These are the winners and losers from the post-Christmas rally

Santa has been enjoying the Australian summer as the market moves positively. Pic:Getty

2018 was a lot of things, but it won’t go down as a year of certainty and stability.

Trade wars, government shutdowns, Brexit, leadership spills, you name it, it affected global markets.

And the small end of town wasn’t immune: at one point in October it got so dire that the ASX Small Ords lost all of the gains it made in the year prior within the space of a few days.

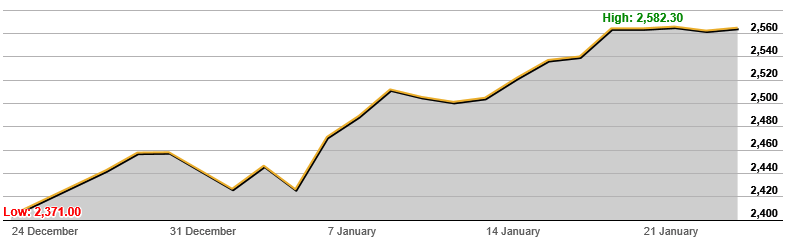

But as January nears its end, we thought it was a good time to take a look at market movements since that ever-joyful time, Christmas.

There’s good news. The Small Ords index, which was sitting in the doldrums at 2,371 points at Christmastime, has hit highs of 2,582.3 points in the past week, a 9 per cent turnaround.

And the ASX 200 and All Ordinaries have also seen 9 per cent rises, the former reaching highs of 5,911.8 points and the latter faring even better at 5,975.6 points.

Berkeley Energia (ASX:BKY) is the biggest winner, up 189 per cent thanks to reports it could become a top 10 uranium producer.

The company also released its quarterly report yesterday, which showed it is well stocked with nearly $100 million cash in the bank.

Both Golden Cross (ASX:GCR) and Redbank Copper (ASX:RCP) have enjoyed big post-Christmas runs, up 186 and 185 per cent respectively despite little news.

Eon NRG (ASX:E2E) is also up 100 per cent. It had to answer a speeding ticket from the ASX in mid-Jan, and also experienced a 400 per cent run in a day last year after a sales revenue bounce.

Chris Robertson, director at Arthur Austin Advisory, preaches caution when it comes to investing on the back of big movement..

“On what planet does an announcement cause that amount of movement,” Mr Robertson says.

The experts: why it’s happened and what to watch for

“It’s been a bit of a relief rally and it’s been well and truly appreciated,” says Lee IaFraté, founding chairman of Armytage Private.

“Jerome Powell [chair of the US Federal Reserve] saying there is unlikely to be any further interest rate rises has also helped, underpinning equity markets and stabilising things.

Mr IaFraté says an impending end to the US-China trade war would help ease uncertainty.

“There’s enough momentum around that suggest that the trade war is hopefully coming to a conclusion, you never know with the idiot [Donald Trump], but he is now in an election phase so he will want to be seen to be winning,” he says.

“If there is an agreement that will certainly give the market more strength.”

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Martin Duriska, analyst at Canary Capital, says progress in trade talks will give the market certainty at a critical time.

“We’re at a very important point and February is going to be crucial, because it’s reporting season in the US, and if companies start delivering then there will be rewards,” he says.

“February will set the direction and the tone for the rest of the year.”

Mr Robertson is more circumspect, believing that trade wars, uncertainty and volatility will continue.

“January has brought a bit of optimism back into the market,” he says. “But my personal view is that we are not out of the woods yet.

He also says that “cheap can get cheaper pretty quickly” regarding small caps.

“In bull markets people tend to forget pragmatic advice,” he says. “I wouldn’t be chasing [share price] performance and piling in. Look at the business fundamentals and look for substance.”

Below is a table of the biggest winners and losers since Christmas. Click headings to sort

| ASX code | Company | Last price | 1-month return | Market cap |

|---|---|---|---|---|

| BKY | BERKELEY ENERGIA LTD | 0.505 | 189 | $106.4m |

| GCR | GOLDEN CROSS RESOURCES LTD | 0.06 | 186 | $6.1m |

| RCP | REDBANK COPPER LTD | 0.057 | 185 | $6.7m |

| DDT | DATADOT TECHNOLOGY LTD | 0.004 | 150 | $4.1m |

| IHR | INTELLIHR HOLDINGS LTD | 0.2 | 117 | $21.1m |

| SCN | SCORPION MINERALS LTD | 0.021 | 110 | $3.7m |

| LKO | LAKES OIL NL | 0.001 | 100 | $67.5m |

| KLH | KALIA LTD | 0.004 | 100 | $10.1m |

| MRD | MOUNT RIDLEY MINES LTD | 0.003 | 100 | $6.1m |

| E2E | EON NRG LTD | 0.016 | 100 | $6.5m |

| VPR | VOLT POWER GROUP LTD | 0.002 | 100 | $16.5m |

| PRL | PETREL ENERGY LTD | 0.004 | 100 | $12.1m |

| SVT | SERVTECH GLOBAL HOLDINGS LTD | 0.014 | 89 | $3.6m |

| EN1 | ENGAGE:BDR LTD | 0.045 | 85 | $10.7m |

| QTM | QUANTUM HEALTH GROUP LTD | 0.025 | 79 | $27.5m |

| SPQ | SUPERIOR RESOURCES LTD | 0.007 | 75 | $4.8m |

| KGM | KALNORTH GOLD MINES LTD | 0.007 | 75 | $6.3m |

| YPB | YPB GROUP LTD | 0.019 | 73 | $15.2m |

| TML | TIMAH RESOURCES LTD | 0.031 | 72 | $2.9m |

| MDI | MIDDLE ISLAND RESOURCES LTD | 0.006 | 71 | $8.4m |

| BKT | BLACK ROCK MINING LTD | 0.058 | 71 | $32.3m |

| MRG | MURRAY RIVER ORGANICS GROUP | 0.125 | 67 | $54.2m |

| MCM | MC MINING LTD | 1.19 | 66 | $164.1m |

| GSW | GETSWIFT LTD | 0.58 | 66 | $109.3m |

| AQS | AQUIS ENTERTAINMENT LTD | 0.048 | 66 | $8.9m |

| RVA | REVA MEDICAL INC - CDI | 0.24 | 66 | $99.6m |

| RMP | RED EMPEROR RESOURCES NL | 0.076 | 64 | $38.9m |

| LHB | LIONHUB GROUP LTD | 0.007 | -30 | $5.8m |

| SUH | SOUTHERN HEMISPHERE MINING | 0.031 | -31 | $2.7m |

| VKA | VIKING MINES LTD | 0.011 | -33 | $3.8m |

| OGX | ORINOCO GOLD LTD | 0.006 | -33 | $7.8m |

| RNY | RNY PROPERTY TRUST | 0.004 | -33 | $1.1m |

| NIU | NIUMINCO GROUP LTD | 0.001 | -33 | $2.8m |

| DDD | 3D RESOURCES LTD | 0.002 | -33 | $1.9m |

| LRS | LATIN RESOURCES LTD | 0.0025 | -33 | $5.7m |

| CLZ | CLASSIC MINERALS LTD | 0.002 | -33 | $5.4m |

| SRO | SHAREROOT LTD | 0.002 | -33 | $3.1m |

| BAU | BAUXITE RESOURCES LTD | 0.037 | -34 | $7.9m |

| VBS | VECTUS BIOSYSTEMS LTD | 0.39 | -35 | $9.0m |

| AHN | ATHENA RESOURCES LTD | 0.013 | -35 | $3.5m |

| MZI | MZI RESOURCES LTD | 0.024 | -35 | $7.1m |

| SBB | SUNBRIDGE GROUP LTD | 0.011 | -35 | $5.2m |

| AEB | AFFINITY ENERGY AND HEALTH L | 0.009 | -36 | $8.8m |

| 1AG | ALTERRA LTD | 0.033 | -37 | $4.3m |

| EUC | EUROPEAN COBALT LTD | 0.024 | -38 | $19.0m |

| AMB | AMBITION GROUP LTD | 0.07 | -39 | $4.7m |

| CMC | CHINA MAGNESIUM CORP LTD | 0.018 | -40 | $6.3m |

| AU1 | AGENCY GROUP AUSTRALIA LTD | 0.15 | -44 | $15.6m |

| EGY | ENERGY TECHNOLOGIES LTD | 0.005 | -44 | $1.7m |

| BEE | BROO LTD | 0.024 | -47 | $15.5m |

| IKW | IKWEZI MINING LTD | 0.001 | -50 | $4.1m |

| MAR | MALACHITE RESOURCES LTD | 0.001 | -50 | $1.4m |

| CLY | CLANCY EXPLORATION LTD | 0.001 | -50 | $3.5m |

| PCHDC | PROPERTY CONNECT HOLDINGS | 0.001 | -67 | $460.7k |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.