The Fed’s wild counterstrike hike and what it means for your holidays

Via Getty

The American indices have finally slapped the brakes on its unedifying week-long slue across the icy expanse of Wall Street in June.

Earlier this morning, we saw the US Federal Reserve hike rates by a large calibre 0.75% to launch a long-awaited counterstrike against free range inflation.

The Fed now joins our Reserve Bank of Australia and more than 50 other central banks around the world to have raised rates in anger by 50 bps or more.

While the household stocks and bonds which Make America Great Intermittently couldn’t be accused of rebounding in any great sense, US markets snatched a welcome lung full of oxygen in what has been a drowning-not-waving month thus far.

After shedding a full 10% of weight over the last five sessions, investors dug in their heels following the Federal Reserve’s fullfilment of a Monday night warning to raise the benchmark interest rates by 75 basis points (bps). A chunky three-quarters of a percentage point bump in its most aggressive hike since 1994.

US inflation rate vs Federal Reserve cash rate

The more boisterous move follows our own central bank’s more aggressive stance and comes after the weekend US consumer price index (CPI) shocker which jumped 8.6% on the year in May, totally eclipsing forecasts and bursting the boil of fear and loathing we’ve been doused in so far this week.

If all of this monetary policy stuff makes you anxious, just enjoy this visual ketamine produced by our own banking legends over at Martin Place:

Talking the traders down

Soothing post-coital Fed Talk following the 0.75% hike however, apparently eased the frayed, fraught and raw nerves of US investors.

The concession from Chair J Powell that the brains trust may’ve started bumping up the rate a little too late (but we got this now) was the soothing unguent Wall Street needed to help pull its head in. In his press conference, cigarette dangling from an exhausted but satisfied face, J Powell conceded that “was an unusually large one” and it’s unlikely the same treatment will be meted out next time. Unlikely, not impossible.

The Fed’s benchmark federal funds rate is now in a range between 1.5% and 1.75% after the hike. Good enough.

The Dow Industrial Average closed about 300 points or 1% higher overnight, while the S&P 500 index rose 55 points or 1.5% the better and the skittish, tech-heavy nutbag they call the Nasdaq jumped 2.5%.

Of course, it’s Central Bank Central this week so we’re not out of the woods yet – and they are still definitely on fire.

Thursday night in Londres we have the Bank of England and Friday is the Bank of Japan’s turn to make the call on their respective interest rates conundrums, as if bankers getting high needed an official date.

What’s the biggie?

Well, like American cultural exports, the Fed’s ‘Upsized’ rate hike has an outsized impact on the global economy because almost every country is absorbed into the US mothership to varying degrees.

The good thing is for us, according to CMC Markets’ chief market strategist Azeem Sheriff, the US increasing rates doesn’t impact Australia’s cash rate directly, but indirectly.

“It gives us an indication as to what the RBA might do at the next meeting. Given what we saw last week, we’re expecting another 50 basis points in July; so that’s potentially another 0.50% added to Australian homeowner’s variable mortgage rate,” Sheriff told Stockhead on Thursday morning at an absurdly early hour.

“Of course, higher rates means spending is dramatically reduced and obtaining credit is a lot more difficult.”

“With prices rising as they have been, consumers now have to readjust their spending patterns to accommodate for higher cost of living including food, gas and mortgages,” he added.

The rise in the cost of borrowing Stateside also tends to put the warming flame of the US dollar under the pot of Asian currencies.

A higher US cash rate means the USD is a lot stronger than the AUD right now, Sheriff says.

“So, you have to spend more AUD to get bang for USD – which at the moment in this very tight environment, is extremely difficult.

It’s a challenge for Aussies because they’ll need to readjust their spending patterns at a time of higher prices – to consider if things like holidays are feasible… and I think we’re all overdue for one.”

For our coin – the economic shockwaves from out of Russia V Ukraine continue to drive global energy prices, which adds some welcome ballast to the outlook for our already significant trade surplus. That’s a positive, But Imre Speizer at Westpac warns the Aussie Dollarbuck – a proxy for our resource-laden economy – remains vulnerable when the power of the USD has the power of The Fed behind it.

“The AUD remains at risk against a US dollar backed by the Fed’s determination to front load rate hikes and shrink its balance sheet, a notably more aggressive tightening stance than the RBA (at least for now).

“Daily correlations with equity markets are elevated even by the Aussie’s historical standards, so any renewed equity turbulence could see a return to trade with the 68 US cent handle (along with occasional squeezes higher).

Planning holidays? Well, Westpac still thinks a recovery to 74 US cents is on the cards in Q3. So hang in there.

It could always be worse

Yes, the reassuring motto of the Edwards clan since they were first run out of Wales for being Welsh long before all this interest in rates. It could always be worse does come in handy on a terrifyingly regular basis. Point in case: The Yen.

The ill-tooled currency of the Rising Sum is at its deepest, darkest ebb against the Greenback in more than 20 years. And the dot plots are not encouraging plots. They’re dots of an ill-omen and Friday’s BoJ meet is on a hiding to nothing.

If the Yen was a horse they’d have shot it in 1988.

That’s North Asia, where things are relatively dandy compared to the vulnerabilities in the south.

Sri Lanka broke before the worm had started to turn, last month ‘preemptively’ defaulting on its international debt as its foreign reserves evaporated and people took to the streets amid a terrible shortage of meds, fuel and food.

At least Sri Lanka has Glenn Maxwell to keep them distracted because our Indian Ocean neighbours are in a pickle of the direst sort. South Asia is a tinderbox of debt, absent forex, broken supply lines, rising inflation and stupefied currencies.

Now is when China’s Belt and Road Initiative – what Western analysts have come to refer to as the string of pearls strategy – kicks into gear.

Under Chinese President Xi Jinping, Beijing has been busily dressing up cheap loans as foreign aid, with strategic assets as collateral.

Sri Lanka has been trying to get out from under, whittling down its obligations to Beijing to 10% of its entire national debt. In Pakistan that’s well over 25%.

And then there’s the R word

No. Not Kevin Rudd’s R word.

There’s now a general consensus that economic growth in the US will slow sharply over the course of 2022 and 2023. That’s in large part down to this obstinately toppy inflation and the go-to tool to whack it with – rising interest rates.

But growth is stalling all over the shop and it’s not just a central bank situation, as J Powell was quick to put on tape this morning:

“What’s becoming more clear is that many factors that we don’t control are going to play a very significant role in deciding whether that’s possible or not. And here I’m thinking of course of commodity prices, the war in Ukraine, supply chain.

“The monetary policy stance doesn’t effect those things,” he said.

In a report released this morning, the Economist Intelligence Unit hedged its bets on whether or not an American recession is the next turn up card.

“We expect consumer demand to be resilient enough to avoid an outright recession, thanks in part to the tight labour market and strong household balance sheets. However, this does not mean that a recession is completely off the cards.”

They reckon – not unlike here and China and elsewhere – that you and I are the key.

Consumer spending in the states has been resilient in the face of higher prices, but signs of strain are beginning to show.

Nominal retail sales rose by 8.1% in the 12 months to May 2022, but this is just barely keeping up with headline inflation (8.6% year on year in May).

“If inflation were to jump again later in 2022, after rising interest rates and falling real wages have started to bite (as we expect), an outright contraction in consumer spending could follow,” the EIU says.

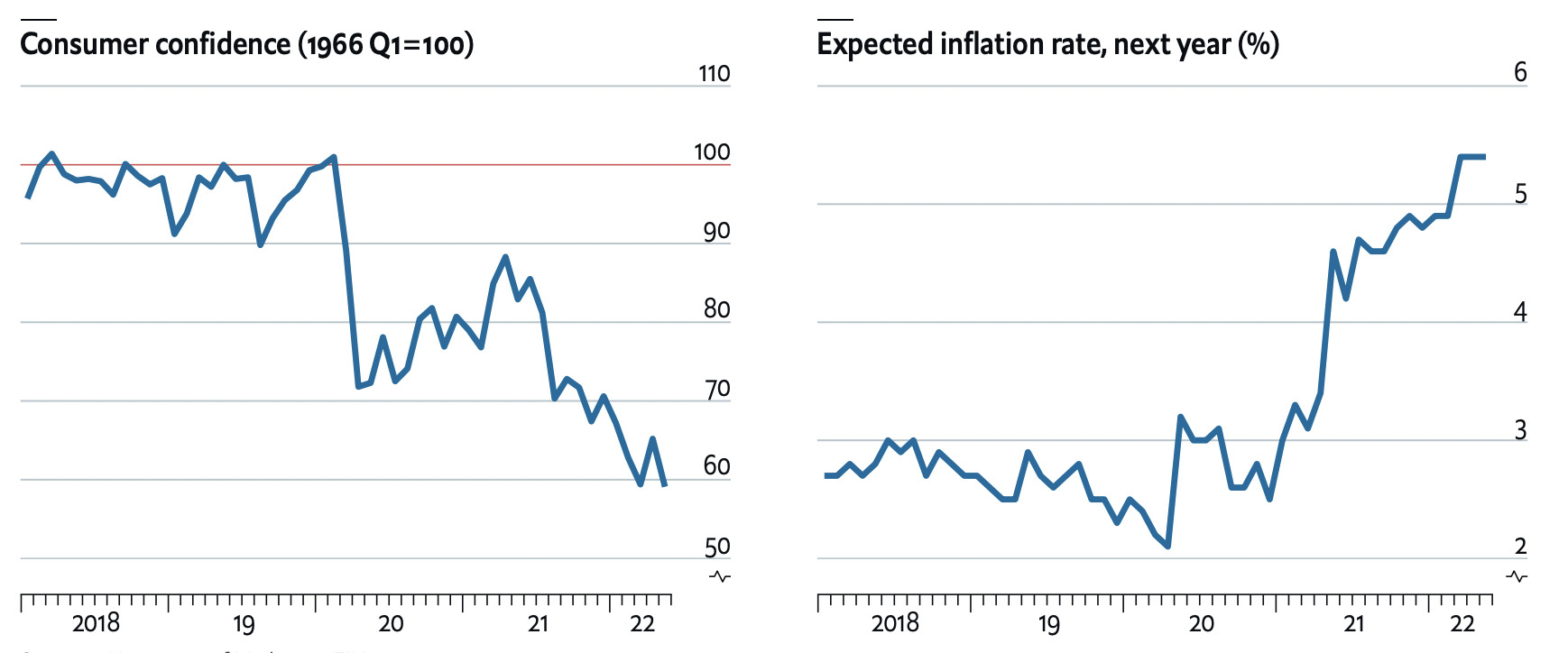

Lower consumer confidence reads = Rising inflation expectations

With private consumption accounting for 70% of US GDP, such a drop in consumption would push the economy into recession.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.