The US debt ceiling: A short history of institutional idiocy, with pics

US debt kitchen. Via Getty

The US President and some top Republicans, led by the possibly loopy House Speaker K. McCarthy, fought like friends and lovers overnight in an attempt to not murder one another and thrash out some kind of arrangement to raise the US gov’s debt limit and avoid a catastrophic US default.

The first bit did not happen, the second bit has not happened yet.

President Biden with a bevy of annoyed Republican and Democratic congressional leaders wrapped up a meeting at the White House sans said deal, keeping the nation on track to default on its debts as soon as June 1.

Biden will apparently cut short a coming Aussie trip and return to play the US fiscal version of chicken in the hopes of not selling the farm.

The ill-mood surrounding the talks grows by the day as they’ve got a little under a fortnight before the world’s largest economy runs out of cash.

What is the US debt ceiling?

The debt ceiling is the legislated amount of debt the US Federal Government can have outstanding. Since 1960 the US debt ceiling has been lifted 78 times. The current debt ceiling limit of $31.4 trillion set in 2021 was reached in January of this year.

In recent months, the Treasury has been using extraordinary measures to help the government continue to pay its bills. The “X-date”, which is the date when the government can no longer pay its bills, is rapidly approaching.

The Department of Treasury estimates the X-date to be June 1; however, with special measures, i.e., short-term fixes and compromise, the X-date might be drawn out until late July or even September.

“It is impossible to predict with certainty the exact date when Treasury will be unable to pay the government’s bills,” Secretary Yellen told Speaker McCarthy.

What’s the point of a debt ceiling?

Nothing.

Really?

Well.. the debt limit — what we’re calling the debt ceiling — isn’t in the Constitution nor the 27 various Amendments. It’s just a statute thingy – a law – enacted as part of legislation allowing the government to issue bonds to finance US participation in the First World War and to provide more flexibility to finance the whole thing.

Congress tweaked the method by which it authorised debt in the ‘Second Liberty Bond Act of 1917.’ Under this, Congress established an aggregate limit, or “ceiling,” on the total amount of new bonds that could be issued.

It’s been happily in place ever since, causing hassles, headaches and various sorts of evasive action, ever since.

The total debt accumulated by the US government has been growing with each budget deficit since the 1700s. But when Congress wanted to issue those war bonds in 1917, there was resistance from all sorts of corners where opposition grew against adding debt or just going to war.

Know your limit

The limit – and the debt – neared the trillion-US dollar level for the first time late in the 1970s.

Former cowboy actor president Ronald Reagan made this a platform in his winning campaign in 1980. Then once in office, he raised it more than a dozen times.

Because. America. When Reagan was done it was $2.8 trillion.

When it was President George H.W. Bush’s turn, the limit was set at more than $4 trillion. The 1980s wasn’t just about excess, it was also the decade with the biggest percentage increase in the debt and the debt limit.

Oh wait, that’s excess.

Under Bill Clinton, like so many of us were, the limit went to about $6 trillion.

Under George W. Bush, circa $11 trillion (2008).

The last time a new limit was set under Obama it was $18 trillion (2015) and the last time under Donald Trump it was $22 trillion (2019).

During the pandemic, Congress just suspended the limit so as to spend without even the slightest restraint.

The debt rose to more than $27 trillion.

The current limit, set in 2021, is $31.4 trillion.

What happens next?

Most expect the debt limit will be raised before a technical default. However, a quick resolution is unlikely, and if the X-date is crossed, it would be the first time the US has defaulted on its debt.

IG Markets Tony Sycamore told Stockhead back in 1995/1996, the US government was shut down twice, for five days and 21 days, respectively, as negotiations over government spending reached a stalemate. Almost 1 million workers were furloughed. A 2013 Congressional Research Service report found that the shutdown negatively impacted many sectors of the economy.

In 2011, Congress agreed to increase the debt ceiling just two days before the X-date. Soon after, Standard and Poor’s cut the US credits rating to AA+ from AAA. The US dollar tanked, the S&P500 fell 19%, while Treasuries rallied on risk aversion flows.

Tony says that the fact negotiations are underway has thus far provided little comfort to markets.

“The 1Y US Credit Default Swap (CDS protects against a borrower’s default) recently traded at a record high of 177 bp. As a way of comparison, it reached as high as 80 in 2011.”

Tony’s S&P500 technical analysis:

Tony, getting out his slide rule, says that the uncertainty created by the debt ceiling has played a part in the S&P500’s lack of movement since our update last week.

“While the S&P500 remains above 4070/60, a retest of range highs 4200/10 is likely. Aware that should the S&P500 then see a sustained break above 4210 (three daily closes above), it would put the August 4327 high on the market’s radar.

“To re-energise the downside, the S&P500 needs to remain below 4210 and then see a sustained break below 4070/60 which would bring into play 4000 and then 3800.”

Tony’s Nasdaq technical analysis:

Fresh cycle highs for the Nasdaq last week as it traded to its highest level since August 2022. Providing the Nasdaq can hold above support formerly resistance at 13350/13200, a retest of the August 13,740 high is possible.

Aware that if the Nasdaq saw a sustained break of support at 13350/13200, it would warn that a deeper pullback is underway towards 12,800. A break of 12,800 would then see downside risks, initially towards the 200-day moving average at 12,163.

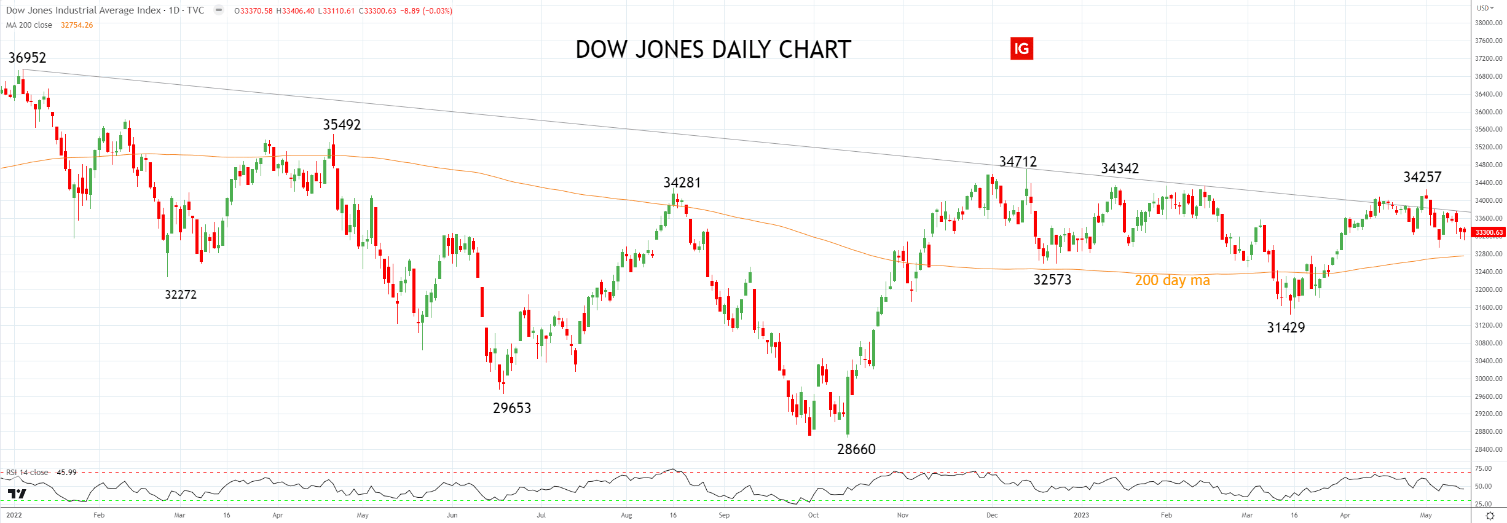

Tony’s Dow Jones technical analysis:

The Dow Jones brief break higher at the end of April was upended by the latest episode of the US banking crisis after PacWest Bancorp reported a drop in deposits during the first week of May. PacWest Bancorp shares ended last week 21% lower at $4.55 and are down 55% in May.

If the Dow Jones can take out the recent 34,257 high and the 34,342 year-to-date high, it would re-energise the upside and open a test of the 34,712 high from December 2022 with scope to the 35,492 high from April 2022.

Until then, allow for a deeper decline to unfold towards support at 32,800, coming from the 200-day moving average with scope to year-to-date lows at 31,429.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.