The next two ASX sessions offer a simple way to test a famous branch of technical analysis… and possibly make money

Or not. Via Getty

Elephant-eared Aussie investors will have noted the dull crack of fibula at 4pm yesterday (Thursday) when the ASX200 vigorously snapped its five-session winning streak.

The local benchmark – in the words of market analyst, fiscal visual artist and technical magus Tony Sycamore – emphatically rejected the midweek push past 7800 points to erase all of its happy post-RBA decision rally.

I’m not a true-believer in the tactical value of technical analysis – not in small part because maths.

But I thought some technical Tony-talk on the recent price action is defo worth sharing.

I have Googled “Three-wave corrective ABC Elliott wave theory,” but, in that way lies madness.

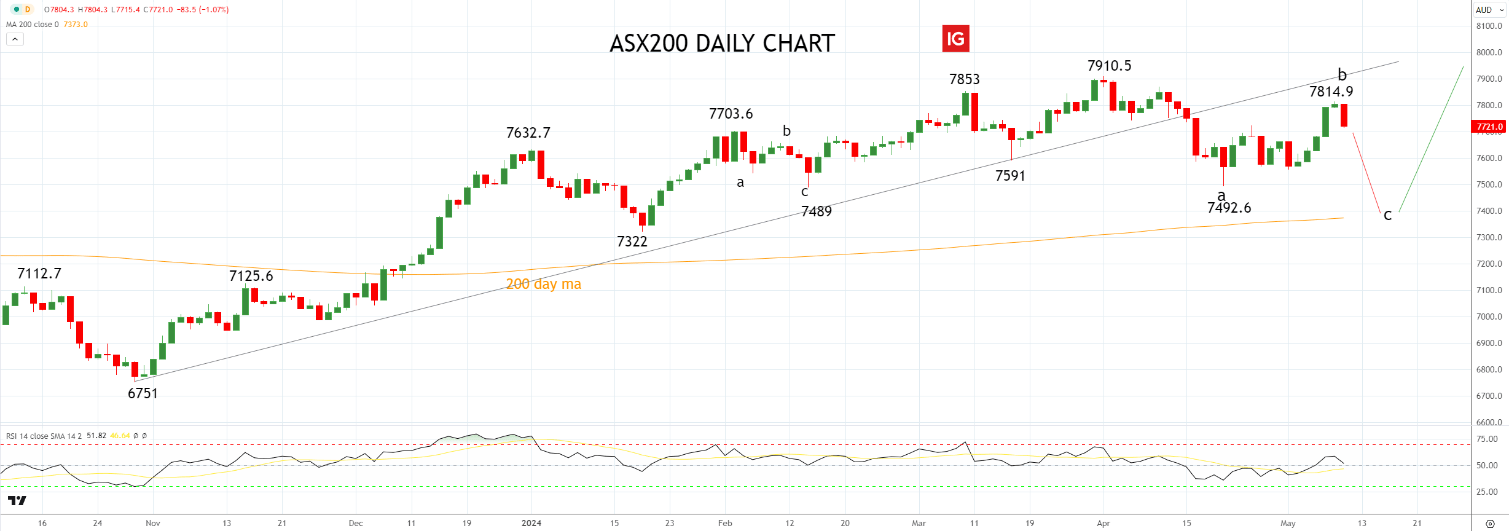

Tony told Stockhead this morning that the ASX price action of late can whittle the next few sessions down into a yes or no question – did the ASX200 pull forward its usual (traditional) May pullback into mid-April and is the correction therefore now over?

Or is the May dip, “which would bring with it the sting in the tail”, to come?

Tony’s view is for the latter based on the ideas of Ralph Nelson Elliott who got real granular back in the day before that was a thing, and apparently identified the specific characteristics of wave patterns and made detailed market predictions based on the patterns.

Tony reasons thusly:

“It’s not lost on this observer that Thursday’s selloff is the third time in two months that a rally above 7800 has been cut short by the emergence of an aggressive sell order that had a snowball effect on the local market.

“While we can’t confirm if yesterday’s sell order is linked to the previous selloffs (on March 11th and April 3rd), it does serve as a cautionary sign that today’s decline could extend further.

“In the lead-up to the sell-off, we have favoured the view that the pullback from the 7910 high was missing another leg lower (Wave C) to complete a three-wave corrective ABC Elliott wave correction.”

Thursday’s losses suggests to Sycamore that a Wave B high is in place at 7814, and Wave C has commenced, which targets a move towards Wave quality at 7390ish.

Tony calculates a sustained move below 7700 in the coming sessions would increase confidence in the view.

“A break below 7700 would all but seal the deal that we have started a deeper pullback. Until then it’s still a bit of wait and see with next week’s US CPI report shaping up as a potential market mover of note.”

ASX200 Daily Chart with candles

So what happened, where on Thursday?

Before you head off and start trading as per Elliott Wave Theory, best take a closer, ‘granular’ peek at where the selling emerged.

Consumer Discretionary stocks have been heavily marked down after disappointing trading updates from some within the sector.

Baby Bunting (ASX:BBN) plummeted 23.42% to $1.46, Temple & Webster (ASX:TPW) dived 12.20% to $11.08, Adairs (ASX:ADH) lost 5.37% to $1.94, and Nick Scali (ASX:NCK) lost 5% to $14.64.

The big banks have entered a seasonally weak period, and they showed it.

Westpac (ASX:WBC) lost 5.61% to $26.35 after it went ex-dividend.

Commonwealth Bank (ASX:CBA) fell 1.93% to $117.43 despite its quarterly trading update impressing banking analysts. National Australia Bank (ASX:NAB) lost 1.22% to $33.54, and Australia and New Zealand Banking Group (ASX:ANZ) lost 1.13% to $28.79.

Macquarie Group (ASX:MQG) bucked the biggies, rising 0.21% to $191.12.

The big mining stocks lost ground as iron ore fell 2.63% overnight to $115.10.

Fortescue (ASX:FMG) fell 0.86% to $26.40, BHP (ASX:BHP) fell 0.62% to $43.11, Mineral Resources (ASX:MIN) lost 0.65% to $76.69, and Rio Tinto (ASX:RIO) lost 0.20% to $129.95.

The robust rebound in Property got skewered by US yields rising for a third straight session ahead of next week’s all-important April CPI release.

The culripts: Lendlease Group (ASX:LLC) fell 2.28% to $6.21, Domain Holdings Australia (ASX:DHG) fell 2.22% to $3.08, Goodman Group (ASX:GMG) fell 1.88% to $33.64, and Scentre Group (ASX:SCG) fell 1.71% to $3.16.

Energy stocks gained as the price of crude oil rebounded above $79.00 following lower-than-expected US inventories, sparing the index further blushes.

Beach Energy (ASX:BPT) gained 1.9% to $1.61, AGL Energy (ASX:AGL) added 1.68% to $10.30, Woodside Energy Group (ASX:WDS) gained 1.11% to $28.19, while Santos (ASX:STO) added 0.40% to $7.66.

A final thought from The Magus:

“If it works out we look like Magicians and if it doesn’t we just look like people who believe in Magic.”

Elliott Wave Theory (Basic Principle)

DELAWARE – APRIL 28: Chase Elliott, driver of the #9 NAPA Auto Parts Chevrolet, waves to fans at the NASCAR Cup Series Würth 400 at Dover International Speedway on April 28, 2024 in Dover, Delaware. (Photo by James Gilbert/Getty Images)

Elliott first published his theory of the market patterns in the book titled The Wave Principle in 1938.In the language of children, movement in the direction of the trend is unfolding in 5 waves (called motive wave) while any correction against the trend is in three waves (called corrective wave). The movement in the direction of the trend is labelled as 1, 2, 3, 4, and 5.

The three wave correction is labelled, cunningly, as a, b, and c. These patterns can be seen in long term as well as short term charts.

Ideally, smaller patterns can be identified within bigger patterns.

In this sense, Elliott Waves are all fractal-like. Just think of a great big piece of uneaten broccoli, where the smaller piece, if broken off from the bigger piece, does, in fact, look like the big piece.

The whole smaller patterns fitting into bigger patterns, coupled with the Fibonacci thingy about relationships between the waves, offers the canny trader a level of anticipation and/or prediction when searching for and identifying trading opportunities with solid reward/risk ratios.

Elliott Wave Theory (Wave 3)

In Elliott Wave Theory, Wave 3 is usually the largest and most powerful wave in a trend (although some research suggests that in commodity markets, Wave 5 is the largest).

The news is now positive and fundamental analysts start to raise earnings estimates.

Prices rise quickly, corrections are short-lived and shallow.

Any punter looking to “get in on a pullback” will likely miss the boat, because as Wave 3 starts, the news is probably still bearish, and most market players remain negative; but by Wave 3’s midpoint, “the crowd” will often join the new bullish trend.

Wave 3 often extends wave one by a ratio of 1.618:1. I’ve been told.

The Wave 3 rally picks up steam and takes the top of Wave 1. As soon as the Wave 1 high is exceeded, the stops are taken out. Depending on the number of stops, gaps are left open.

Gaps are a good indication of a Wave 3 in progress. After taking the stops out, the Wave 3 rally has caught the attention of traders

Questions?

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.