The unfair work compression: These ASX stocks are most at risk from historic wage bump

Via Getty

Last week, the Fair Work Commission (FWC) damned itself and many others by coming out with an official – and historic – 5.75% increase in award wages.

The commission, citing nothing more than a pretty good feeling seemed to insist the chunky hoist wouldn’t trigger a wage-price spiral in the middle of a record breaking Inflation Vs Interest Rate rise battle.

But the tail end of trade last week saw a fair few retail stocks already stumble into the kind of pre-free fall wobble that presages at least some kind of minor tailspin.

UBS agrees and has provided a handy list of exposed ASX players.

To catch you up

The FWC announced a +5.75% increase in the National Minimum Wage (applies to ~1% of all Australian employees), and a +5.75% Average Award wage floor (applies to ~25% Australian employees).

This announcement adds to inflation pressures, with UBS economists now expecting two further 25bp rate increases from the RBA at both the June and August meetings, seeing the cash rate reach 4.35%.

The new national minimum wage will be $23.23 per hour, and $882.80 per week, based on a 38-hour week.

But that increase in the minimum wage comes with a sneaky rider.

The FWC’s concession there’d be a ‘modest’ bump to wages growth over the next fiscal year, but suggested it’d ‘not cause or contribute to any wage-price spiral.’

And to lose anyone trying to follow the reasoning behind the decision, the FWC went on to explain, the minimum wage also ends “the alignment between the national minimum wage rate and the C14 classification wage rate in modern awards.”

WTF you ask?

Well, skipping the C14 etc nomenclature, it means the national minimum wage will actually lift by 8.65% compared to last year’s (lower-comparative) minimum wage rate.

The FWC is selling it as only a 5.75% increase, because that’s the size of the increase compared to a new classification thingy it also sprung at the same time.

“We acknowledge that this increase will not maintain the real value of modern award minimum wages, nor reverse the reduction in real value that has occurred over recent years.”

Good one. The wage hikes begin on the first full pay period from July 1.

Brass tacks

As Treasurer Jim Chalmers correctly said on Friday, “The 5.75 per cent increase to awards is the biggest in history and will help 2.7 million workers.”

The 8.65% increase is obviously much bigger, than the biggest in history.

From the POV of a lot of ASX businesses the increase will hurt a lot of other people.

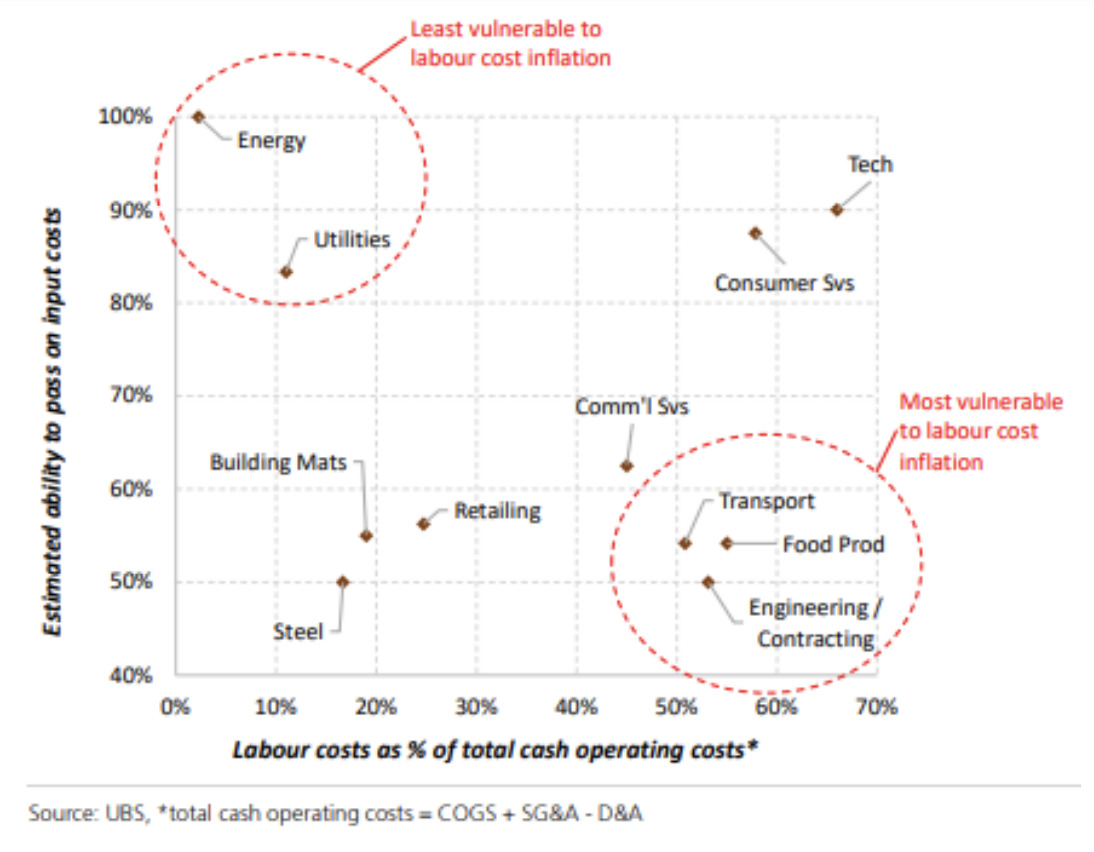

Companies most at risk can be formed into three groups with silly hats.

Retailers and supermarkets such as Adairs (ASX:ADH), Accent Group (AX1) and Premier Investments (ASX:PMV).

Building material companies such as Boral (ASX:BLD) and Adbri (ASX:ABC).

Transport and construction-services-exposed companies such as Aurizon (ASXAZJ), Downer (ASX:DOW), Kelsian (ASX:KLS), Qantas (ASX:QAN) and Qube (ASX:QUB).

Earnings and profit margins will be first to go

Company results through the February reporting season showed that still solid levels of end demand were allowing most companies to withstand higher input costs by passing on to their customers.

However, UBS says with the labour cost pressures now intensifying, “by next results season in August, we could see an increased skew toward profit disappointment as swelling wage bills begin to eat into profit margins.”

All retailers in Australia will face an increase in labour costs greater than historical levels and at a scale that UBS says many will find it difficult to offset.

Voila. Enter the risk to industry EBIT margins rather skewed to the downside.

UBS: Comparatively better positioned ASX retailers

1. Woolworths (ASX:WOW): low labour costs / sales, largest food retailer in Australia; essential products; large stores; well established & ongoing productivity initiatives including in-store automation.

2. Wesfarmers (ASX:WES): existing cost saving programmes in place across its retail divisions; Bunnings, Kmart ($7 average ticket size) & Officeworks enjoy strong value positions in market; Bunnings’ enterprise agreement at 10.5% for 3yrs with productivity initiatives including its ‘bank of hours’ model.

3. Coles (ASX:COL): low labour costs/sales; second largest food retailer in Australia; essential products; large stores; ‘Smarter Selling’ cost savings programme expected to continue in FY24E onwards, although yet to be announced.

UBS: Comparatively worse positioned ASX retailers

1. Premier Investments: high labour costs/sales; smaller stores; less essential product; ~90% of FY22 sales in ANZ.

2. Accent Group and Universal Stores: high labour costs / sales, smaller stores, less essential products

3. Lovisa (ASX:LOV): very high labour costs/sales; smaller stores; less essential product but a very low price point; only 38% of sales in ANZ (28% of stores).

4. Harvey Norman (ASX:HVN): labour costs incurred by franchisees; large stores; but track record of HVN supporting franchisees; non-essential category; 66% of retail network sales in Australia

5. Super Retail Group (ASX:SUL): super high labour cost/sales; less essential product; active plans to reduce costs [e.g. smart rostering];

6. JB Hi-Fi (ASX:JBH): low labour cost/sales; less essential product (but strong telecommunications offer); already lean but will reduce casual hours

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.