The Ethical Investor: Why women will drive investments into ESG, with Pearler founder Nick Nicolaides

Women are more likely than men to invest in ESG themed funds. Picture Getty Image

- Research from Pearler suggests that women are more likely than men to invest in ESG-themed funds

- Another research shows that as women live longer than men, they will control two-thirds of wealth

- Stockhead reaches out to Pearler founder, Nick Nicolaides

A new research from Australian investment app, Pearler, shows that millennial women are picking up share investing at the same rate as men, despite having to overcome a 36% wage gap.

The study shows that both women and men hold an average of 2.5 assets, invest once a month, and allocate about 70% of their portfolio to ETFs.

The research shows women are investing, on average, 12% of their post-tax income whereas male investors invest 10% of their relatively higher incomes.

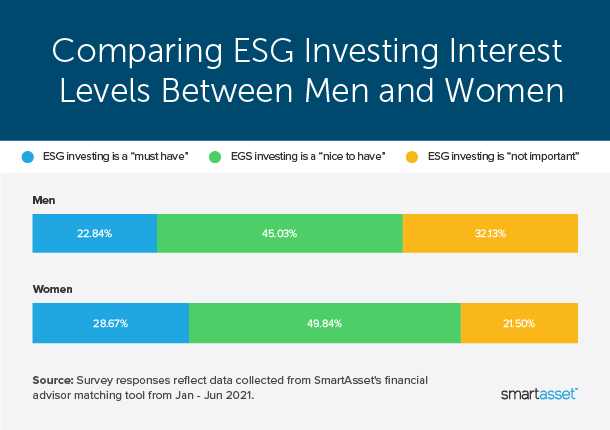

According to Pearler, what stands out most is that women are investing in ESG ETFs at double the rate of men.

Claire, an investor on the Pearler platform, says: “I think about how my son will be in his early 30s in 2050, when the climate will be much more difficult to live and thrive in.”

“I want to support industries that are doing the right thing for future generations and investing in decarbonisation and the circular economy. I will be able to enjoy retirement knowing I did right by him.”

Another Pearler investor, Kelly Foreman, believes there is no performance sacrifice when investing in sustainable companies.

“You don’t need to compromise financial returns when considering the ESG criteria; there doesn’t need to be a performance sacrifice.

“It’s been really interesting to take a deep dive into companies that align with my values and meet the ESG criteria,” Foreman said.

Women will control two-thirds of wealth by 2030: research

The data from Pearler is backed up by another survey done by US-based RBC Wealth Management.

According to RBC, the number of high-net-worth women is growing twice as fast as the number of affluent men.

As Baby Boomers age, women continue to enjoy longer life expectancies than men, according to US census data, and by 2030, women are projected to control two-thirds of all the wealth in the US.

“Clearly, given their growing financial power, the values that women hold will shape how wealth is created, mobilised and passed down to the next generation.

“And increasingly, studies show that they value the principles behind ESG investing,” says the report out of RBC.

In 2021, RBC conducted another study which revealed that 55% of individuals who invested in the company’s ESG thematics were women.

“At the end of the day, how a person says they intend to invest is one thing, while what they actually do with their dollars can be quite another.

“However, when it comes to women and ESG investing, we found that there doesn’t appear to be a disconnect between intent and action,” concluded RBC.

Interview with Nick Nicolaides, co-founder of Pearler

Stockhead reached out to co-founder of Pearler, Nick Nicolaides, to get his thoughts on the ESG industry.

Pearler is an Aussie retail wealth platform that has taken a position as the ‘Anti-Robinhood’ (day trading app) and makes investing rewarding, simple and even a little boring.

Launched in 2021, the platform lets users set financial goals, trade, and connect with a community of like-minded folks.

The platform backed up its focus on passive investing with Autoinvest, the first fully automatable CHESS-sponsored rebalancing tool.

Autoinvest removes the banking, market timing and hands-on friction of self-directed share investing, and allows you instead to focus on goals, dollar-cost-averaging and further education rather than the transaction.

Prior to cofounding Pearler with current CTO Hayden Smith, Nicolaides had stints with EY, JP Morgan and Atrium.

What’s your data telling us about women as ESG investors?

“From our direct discussions with investors, the motivations for investing in ESG are largely the same between women and men who allocate to ESG strategies. There are just more women participating,” Nicolaides told Stockhead.

“If we dig a little deeper into our cohorts, the concentration seems to be most visible in investors 25 years and under.

“For those 25 and under, the data is showing that women are allocating more to ETFs in general, around 80%, and then within that, ESG.

“Men are allocating more to direct stocks, around 50/50.

“As our investors get older, the ETFs vs shares behaviour swings heavily towards ETFs, approximately 70% overall.

“So from that, you could suggest that women are adopting passive investing earlier than men and with that, gaining access to ESG solutions earlier.”

Describe the current ESG landscape you’re seeing at the moment

“We see a constant stream of query and discussion on just what is ESG, particularly pointing out companies in popular indexes that are hard to justify, for example transport, materials etc,” explained Nicolaides.

“Then at the other end of the spectrum, a growing scepticism that ESG can’t just be a proxy for tech stocks.

“I believe that the investor will continue to become more educated on the nuances between each of the mainstream ESG options.

“We will see FUM (funds under management) move from those with less defendable indexing strategies, to those where the manager can show most clearly how the companies in their ETF fit the mainstream idea of ESG.

“It won’t be enough to simply say, this index has got a seal of approval.

“Overall, it will continue to grow as people see the value in what makes it in or out. And we will potentially see consolidation as investors vote with their feet.”

Should ESG investors start looking at overseas stocks and ETFs?

“From our data, ASX listed shares still far outweigh direct investing into the US and other markets,” Nicolaides said.

“Whilst there is a decent cohort of US and global ESG options trading on the ASX, plus newer thematic options, the size of our listed market probably means that an Aussie ESG strategy is going to either ignore large chunks of the market, leading to concentration and goes against the main ETF selling point, or include companies many people don’t associate with ESG.

“Both these factors probably weaken the story and investing profile of an Aussie ESG strategy, particularly as investors become more sophisticated on what they’re looking for.”

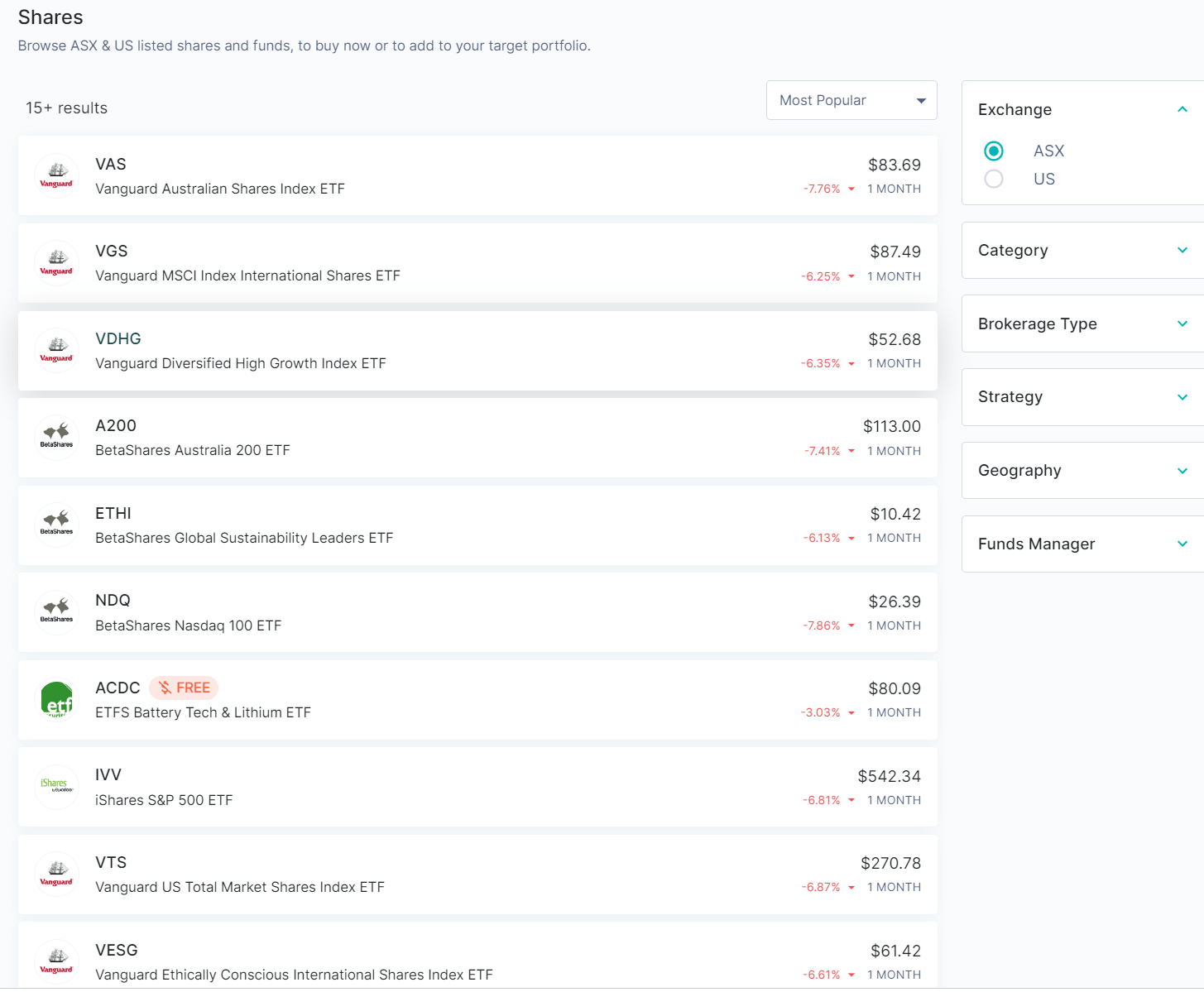

What are the top 10 most traded stocks or ETFs on the Pearler app?

“This info is available to everyone, right on our public website, whether you’re a Pearler investor or not,” Nicolaides said.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.