There’s a nice, odd feel around the sizzling ASX as Wall St booms its way into recession

Via Getty

It’s a fascinating time to be invested on the ASX.

A new game is afoot. Or maybe an entirely new sport.

For now at least the local market appears brimming with unknown possibility. It feels like any man, woman or child with a stash of cash on the side could be forgiven for feeling the undeniable burning sensation around the hip pocket region.

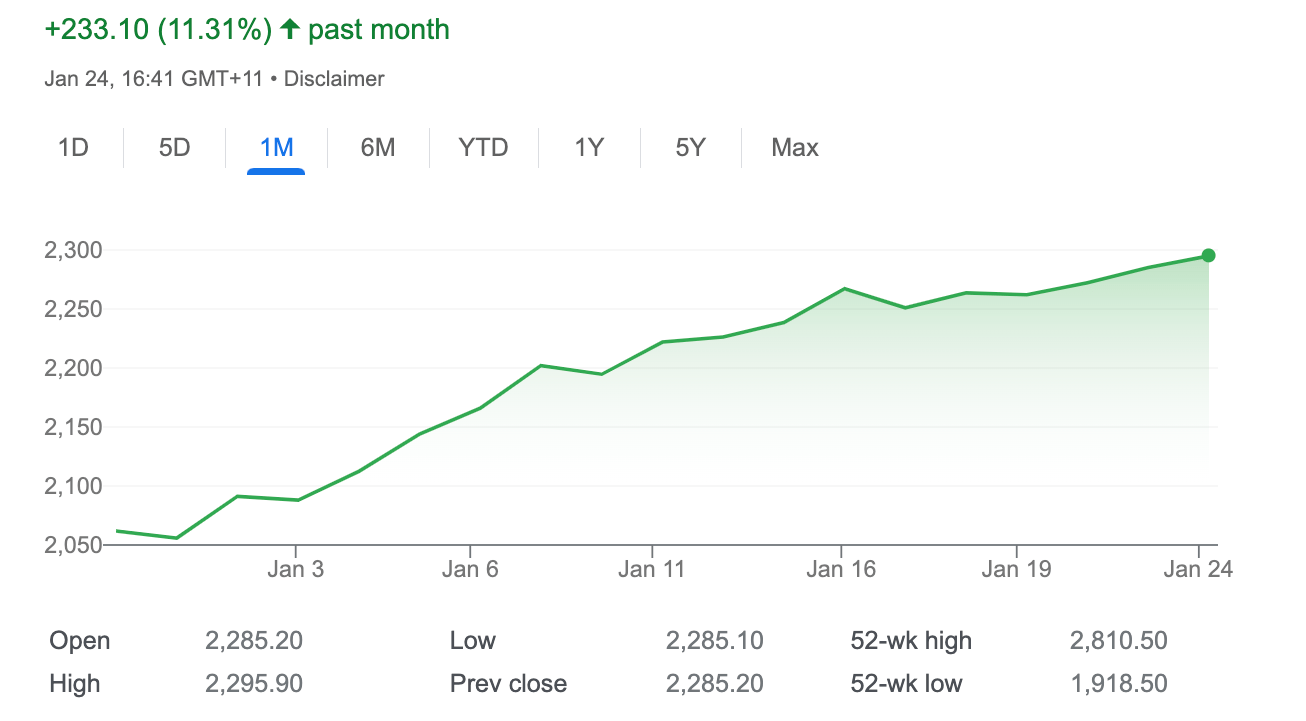

It’s been a new year indeed. This is how the S&P/ASX Emerging Companies (XEC) index feels after Christmas:

As our Josh Chiat notes, the brokers have largely changed their tune on many things which have a big hand in what happens on the ASX, with predictions commodities and metals would benefit from China’s reopening bearing large, thirsty fruit – probably pomegranates, passionfruit and pineapples – as once disregarded lithium miners are already nudging all time highs.

Still standing, Elton John like

The benchmark has copped a few glancing blows in January, but none have really landed.

“It’s a case of rinse & repeat for the ASX with an early sell-off then seeing support kicking in before midday to take the index to a new 9-month high,” said Market Matters lead portfolio manager James Gerrish.

And it was the bulls over in the Materials sector which continued to to drive buying of the kind that lifted the ASX/200 within 2% of all-time highs.

The sector ‘s 1.26% gain on Tuesday has taken its January just about into double figures with a monthly gain so far 9.85%.

Asian stocks were largely closed for the Chinese Lunar New Year holiday. Iron Ore was closed in China as well. Japan’s Nikkei rallied 1.53%. Singapore iron ore prices were down slightly to US$125.05/t, with most iron ore producers in broadly positive territory.

But Stockhead’s Josh Chiat insists that it’s the lithium large caps who are really moving the needle at the moment.

UBS came out swinging – upgrading its lithium forecasts and subsequent major name share price valuations.

“Mineral Resources (ASX:MIN), which dabbles in both markets as well as mining services and gas, hit an all time high of $96.15 on Tuesday, giving it a market cap of $18.25 billion,” Josh says.

While MIN’s peers Pilbara Minerals (ASX:PLS), Allkem (ASX:AKE) and IGO (ASX:IGO) all pushed higher, stronger, faster,

“The share price of the $15 billion cap PLS cracked the $5 mark for the first time since the broker-led dip in lithium sentiment in November.”

Having said all that, the REITs and the tech names provided real structural ballast.

But at home, the Real Estate sector was in fact the piece de resistance, up +1.82% while the volatile Tech sector was the other hero of the dish, adding a +1.32%.

“Despite the strength in the index, the banks failed to join the rally, certainly surprising to see such a strong move without the Financial sector contributing, likely on the back of a sector-wide downgrade coming through from Macquarie yesterday, ” James Gerrish noted.

More signs of life at home betray a more resilient confidence than we’ve seen for some time. You know things aren’t going to hell in a shopping basket when Myer can jump by almost 5.5% because it’s sales literally vaulted some 25% between July and January compared to the same time in 2021.

The other confidence booster has been Premier Investments (ASX:PMV), which walked away almost 4% higher.

The most discretionary of almost all ASX consumer stocks, caught the eye of brokers who upgraded the owner of must-haves like Smiggles and Peter Alexander.

Morgan Stanley has gone and made PMV their No. #1 pick with a bullet in the emerging retailer’s space, liking the cut of Premier’s global growth potential and its admirable balance sheet.

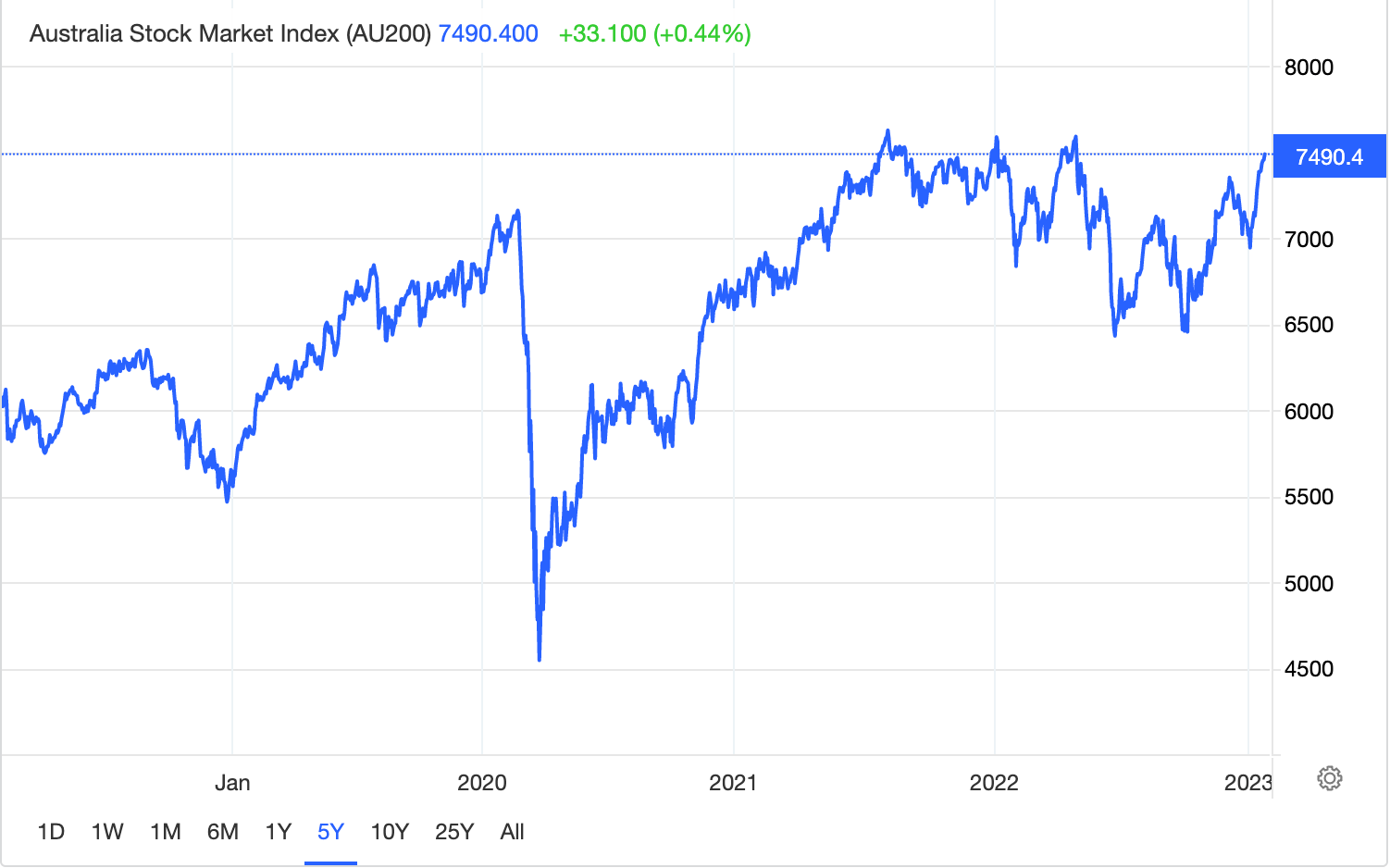

The ASX 200 finished 33 points or 0.44% higher, at an impressive 7490.

Meanwhile, there’s a recession-boom on Wall St

The most vulnerable sectors – hardest hit in the 2022 selloff which began in earnest at the end of May, have led the bumpier rally in 2023 thus far on Wall Street, where growth-flavoured equities are back on the menu so soon.

The US is salivating at the promise of a fiscal loosening, and the hip pockets on Wall St are literally smoking slowing rates has with investors unable to contain the excitement of undervalued growth stocks and the lure of future rock’n roll growth.

The tech-heavy Nasdaq Composite is also up in January, almost as high as our local Materials corner of the ASX, at almost 9%.

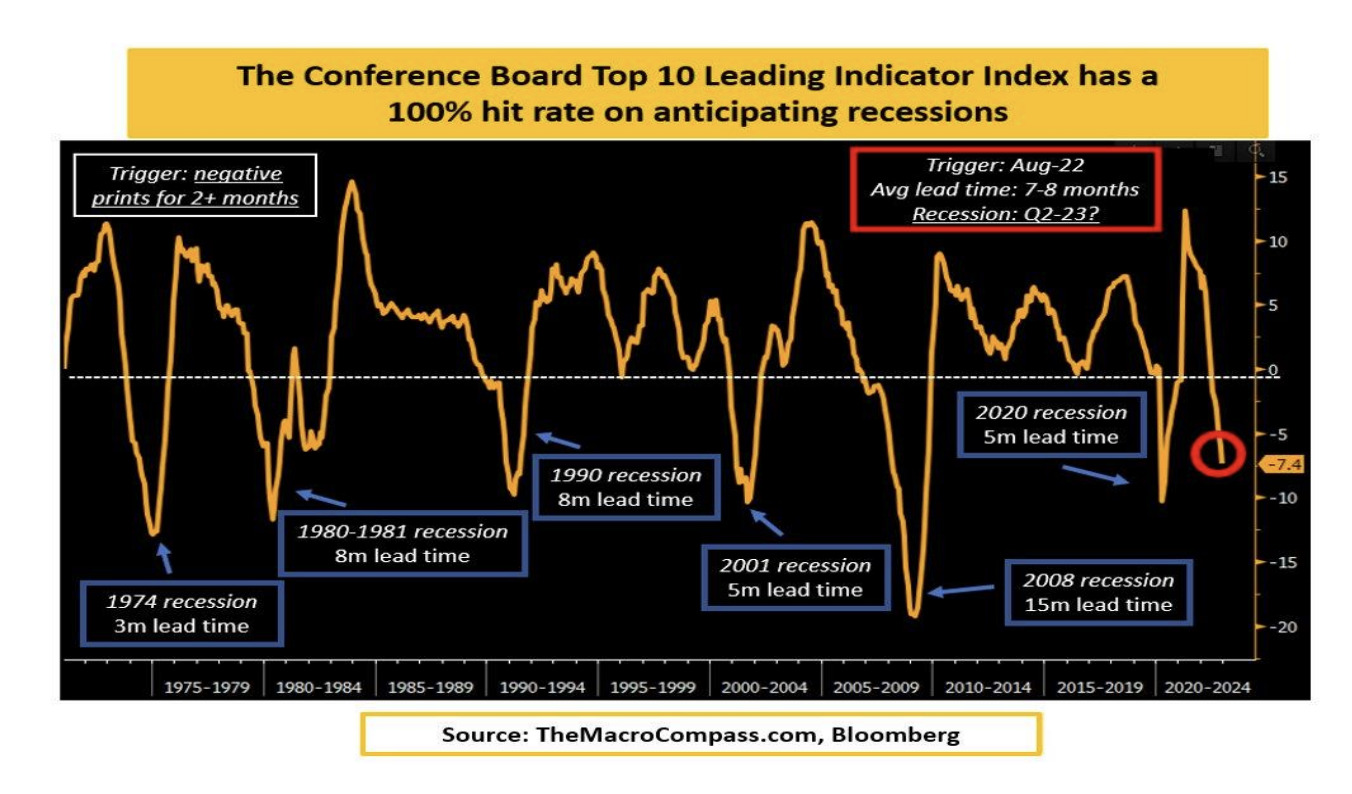

A widely adored (but not entirely understood) top US economic indicator which seems to function as a measurement of the American business cycle, this week showed another sharp decline for December.

The name says it all really – The Leading Economic Index (LEI) – is a predictive variable which has been said to anticipate pivot moments in the US business cycle by around 7 months.

Produced by The Conference Board group, the index is a melange of 10 indicators including the initial job claims , PMI’s, building permits, equity movements… how happy consumers and their expectations are.

But the LII’s real function is to signal swings in the business cycle and this cycle is apparently just swinging.

December was the 10th straight month of copping it below the belt.

UBS analysts say that’s never happened before outside of a recession.

The Conference Board said this week that its Leading Economic Index fell by 1% to 110.5 in December after dropping 1.1% in November, a sharper decline than the 0.7% expected by economists polled by The Wall Street Journal.

According to Ataman Ozyildirim, the senior director of research at The Conference Board, the LEI indicator continued to scream of a world in 2023 with recession all over it.

“Overall economic activity is likely to turn negative in the coming quarters before picking up again in the final quarter of 2023.”

For Wall St, it’s inflation or tightening and not much in between.

But there is something… not in between, but perhaps Down Under?

In the meantime, the ASX will be looking like a good hunting ground for foreign investors. Goldman et al have already noted – pre Xmas – how luscious the meadows look on our Materials heavy, China exposed, broadly defensive and Big 4 ballasted bourse.

Now Goldman’s even in two minds about what side of the material-rich Mining sector should be favoured.

Last year it was battery metals and coal that set the market alight as iron ore, gold and base metals floundered amid rate rises and Chinese economic struggles.

This year the shoe is on the other foot, Goldman Sachs’ Australian analyst team believes, with Paul Young’s team going with base metals and ferrous plays over the lithium and coal stocks which dominated 2022.

“Into 2H, we are most positive on the ferrous complex (steel, benchmark 62% and high grade iron ore, and coking coal) on an expected recovery in Chinese steel production and prices, base metals (specifically copper, aluminium & zinc) on low inventories and supply side disruptions (in particular Chilean copper mine production issues and slow restart of European aluminium and zinc smelters),” they said in a note last week ahead of earnings season.

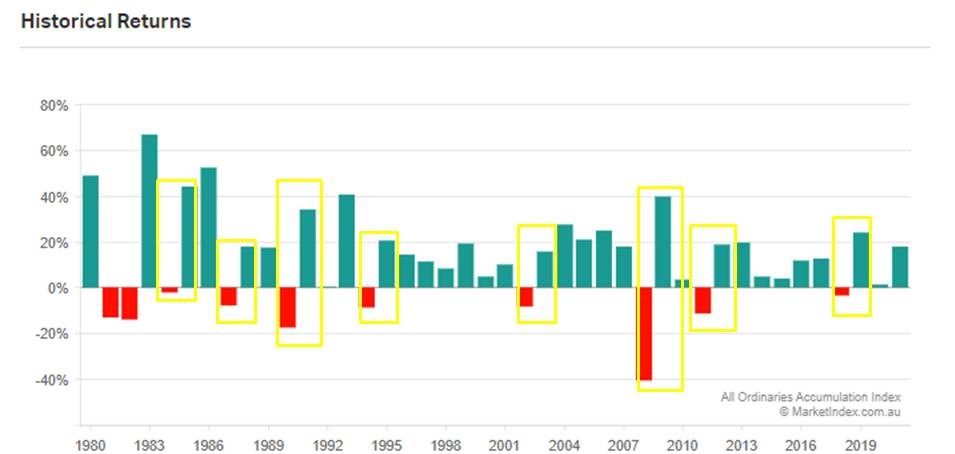

China and central banks aside, chatting with IG Market’s Tony Sycamore (always enlightening) I was reminded (and then forwarded) the shape of the local benchmark’s historical returns in the shadow of a downturn.

During the past 40 years, the Australian share market has shown a strong pattern of outperforming with a double-digit rebound following a year of decline. The only exception Tony says was during the recession in 1982-1983, but the stock market then made a record 60% jump in the following year.

“Even with the absence of (an impending) first rate-cut to, the pause of the current tightening journey is likely to reignite the risk appetite for Australian equities.

Back to history class

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.