The Great American Rebuild is now an ASX dream that’s 100% Trump proof

Build it and they will not come. A barbed wire border fence separates the US and Mexico in New Mexico. Pic: Luke Sharrett/Bloomberg via Getty Images

We’re big fans here at Stockhead of the behavioural-economist-as-investment-adviser.

You don’t get a lot of them and even fewer skirting the globe with a Masters in War Studies from King’s College.

I met one last week. My guy is Dr Scott Helfstein.

Right now, he’s the head of investment strategy at Global X, where he largely seems to jump on and off planes, “delivering actionable insights and innovative investment strategies, researching trends at the intersection of accelerating technological, demographic, and environmental change.”

Basically, he helps make exchange-traded funds.

It’s a surprising gig for someone who’s served as the director of research at West Point’s Combating Terrorism Center.

That’s right. Pretty much the same place Jack Bauer used to work.

The Ex-Morgan Stanley and BNY Mellon Investment Management man appears to be your garden variety market strategist, carving out a few equity portfolio solutions, dabbling in some thematic investing, a little tactical market communications.

But on the other hand, he’s like a character out of a Tom Clancy techno-thriller, someone who sees the global macro trends which move markets through a lens of behavioural economics and complexity theory – his speciality.

Perhaps Scott is the only thematic investor out there with a Joint Doctorate in Public Policy and Political Science (Uni of Michigan) and that Masters in War Studies (King’s College, London).

And not unlike Clancy’s academically inclined hero Jack Ryan, I caught Scott a few hours before he jumped on a plane to disappear into Queenstown, New Zealand.

We talked about China. And we talked about what he’d call the global flow of money and I’d call Geopolitical Investing.

And aside from a growing sense of having wasted my life, this is what I took from it all.

“In an uncertain world, invest in certainty.”

US President Joe Biden might look a bit unconvincing at times but it hasn’t stopped his administration setting the stage for the largest federal investment in US infrastructure in the digital age.

Maybe investing in the poles and potholes of US infrastructure might seem as sexy as a road accident, but with almost US$4tn in spending required to upgrade America’s ailing infrastructure assets, there’s an awfully obvious attraction to the simplicity of it.

Dr Helfstein says US infrastructure development promises to be one of the only bipartisan projects guaranteed to attract total commitment from either side of the US political divide beyond the upcoming election.

The long-term outlook for the sector is robust, given the US government has made closing the funding shortfall a priority.

“The US infrastructure sector is facing an urgent need for development,” Helfstein says.

As recently as 2021, the American Society of Civil Engineers assigned US infrastructure a ‘poor grade’, highlighting a terrifying list of “significant deficiencies” in the states “which must be addressed.”

It may be a US$25tn economy, you’ve had the disconcerting pleasure of visiting the States lately, the look of its systems right now isn’t all that pretty.

Roads, railways, power grids and internet providers. Mines, manufacturing, critical minerals. Planes, trains and automobiles. They were built decades ago and are struggling to keep pace.

On top of the direct budgetary impacts captured by the ‘fiscal impulse’ measures, the new incentives created will drive private sector investment at a level that far exceeds direct government spending.

“This has spurred several long-term legislative catalysts, including the Infrastructure Investment and Jobs Act and CHIPS and Science Act, amounting to nearly US$2 trillion in federal investment,” Helfstein says.

“Which is distinct from investing in infrastructure assets themselves, is critical for the growth and modernisation of any economy. Within the US, these legislative acts are directing substantial funding towards infrastructure initiatives, signalling enormous growth potential for companies in this sector.”

Making America Function Again

Being the year of another US election cycle, it’s probably fair-to-factual to say fiscal consolidation won’t be a significant headwind to US growth this year or next, Helfstein says, betraying a gift for quality understatement.

It’ll be a spendfest.

The question is how can we – the ASX punters driven to distraction by the improbable enormity of Artificial Intelligence and the meteoric rise of the Nvidia’s of Wall Street – make good on this looming and booming build out?

As it turns out, about three weeks ago everyone missed the arrival of an ASX-listed ETF which hitches handily onto the growing inevitability of the next great phase of United States infrastructure investment.

Launched in June, the Global X US Infrastructure Development ETF (ASX:PAVE) tracks the Indxx US Infrastructure Development Index with a focus on companies involved in the construction and engineering of infrastructure projects.

That includes those in raw materials, heavy equipment, engineering and construction, likely to benefit from increased spending on infrastructure projects in the world’s largest economy.

According to Global X, PAVE stands “uniquely positioned to capitalise on this momentum, offering a balanced portfolio that strategically leverages these long-term trends…. providing investors with opportunities for both stability and growth, enabling them an opportunity to participate in this transformative period.”

Bipartisan war footing

Good blurb. And when it comes to rebuilding America’s sprawling, frazzled infrastructure the White House has gone nuts, and, as unlikely as it sounds, the Republicans have backed them to the hilt.

There’s many reasons for America to feel itself on a war footing and all the while US infrastructure is both dangerously overstretched and lagging behind that of its economic enemies, particularly China, but with Russia’s troublemaking President Putin making friends with PyongYang, there’s plenty of reasons to get building.

The US industrial policy programme is being defined by three fat pieces of legislation already passed over the last few years

- The Infrastructure Investment and Jobs Act

- The CHIPS Act

- The Inflation Reduction Act

From ailing roads to spotty internet, the need to update and protect modern America’s fundamental building blocks is the single space where there’s bipartisan enthusiasm, and that’s an extraordinary tailwind advantage in itself.

Given the relatively long lead times on the projects, the majority of the spending driven by these bills is all in the post, with the peak due around 2026-2027.

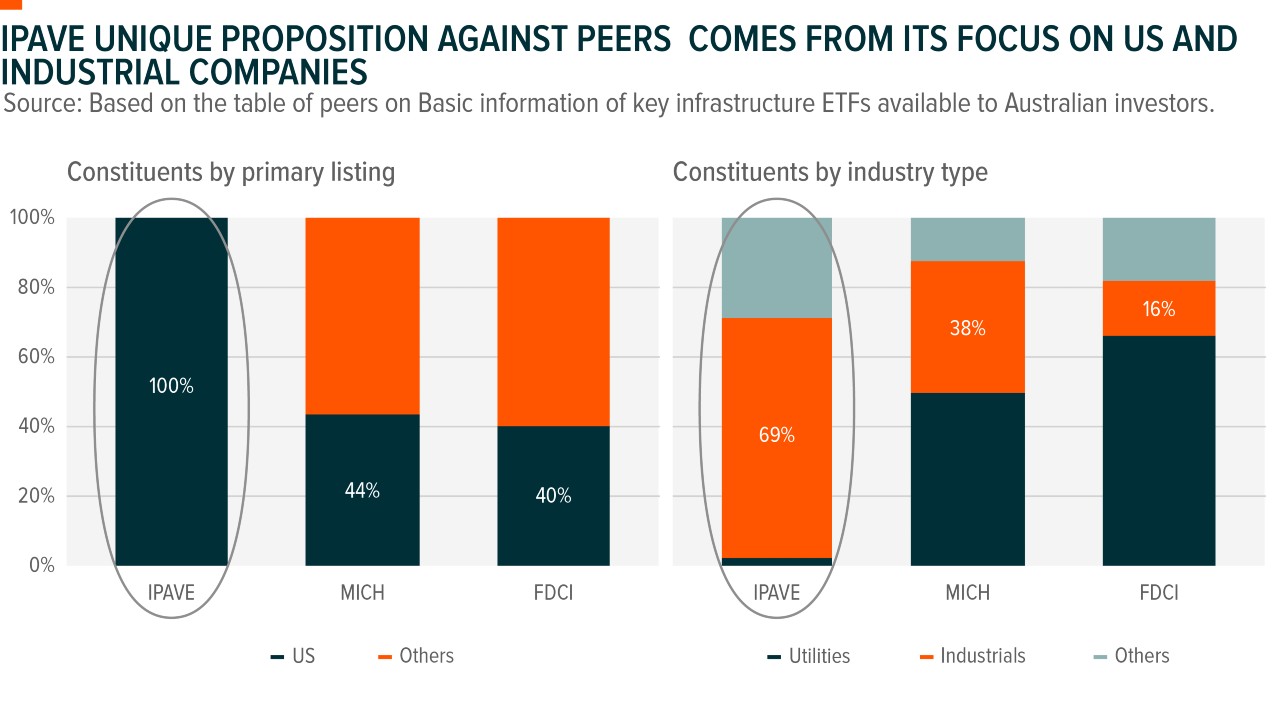

Scott’s ETF (PAVE) has the “unique composition” to best take advantage of the coming rain, he believes.

“Who can out hawk who on China”

As the head of Global X ETF’s investment strategy, Dr Helfstein reckons that out of what’ll be a very contentious election, there’s two issues that merge into one when it comes to guaranteed bipartisan enthusiasm.

“It’s who can out hawk who on China, and infrastructure,” he told Stockhead.

“Firstly, we observe an increase in flows to the US, driven by its robust economic performance in comparison to other large emerging or developed economies. This growth is fuelled by various factors such as automation, digitalisation, onshoring of technology – semiconductors, microchips, critical minerals, reviving manufacturing and increased automation in the services sector.

“A significant focus in our discussions revolves around the US infrastructure, which is currently a key topic following the recent launch of president Biden’s $1.2 trillion infrastructure bill.

“A substantial portion of this allocation, including $600bn for chipsets, aims at bolstering semiconductor production through public-private partnerships.”

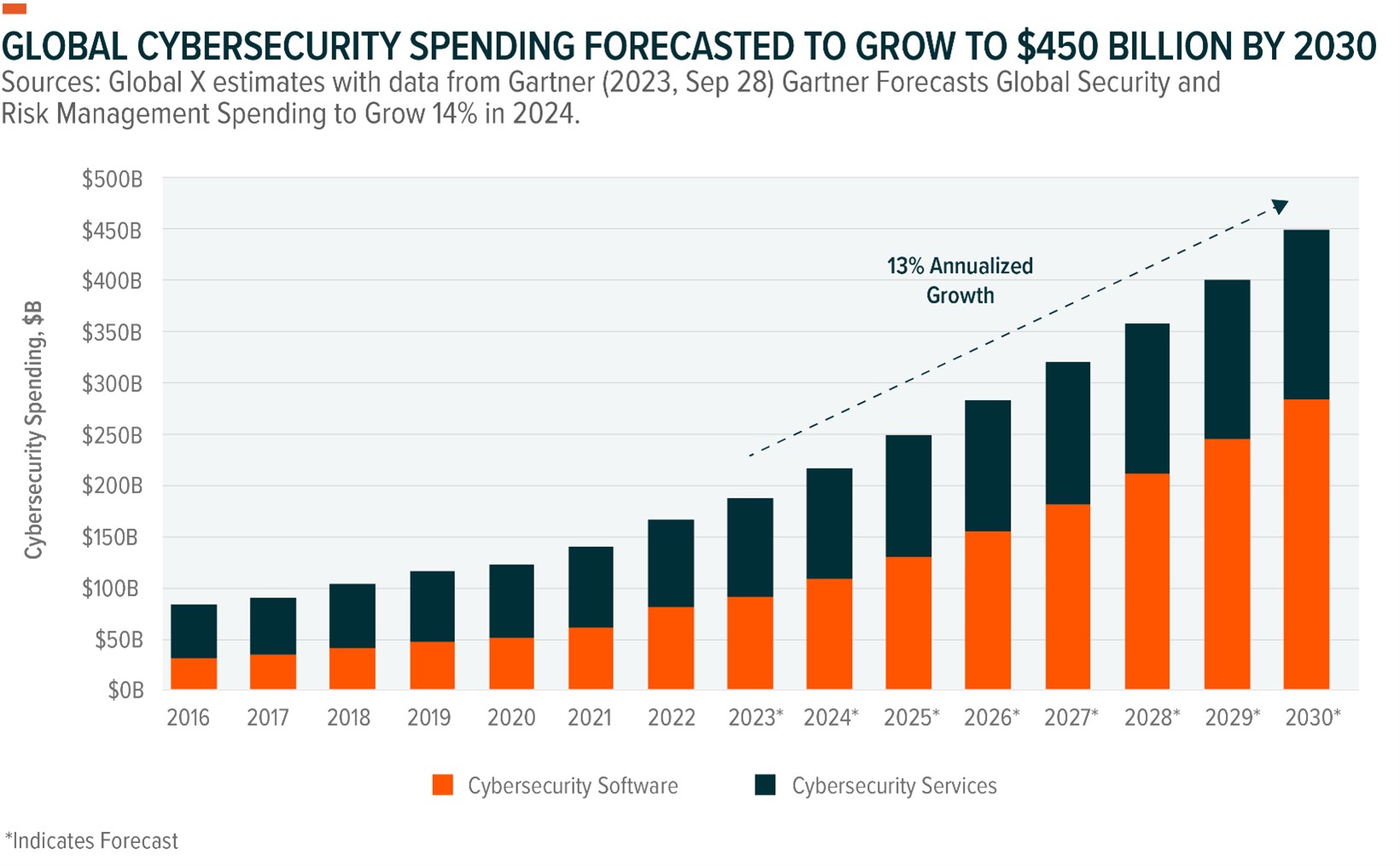

Then there’s the question of bulking up America’s digital infrastructure.

“This investment, amounting to US$1.8trn primarily supports construction-related industries, highlighting the sector’s importance for economic development.”

Bipartisan consensus on issues related to China and infrastructure underscores the significance of these areas in shaping geopolitical and economic strategies.

“The evolving dynamics between China and Western nations have shifted significantly in recent years, triggering debates around the Thucydides Trap and self-fulfilling prophecies,” Helfstein says.

“China’s assertive and sometimes coercive economic policies have prompted strategic responses from countries like Australia, Canada, and the United States, signalling a recalibration of global economic relationships.”

He adds that not only has the realisation of alternative markets beyond China (think Australian coal following China’s punitive tariffs) has underscored the importance of diversification and resilience in economic strategies, challenging previous dependencies on a single market.

Certainly, for both Biden and Trump, the course is set.

Build or die

After the initial optimism that accompanied China’a ascension to the World Trade Organisation in 2001, the tide has turned.

20 years later, a Beijing embracing the dictatorship of the Party, economic coercion, suppression of free market activity for state-led development, and the leveraging of subsidies into targeted industries to the detriment of foreign competition have made China under Xi Jinping a clear danger to American interests.

State-connected Chinese companies like Huawei and TikTok-owner Bytedance are anathema to national security.

The US has long accused China of pressuring American companies to share technology, but research from our own Australian Strategic Policy Institute has long shown how China has been infiltrating institutions, leveraging commercial advantages or just stealing IP and tech outright.

In a sign of more of the same, both Biden and Trump are vying for office again in 2024 and both have taken the same two-pronged approach on China.

The first prong has been offensive moves in trade, the second shoring up infrastructure at home to ensure competitiveness.

A race for economic hegemony has begun and China’s belligerence has been the catalyst.

“If you’re gonna be tough on China then it’s really about competitiveness and who can be more competitive. And that competitive story feeds right back into infrastructure.”

The massive US investment in post-World War II infrastructure set the foundation for the nation’s ascension in the aftermath and ensured safety at home and strength abroad.

Helfstein says at the same time, poor infrastructure can undo the world’s largest economy from within.

As the impact of climate change grows, infrastructure failures could impose huge costs that hobble the economy.

Even this year we’ve already seen how things like bridge collapses from inadequately maintained waterways can cost billions of dollars in lost economic productivity.

According to Scott, PAVE and its 100 US-listed companies captures the resurgent focus on infrastructure by investing in the construction, engineering, cyber-infrastructure, material procurement, transportation, and equipment distribution corporates up and down the supply chain of these infrastructure projects.

Size, scope and policy certainty

In a world where everything else, even the trajectory of the so-called Magnificent Seven, is beset by uncertainty, a locally listed ETF which taps into the trillions of US dollars is a local play which can provide exposure to a ludicrously underserved area.

The recent and growing investments in US infrastructure are set to transform the nation’s landscape, enhancing transportation, energy, and communication systems.

This focus on infrastructure is expected to unlock new markets and spur economic growth worth trillions of dollars.

The evolution of the global infrastructure investment landscape has significantly accelerated from being a story of a few key resource commodities, and fixed assets (like utilities).

Now, Helfstein says, the story is one of onshoring capacity for advanced materials, cutting-edge technologies, and modern equipment required for maintenance and growth.

This shift not only promises better growth prospects but also aligns with government policies ensuring “lower leverage and potentially higher returns” for investors.

The message from Global X is this makes PAVE exactly the kind of local investment vehicle which opens up a channel for Aussie investors to tap directly into a part of the resilient US economy from the comfort of the back porch at a fraction of the cost and bother.

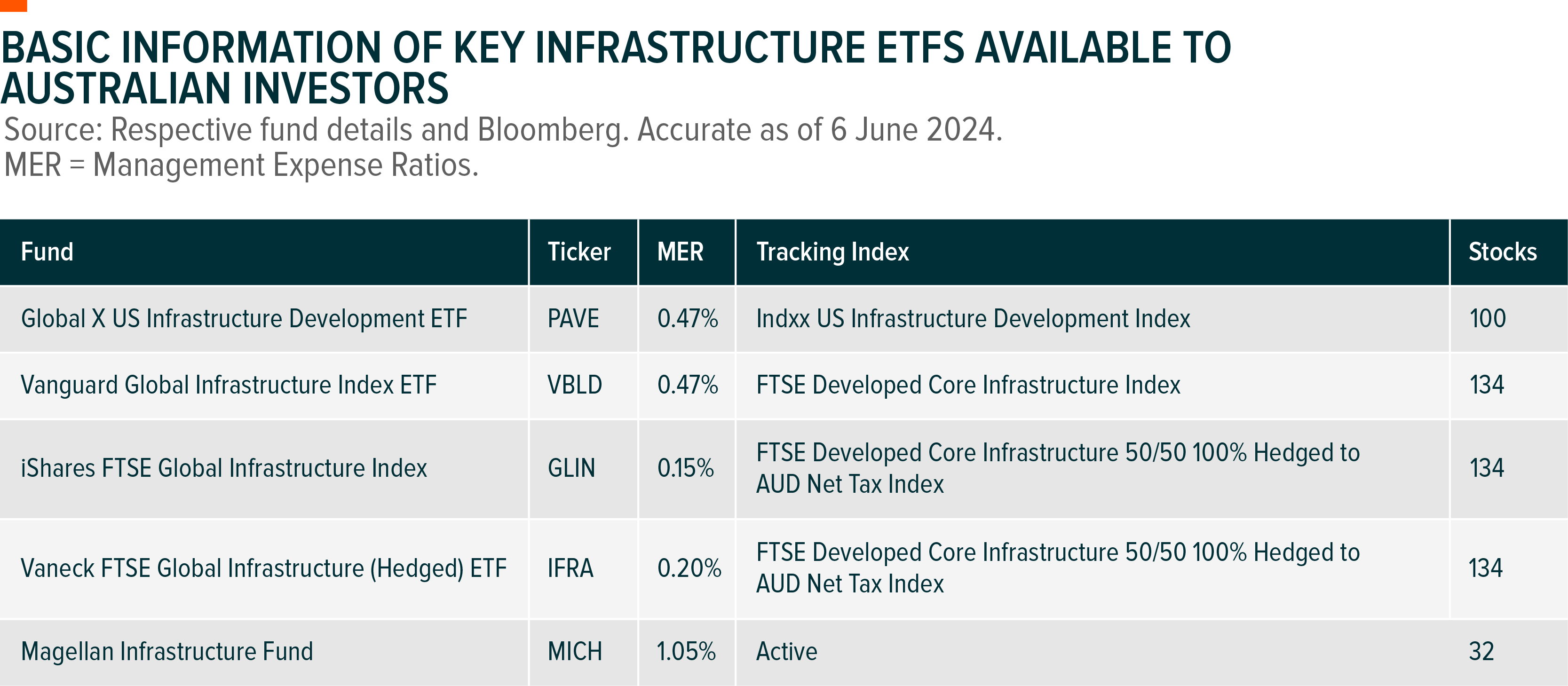

Here’s the options out there on the ASX right now:

“In our view, these companies help illustrate the broader array of investment opportunities that are available across the entire infrastructure value chain.”

All this brings the number of funds in Global X’s ETF range in Australia to 30 after the release of a gold bullion ETF last month and an artificial intelligence-focused fund in April, and even more recently a hedged version of their popular FANG+ ETF.

Holdings: Global X US Infrastructure Development ETF (ASX:PAVE)

Stability, lower leverage and structural megatrends

S&P500 companies have delivered profit margins above 12% for 11 quarters straight, highlighting the economic stability the US stock market is now seeing.

In the last three to five years there has been the same level of margin expansion seen over the last 75 years.

Helfstein says these margins were achieved thanks to company spending and reinvestment, largely in automation and digitalisation – as well as structural megatrends.

“With the awakening of AI, we are living through the fourth great innovation boom, and it’s being driven by corporate America,” he notes.

“Although it may be tempting to compare this market to that of the dotcom era, I’d highlight that the dotcom bubble was exorbitant, while the AI rally has been largely rational with lower price-to-forward multiples and performance metrics aligned with quality investing,” Helfstein said.

Financial stability is another hallmark of PAVE’s underlying companies.

“With a net debt to equity ratio of 73.6% and a higher current ratio, these companies show better financial health and lower leverage compared to many peers. This lower leverage ratio reflects prudent financial management and resilience against economic fluctuations, further supported by their alignment with government initiatives.”

The backing of policies like the Infrastructure Investment and Jobs Act, Inflation Reduction Act, and the CHIPS and Science Act provides these companies with substantial support, enhancing their stability and reducing financial risk.

Australian investors could benefit from opportunities in the US as its economy, markets, and top companies are far more robust than many are giving them credit for.

“The real place we should be drawing a parallel between the dotcom and AI phenomena is that both technologies have and will fundamentally change the world as we know it. So, when people ask me whether they have missed the AI opportunity, I say, ‘sure you may have missed Nvidia, but the ship has far from sailed’,” Helfstein says.

“The internet absolutely revolutionised every facet of life, it just took an additional 15 years than when the dotcom bubble burst because there was more groundwork to be done before it was viable, and I expect the same to be true of AI.”

AI is driving capital expenditure and subsequently capital growth in companies involved directly in the development and adoption of the technology, hence the AI thematic will continue to perform, as will the likes of semiconductors and cloud computing.

Helfstein is also looking laterally at adjacent industries which are positioned to benefit from AI expansion such as nuclear energy. He says Amazon’s purchase of a datacentre right next to a nuclear power plant was a lightbulb moment.

“More AI equals more computing power, equals more energy – it’s a simple equation really. Nuclear energy is likely coming online in the US while Japan (may turn) their reactors back on and major European economies are back under pressure to use nuclear as sanctions on Russian commodities squeeze supply. All things indeed being equal, demand for uranium and nuclear energy will could rise alongside AI,” he said.

“Ultimately, these thematics can be difficult to access for Australian investors because they are US-centric. Thematic ETFs provide local investors an accessible route to a wide world of opportunities.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.