Think Big: Where to next for the Aussie dollar in 2021?

A road-train truck carries iron ore in Pt Hedland, WA. (Pic: Getty)

ASX investors who keep an eye on currency markets would know the Aussie dollar (AUD) has been up and about lately.

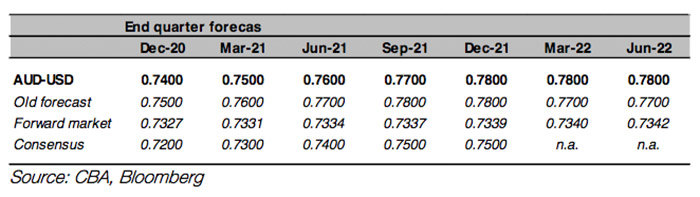

It’s currently trading above US74c for the first time since 2018, and analysts from CBA expect it to go higher next year.

The CBA team expects the AUD will climb steadily in 2021 to finish next year at around US78c:

Currency matters

The global foreign exchange market is the biggest financial market in the world, with daily volume of more than $US6 trillion.

By extension, it’s also one of the most complex, where price moves are subject to numerous changing inputs.

And the relative strength of the AUD is still relevant for stock investors, particularly with respect to gold prices.

For example, in US dollar terms the precious metal climbed to all-time highs above $US2,000 this year.

In addition, the AUD traded below US70c for most of this year. In that environment, Aussie producers can benefit from the currency difference between their input costs (measured in AUD) and spot gold prices (usually settled in US dollars).

Aussie rebound

Earlier this week, GDP data for the September quarter confirmed Australia’s economy is back on the rebound with Q3 growth of 3.3 per cent.

The CBA team (led by fixed income and currency strategist Martin Whetton) now expects the AUD to find support in the mid-point of its fair value range between US72c – US82c.

As mentioned, when markets value a currency pair there are numerous factors at play – along with the relative strength of each economy, interest rates also play a key role.

But as one of the world’s largest commodity exporters, the outlook for commodity prices will be a central factor supporting the AUD in 2021, CBA says.

“Commodity prices are a more important driver of AUD/USD than interest rate differentials,” CBA said.

And Australia’s biggest export – iron ore – finished the week at new record highs of almost $US140 per tonne.

Despite ongoing trade tensions, robust demand out of China combined with some supply restrictions has sent iron ore prices on a relentless march higher.

“In our view, the better outlook for the world economy in 2021 is an important source of support for AUD/USD that outweighs the downsides from interest rate differentials,” CBA said.

Looking ahead, the analysts said ongoing strength in China’s economy could provide more upside risk for the AUD, if infrastructure investment continues to underpin steel demand.

Conversely, the simmering tensions with our largest trading partner may also weigh on AUD strength.

CBA highlighted China’s recent shift towards US suppliers in the agricultural sector, at the expense of Australian producers.

There are other agricultural export markets in south-east Asia, but smaller markets offer no guarantee that Aussie agriculture exporters will be able to fetch the same prices.

“So far this year there is no obvious downtrend in Australia agricultural prices. But it is a risk worth monitoring,” CBA said.

While Australia’s economy is small by global standards, the AUD is one of the most traded currencies in the world and is also viewed as a proxy for risk appetite in global markets.

Somewhat conversely, the USD – the world’s reserve currency – mainly trades as a “counter-cyclical” currency that “decreases as the world economy improves”, CBA said.

In that context, additional strength will be worth monitoring. Upside risk, where the AUD pushed above US80c, could deliver a headwind for the ASX given Australia’s export-focused economy usually benefits from a weaker currency.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.