The Ethical Investor: Why buying ESG ETFs makes you an investor in tech stocks, including red hot Nvidia

Investing in ESG ETFs mean you will be exposed to tech stocks. Picture Getty

- Why global ESG-themed ETF portfolios are stacked with tech stocks

- Why ESG ranking matters, and the problems with it

- We list a bunch ESG-focused ETFs to invest on the ASX

Investing in tech companies are probably not what ethical investors have in mind when they opt for ESG ETFs (exchange traded funds).

Yet, that’s exactly what you’re getting if you invest in globally focused ESG themed funds listed on the ASX.

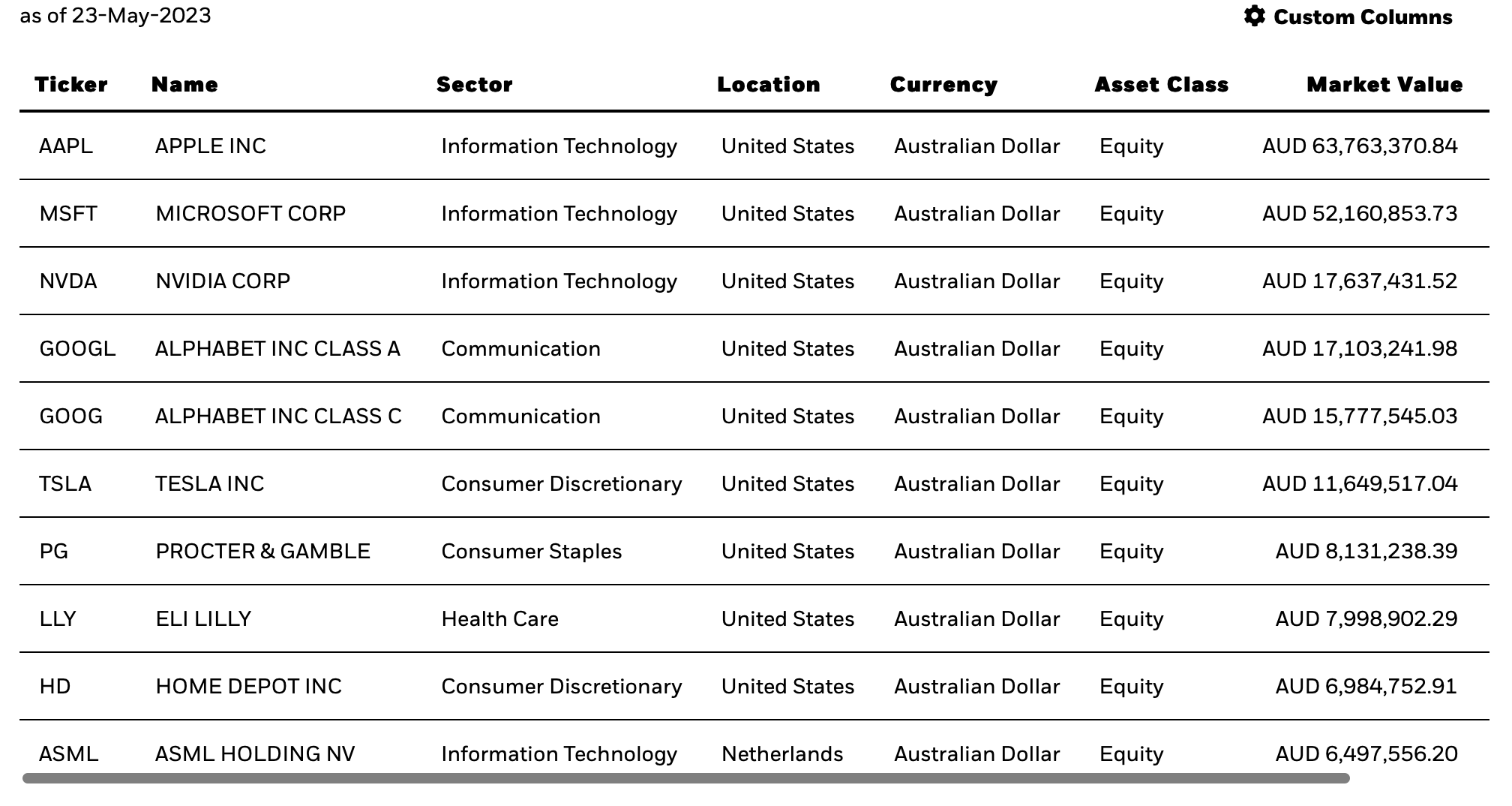

For example, one of the biggest funds listed, the iShares Core MSCI World Ex Aus ESG Leaders ETF (ASX:IWLD), which is run by global behemoth Blackrock, has clearly tilted its portfolio toward US tech stocks.

The fund’s top six positions include names such as Apple, Microsoft, Alphabet, and red hot Nvidia.

One reason for the bias is that the mandates of these funds are often exclusionary, meaning that they agree not to invest in certain things like oil, gambling or alcohol stocks.

And when you exclude all those stocks, you’re likely left with an over-representation in areas like Tech, especially in the US where the sector makes a big part of the index.

Another argument often quoted for picking tech stocks is that technology companies help communicate and share knowledge, fuel economic growth, and extend the reach of healthcare.

“Each of these issues is at the heart of sustainable development. It would be strange, we think, to ignore them in an ESG fund,” according to fund manager AllianceBernstein.

“Technology stocks are a vital component of the modern global economy, and an important agent for positive change that have a natural home in ESG-focused portfolios,” added the manager.

ESG label matters

ESG ratings also have a big impact on the decisions made by ESG fund managers.

Blackrock has clearly said it is “tilting towards” US companies with favourable ESG ratings.

On this front, Sustainalytics and MSCI are probably two of the leading rating agencies out there.

Apple for example has one of the highest ESG rating of any companies in the world – the exact reason why it sits at top position of Blackrock’s IWILD ETF portfolio.

According to the Sustainalytics platform, Apple has been a pioneer in the field of sustainable business practices for a long time, with a commitment to reduce its environmental impact.

Nvidia Corp, the AI chipmaker that has taken the market by storm in recent days, has an ever higher rating than Apple, sitting sixth out of 326 semiconductor companies ranked by Sustainalytics (Apple sits at 230 out of 650 tech hardware companies surveyed).

Tesla on the other hand, was given a Medium Risk rating by Sustainalytics, and sits at 59th place out of 90 automobile companies reviewed.

Tesla was actually removed from the S&P 500 ESG index last June, with S&P saying that Tesla’s “lack of a low-carbon strategy” and “codes of business conduct”, along with racism and poor working conditions, had affected its overall ESG score.

Despite this exclusion, Tesla shares have regularly featured in the top 10 holdings of most global ESG portfolios.

The problem with ESG ratings

Clearly there’s a huge demand right now for ESG ratings, but there’s also a huge dose of scepticism about the services being provided.

A key problem is the lack of common industry standards, where ratings and rankings are being performed by non-regulated providers.

Instead of focusing on what’s important for environmental sustainability, some say ESG ratings often focus on what’s significant to a company’s bottom line.

And not many people understand what goes into making those ratings, but they have nevertheless become the basis of the multi-trillion dollar ESG industry.

For a company, getting a high ESG rating it can be significant because it can help lower the cost of capital, which also helps those companies get included in one of the big ESG funds like Blackrock’s.

ESG-themed ETFs on the ASX

Socially responsible investing and particularly ESG-themed ETFs have seen a huge rise in popularity among Aussie investors over the last few years.

ESG ETFs listed on the ASX are becoming the go-to investments for those wanting invest in ethical companies, while at the same time diversifying their risk.

Here are some of the ESG-themed ETFs which investors can trade on the ASX. The list is by no means exhaustive.

Janus Henderson Global Sustainable Equity Active ETF (ASX: FUTR)

The fund invests in companies seeking to confront global challenges posed by so-called “mega trends” like electric vehicles.

Speaking with Stockhead, Janus Henderson’s head of Australia Matt Gaden said things that fall into this category include climate change, resource constraints, and population growth.

“I think there are different categories of ESG strategies, you’ve got what might be referred to as ‘integrated’ – meaning that a fund considers and integrates ESG considerations into the portfolio,” Gaden said.

ETFS Battery Tech & Lithium ETF (ASX:ACDC)

This fund focuses on companies involved in the supply chain and production for battery technology and lithium mining, and even includes car makers like Tesla.

The ETF tracks the performance of the Solactive Battery Value-Chain Index, which comprise mainly of companies that are providers of electrochemical storage technology and mining companies that produce metals.

ETFS Hydrogen ETF (ASX:HGEN)

This fund tracks the Solactive Global Hydrogen ESG Index, which is a basket of 30 companies in the hydrogen space globally.

HGEN is riding the wave of the boom in hydrogen – particularly green hydrogen – which has taken off recently as the world transitions towards renewable energy and various countries strive for “net zero” emissions.

BetaShares Global Sustainability Leaders ETF (ASX:ETHI)

The ETHI fund aims to track the performance of an index that includes a portfolio of large global stocks identified as “Climate Leaders”.

This excluded companies with direct or significant exposure to fossil fuels, or engaged in activities deemed inconsistent with responsible investment considerations.

Notable stocks in the portfolio include Apple, Home Depot, and PayPal.

BetaShares Climate Change Innovation ETF (ASX:ERTH)

This fund will provide exposure to global companies leading the climate fight, and likely to benefit from what it believes to be a long-term megatrend.

“This will include not only clean energy but electric vehicles, energy efficiency technologies, sustainable food, water efficiency and pollution control – in short, a broad range of solutions that directly enable the reduction or avoidance of carbon emissions,” said Betashares CEO, Alex Vynokur.

Betashares Global Healthcare ETF (ASX:DRUG)

The healthcare industry is a big part of the ESG segment, based on the very fact that health care provides improved and equal living standards for society as a whole.

Ageing populations and ongoing medical advancements globally are expected to support increasing ongoing demand for healthcare products and services.

The pandemic has also shifted investors’ eyes on to this sector, perhaps permanently.

Vanguard Ethically Conscious International Shares Index ETF (ASX:VESG)

The VESG ETF tracks the return of the FTSE Developed ex Australia Choice Index.

The index measures the performance of the FTSE Developed ex Australia Index, after excluding companies involved in vice products such as adult entertainment, alcohol, gambling and tobacco.

Other industries the fund avoids include non-renewable energy, and weapons.

Unit prices today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.