These are the cleantech stocks that beat the ASX last quarter

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

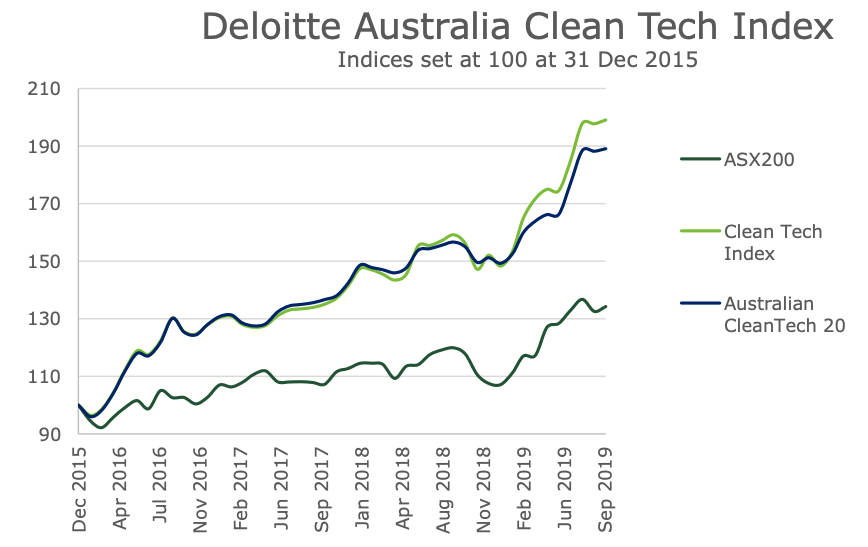

Cleantech stocks continue to outperform the wider market, notwithstanding a go-slow on climate and energy policy from the federal government.

The Deloitte Australia Clean Tech Index, an index of 93 ASX-listed cleantech companies, rose 7.8 per cent in the September quarter, compared to a 1.1 per cent rise in the ASX 200.

The Australian Cleantech 20 rose 6.9 per cent in the quarter.

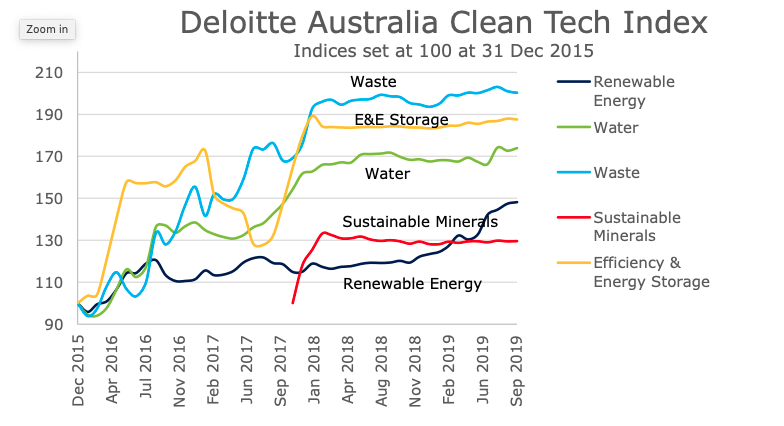

The biggest sector contributors were water and renewable energy.

The stocks that led the charge

The best performing companies by share price alone were SciDev (ASX:SDV, up 377 per cent), Envirosuite (ASX:EVS, up 125 per cent), Volt Power Group (ASX:VPR, up 100 per cent) and Secos (ASX:SES, up 86 per cent).

Rounding out the top eight were Ioneer (ASX:INR), Pacific Energy (ASX:PEA), Hazer (ASX:HZR) and Phoslock (ASX:PET).

The worst performing companies by share price were ReNu Energy (ASX:RNU, down 54 per cent), Buddy Tech (ASX:BUD, down 53 per cent), Volt Resources (ASX:VRC, down 50 per cent) and Battery Minerals (ASX:BAT, down 43 per cent).

Rounding out the losers were Integrated Green Energy Solutions (ASX:IGE), Syrah Resources (ASX:SYR), Triton Minerals (ASX:TON) and MPower Group (ASX:MPR).

The 20 largest companies by market cap in the index are led by Meridian Energy (ASX:MEL) and Mercury NZ (ASX:MCY). Ioneer and Australian Ethical Investment (ASX:AEF) have replaced Syrah Resources and Clean TeQ (ASX:CLQ).

Renewable energy (up 4 per cent), albeit off a low base, and water stocks (up 4.6 per cent) were the winning sectors in the September quarter.

Waste, sustainable minerals and efficiency & energy storage delivered sub- or slightly above par returns for the quarter.

Most positive contributor award

The stock with the largest positive contribution to the index was market darling Phoslock, which sells large-scale water cleaning technology that permanently binds excess phosphorus in water.

It jumped into investors’ consciousness in early 2018 when it announced a maiden profit on the back of work in China, where it has been since 2005 and continues to make its fortune cleaning vast tracts of polluted waterways.

READ: Phoslock reckons the Chinese water dragon could turn it into a unicorn

Phoslock shares rose 49 per cent in the quarter.

The company is currently working on four large projects around China with potential revenue ranging from $20m to $200m, and it secured the exclusive global licence to manufacture, sell and distribute a new product which, after removing phosphorus from polluted water, can be reused.

It expects the new product will be available by mid-2020.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.