Think Big: The RBA has bumped up its forecast for inflation (but CBA thinks it will rise faster)

Pic: Getty

Following the RBA’s policy announcement on Tuesday, traders were awaiting the release of Friday morning’s quarterly Statement on Monetary Policy (SoMP) with renewed interest.

As expected, the bank has bumped up its forecast for inflation. The RBA’s base-case scenario is for inflation to climb to 2.5% — the midpoint of its target range — by the end of 2023.

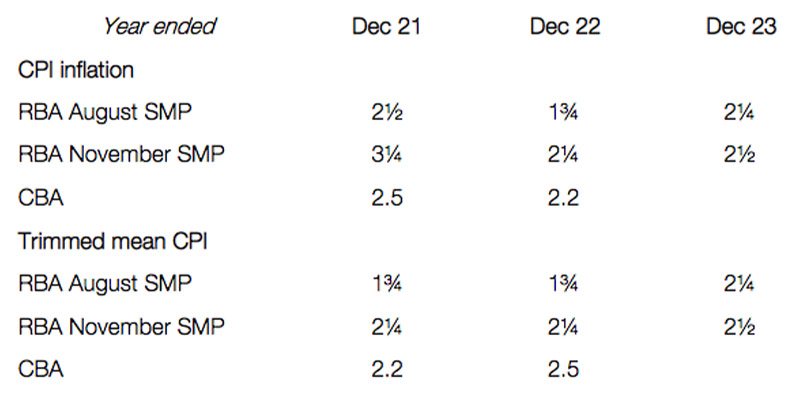

Here’s a summary from CBA of how the RBA’s forecasts have changed, compared to its August meeting:

In the wake of the pandemic, the RBA’s central message has changed. Interest rate hikes are now dependent on two criteria:

1) Inflation rising and 2) inflation staying elevated in the 2-3% target range.

For the second criteria to be achieved, the RBA has communicated its belief that such a scenario will require a broader lift in wages.

While Australia’s unemployment rate has fallen, the central bank is not yet of the view that wage growth will underpin a sustainable rise in inflation.

But although the RBA did bump its inflation estimates up a notch, CBA economists Kristina Clifton and Stephen Wu reckon it hasn’t gone far enough.

To Clifton and Wu, “supply constraints and strong demand for goods globally is putting upward pressure on inflation.”

In addition, domestic consumption is expected to be strong as households emerge from the pandemic with higher savings rates.

House prices have also seen a record year of growth.

In its SoMP, the RBA flagged the effect of that wealth increase as a key variable in the consumption outlook.

“A stronger response than has been the case on average historically would support stronger economic growth and the unemployment rate falling well below 4 per cent by the end of 2023,” the RBA said.

In that scenario, “trimmed mean inflation would rise a little above 3 per cent”.

CBA reckons the combined effect of those supply and demand forces is that instead of year-end 2023, the trimmed-mean measure of core inflation will hit 2.5% by the middle of next year.

Clifton and Wu said the bank would then need to allow for some time to confirm the inflation lift was sustained.

Rate rises

Taking that into account, rate hikes are on the cards for 2022 (by around November), they said.

That forecast is reflective of the fact that markets (and economists) are increasingly in disagreement with the central bank on interest rates.

Since the RBA changed its key message around inflation and interest rates, the bank has stuck firmly to its message that rates won’t go up until 2024.

At its policy meeting earlier this week, the reserve did entertain the idea of a 2023 rate hike for the first time.

But based on the recent data, 2022 is out, the RBA said.

However, as the economy emerges from the pandemic, economists are coalescing around the timeframe of late-2022 to early 2023.

While CBA is angling for late-2022, Westpac chief economist Bill Evans chose February 2023 as the liftoff date in research released last week.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.