The Fed holds again… but can the world’s home owners?

Looks like a little bubble. Via Getty

Overnight, the US FOMC (Federal Open Market Committee) rate-setting clique agreed unanimously to keep the benchmark federal funds rate steady at between 5.25%‑5.50%, as widely expected.

And there was little rejoicing.

Here’s some of the exciting things which happened in the decision’s immediate aftermath…

And this…

But it’s not the end of the world.

Not yet. But the world is watching.

Fannie Mac: Is this a bubble I see before me…?

As CBA’s Harry Ottley just observed – the post-party statement dropped the hiking bias but did not suggest rate cuts were imminent.

“Speaking after the decision, Fed Chair Jerome Powell asserted rates have peaked in this cycle and that easing will be appropriate this year, but stopped short of declaring victory on a soft landing,” Harry said.

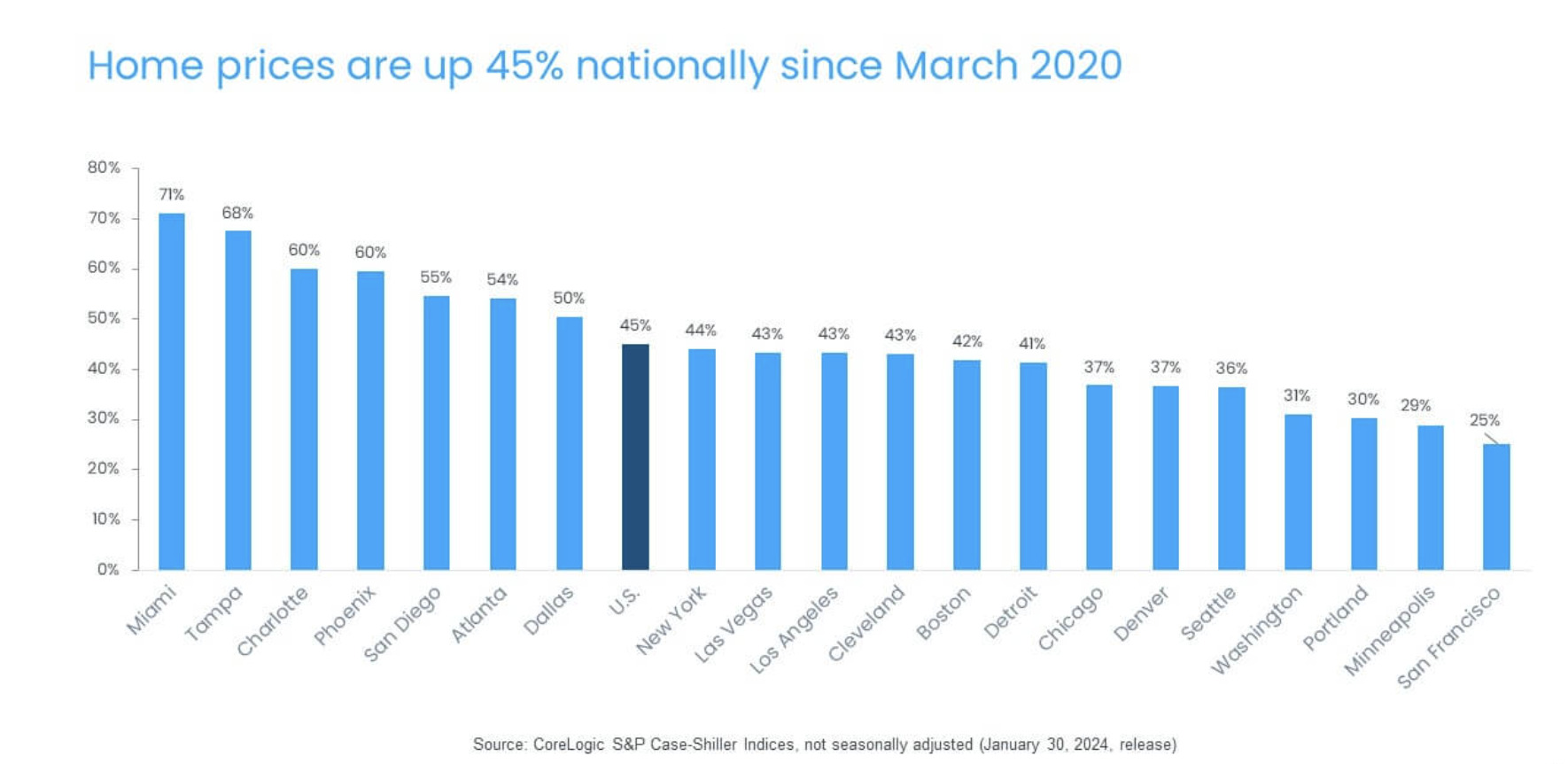

It’s the fourth straight month of holding for US cash rates, but – alas – to the unending gall of buyers, not even the toughest mortgage rates of the millennium seem capable of stymying the continued rise of home prices.

Around the same time our real estate market fell off a relative cliff, the US housing market started slowing in late 2022, and home prices seemed all set for a significant correction.

But a strange thing happened on the way to the housing market crash: Home values started rising again.

In fact, eerily, other than that wee pause, the US real estate market has been heading off largely in one direction the whole time…

Prices increased once again in December, according to the latest numbers out of the US National Association of Realtors (NAR), which says the average (existing-home) prices came in 4.4% above the same time last year — a sixth straight month of year-over-year jumps.

The good news is, it’s not everywhere. Nor even anywhere… absolutely MAGA…

Global property markets are all under pressure from increased vacancy rates, falling values and, in the office sector that is most affected, the post-pandemic changes in the ways and locations of work.

The key here is a familiar story for aspirant Aussie home owners – a dearth of supply. US developers remember the Great Recession all too well, and they’ve been cautious about their pace of construction. The result is an ongoing shortage of homes for sale and a weak inventory pipeline. So while markets might decline, they’re unlikely to crash, given the strong levels of US household savings.

Fed Chair J. Powell jumped on the diminishing speculation of interest rate cuts before March overnight with both feet.

That’s not at all the base case, J told gathered accolytes, as the central bank considers easing monetary policy this year.

Signs of falling US inflation since before Christmas has led the market bets that the Fed could begin cutting rates from their 23-year high at its next meeting this spring. But the Fed chair said the central bank still needed “greater confidence” that inflation was “sustainably” lower.

“I don’t think it’s likely that we’ll reach a level of confidence by the time of the March meeting . . . I don’t think that’s the base case.”

Powell’s carefully crafted comments nevertheless inspired US traders to start reeling in the rivers of equities they’ve been plunging into growth stocks lately, with Wall Street indices taking a dive overnight.

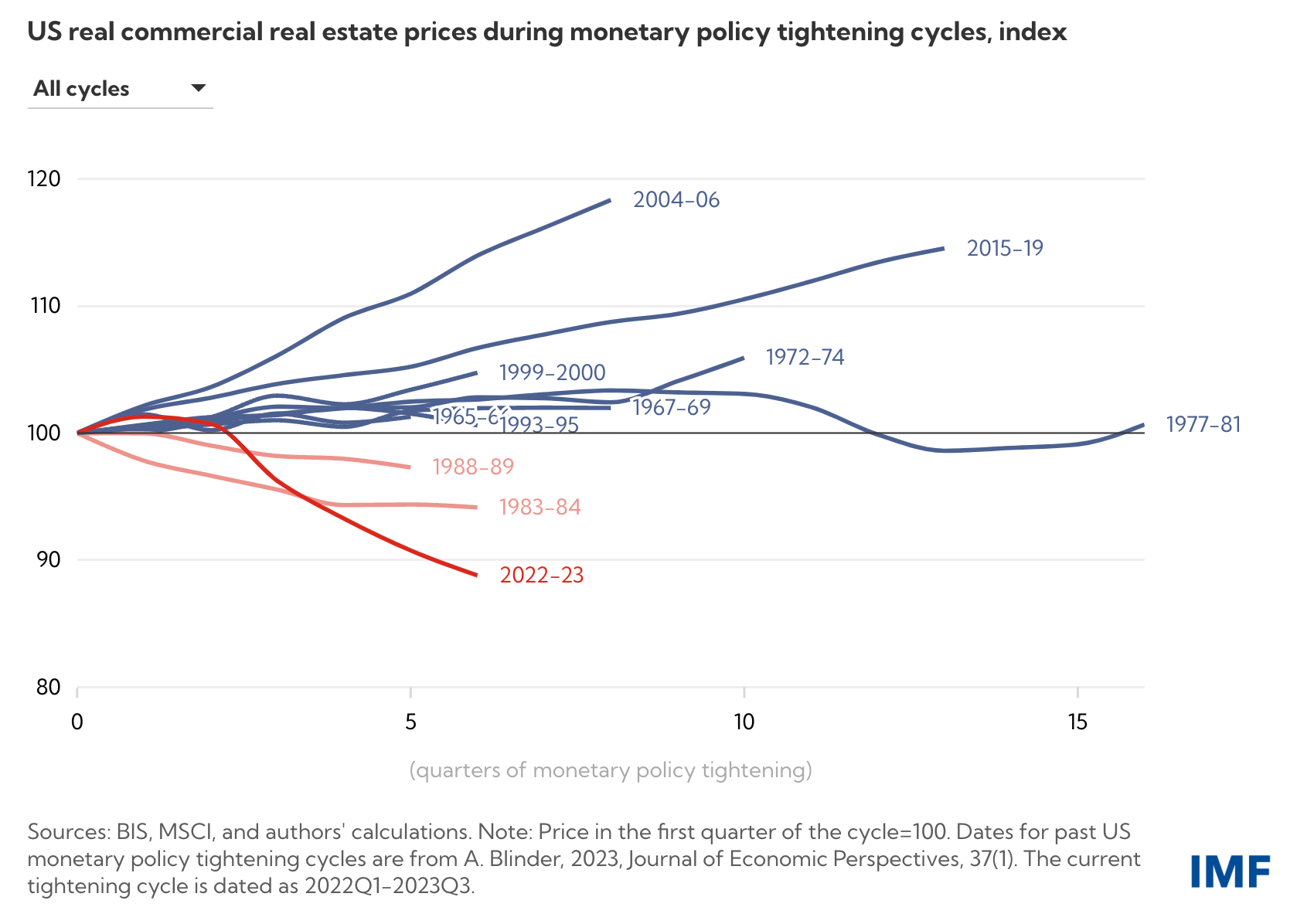

The IMF (International Monetary Fund) has been in fits and starts about the state of the global commercial property market as well, wobbly as it is in the face of elevated interest rates, particularly in the US, the largest such market in the world.

Starved of attention so far this year the IMF got up in our faces a few weeks ago to warn everyone about the terrifying risks facing the US banking sector and the inevitable chain reaction any subsequent distress would create in America’s property sector.

On it’s blog, which I shouldn’t read, the fund noted that commercial property prices there had “tumbled by 11 percent since the Federal Reserve started raising interest rates in March 2022, erasing the gains of the preceding two years.”

European Vacancies

Meanwhile, over in Old Europe, various housing markets have been wilting in the face of rising interest rates.

Of 25 of the largest cities across the world, UBS says real house prices fell by 5% on average between mid-2022 to mid-2023 and that this trend is likely to continue.

European real estate investment is at a decade-low, and many forecasts expect 2024 to be the year to turn this trend on its head, not least due to potential key rate cuts.

It appears that 2024 promises to be the year when affordability will increase, inflation will cool, employment will stabilise and mortgages will potentially get cheaper.

The ratings agency Fitch reckons mortgage rates across the EU will steady themselves this year and even lower slightly in the 2H.

Small increases may only be observed in countries with a significant number of variable-rate mortgages (Denmark, Italy, and Spain) or mortgages fixed for short periods, as in the UK.

Fitch also forecasts that home prices in six of the seven largest European markets will be flat this year.

The exception OFC, is in La France, where values are going to slide by as much 4% in 2024, Fitch says.

The problem in France is also exacerbated by supply – onerous regulatory conditions, and because French and foriegn buyers alike are struggling to afford France when the mortgage rates are so Haute-Savoie.

The China Syndrome

China’s new home sales dropped 6% in 2023, with secondhand home prices declining in major cities.

Real estate firms faced $125 billion in bond defaults between 2020 and 2023.

The property sector’s slump has dragged down China’s economy, leading to layoffs and financial instability.

Municipalities, many of which rely on land sales as a key source of income, have been introducing “old-for-new” support measures meant to stimulate new home purchases.

Evergrande — once China’s largest real estate developer — was forced to liquidate on January 28. It was yet another strike against the China’s now fledgling real estate market, adding to a growing list of the country’s economic worries.

In the charts above we show two annual metrics related to China’s real estate crisis from 2003 to 2023. The first looks at apartment and commercial property sales using Bureau of Statistics data from Bloomberg, and the second examines new housing starts using data from the World Bank.

This Evergrande business is particularly upsetting because so damn many Chinese buy their homes off the plan.

So all those fully paid deposits – usually life savings – are up in smoke at the moment. Others will follow like so many dominoes, because of all the other giant-sized property-related companies which get their business from Evergrande.

Local and provinical level governments are up to Evergrande to their eyeballs. Then there’s the construction and design firms, the materials suppliers, the lawyers and insurers, let alone the massive – truly massive – labour force which is made up of largely uninsured migrant workers.

It’ll be a bankruptcy breakout.

Which brings us to China’s anaemic, diabetic and COVID ravaged financial system. Beijing is iffy when it comes to sorting out how to back its lenders at this stage, let alone bail anyone out.

This excitement has already unmanned the foreign investors upon whom China has been able to leverage off for so long.

That tap is dry.

Our own CoreLogic Conundrum

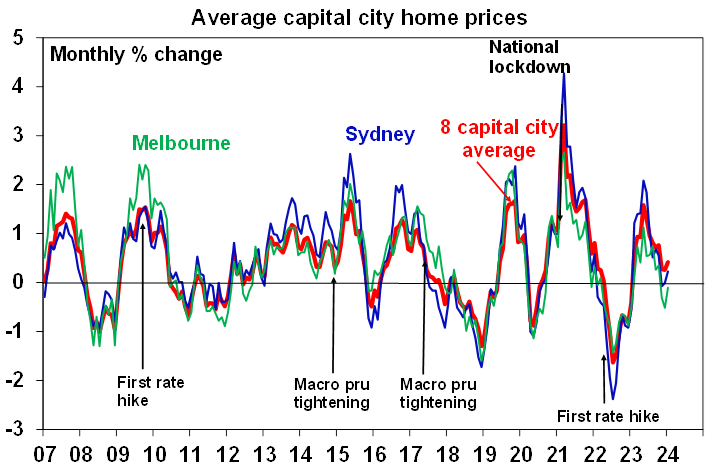

Meanwhile, a home, according to our own CoreLogic, home prices in the eight capital cities rose by 0.4% in January 2024. This followed two months of gains of 0.3% each, noting December was revised down from 0.4%.

The gains illustrate home prices are still rising, but the pace of gains are slower than mid 2023. Home prices have now risen for 12 consecutive months in what has been an extraordinary period of growth during a period of rising interest rates.

The total growth from the trough reached 11% in January and prices are now 1.3% above the previous peak in April 2022.

As Belinda Allen, CBA’s senior economist, noted, the latest Aussie property boom has been driven largely by the same problems with inventory like in the States.

“We expect these supply and demand issues to continue this year,” Belinda says. “Rental vacancy rates are low, rents are rising and making home ownership more attractive for those able to.”

CoreLogic says sales are now above the five-year average.

“We expect these dynamics to continue in 2024, pushing prices higher, but at a more moderate pace given constraints from both restrictive interest rates and affordability perspectives.”

AMP’s chief economist Dr Shane Oliver says our property market remains caught between the extremes of high rates and the housing shortage.

The big negative influence on the property market remains poor affordability and high mortgage stress.

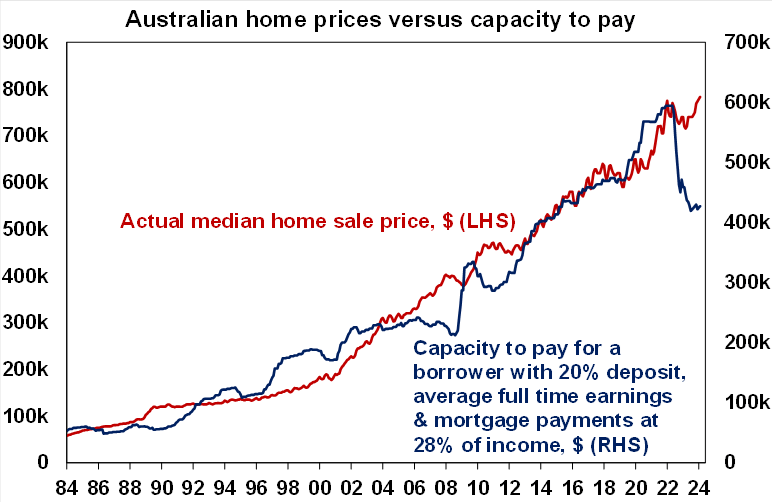

“For years property prices were supported by ever lower interest rates but due to the rebound in interest rates from May 2022 and high home price to income ratios there is now a wide divergence between buyers’ capacity to pay for a property and current home prices – which we estimate to be around 28%.”

AMP’s base case remains for softer home prices this year… although the acute housing shortage and increasing confidence in rate cuts may keep average house price gains “modestly positive.”

Expect a renewed upswing from later this year in response to lower mortgage rates. Falling inflation adds to confidence that rates will be falling from mid-year, but bear in mind that RBA communication will likely remain cautious on inflation and rates for a while yet.

Shane says that in the absence of rapid interest rate cuts, this continues to point to a high risk of lower property prices ahead.

“This is reinforced by ultra-low sentiment towards property. A sharp rise in unemployment in response to slowing spending in the economy would add to the downside risks flowing to property prices from high rates.”

But against this though is what got us here in the first place – supply vs demand.

The chronic housing shortage which got the upper hand over the last year as immigration levels has surged, according to Dr Oliver.

“At the same time access to ‘the bank of mum and dad’ and savings buffers built up through the pandemic appear to have protected the property market from high rates last year…. And at some point, the anticipation of lower interest rates ahead will start to help the property market, and this may be already starting.

“Just bear in mind though, that while RBA communication is likely to become less hawkish, it’s likely to remain cautious for while yet.”

Dr Oliver reckons the main downside risk would come from one or both of these:

- A renewed upswing in interest rates (which, he adds, looks as yet unlikely)

- Or sharply higher unemployment (which Dr O says is the bigger risk)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.