There’s more lithium in this American volcano than all the Li in China

Pu'er tea factory in Yunnan, Xishuangbanna, China. Via Getty

Out along the Nevada–Oregon border sits an unassuming 16 million years old volcanic caldera, which – according to new research published in Science Advances – is probably the largest lithium deposit in the world by a very long way.

Last week a team backed by Canadian explorers from Lithium Americas Corporation, GNS Science, and Oregon University published a paper which argues the epic McDermitt Caldera actually hosts between 20 to 40 million tonnes of lithium inside its more-curious-than-originally-suspected mineral clays.

If verified, this would certainly make it the largest known deposit of lithium on Planet Earth, dwarfing previous deposits like those wee ones we have and say, the headline ones tucked under the Bolivian salt flats.

A newly discovered sedimentary lithium deposit from McDermitt Caldera in northern Nevada could place the site among the largest known lithium reserves in the world, according to a new study in @ScienceAdvances. https://t.co/FLb4QodEin pic.twitter.com/DKcYiXreEx

— Science Magazine (@ScienceMagazine) September 6, 2023

So put on your protective glasses, science fans:

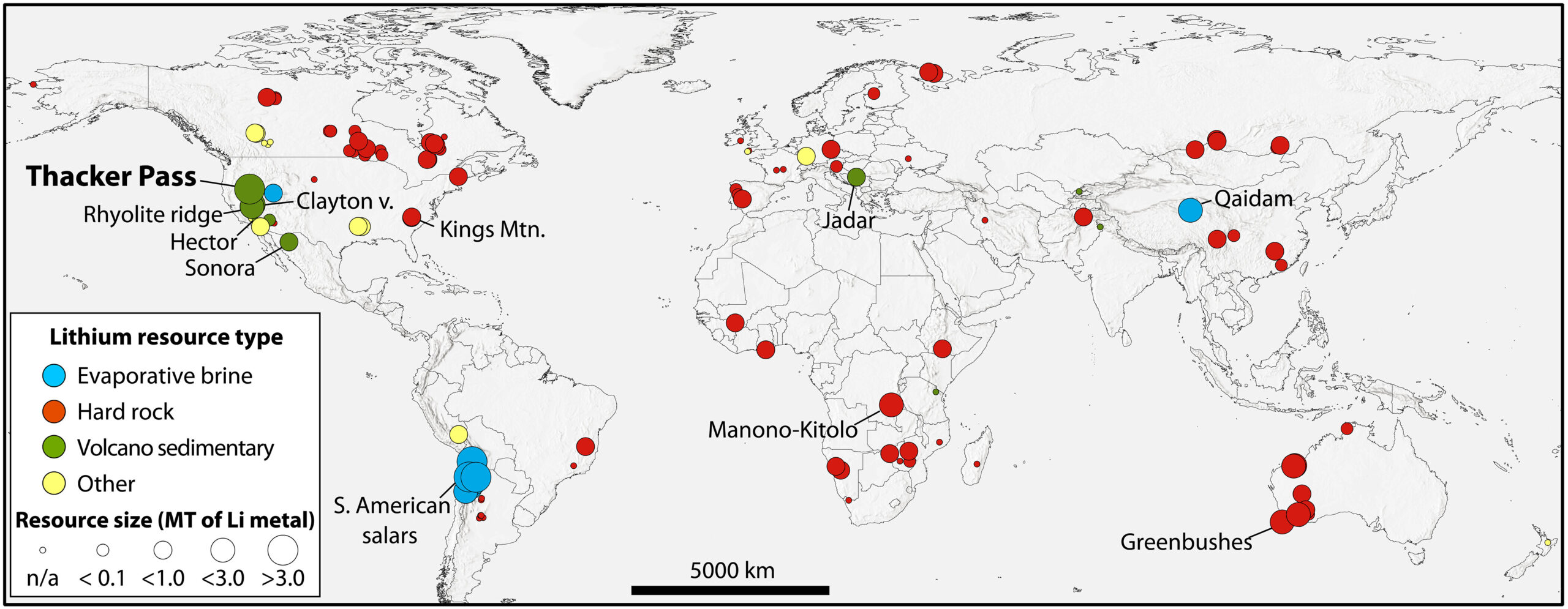

Your standard lithium resources are pretty abundant around the world, but we know them mainly as pegmatites and greisen veins — hard rock. And we also know them as high-elevation evaporite brines.

These account for all current global Li production, the paper says… but:

“A third type of Li resource, herein termed volcano sedimentary, occurs as sediments associated with, or adjacent to, centers of silicic volcanism.

“Chief among volcano sedimentary resources are the clay-rich lacustrine sediments deposited within the middle-Miocene McDermitt caldera, located along the Nevada-Oregon border on the northwestern edge of the Basin and Range province, USA.

“To date, 5.1Mt of Li have been reported as Canadian and Australian reporting code-compliant Measured and Indicated Resource estimates at the Lithium Americas Corp. Thacker Pass project (3.0 Mt of Li) and the Jindalee Resources Ltd. McDermitt project (2.1 Mt of Li) obtained through extensive drilling, resource, and economic modeling…”

Current production is predominantly spodumene from pegmatites in Australia (47%) and brines underlying salt flats in Chile (30%), China (12%), and Argentina (5%) (2).

Yes, out that way already is Aussie lithium pure play, Jindalee Resources (ASX:JRL).

In June 2018 JRL acquired x2 lithium sediment projects at McDermitt and in Clayton North which isn’t too far away from McDermitt.

And McDermitt itself is looking pretty central to America’s battery production infrastructure.

US Battery Production (operating and announced)

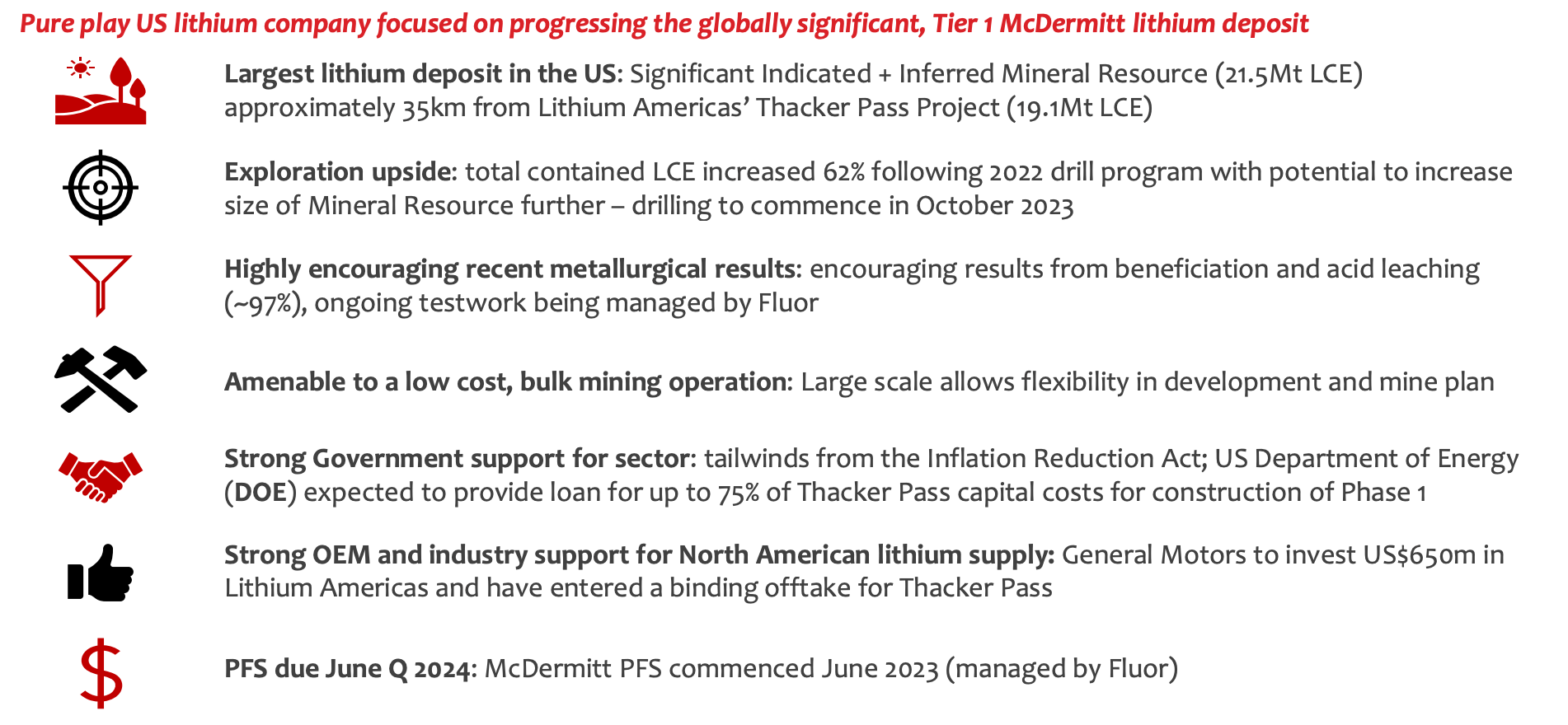

Both projects are 100% owned by HiTech Minerals Inc., itself a wholly owned, US-based subsidiary of Jindalee but entirely focused on progressing its Tier 1 McDermitt lithium deposit.

They put out an investor presso which nicely wraps up their jig:

On Thursday last JLS reported ‘significant progress’ at the deposit with the mineral resource increasing after each drilling program.

There’s been a 62% increase in total contained LCE following the 2022 drilling campaign, and the company believes there’s heaps of potential to lift the size of mineral resource further.

For now the 2023 indicated and inferred resource estimate stands at 3.0Bt at 1,340ppm Li for 21.5Mt LCE.

We asked Jindalee’s CEO and MD Lindsay Dudfield what his take was on the latest world-breaking promises from inside the lithium caldera

“Well. The paper was co-authored by Tom Benson from Lithium Americas (TSX: LAC) so not surprisingly has a bias towards LAC’s Thacker Pass deposit.

“That said, the paper is correct in stating that the McDermitt Caldera has a phenomenal lithium endowment with the 2 largest lithium deposits in North America located at opposite ends of the Caldera: at the northern end is Jindalee’s McDermitt deposit with 21.5Mt LCE (Lithium Carbonate Equivalent) and Thacker Pass with 19.1Mt LCE at the southern end. By comparison Liontown’s Kathleen Valley deposit contains 5.4Mt LCE,” Lindsay says.

“Both Thacker Pass and McDermitt are sediment hosted deposits, an emerging class of open pittable lithium deposit with the potential to supply huge volumes of lithium carbonate for decades (they are large tonnage-low grade deposits so analogous to the Chilean porphyry copper deposits). The massive scale of these deposits and their strategic importance to the US economy is why investors should consider adding Jindalee shares to their portfolio.”

According to the Jindalee boss, LAC is proposing to beneficiate Thacker Pass ore and then leach the beneficiated material with sulphuric acid before sequentially crystallising the contaminant minerals to leave a lithium rich solution from which lithium carbonate will be precipitated.

He says right now, the Thacker Pass Project is more advanced than McDermitt and is now under construction, having tested their flowsheet at pilot plant scale for several years.

Engineering consultants Fluor (they’re managing Jindalee’s testwork and are lead engineer for the McDermitt PFS) have reviewed Jindalee’s testwork to date and have recommended a similar processing route for McDermitt with further metallurgical testwork to refine the flowsheet currently underway in the USA.

“Thacker Pass is higher-grade than McDermitt but our testwork has shown that McDermitt has simpler mineralogy (smectite ore only, so no blending needed) and has returned much higher lithium extraction rates from acid leaching (97% versus 84% at Thacker Pass),” Lindsay Dudfield says.

Both deposits are strategically very important to the USA’s electrification goals, he says, and there is strong OEM and bi-partisan government support for domestic lithium projects like Thacker Pass and McDermitt.

On 31 January 2023 LAC announced a US$650m placement to GM in return for off-take from Thacker Pass, and on 22 February 2023 they announced that they expect to receive a loan covering up to 75% of the capex of Stage 1 of the Thacker Pass Project (producing 40,000t LCE pa) from the US Department of Energy.

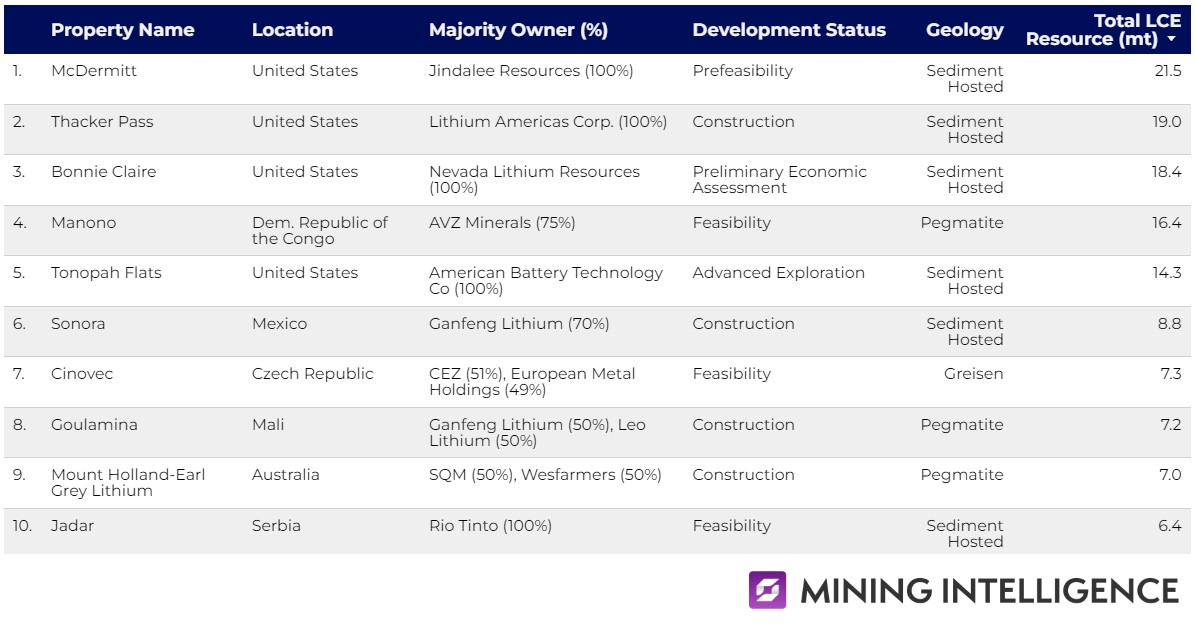

Last month, Mining Intelligence drew up the lithium global project pipeline for the year, ranking the largest clay and hard rock projects of 2023, based on total reported lithium carbonate equivalent (LCE) resources and measured in million tonnes (mt).

There’s a few familiar names, but one very familiar right at the top, before the latest study called the caldera the world’s biggest.

These projects will add to already robust production growth with global output set to come close to 1 million tonnes this year ramping up to 1.5 million tonnes in 2025, double production levels in 2022.

Back to the science

Recent calculations by Castor and Henry (Ed: they’re the Lithium Americas geologists) estimate an in situ tonnage of ~20 to 40MT of Li (maximum 120MT of Li) to be contained within sediments of the whole McDermitt caldera.

This back-of-the-envelope estimation is calculated using caldera-wide extrapolation of publicly available drill hole data from Lithium Americas Corp. and Jindalee Resources Ltd. and is not a reporting code-compliant mineral resource estimate that considers economic viability.

Even if this estimation is high due to variations in sediment thickness and/or Li grade, the Li inventory contained in McDermitt caldera sediments would still be on par with, if not considerably larger than, the 10.2 MT of Li inventory estimated to be contained in brines beneath the Salar de Uyuni in Bolivia, previously considered the largest Li deposit on Earth.

Exciting, despite the speccy undertone.

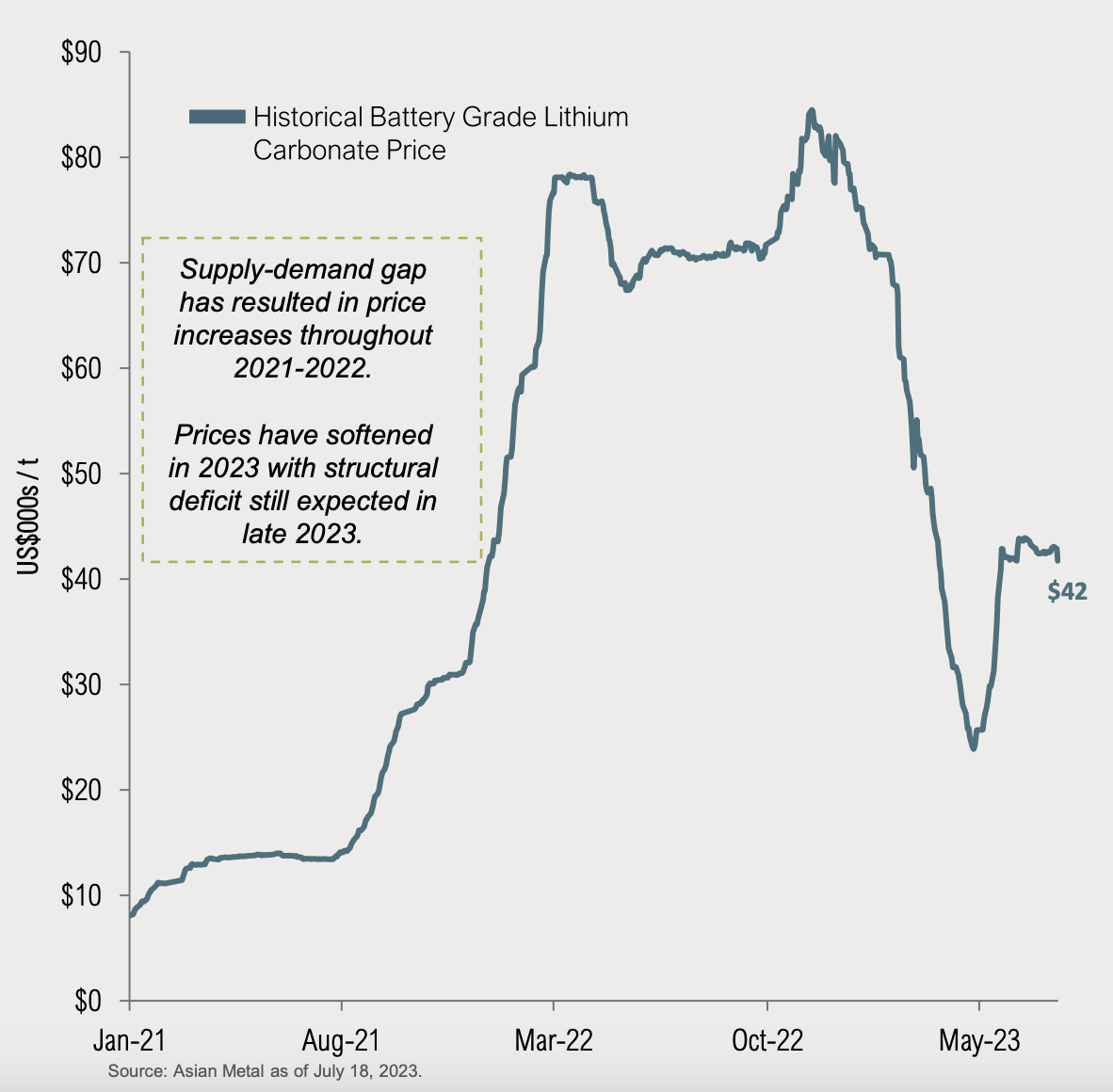

If Lithium Americas’ view of the caldera ring true, then Jindalee might enjoy some exciting nearology – a find of this scale could turn the global lithium dynamic upside-down in terms of price, security of supply and geopolitics.

Closing the supply/demand gap in favour of not China

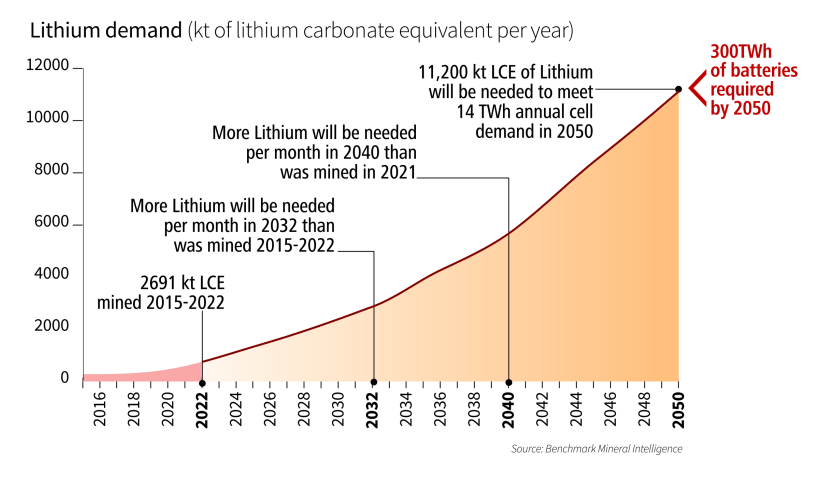

Top US lithium producer Albemarle (ALB) expects lithium demand to increase 5x by 2030 to 3.7Mt LCE pa, due to strong EV demand & the Inflation Reduction Act.

The White House is laying aside billions of dollars to back the creation of a domestic supply chain which circumvents China to meet clean energy demand.

Benchmark Mineral Intelligence forecasts 11.2Mt LCE pa will be needed by 2050 (2022 production ~0.75Mt LCE).

Investment in new Li sources to meet demand

China’s long march for lithium

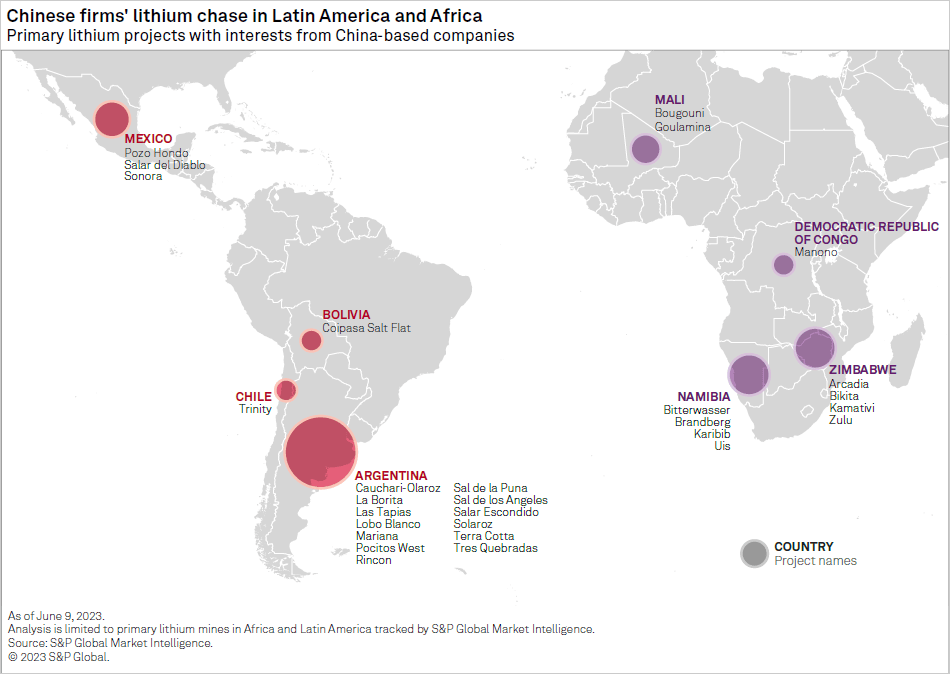

According to S&P Global Ratings, since 2018 China has continued to send forth its armada of state-backed firms to buy up 50% of all US$100m plus lithium mining projects worldwide, spending almost US$8bn in a global EV battery supply chain land grab.

China currently dominates the global lithium supply chain with over 60% of processing capacity, 65% of lithium-ion battery component manufacturing, and 77% of battery manufacturing.

China’s latest global Li stakes

The concentration of the lithium supply chain in China has raised concerns in the States and the EU in particular, resulting in the shared purpose of tearing the Band-Aid off Chinese mineral dependence in their respective industrial and trade policies.

Here in Australia we punch well above our weight, but there’s a problem with where we are in the supply chain now that we’ve signed up to the US-led Minerals Security Partnership.

The partnership aims to sidestep China and strengthen mineral channels between geo-strategically tight nations like us. But while we account for well over 50% of global lithium production – last year we sent almost all of it, some 96% – over to. yup, China.

Dr Marina Yue Zhang, an associate professor at the Australia-China Relations Institute (ACRI), at the University of Technology Sydney notes that we’ve got a few choices when it comes to securing our role in the global chain.

“For Australia, it is important to go beyond simplistic policies and carefully assess the benefits and costs of joining a US-centred geopolitical bloc in the lithium supply chain.”

“Such a decision could have repercussions, including retaliations and disruptions in global supply chains and trade.”

Discoveries like the one Lithium Americas believes it’s sitting on might reshape those supply chains faster than we can formulate policy.

According to Lithium America’s crew, in-situ analysis suggest an odd clay stone, rich in mineral illite, harbours between 1.3% to 2.4% of lithium inside the volcanic crater – for the uninitiated, that’s about x2 the lithium present in the usual lithium-bearing magnesium smectite clay.

Then there’s the scale. The McDermitt Caldera is circa 45km long and 35km wide.

Previous research has suggested it formed as part of the ginormous Yellowstone hotspot, which in itself created led sequence of calderas dating back almost 20 million years ago. The location holds both smectite and illite, and the company plans to extract lithium from both materials.

Geologically speaking there was some mighty fascinating and unusual conditions involved in forming the McDermitt caldera.

The scientists posit that on an ordinary day up north, about 16.5 million years ago about 1000km3 of magma suddenly and fairly catastrophically exploded outwards, upwards and everywhere. As the pyroclastic dust literally settled, the new caldera became filled with an alkaline magma detritus rich in sodium and potassium, as well as lithium, chlorine and boron.

As it cooled, a finely crystalline volcanic glass formed called ignimbrite, which weathered to produce lithium-rich particles.

Which itself is not too far from what we’d call obsidian, or indeed what the Maesters of Westeros referred to as ‘Dragon Glass’…

Anyhoo, according to Science Advances:

“… the lake subsequently formed in the crater, persisting for hundreds of thousands of years, with weathered volcanic and surrounding materials forming a clay-rich sediment at its bottom. The new analysis suggested that, after the lake had emptied, another bout of volcanism exposed the sediments to a hot, alkaline brine, rich in lithium and potassium.”

What Lithium Americas has been after is a clay mineral called illite, which has 2x the concentration of lithium as the smectite that’s more commonly found throughout the caldera.

Solving the illite-origin mystery has been the scientific goal for Lithium Americas.

In their paper, the team proposes a 40m thick layer of illite formed in the lake sediments by this hot brine. The fluid moved upwards along fractures formed as volcanic activity restarted, transforming smectite into illite in the southern part of the crater, Thacker Pass.

The result was a claystone rich in lithium that Christopher Henry, emeritus professor of geology at the University of Nevada in Reno said looked ‘a bit like brown potter’s clay.’

“It is extremely uninteresting, except that it has so much lithium in it.”

Lithium Americas obtained a stake at the part of the caldera called Thacker Pass which researchers in 2017 suggested could be among the largest sources of lithium ever found and began testing mining operations.

Thacker Pass is near the southern rim, where especially high-grade materials have been found.

With all federal and state-level permits received, construction at Thacker Pass commenced in March 2023. First production is expected the second half of 2026, after lengthy legal battles.

In January, General Motors announced a US$650 million equity investment in Lithium Americas, giving it exclusive access to lithium from Thacker Pass during the first phase of mining.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.