Think Big: CBA says a ‘V shaped’ economic recovery is in play

CBA says Australia's economy is on the winning track. (Pic: Getty)

At the height of the COVID-19 crisis, there was plenty of chatter about what a post-crisis recovery would look like — V-shape, L-shape or U-shape?

The scale of the plunge in economic activity warranted some pessimism in the early going.

But the way things have played out, CBA reckons the Australian economy is now well on track for a V-shaped rebound.

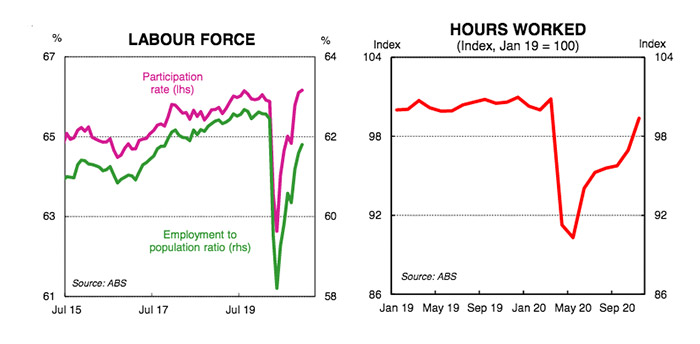

And for Australia’s labour market — a critical metric for economic health — the proof is in the (chart) pudding:

(Conversely, the chart of the unemployment rate also reveals a V of sorts — just flipped upside down).

For CBA economist Gareth Aird, the employment rebound is one of multiple factors that point to a strong year of growth in 2021.

“Policymakers spoke often over 2020 about the need to build a metaphorical ‘bridge’ to take us to the other side,” Aird said.

“But generally speaking nobody knew how long or wide the ‘bridge’ needed to be. Things look a lot clearer today.”

On the health side, the nation is more or less COVID-free (for now) and vaccine rollouts will commence in February.

“In short, the Australian economy will have clear air once the rollout is complete and the very thing that has been holding the economy back will no longer be an issue,” Aird said.

In addition, a curious thing happened in the wake of the pandemic — consumer confidence surged to a 10-year high.

And with job losses contained, it meant more Aussies maintained their earning power while pandemic restrictions curtailed household spending.

Remember the extra $100bn Australians had saved heading into Christmas?

Aird reckons that figure has now climbed to around $125bn, equivalent to six per cent of GDP.

“A partial drawdown in the accumulated stock of household savings will be a big tailwind on household consumption in 2021,” Aird said.

As more people spend extra on goods and services, more businesses make money.

“This will create a positive feedback loop that will support aggregate demand and job creation,” Aird said.

In addition, Aird said the robust gains in Australia’s largest asset class — housing — will flow through to support growth via the indirect wealth effect.

Governments at both the federal and state level have also committed to a number of big infrastructure spending packages.

Add it all up and CBA expects to see a strong rebound in GDP — to the tune of 4.2 per cent annual growth in 2021.

For stock investors, one of the key questions is how the extra growth will change the outlook for interest rates and the ultra-supportive financial conditions that have helped support equity markets.

In Aird’s view, the answer is…not likely.

In recent research he highlighted that the outlook for inflation — the key driver of rate rises — will be “very much one to watch” this year.

Data this week showed q/q inflation growth rose to 0.9 per cent in the December quarter.

However, most economists took the view that the underlying drivers of sustainable long-term inflation growth remain relatively weak.

And what does the arbiter of interest rates — the RBA — think?

Aird noted that by the end of next week, markets will have a much clearer idea of what the bank is thinking.

Tuesday’s interest rates announcement will be followed by the quarterly Statement on Monetary Policy on Friday, which will includes the RBA’s latest set of economic forecasts.

CBA flagged “modest upward revisions” to the RBA’s inflation forecasts, “although we expect them to continue to forecast below target inflation over the bulk of their forecast horizon, if not all of it”.

In turn — and despite the V-shaped economic recovery taking place — CBA expects benchmark rates to stay on hold through to the end of 2022.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.