The world’s 10 largest ETFs grew by half a trillion dollars in 12 months. Is it time to ride the wave?

The world's 10 largest ETFs have grown by US$546 billion in 1 year. Picture: Getty Images

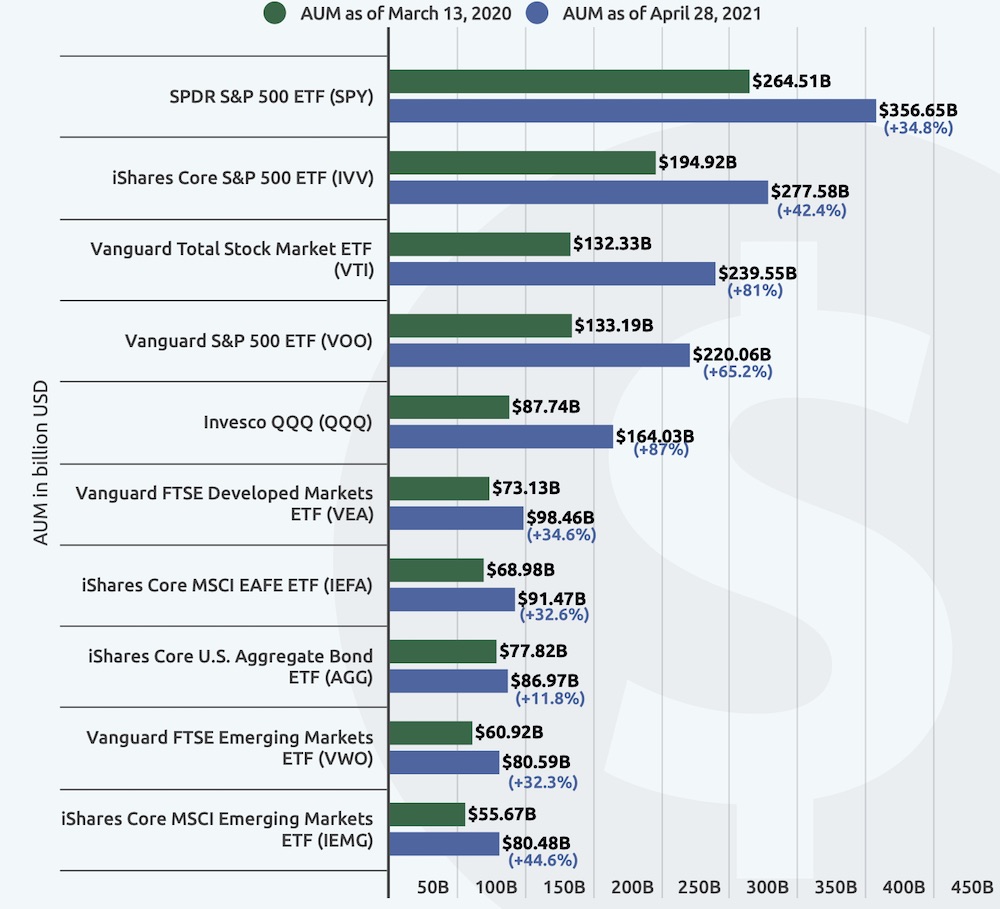

The world’s 10 largest ETFs have grown by 47 per cent, adding US$546 billion to the market caps in just the last 12 months.

According to the latest data from Finbold, assets under management (AUM) of these 10 largest funds have increased from $1.14 trillion to $1.69 trillion since the pandemic began.

There’s no doubt we are in unprecedented times globally – historically low (even negative) interest rates, coupled with the highest level of government stimulus.

But these numbers show that ETFs are still one of the asset classes preferred by investors.

And according to data from ETF Trends, younger people are getting more into the action.

Millennials, or those born between 1981 to 1996, have grown as a percentage of investors from 9% to 14% since 2017 – and represents the fastest-growing generation of investors.

Generation X investors, those born 1965 to 1980, also grew from 24% to 27%.

The table below, which was supplied by Finbold, is a snapshot of where the money has been going to.

The SPDR S&P 500 ETF (SPY) is still the world’s largest ETF fund, and its AUM has grown by 35 per cent to US$356 billion.

The network of SPDR funds, known collectively as Spiders, is run and managed by State Street Global Advisors (SSGA).

The fund invests heavily in technology stocks, and its top five holdings are Apple, Microsoft, Amazon, Facebook, and Alphabet (Google). The fund has a total one-year return of 45 per cent, and 18 per cent over three years.

The world’s second biggest ETF, the iShares Core S&P 500 ETF (IVV) meanwhile, has grown by 42 per cent in the past year. The fund is managed by Blackrock, and is also invested heavily in tech stocks. Its top five holdings are similar to that of SPY, with similar returns.

But the fastest growing ETF is the Invesco QQQ (QQQ) fund, managed by Illinois-based Invesco Capital Management. This fund has around half its portfolio also invested in tech stocks, with Apple making up 10 per cent of the total. The fund’s 1-year total return is 56 per cent.

ASX-listed ETFs

Australian investors can easily buy the ETFs mentioned above right here on the ASX.

But if you’re looking for a more thematic fund, the ASX is also good place to look, where the average ASX ETF has returned 7 per cent per year.

You can invest by geography, such as buying into an Australia, USA, or Asia-themed funds. You can also narrow down your preference to an asset class, like commodity-themed ETFs such as the VanEck Vectors Gold Miners (ASX:GDR).

For a more risky exposure, emerging markets-themed ETFs like the BetaShares Legg Mason Emerging Markets Fund (ASSX:EMMG) are a popular choice.

How about exposure to ASX small caps?

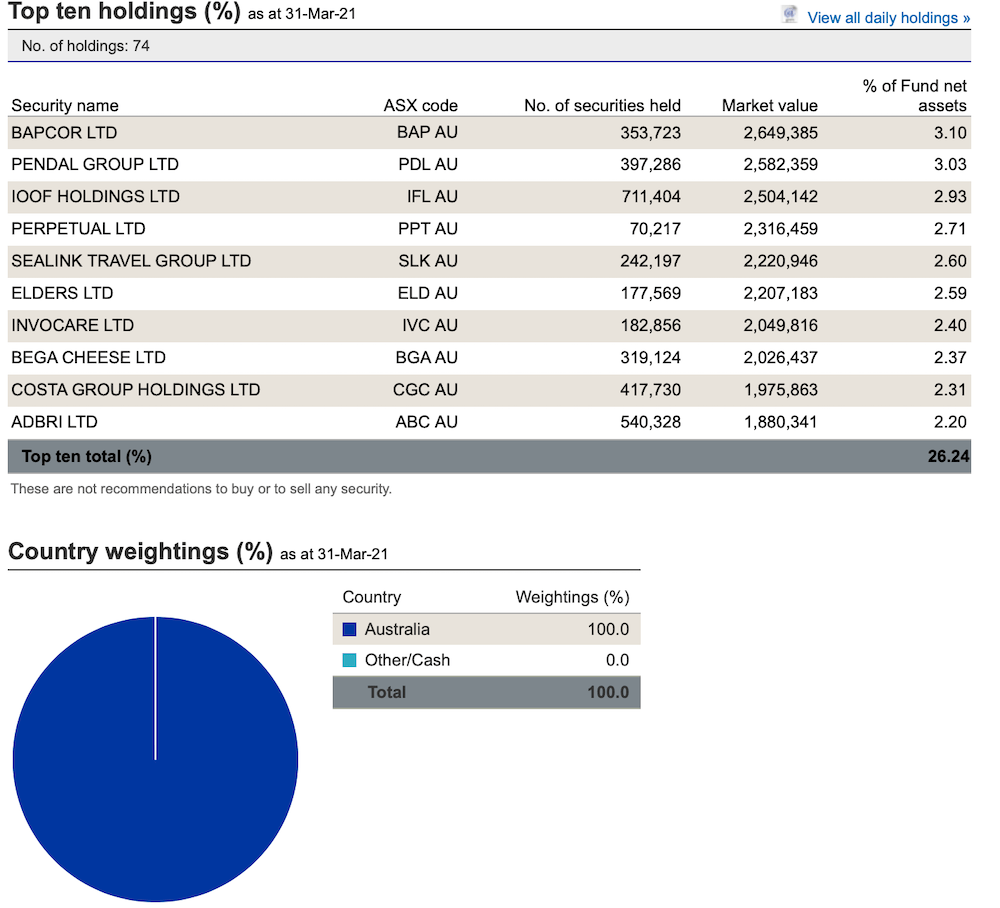

Yes, one can definitely get that exposure by buying into the VanEck Vectors Small Companies Masters ETF (ASX:MVS), which invests in a diversified portfolio of ASX-listed small companies.

The fund’s top 10 holdings are shown below.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.