The three ASX investment funds that just posted triple-digit annual returns

(Pic: Getty)

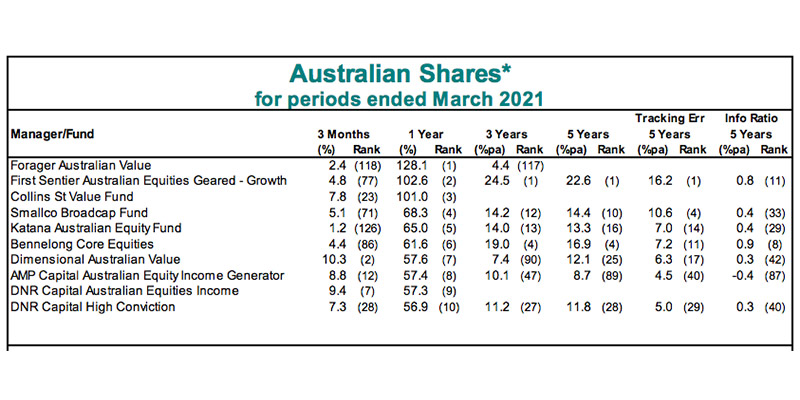

Services firm Mercer has released its latest report card for the best performing Australian fund managers, and there were some hefty annual returns on display.

The latest data set was tallied up for 12 months ended March 31, which means it incorporated some low base effects after COVID-19 wreaked all-out havoc on global stocks in the first quarter of last year.

As a result, three fundies led the pack with annual investment returns of more than 100 per cent — an exceedingly strong result by funds management standards.

For comparison’s sake, the best performing fund in the 2020 calendar year was Melbourne-based Collins St Value Fund, which posted investment returns of 43.6 per cent.

Fast forward three months and Collins St is still sitting pretty in the Top 3, this time with an annual gain of 101pc.

Here’s the Top 10:

ASX investment funds — the breakdown

Commenting on the results, Ronan McCabe from Mercer said Q1 2021 saw a continuation of the December quarter trend, where funds with a portfolio weighted to value stocks (over growth) made a long-awaited climb off the mat.

Following on from the positive vaccine news in November, value stocks got another boost when bond yields started to rise in February — a catalyst which prompted a sharp move out of high-growth tech sectors.

“After a protracted period of underperformance spanning more than a decade, Australia is witnessing the strong performance of value factors seen elsewhere in the world,” McCabe said.

As a measure of how things can change, McCabe’s commentary six months prior highlighted the continuing outperformance of growth over value for the year ended September 30.

So far in April, big tech has made a bit of a comeback as concerns about inflation and rising yields take a back seat (for now).

That’s probably good news for ASX investment funds such as Hyperion, which topped the tables in Mercer’s September results but fell back to the pack as ‘value’ themes took centre stage.

While “we don’t know whether the current outperformance of value will be sustained”, McCabe said some exposure to traditional value stocks such as banks is an effective way to manage a diversified investment portfolio.

Looking ahead, “other influencing factors on investor sentiment include the pace of the economic recovery and the risk from rising inflation”, McCabe said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.