The Ethical Investor: El Niño is back! But there’s one ASX company that could benefit from a potential drought

US scientists have confirmed that El Nino has officially begun. Picture Getty

- There’s a fair chance that El Nino will come back this year

- There is a 98% chance we will have the hottest year on record by 2027

- Duxton Water’s business model means that it does well during a drought

US scientists have confirmed that El Niño has officially begun.

This comes as the World Meteorological Organization (WMO) released a dire warning:

“There is a 98 per cent chance that Earth will set a new record for the hottest year in recorded history by 2027.”

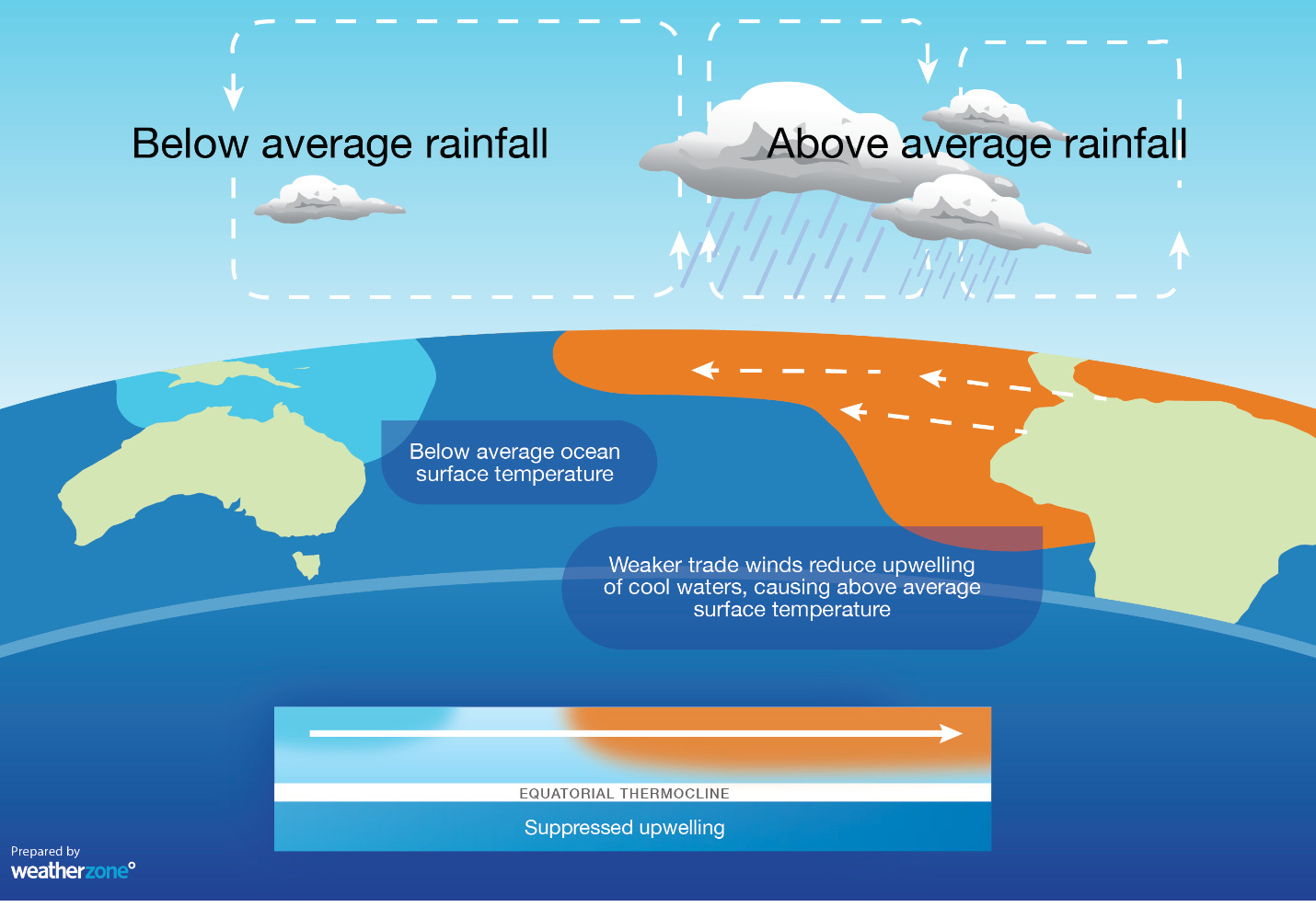

If you don’t remember everything from your Year 9 science class, El Niño is natural weather pattern characterised by unusually warm water temperatures that periodically develop across the east-central equatorial Pacific.

Translated to “Little Boy” from Spanish, El Niño often leads to changes in global weather patterns including increased rainfall in some regions, and drought in other places like Australia.

El Niños typically occur every 3 to 5 years, and during those events, there is a temporary weakening or reversal of the trade winds over the tropical Pacific Ocean, which cause these winds to blow from east to west.

This in turn causes the ocean near Australia to be cooler than usual, bringing lower than average winter–spring rainfall over eastern and northern Australia.

Severe droughts in Australia in the years 1982, 1994, 2002, 2006, 2015 were all associated with El Niño.

Not all El Niño events lead to drought, but in 2015, the drought in Australia caused by El Niño brought about substantial economic impacts in agriculture, livestock and reduced water supply.

The link between climate change and El Niño

There is evidence to suggest that climate change influences the characteristics of El Niño events.

Although the exact nature of this relationship is still an area of active research, some studies suggest that El Niño events may become more frequent or more intense under future climate change scenarios.

“Extreme El Niño and La Niña events may increase in frequency from about one every 20 years, to one every 10 years by the end of the 21st century under aggressive greenhouse gas emission scenarios,” said Michael McPhaden, a senior scientist with the US National Oceanic and Atmospheric Administration.

Australia’s CSIRO has also published an article last month to corroborate that theory.

“Even if greenhouse gas emissions were slashed and global warming was kept to 1.5℃, as per the goal of the Paris Agreement, we can expect more frequent strong El Nino events for another century,” said the CSIRO.

The importance of the Murray Darling Basin

According to the latest forecast from our own Bureau of Meteorology (BOM), there is a ~50% chance of El Niño and a high likelihood of a positive Indian Ocean Dipole (IOD) forming later this year.

Over the past three months, the Murray-Darling Basin has seen an average to below average rainfall, which is consistent with the chance of drier El Niño conditions later in the year.

Spanning 77,000km, the Murray-Darling Basin is Australia’s largest river system that provides quality water for drinking and agriculture, contributing around $22 billion worth of food and fibre every year.

Around 40% of all Australian farms are in the Basin, which means that a drought could be catastrophic to our agricultural industry.

Why ASX-listed Duxton Water could benefit

One ASX company that could benefit from a potential drier season is Duxton Water (ASX:D2O).

Duxton owns and manages a portfolio of water entitlements and assets, primarily located in the Southern Murray Darling Basin.

In the past, irrigators received a permit to access water based on their agricultural plantings; but in the 1990s, it was realised that further issue of water permits was not sustainable, so a cap was placed on the further issuance.

To allow water-users to continue to develop however, the Government developed a trade capability by recognising the permit as a perpetual right to the resource, and by separating this asset from the land. So, one can own water without land, and land without water.

Today, these rights are called water entitlements, which are a perpetual right to a particular volume of water.

Each year, the entitlement holder receives an allocation based on their entitlement and its particular characteristics. In some years it may be a full allocation (i.e. they receive 100% of their entitlement) and in other years it may be as low as 0% for some entitlements.

Exchange platforms and brokers were introduced to facilitate trade of these two assets – entitlements, and the annual usable volume of water (allocation) – and that’s where Duxton Water comes in.

The company has said the prospect of a drier outlook usually increases demand for leases and forward contracts from its customers.

“Finalising new leases has been one of our key priorities over the last month,” said the company.

“There remains consistent demand for new leases to commence 1 July 2023, with counterparties still favouring longer term options (5-10 years).”

Duxton’s forward looking statements

Duxton says a forward sale of water allocations is important to farmers as it mitigates their risk.

“Forward allocation sales act as a price hedging tool for irrigators, as they provide visibility to cost and supply of allocation for the year ahead,” it said.

Given the drier than average outlook and receding floodwaters, Duxton looks well suited to take full advantage of the current conditions.

At 30 April, the company had 58% of its permanent water portfolio (by value) leased to Australian farming businesses, accounting for 78% of the company’s high security portfolio.

Looking ahead, Duxton says it will continue to have discussions with customers about forward sale of allocations for next season.

“Water is a defensive asset class that continued to generate positive returns for our shareholders.

“We remain confident in the long-term strategy of our business and would like to reaffirm our intention to continue to provide shareholders with a bi-annual dividend, franked to the greatest extent possible.”

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.