The Ethical Investor: SPAC-listed ESG stocks get more scrutiny, and Giles Gunesekera talks about his new fund

Picture: Getty Image

The Ethical Investor is Stockhead’s weekly look at ESG moves on the ASX. This week’s special guest is CEO of Global Impact Initiative, Giles Gunesekera.

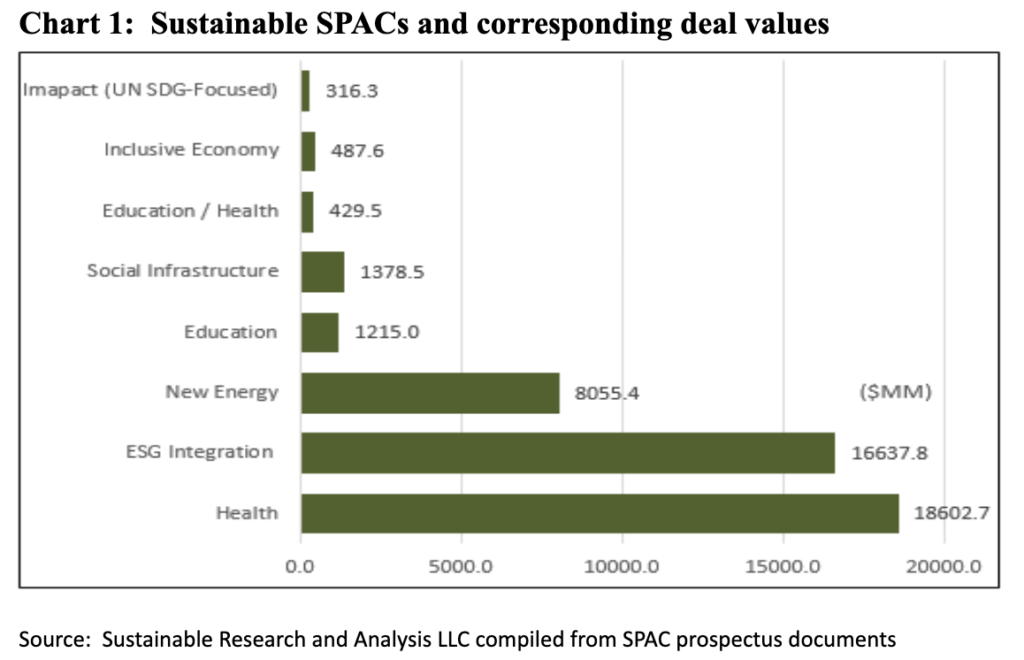

More and more ESG-focused companies in the US are going public via the SPAC route.

A SPAC, or special purpose acquisition company, is essentially a shell corporation listed on a stock exchange with the purpose of raising funds to acquire a private company.

Also called a “blank cheque company”, a SPAC is created specifically to finance an acquisition within a set timeframe.

Voltus Inc, an ESG-focused electricity market startup, is going public via a merger with a SPAC called Broadscale Acquisition, valuing the startup at US$1.3 billion.

Securus Technologies, a prison services company that brands itself as ‘socially responsible’ will also be going public via merging with a SPAC called Atlantic Avenue Acquisition.

The startup company, which charges families for the phone calls made by the incarcerated, has caused controversy because it makes profits out of the tax-funded prison system.

The two listings highlight the recent focus of the US Securities and Exchange Commission (SEC) to clamp down on ESG companies that manage to go public without the normal scrutiny of an IPO listing.

For now, the SEC focus on ESG seems to be on scrutinising whether companies are making misleading statements to the public (greenwashing).

But looking forward, SEC chairman Gary Gensler indicated that the commission was considering rule amendments to expand disclosure requirements for companies going public via SPACs.

ESG interview with CEO of Global Impact Initiative, Giles Gunesekera

Gunesekera sits on two UN Advisory Boards and also on the CFO Taskforce, advising the UN on mobilising capital for the Sustainable Development Goals (SDG).

He’s about to launch the Global Impact Initiative (GII) Global Gender Equality Fund, a portfolio of carefully selected global companies which recognise and promote gender equality.

The fund’s goal, according to Gunesekera, is to achieve the UN’s SDGs, which is the blueprint to achieving a better and more sustainable future.

Give us a brief background about yourself and GII

“I formed GII in 2015 after spending 20-plus years in funds management.”

“Simultaneously, I spent 30-plus years in the non-profit sector as a director on a number of different boards, including eight years with Amnesty International.”

“Impact investing really soared 10 years ago as a way of bringing these two worlds (corporate and non-profit) together, with a dual focus of financial return and social impact.”

“GII is divided into five main pillars – gender equality, indigenous communities, health, affordable housing, and climate.”

“In each of those pillars, we play two very distinct roles. One is where we set up a fund under our name, and the other is where a fund manager brings us in to help them set up an impact fund on their behalf.”

“Gender equality goes right across all those pillars, and it’s taken us four years of research to get the Global Gender Equality Fund off the ground.”

“An important part of our model is that when we set up the funds, we engage investors around the world, ensuring that it’s got investor input and support.

“Everything that we do however, has to have that dual purpose of both financial return and social impact.”

What social impact does Global Gender Equality Fund have?

“There’s a number of women-focused ETFs out there, but there are no solutions that actually look at creating more opportunities for girls.”

“What we’ve found throughout our research was that in order to progress from girls to women, what’s needed were better health, better education, nutrition and socio economic empowerment.”

“So we’ve packed the fund with experts in those four areas, and appointed Robeco to manage the portfolio.””

What stocks are in the portfolio?

“Firstly, we don’t invest in businesses that are involved in alcohol, gaming, tobacco, weapons, and fossil fuels, and Robeco applies those same screens.

“We basically screen for companies that have a high percentage of women on the board, women in senior management, with pay parity and family friendly policies.”

“The universe is the MSCI World Index, and when you apply those negative screens and a gender lens, the investable pot is about 3,000 companies.”

“Out of those 3000, Robeco invests in roughly 60 stocks.”

“At the moment our portfolio includes well known stocks such as Estee Lauder, Unilever, Thermo Fisher, Schneider Electric, Mastercard and Accenture.”

“And this is where it gets interesting and what sets us apart from other funds.”

“As an investor in the Class B of the GII Global Gender Equality Fund, you’ll obviously be getting a financial return from the capital appreciation of the portfolio.”

“But on top of that, you will also agree to sacrifice the dividend income, and that income will go to girls’ charities.”

“Before that money goes there, we sit down and map out the social impact of that donation.”

“So to give you an example, before we would make a donation on behalf of investors to the Malala Fund, we would sit down with them and discuss specific outcomes like: how many girls are going to be educated, in which countries, and at what year levels?”

“And then we obviously monitor that and measure it back to the UN SDGs.”

How could retail investors invest in the fund?

“Retail investors could participate in the fund through the Macquarie Wrap platform, which is used by more than 7,000 financial advisers in Australia.”

“People can also come directly to us; it’s a wholesale fund so you need to be classified as a sophisticated investor.”

“The minimum investment is only $5,000, so it’s effectively a retail minimum, but within a wholesale investment memorandum.”

ESG related news in Australia

Australia needs 10 gigawatts of home batteries by 2030 to soak up excess solar, according to a report from RenewEconomy.

We’ve now passed over 3 million rooftop solar panels, and the capacity those panels generate will far exceed the highest of demand in any given day.

What’s important now therefore, is that a further rollout in solar panels must be coupled with an equivalent mass rollout of batteries, the report concludes.

As reported by Stockheader Jessica Cummins earlier this week, the Western Australian Government has launched a two-year pilot project to discover ways to make the most of household solar and battery assets.

Named ‘Project Symphony’, the project will help understand how rooftop solar and batteries could be centrally orchestrated to balance broad-scale electricity supply.

“In the future, houses will become the power station through their rooftop solar,” said Minister for Industry, Energy and Emissions Reduction, Angus Taylor.

“Project Symphony will test how increased access to renewables can benefit communities and is a major deliverable of the Distributed Energy Resources Roadmap.”

Some Australian companies are already getting into this action with novel ideas.

Earlier this year, Carlton and United Breweries (CUB) launched the Solar Exchange program, giving out VB beers to households who have rooftop solar power to spare.

CUB said it was looking to buy excess solar power from households and would pay in cans of beer instead of cash, all in the name of getting to net carbon zero by 2025.

Notable ASX ESG stock news in the week

Lendlease (ASX:LLC) global CEO Tony Lombardo told the Australian Financial Review Property Summit that property companies that have not developed a focus on green buildings will be left out by investors.

“If you haven’t gone on to developing sustainable buildings, you’re in trouble,” he told the AFR.

For the second year in a row, Evolution Mining (ASX:EVN) has been included in the Dow Jones Sustainability Indices Australia Index.

The company has retained its ranking in the top performing Australian mining companies for corporate sustainability, as judged by the DJSI annual assessment.

Meanwhile, a new ESG-focused recycling company has just hit the bourse on Thursday after raising $12m at 20c.

By the day’s close, the Close the Loop (ASX:CLG) stock price has hit 30c, a huge 50% premium that valued the company at around $65m.

“Sustainable packaging has been number one target for a long time, and we’re happy with the regulatory tailwinds in Australia and around the world which has helped us put the message out and all get involved in the circular economy,” Close the Loop CEO Joe Foster told Stockhead.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.