‘Come and Say G’day’: These ASX stocks are set to embrace the return of China’s US$225 billion outbound visitor market

When will Chinese tourists come back to Australia. Picture Getty

- Chinese visitors are the missing ingredient Aussie tourism desperately needs

- Stockhead spoke to Tourism Australia and Austrade for some numbers, dates and straight answers

- This list of ASX stocks could begin to spike as Chinese tourists return to our shores

China’s fast-track reopening and refined zero-Covid policy has taken the travel industry by surprise.

Starting in November last year, the CCP had unexpectedly removed testing requirements for most travel and allowed home quarantines for positive cases.

The initial stages were chaotic and didn’t give enough time for the country’s often unreliable medical system to be prepared.

As a result, the death toll spiked dramatically with almost 60,000 people dying of Covid in Chinese hospitals since early December.

Despite these grim stats, Claire Huang, a senior strategist at Amundi Institute, says she doesn’t expect the Chinese government to backtrack.

“China has passed the point of no return. Soon the government will have to let go of most restrictions,” Huang said.

Outbound travel bookings from mainland China to Southeast Asian countries have since jumped by more than 10x.

Thailand’s tourism authority for example expect some 300,000 Chinese tourists to arrive in the first quarter alone.

Elsewhere in Paris, long queues of Chinese tourists were seen at Louis Vuitton stores.

The overall picture is improving rapidly for China, and Huang believes the country will be back in business very soon.

“Returning to work is expected to start in February, and full production is likely in March,” she said.

Top destinations

Before Covid in 2019, China’s deep-pocketed tourists numbered around 12 million outbound air passengers per month.

According to Statista, these tourists spend a total of around US$255 billion globally over a year.

Countries that would benefit most from the return of Chinese tourists are mostly the Pacific Asia region, which include Thailand, Japan Hong Kong, and of course Australia.

The top 10 destinations for Chinese tourists in 2019 were (source: China Outbound Tourism Research Institute)

- Hong Kong

- Macau

- Taiwan

- Thailand

- Japan

- Vietnam

- South Korea

- Singapore

- USA

- Italy

When will Chinese tourists come back to Australia?

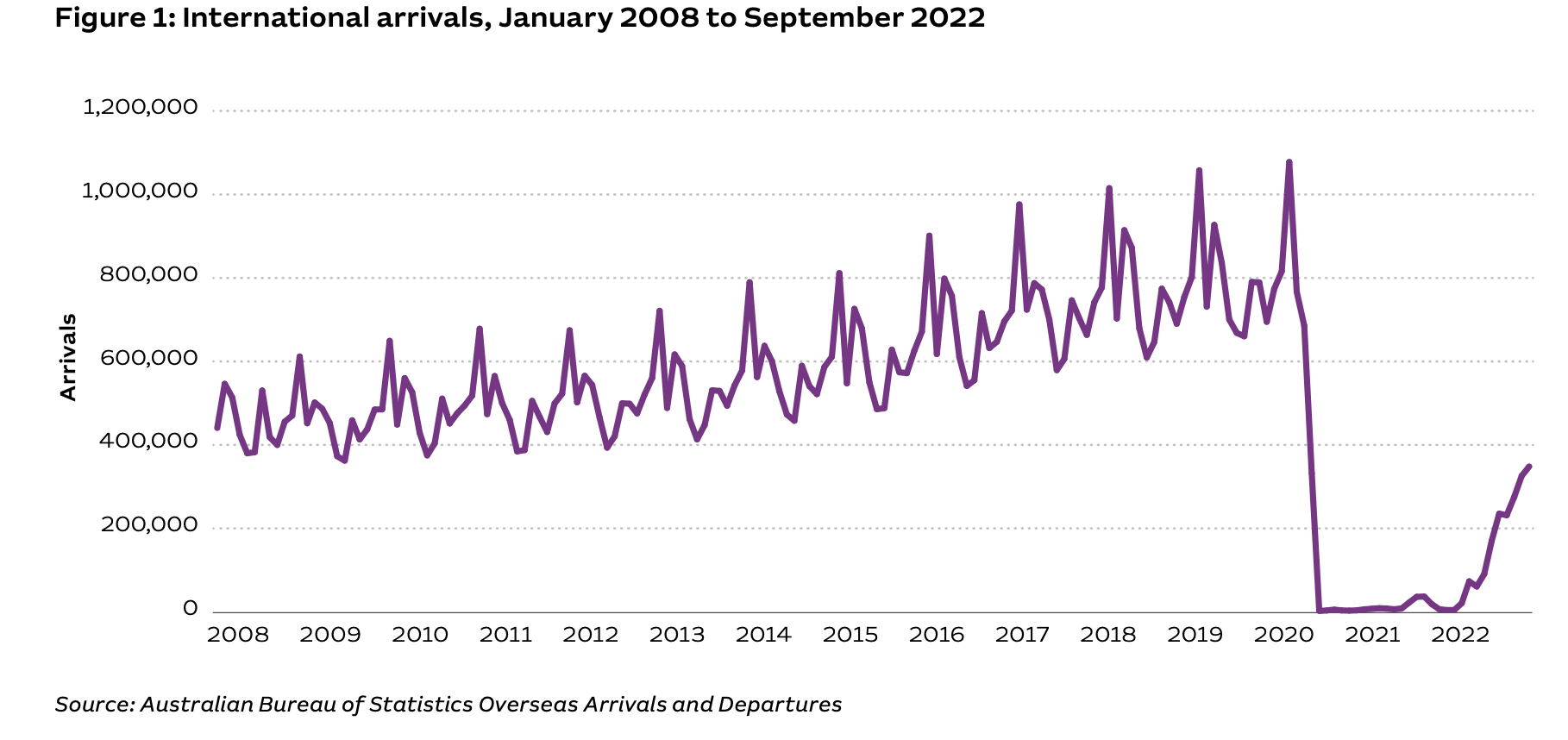

According to the trade organisation Austrade, whom Stockhead reached via email, China was Australia’s leading visitor market pre-Covid, and contributed 15% of short-term visitor arrivals.

In 2022 however, there were only 66,300 short-term Chinese visitors to Australia (up to October 2022), which was a measly 5% of the number of visitors in the same period in 2019.

Those visits were also predominantly for education (around 50 per cent) or for visiting friends and relatives ( around 30 per cent).

Looking ahead, Austrade told Stockhead that there are no clear trends yet related to holiday or business travellers from China.

“With factors like flight availability and affordability impacting immediate travel plans for a range of markets, we eagerly await further data in order to estimate the Chinese recovery timeframes,” said Austrade.

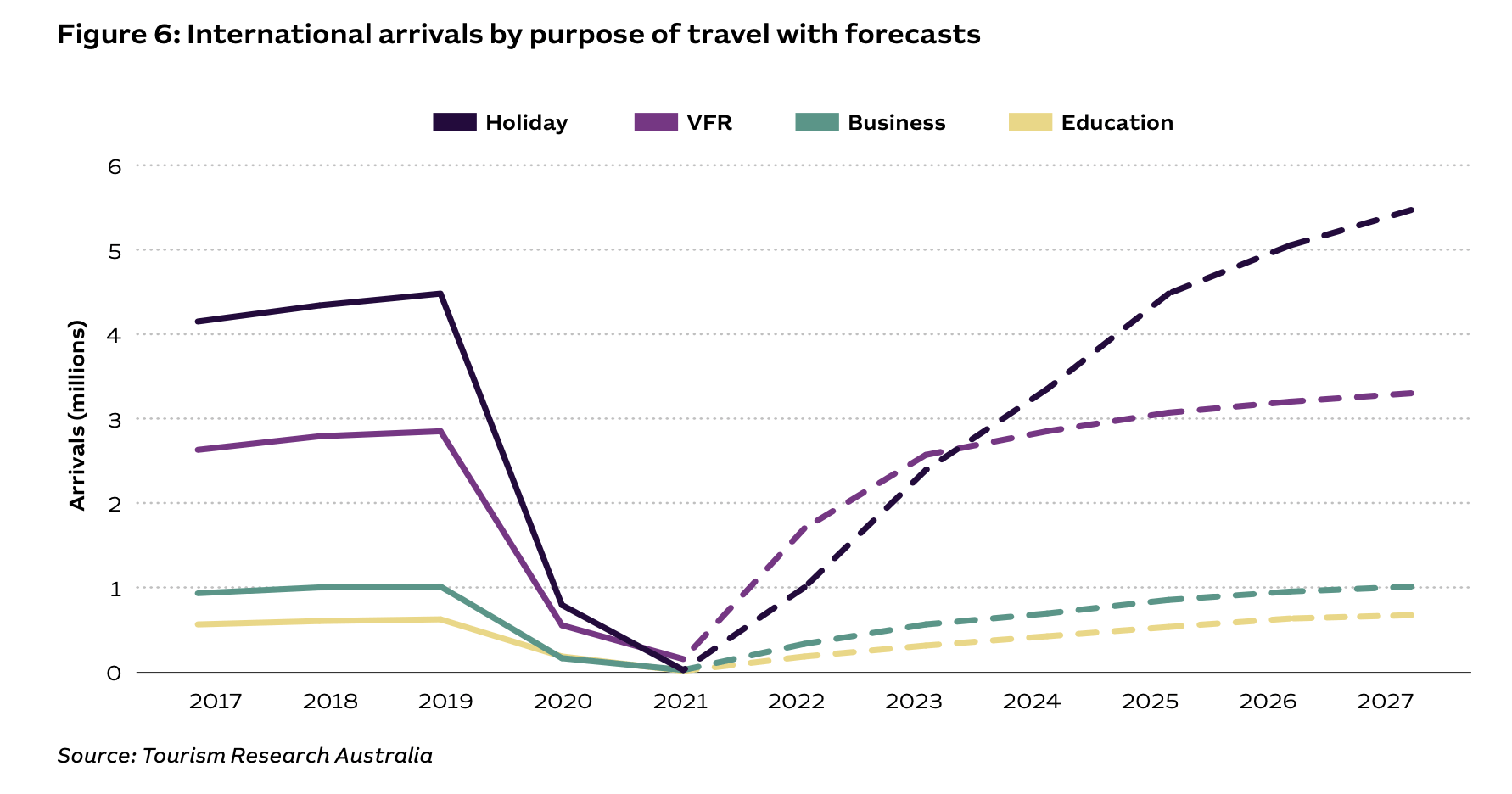

Tourism Research Australia meanwhile has just released its five-year forecasts (see Tourism Forecasts for Australia 2022 to 2027).

With regards to China, the forecasts suggest many factors that could support a strong turnaround in Chinese visitation once travel restrictions ease fully.

The research found that China’s outlook for economic growth relative to most developed countries, along with its ever increasing middle class, will be the main drivers driving outbound tourism to Australia.

Australia’s status as a relatively short-haul destination for Chinese travellers, along with our reputation as a destination of choice for international students, are also reasons to be optimistic.

“In view of these factors, the forecasts project visitor arrivals from China growing from their current low base back to pre-pandemic levels by 2026,” Tourism Australia told Stockhead.

‘Come and Say G’day’

Tourism Australia (TA) says it has identified its target audience and will be focusing on High Yield Travellers (HYT) who are likely to travel Out of Region and spend more on their trip.

“We target these HYTs in 15 key markets around the world: USA, Canada, UK, Germany, France, Italy, China, Hong Kong, Japan, South Korea, Singapore, Indonesia, Malaysia, India and New Zealand,” it said.

TA’s global campaign, ‘Come and Say G’day’, is a $125 million campaign which will run over two years across 15 international markets.

Come and Say G’day launched in October 2022 with in-market media and viewing events taking place in New York, Tokyo, Singapore, Mumbai, Frankfurt, Berlin, Paris and London.

TA is also planning ‘Australia Marketplace’ events in South East Asia, India, North America and China to connect the Australian tourism industry with travel decision makers around the world.

“Additionally, Tourism Australia will look to capitalise on global events in Australia in 2023, including WorldPride and the FIFA Women’s World Cup,” the TA told Stockhead.

Which will ASX stocks will benefit from the return of Chinese tourists?

Star Entertainment Group (ASX:SRG)

There’s no sugar coating for SGR, which has certainly not been shining brightly in 2022.

The casino giant has been hit with a string of bad PR, including being found unsuitable to hold casino licences in NSW and Queensland.

But its Sydney casino’s doors will remain open despite being fined a whopping $100m and having its licence suspended.

AQS specialises in developing and operating integrated resorts comprising hotels, convention centres, and other entertainment including restaurants, gaming, shopping, and shows.

Following the acquisition of Casino Canberra in late 2014, Aquis has demonstrated its commitment to supporting Canberra’s evolution as a vibrant and modern capital city.

The company’s $14 million investment to refurbish the existing casino is a strong endorsement of this.

ALG owns and operates a portfolio of assets of entertainment and leisure businesses, including Dreamworld, White Water World and SkyPoint on the Gold Coast.

The company has outlined plans for investments valued at over $50 million of development capex planned over next 3-4 years.

And it’s not just entertainment stocks – one stock that will benefit from the return of the Chinese in Australia is IPD Education.

Before the pandemic in 2019, the majority of overseas students in Australia came from China, accounting for 28% of international students.

The biggest market is Chinese students and migrants so with China having its zero policy for more than a year, what IEL has been missing is those students coming back.

Daigous to make a comeback?

A handful of companies are hoping the reopening will attract the arrival of Chinese international students, who could kick-start the daigou sales channel once again.

Daigou, literally ‘surrogate shopping’ in Mandarin, is where an individual in Australia purchases commodities like infant milk formulas from retailers, and sends them to China at a hefty markup.

A2 Milk (ASX:A2M), one of the biggest beneficiaries of the daigou sales channel, could benefit from this.

The A2M stock price has taken a 50% tumble in the last 12 months, as China sales channel dried up along with a falling birth rate in the country.

Bubs Australia (ASX:BUB) and Blackmores (ASX:BKL) are also some of the other stocks that could benefit from the coming of international students.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.