Think Big: How the billionaires are investing their capital amid the COVID-19 pandemic

US billionaires Bill Gates (L) and Warren Buffett. (Getty Images)

The COVID-19 outbreak has turned what looked like a relatively benign 2020 outlook on its head.

But when major stock indexes fall by more than 30 per cent, it gets everyone’s attention – from professional fund managers to tradies on a construction site.

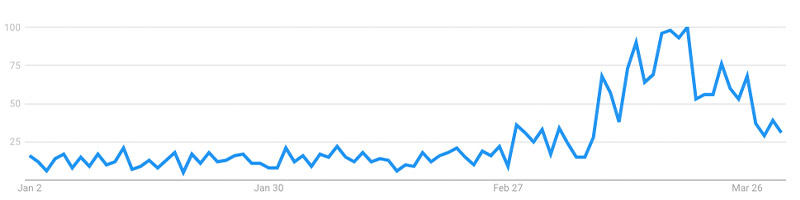

For evidence, here’s indexed data from Google Trends on the number of Australians who searched “buy stocks” over the last 90 days:

(By state, Queensland, WA, NSW and Victoria all registered readings above 90. South Australia was lowest with a reading of 58).

The search query “best stocks to buy now” also increased by 450 per cent over the same time period.

Inevitably though, bouts of volatility like the one seen in March make it harder to predict what will happen next.

To inform one’s judgment, it helps to take a look at how some of the world’s high-profile investors are assessing the situation.

Among them, US-based hedge fund billionaire Bill Ackman had an eventful month as markets tanked.

The founder of Pershing Square Capital Management moved markets (down sharply) in an interview with CNBC two weeks ago, where he said “hell is coming” and advocated for a one-month shutdown of the US economy.

Financial media then reported that Pershing Square had booked a $US2.6bn ($4.3bn) gain amid the crisis, by placing $US27m of hedged credit instruments against the market in early March.

Ackman then defended himself against claims he “talked his book” in a Twitter thread, where he said the $US2.6bn offset losses in the company’s stock portfolio.

Now, he’s betting on a turnaround. Pershing Square is unhedged, with long positions in US stocks and some extra cash on hand to buy more if prices fall further. He also asked Donald Trump to take advantage of record low rates to launch a huge infrastructure program. Shortly after, Trump tweeted this:

With interest rates for the United States being at ZERO, this is the time to do our decades long awaited Infrastructure Bill. It should be VERY BIG & BOLD, Two Trillion Dollars, and be focused solely on jobs and rebuilding the once great infrastructure of our Country! Phase 4

— Donald J. Trump (@realDonaldTrump) March 31, 2020

Meanwhile, no media outlets have heard from investing legend Warren Buffet since he spoke with Yahoo Finance on March 11. (His company, Berkshire Hathaway, has plenty of money to spend — it’s sitting on a cash pile of around $US130bn).

At the time, Buffett said the COVID-19 threat – combined with the previous weekend’s oil crash – didn’t appear to be as big a threat to markets as the 2008 financial crisis.

This week, Buffett’s name was cited by the WSJ along with hedge funds and private equity firms; cashed-up buyers who are now looking at investment opportunities in airlines, hotels and entertainment – sectors that have been hardest hit by the health crisis.

But some of the most interesting analysis so far has come from Howard Marks, co-founder of US investment firm Oaktree Capital (net worth: >$US2bn). Marks provided some insights this week in one of his famous client memos, where he outlined bullish and bearish scenarios for the months ahead.

In what could be an ominous sign, his positive case ran for just over one page, while the negative case took up the better part of three.

In his optimistic scenario, Marks cited evidence that countries further along the COVID-19 curve had success in slowing the spread. US banks are also better capitalised than the financial crisis, and government stimulus measures will effectively provide life support while the economy is “put into a coma”.

In the event of successful containment, Marks cited economic projections indicating a sharp decline in Q2 which would be followed by a strong rebound in Q3.

Unfortunately though, Marks described himself as “more of a worrier than a dreamer”.

In the near-term, his concerns are particularly focused on the health aspect of the crisis, where he cited the lack of a coordinated response plan from US policymakers, and the fact that positive test cases in the US were continuing to rise rapidly.

In turn, headlines about COVID-19 casualties and broader stresses on the health system “are going to get much uglier”, Marks said.

As the health crisis peaks, isolation measures will need to be more strictly enforced, which led Marks to another difficult question: how to “resolve the conflict between social isolation and economic recovery”.

Ultimately, for the economic outlook to improve new COVID-19 cases have to not only fall, but stop. Otherwise, uncertainty around future outbreaks will linger.

If you think that seems a long way off, Marks said to prepare for more volatility in the months ahead.

A credit markets specialist by trade, Marks noted that many companies came into this crisis with high debt levels, taking advantage of the low interest rates on offer. As revenues decline, the corresponding increase in costs will be difficult to align.

As a result, he’s expecting to see more defaults and lenders forced to take a “haircut”. And if oil prices stay at their current levels, he highlighted the prospect of job losses and declining capital investment across the US oil industry.

Marks also compared the pandemic to the 2008 financial crisis, which although it wreaked havoc on financial markets, everyday life for most people wasn’t threatened like it is now.

“Today the range of negative outcomes seems much wider”, Marks wrote.

And in the wake of unprecedented stimulus measures from the US government to combat the crisis, he posed some bigger questions around the fallout from that kind of spending — whether it will materially affect the value of the US dollar, or lead to increased inflation.

But for now, one of the world’s leading investors is bearish. Weighing it all up, his view is to “expect asset prices to decline”.

“You may or may not feel there’s still time to increase defensiveness ahead of potentially negative developments,” Marks wrote.

“But the most important thing is to be ready to take advantage of declines.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.