The Ethical Investor: Is doing well compatible with ESG? We ask Bloom Impact’s Camille Socquet-Clerc

Is doing good compatible with doing well? Picture: Getty Image

- A recent research report from JPMorgan explains what ESG investors have to do in order to beat the market

- Bloom Impact Investing’s Camille Socquet-Clerc discusses her ESG fund’s methodology

Can you make money if you invest according to your values?

Just five years ago, the consensus was that you somehow had to trade off financial returns in order to save the planet.

The investment community largely believed that alpha (outsized market return) was unattainable in an ESG portfolio, because doing good was simply incompatible with doing well.

Times have changed, and a lot of market research has been done to disprove that theory as ESG exploded over the last few years.

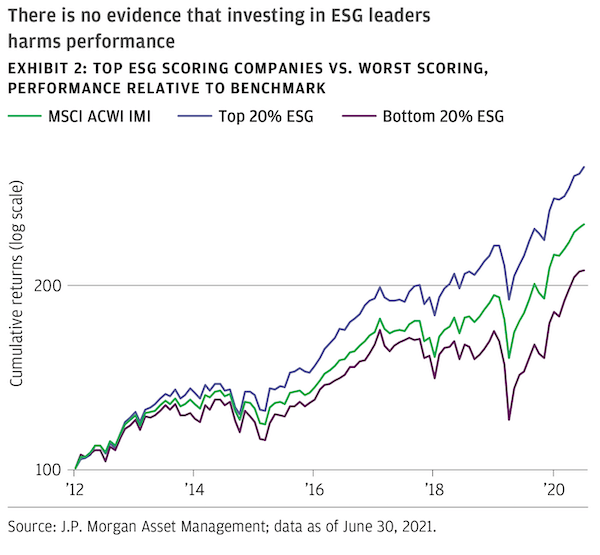

A recent research note out of JPMorgan showed conclusively that investing in ESG was not only compatible with doing well, but it also almost guaranteed alpha return for investors.

JPMorgan concluded that there was no meaningful trade-off between doing good and doing financially well, when investing in public (listed stocks) markets.

But in order to beat the benchmark and generate that alpha return, the report says that ESG investors must diversify and explore other asset classes outside of listed stocks.

Do this to beat the market

JPMorgan says the best way for ethical investors to beat the market is to diversify their portfolio into three different ESG asset classes – listed stocks, green bonds, and private markets.

Listed equities

For equities, a strategy that involves good sector screening is imperative.

This means picking the best ESG leaders and staying away from those companies that don’t exhibit sustainable qualities.

It also means filtering out completely companies that operate in ‘sin’ sectors such as gambling, weapons and tobacco.

Green bonds

In fixed income, the market is a little bit more tricky because the green bond market has lagged stocks when it comes to applying ESG criteria.

This is due to a range of factors.

First, bondholders don’t have control rights of the company. This means they aren’t able to vote or influence important decisions that a company makes.

Second, bonds are usually issued by subsidiaries, making it hard for investors to obtain information.

JP however believes that while there is evidence that higher ranked ESG issuers pay lower coupons, investors are likely to be compensated with lower default risk.

Private markets

This is where it gets difficult for the average retail ESG investor.

Investing in private, non-listed companies takes a lot of independent research, because the ESG information tends to be less readily available.

Private investments also normally require a huge sum upfront, as investors can’t buy into smaller units of shares.

JP acknowledges that finding ESG leaders can be challenging in private markets, but there are solutions around it such as engaging with management and building a relationship with them.

But JP believes that investing in private assets plays a crucial part in generating income, diversification and alpha in the ESG portfolio.

This Aussie startup executes on that model

Australian-based startup Bloom Impact Investing is a managed ESG investment fund that shares the same diversification philosophy as JPMorgan.

Backed by Envato founders and tech accelerator EnergyLab, the fund gives investors access to alternative, bonds and infrastructure investments that were previously only available to wealthy, sophisticated or institutional investors.

The fund was founded by millennials Camille Socquet-Clerc and Bertrand Caron, who wanted to prove money-making and saving the planet weren’t mutually exclusive.

Bloom has just launched Australia’s first climate impact investing app.

On the app, customers can invest for as little as $500, with no brokerage fees, while institutions can do the same for a minimum of $5000.

Interview with Bloom’s Camille Socquet-Clerc

Do you believe doing well is compatible with doing good?

“I would say there are no compromises to be made here,” Socquet-Clerc told Stockhead.

“There are incredible tailwinds behind clean technology. Let me give you some statistics to back this up.

“The Deloitte’s Australian Clean Tech Index which tracks all the clean tech companies listed in Australia has been outperforming the ASX 200 for six years in a row.

“That proves that we can absolutely make money with climate impact.

‘It’s been a tremendous growth with the shift towards clean energy also accelerated by the crisis in Ukraine.”

Tell us about stock picking methodology at Bloom

“Our starting point is a positive screening process,” Socquet-Clerc explained.

“To do this, we’re using a scientific model called Project Drawdown, which basically maps 80 solutions that we need to invest in and develop to get to net zero.

“This gives us a huge array of things, and of course there are the classic things – solar energy, wind, etc.

“But there are also other solutions which are less well known, such as telepresence, dynamic glass, alternative cement, insulation technology, and energy efficiency.

“What we do then is map these solutions to listed and non-listed companies.

“Currently we have 70% of our portfolio in listed equities in Australia and overseas.

“We also also invest in private markets and and green bonds.

“So it’s a fully diversified portfolio, and one common thread being that each asset in the portfolio corresponds to one climate solution as defined by our scientific model.”

At a macro level, what ESG trends are you seeing right now?

“There are three big trends in climate impact investing that we’re seeing – wind, storage and electrification,” said Socquet-Clerc.

“In electrification, we’re seeing pretty much every country in the world having very aggressive targets in the transition towards an electric transport system.

“Obviously there will be massive tailwinds for battery storage as a result of that.

“With wind energy, this will be driven by the Europeans trying to get quickly away from Russian gas. Europe will massively invest in wind technology to achieve energy independence.

Tell us about your private market investments

“We invest in clean energy projects like solar farms, wind farms, and battery projects in Australia,” explained Socquet-Clerc.

“These assets are typically very difficult to access when you’re a retail investor. But with Bloom, you can start investing in those projects from $500, when previously you had to have anywhere from $50,000 upwards to $5 million.

“One example of our private investments is a company called ESCO.

“We like this company because since its inception, ESCO has implemented over 3,000 clean energy projects for businesses and governments.

“Some examples of ESCO solar projects include the Maroochydore Government Office Building, Santos Place in Brisbane and Somerville House boarding house also in Brisbane.”

What listed stocks do you have in your portfolio

“In listed stocks, we like Infineon Tech (ETR:IFX),” said Socquet-Clerc.

“They’re a leading German semiconductor maker that aims to make energy-intensive technologies safer and greener, and has a strong commitment to reduce its climate impact.

“Another stock in our portfolio is Vestas Wind Systems (CPH:VWS).

“They’re leading the world in renewable wind energy, with over 145 gigawatts of wind turbines in 85 countries.

“We like Vestas because of their commitment to be carbon neutral in their business, which includes becoming completely powered by renewable energy for all of their global electricity consumption.

“In 2021, they reduced their carbon footprint by 33%.

“We also like Trane Technologies (NYSE:TT) because they’re a climate leader in heating, ventilation, air conditioning, and refrigeration for homes, buildings, and transport.

“By 2030, Trane has a target to cut customers emissions by 1GT, or 1 billion metric tonnes. That’s around 2% of the world’s annual emissions.”

Which green bonds do you hold?

“In fixed income, we’re invested in the Artesian Green & Sustainable Bond Fund,” Socquet-Clerc told Stockhead.

“This fund invests in a diversified portfolio of liquid, predominately investment grade sustainable and social corporate bonds.

“Green bonds are rare and highly sought after in Australia, and access to this market requires specialist managers with a strong green mandate.

“We believe Artesian has built a team of experts that applies a rigorous and recognised analysis of the ‘use of proceeds’; and it aims to exceed market performance standards.”

Other ESG news on the ASX this week

As reported by Stockhead’s green expert, Jessica Cummins:

Genmin has signed an MoU for the supply of renewable hydroelectricity from the Grand Poubara hydropower station for the Baniaka Iron Ore project in Gabon.

The term of supply is up to 20 years, with pricing reflecting the generally lower cost of hydroelectricity generation, and is less than US¢10 per kilowatt hour (kWh).

Griffith University wrapped up a three-month Extended Carbon Market Scoping Study, which forms part of Zeotech’s dual stream agricultural product development project underway at the university.

This study was strategically tailored to identify opportunities for materials-based greenhouse gas (GHG) mitigation.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.