Think Big: Governments giveth, governments taketh away?

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

Fiscal firepower has been the order of the day since COVID-19 spread globally.

And stock investors have reaped the benefits, with US markets hitting new all-time highs this week while the ASX200 recouped all of its pandemic losses.

But looking ahead to 2021, CBA analyst Kim Mundy says governments globally are giving signals the fiscal party can’t go on indefinitely.

Globally, “fiscal policy is projected to tighten significantly in 2021 as temporary support (including income subsidies) is unwound”, Mundy says.

The US outlook is particularly interesting, with Joe Biden still expected to assume the US presidency on January 21.

An additional $US2.2 trillion stimulus bill has already been passed by the lower house, but it doesn’t yet have Senate support.

The opposition Republicans currently hold a 50-48 majority with all eyes on Georgia, where runoff elections for the two remaining seats will take place on January 5.

Democrats need to win both to take control of the senate, with Vice-President Kamala Harris holding the tiebreaking vote.

“Political analysts consider it very unlikely Democrats will win both senate seats. But the polls have tightened,” Mundy said.

At last count, one race is a tie while in the other, the Democrat candidate holds a one-point lead.

And if Republican party wins one of those races, it could mean the passage to further stimulus becomes a lot tougher.

“If history serves as a guide to the future, Republicans are less supportive of fiscal stimulus when in opposition,” Mundy said.

Across the pond in the UK, federal Chancellor (equivalent to the Treasurer) Rishi Sunak has indicated the government’s post-Covid spending path is unsustainable, Mundy said.

Sunak has flagged plans to cut government spending by £10 billion annually, starting in the 2022 financial year.

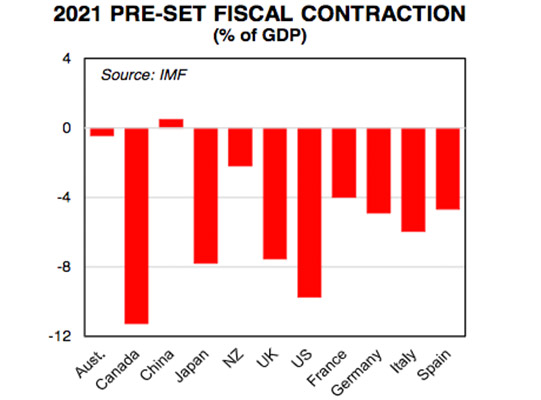

And among major Western economies, the UK’s pending fiscal contraction is one of the largest as a percentage of GDP (behind Canada and the US):

Will reduced fiscal spending pose a problem? Mundy thinks so.

“The premature withdrawal of fiscal support is a downside risk facing the global recovery,” he said.

To back up his point, Mundy cited the fallout from the last big economic shock – 2008’s global financial crisis.

In that case, an “unwinding of fiscal support post-GFC delayed a full recovery in the US, the UK and the Eurozone”, he said.

Fast-forwarding to 2020, the only country on Mundy’s chart where fiscal spending is forecast to expand as a percentage of GDP is China.

Australia, the US, UK, Japan and major Eurozone economies are forecast to tighten the purse strings.

And if that happens, “it suggests the global economic recovery will be slower in 2021 than it might have been otherwise”, Mundy said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.