The Ethical Investor: There’s growing backlash on ESG investing, so we ask two experts what the future holds

What does the future hold for ESG investing. Picture Getty

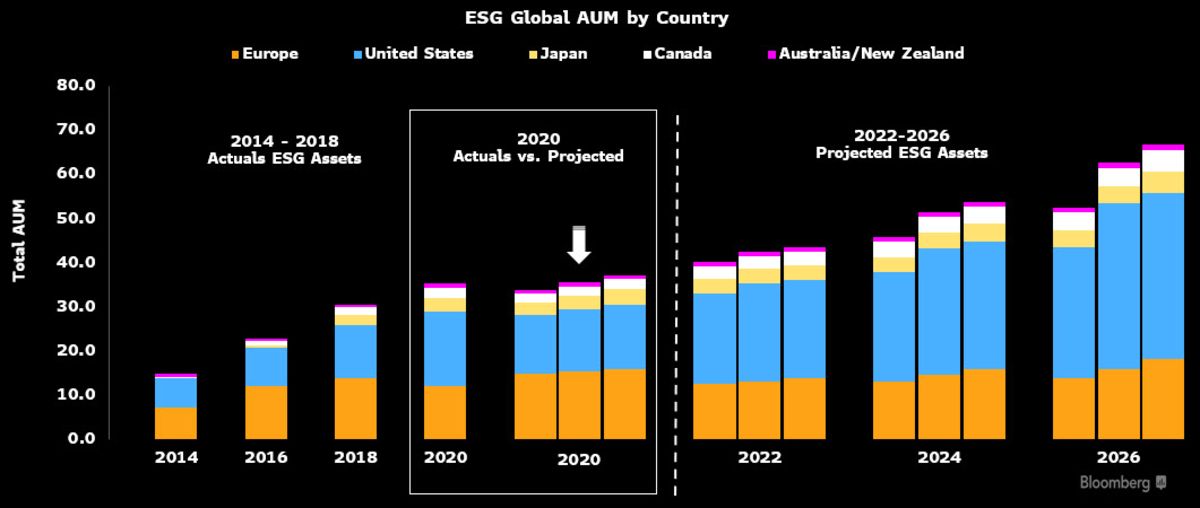

ESG investing bloomed in 2020 and 2021 when low oil prices were low, and fund managers were happy to divert their money into clean energy.

But once oil prices started surging in 2022, fundies began to question whether forsaking all that oil profit was worth it.

Word is that after years of demonising the fossil fuel sector, some “environmentally responsible” themed fund managers are now warming up to it.

Recent analysis shows that ESG fundies are moving their funds to the oil and gas sector, an unimaginable thing to do just a couple of years ago.

Despite the shift, the traditional ESG theme is still going strong and funds are still pouring into the sector.

But what the shift has done is widen the spread between dirty and clean energy returns:

Criticisms of ESG

Away from the price action, criticisms of ESG investing have increasingly grown louder recently.

According to McKinsey, the most prominent objection of ESG is that it gets in the way of what critics see as the essence of what businesses are supposed to do.

Which is to “make as much money as possible while conforming to the basic rules of the society,” as Milton Friedman phrased it more than a half-century ago.

Others have cynically said that ESG is simply just a marketing label, another reason why there’s a good dose of backlash right now.

There’s also criticism around the accuracy of ESG indexing.

The issue here is that there has been large gaps and little correlation between the different index providers.

For example, Tesla was given an “A” rating by the MSCI ESG Ratings, but at the same time, was booted out of the S&P 500 ESG Index.

Money managers say ESG is diverting capital into the wrong places, causing a dislocation in the capital markets and undervaluing the prices of coal, tobacco and alcohol stocks.

In the political realm, ESG is causing increasing polarity between the left and right. Some elements of the right have labelled it as a form of “woke capitalism”.

Former US Vice President Mike Pence wrote in a op-ed on the WSJ in May calling ESG a “pernicious strategy” from the “woke left”, financed by “large and powerful Wall Street financiers”.

Finally, as the SEC begins to formulate new regulations for the ESG industry, critics have questioned whether the government should in fact be the final gatekeeper in deciding whether or not an investment is socially responsible.

They argue that interpretations of what is and what is not sustainable would change as the government changes.

Insights from two market experts

So what then is the future of ESG investing?

Is sustainable investing actually sustainable as a long term source of returns for investors?

To answer these questions, Stockhead looks for insights from two market experts:

Interview with Anirban Mahanti, lead advisor at 7Investing

What is the future of ESG investing?

“Is ESG a trend that will make way for other trends? That’s the biggest question in my mind,” Mahanti told Stockhead.

“More broadly, I think investors might ask what purpose does ESG investing serve.

“The goal for investors should be to attain market-beating or at least market-matching returns. With respect to the former, it isn’t clear how ESG might be a differentiator for returns.

“A company might be 100% ‘ESG complaint’ but if it operates in an industry with poor economics, I would bet its returns will reflect the dynamics of the industry.

“As such, ESG is such a broad catch-all area, it is hard to have even a view on how ESG indices might differ from the broad market.”

In that context, could ESG investing offer superior returns?

“Returns depend on the companies included in an ESG fund or index,” explained Mahanti.

“Some companies might score high marks on chosen ESG factors, but that doesn’t necessarily mean they will be good investments.

“Ultimately, when we slice and dice investments by strategies or sectors, we move away from passive towards active investing.

“Then the question becomes one of how good that active strategy is, what are the qualities of the manager, and so on.

“So, I would say some ESG funds and indices will offer superior market-beating returns, while many won’t. That’s just the nature of active investing.”

Interview with Tom King, CIO at Nanuk Asset Management

King runs Nanuk’s sustainably themed Nanuk New World global equities fund out of Sydney.

What is the main issue with ESG investing right now?

“The main problem facing ESG investing today is that it is not one thing,” King told Stockhead.

“ESG investing is a widely used term, but is used by different people to mean different things. Consequently, generalising about the performance of ESG investments can be misleading.

“ESG investment is used to describe products with a range of distinct features.

“At a high level, traditional ESG strategies focus on investing in companies with better governance and environmental and social practices with the intent to reduce investment risk. But this does not necessarily lead to improved returns.

“Then you have the ethical strategies. They focus on the avoidance of investments in areas of ethical concern, typically through negative screening.

“There’s also low carbon strategies, which are again different. Low carbon companies invest in companies with low levels of carbon emissions – which is very different from investing in the companies aiding the low carbon transition by making solar panels, wind turbines or electric vehicles.

“The latter is the focus of sustainably themed strategies, which like ours, are investing in companies whose activities are contributing to improving sustainability.

“And then there’s the impact strategies. This is a term that is being used increasingly loosely, but historically has referred to intentional and measurable environmental or social outcomes, often achieved at the expense of investment returns.

“Finally, you have the engagement strategies. They’re ocused on improving governance or environmental and social outcomes through interacting with investee companies.”

Do all these different strategies create a problem for ESG funds?

“These different aspects of ESG aren’t entirely mutually exclusive and many funds, like ours, do offer several of these attributes,” said King. “However it is not possible to do all of them well in the one product.

“Making electric vehicles or wind turbines is far more carbon intensive than providing software or insurance, for example.

“So for an engagement strategy to be truly effective, it needs to be investing in poor performers from an ESG perspective.”

What trends do you see in ESG investing in the coming years?

“The most important trend in ESG in coming years is going to be the delineation between different types of ESG or responsible investments,” King told Stockhead.

“Clients are becoming increasingly discerning about where their capital is invested, and simply having an ESG badge or rating won’t meet their expectations.

“They want to know they’re invested in companies doing good for the world, or alternatively not doing bad. They want to invest in managers that are seeking to influence outcomes.

“Not surprisingly, the risk and potential return profile, and consequently performance of different types of ESG investments, varies considerably over time.

“A lot of capital is weighted towards traditional ESG strategies, and focused on higher ESG scoring companies.

“These are typically overweight large cap US stocks that rank well on these types of metrics – leading to portfolios that have been overweight higher growth and technology companies, and underweight in traditional energy such as oil and gas.”

So which ESG strategy should investors put money into?

“It is not surprising that those funds have generally underperformed over the last 12 months after a period of extended outperformance,” explained King.

“In reality, they may offer slightly lower volatility and risk, but there is little reason to think that they will offer significant outperformance over the longer term.

“Sustainably themed funds can, however, offer greater return potential through investing in growing areas of the economy increasingly supported by government policy.

“It is certainly not true that they all will, but there is mounting evidence that this part of the equity market offers higher return potential, albeit with potentially higher risk and volatility.

“The outlook for engagement strategies is very specific to the nature of the strategy.

“Some focus on enhancing company performance and consequently investment returns, whereas others focus on achieving sustainability outcomes, like decarbonisation. This may come at the expense of investment returns.

“But the lesson in all of this is that investors seeking ESG or responsible investments need to be clear about what aspect of ESG they are interested in.

“And also whether they are pursuing it for investment returns, risk reduction or altruistic reasons, before they select an appropriate investment.

“At the end of the day, a quick look at the top 10 holdings of any ESG fund will give you a good idea of what you are getting.”

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.