achieving the best possible price.”

On Thursday, Jumpy Jim Chalmers said – and here I’m paraphrasing – that Aussie inflation can, eventually, be excorcised, but…

“It will subside but not overnight.

“Left untreated, inflation which is too high for too long undermines living standards in jobs and wrecks economy. But the medicine is also tough to take — and millions of Australians with a mortgage are feeling that pain right now.”

Cue scary laughter…

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.