The global IPO emergency and what it says about money in 2023

Via Getty

- Q1 2023 global IPO volumes fell 8%, with proceeds down by 61% YoY, says EY (and remember 2022 was already awful)

- There was but one mega IPO (Adnoc Gas), an energy deal coming out of the Middle East, with US$2.5b in funding

- APAC did best in Q1 (no thanks to the ASX), accounting for circa 60% of all IPO deals

We’re a full quarter of adventure into the calendar year and the absence of any headlining grabbing global initial public offerings (IPOs) is in itself a handy measurement of the direction which money – smart or otherwise – is going and what it’s thought capable of doing right now.

After the pandemic-inspired euphoria of 2020 and 2021, the come-down is proving itself to be long and painful. If 2022 was where start-up dreams came to die, then 2023 looks like being the cold, day-lit desert for IPOs and the once bright rays of sentiment they encapsulate.

Take the wonder bus Japanese holding company SoftBank Group which had headline plans to bring its chip-making unit to market sometime later this year, with its eyes on a circa US$8 billion kitty. It’s a good time to make a few chips. AI is in the wind and the US has stomped on China’s budding industry.

But SoftBank has said it’ll be banking on another time.

The next generation of bright young things and their momentarily less angelic investors are hunkering down. Unwelcome interest rates, awful inflation, stupid banks and the volatility these tend to inspire, makes listing on a stock market seem like a dumb idea.

That’s according to an EY report Thursday, which found that 299 companies around the world went public over the past three months, down 8% compared to the same time last year.

More damning for the state of things today: after crashing by half in 2022, the total amount of funds raised from those listings crashed again – this time by more than 60% year-on-year, to US$21.5 billion.

In 2023, there have been just 40 IPOs filed, up slightly from 36 for the same period the year before, according to both EY and the US-based Renaissance Capital, which specialises in new public listings.

This year’s slump follows the 45% drop in the number of IPOs last year, according to the number crunchers at Ernst and Young. In 2022 there were some 71 listings which raised almost US$8 billion; that performance contrasts with the terrifying record set in 2021, when there were 397 listings which attracted about US$142 billion per Renaissance.

The problem, of course, is that the stock market fell hard in 2022, with the S&P 500 losing almost 20%. 2023’s performance has so far been so-so, as the index has logged a 5.4% total advance, with January a decent month and a falloff in February.

That record has not inspired confidence in companies looking to make a big score.

With a total of 299 IPOs raising US$21.5b, an 8% and 61% decrease year-over-year (YOY), respectively, Q1 was another down period amid interest rate rises, a lukewarm stock market, entrenched inflation, and unexpected global banking industry turbulence.

Despite this ongoing uncertainty around the economic and geopolitical environment, the IPO pipeline continues to build up and hope remains for a turnaround later this year.

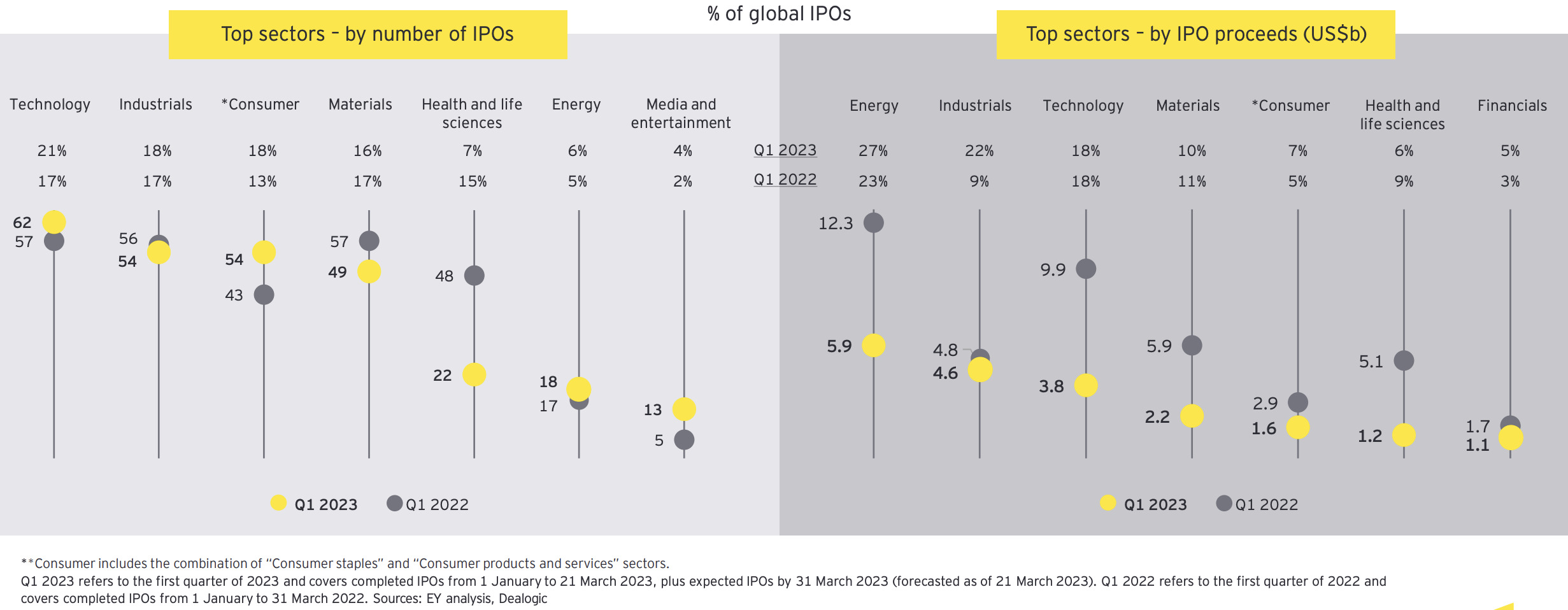

Tech firms, the keystone of IPOs especially in the last few years, saw some sharp declines in valuations, and the hoopla roiling crypto markets and the global banking industry hasn’t been a tailwind. So, even though tech continued to drive IPO volumes, four of the top 10 listings in Q1 2023 were in the energy sector.

Energy IPOs remained well out in front on total funds raised, EY notes, in fact four of the top 10 IPOs in Q1 2023 were in the revivified sector.

Tech IPOs continue to deliver the highest number of deals, but average transaction size is dwarfed by the energy sector. This trend is in line with the steep downward correction in tech company valuations over the past 18 months.

High liquidation and poor post-listing performance of de-SPACs dampened investors’ appetite for new IPOs, says EY.

“This quarter, SPAC IPO activity was at one of its lowest levels in recent years – it hit a six-year low in terms of volume, with proceeds also down to levels not seen since 2016. As market conditions remain challenging and many promoters of SPACs listed in early 2021 need to complete or unwind their transactions, SPAC IPO activity is likely to be muted in the near term.”

The Americas

Over the weekend, the Financial Times reports that Allied Universal, the world’s biggest employer of private security guards, has also put its multibillion IPO on ice – facing the same inclement headwinds as everyone else, but also throwing in disastrous labour shortages as the final straw.

“The last 10 to 12 months have been really choppy waters for public markets, so we’re very comfortable just continuing to remain private,” said chief executive Steve Jones.

For a company already finding some 800k workers gameful employ, the concession is an uncomfortable one.

The economic rollercoaster has unsurprisingly taken the fun out of prospective listings in the US. Ernst and Young notes that IPO activity in the states was in line with Q1 2022, but it still way, way down on a busy last 10 years. The Americas as a whole managed to pull in 40 deals and US$2.6b in proceeds, up 11% and up 9%, respectively, YOY.

On US exchanges, there were 31 deals, eight of which were in excess of US$50m.

Canada saw its biggest IPO since May 2022, raising over US$100m in proceeds.

“Even though IPO activity levels have been on the lighter side, we have begun to see some early positive developments in the areas of inflation, interest rates, valuations and market volatility, which could set the stage for a potential recovery in the Americas IPO market,” EY said.

APAC

Even though the Asia-Pacific IPO market accounted for 59% of global IPO deals, its activity declined 6% by number and plummeted 70% by proceeds, respectively, YoY, recording only 175 deals and US$12.7b in proceeds for the quarter.

Despite the lifting of almost all its pandemic control measures earlier this year, the Mainland China market was a bit quieter than usual, but it is on a healthy projected track and still accounts for more than 40% of all global IPO proceeds.

Hong Kong, also usually a powerhouse for new listings, was uncharacteristically quiet.

Overall, Asia-Pacific, took a “wait and see” attitude, as investors kept their powder dry and looked for further indicators of market recovery.

EMEIA (everywhere else)

Also facing its own rash of withdrawls or postponed IPO filings due to market conditions, Europe, the Middle East and Africa (EMEIA) IPO fun fell away by 19% and 36%, EY says, raising just US$6.2b for Q1.

India as a region had the greatest drop in proceeds for EMEIA, funds raised collapsed by well over 80%, even though it had a 50% increase in the number of listings.

Globally, this quarter, the Middle East was also the only region with a mega IPO.

Adnoc Gas, a subsidiary of Abu Dhabi’s biggest energy company, surged in its trading debut on March 13 after raising US$2.5 billion in the world’s biggest initial public offering (IPO) this year.

On the back of Russia’s invasion of Ukraine and soaring energy prices, shares of Adnoc rose as much as 25% as investors placed nigh on US$125 billion of orders.

Despite this and the Middle East’s upbeat economic indicators, sentiment elsewhere remains cautious EY notes. At best, investors are being highly selective in a buyers’ market, seeking only the evidently profitable and sustainable business cases.

Q2: Can the foot switch the shoe?

EY Global IPO leader Paul Go – a gentlemen who knows a thing or two about listing having served on the Listing Committee for Hong Kong Exchanges and Clearing, says despite the uninspiring global economic and geopolitical backdrop, there’s some light on the horizon.

Go cites the inflation which could be peaking, the energy prices which look like softening, and the bounce in the step of a rebounding Chinese economy.

“However, the backlog for IPOs is continuing to build as companies are holding out for the stock market to stabilise and rebound before listing.”

The fact is, when the going gets tough investors previously itchy to get on the path to funding growth are now far happier to can their ambitions and stay afloat. The path to profitability and cash flows is the new offer, and the public don’t need to know.

Collaboration between governments, including cooperation and stock-connect programs, along with investor appetite for diversity, could also lead to a wave of dual listings and cross-border deals this year, Go believes.

And China is where all eyes now turn.

Late last week, Alibaba floated plans for a six-way de-segmentation which CEO Daniel Zhang has already said can produce a string of big IPOs.

The word on Bloomberg Street is that Cainiao logistics will be first, just as 2 x JD.com subsidiaries reportedly filed for first-time share sales in Hong Kong – the three deals alone representing a US$ 5 billion IPO haul – that’s according to another weekend report from Bloomberg, citing unnamed insiders.

Naturally, having kicked the golden geese of innovation over the last few years, Beijing would now like its well-behaved egg-laying mega tech platforms to do their bit to show the world it’s safe to come to business again in China.

The CCP needs to show that it can be home again to the most lucrative investment deals, loosening requirements for OS listings, even.

That shake-up accomplishes Beijing’s broader aim of carving up tech titans and diminishing their influence over swaths of the economy — while unlocking potentially billions of dollars in value.

Any golden eggs from the dormant Chinese tech IPO battery farm would settle years-long anxieties built up ever since regulators kicked its first goose more than 12 months ago – when it canned Alibaba fintech Ant Group’s record IPO moments before landing.

Should I stay or I should I PO?

Paul Go says for now, IPO hopefuls face “high-cost and reduced liquidity.” An unattractive combo.

“(But) once there is evidence of a more stable market with higher certainty, investor confidence should return, and prominent companies that have postponed IPO plans may restart, albeit at more modest valuations.”

“Amidst persistent macroeconomic and geopolitical uncertainty, exacerbated by stress in the global banking system, IPO windows are fleeting and funding conditions are getting tougher, with investors prioritising value over growth.

“IPO-bound companies need to focus on building sustainable businesses with strong fundamentals to be well-positioned in a volatile environment and meet the challenges and opportunities of going public,” he concluded.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.