The Ethical Investor: Does ethnic diversity lead to higher stock prices; and Lonesec’s Tony Adams on rating ESG funds

Picture: Getty Image

The Ethical Investor is Stockhead’s weekly look at ESG moves on the ASX. This week’s special guest is Lonesec’s Tony Adams.

Major proxy advisory firms, ISS and Glass Lewis, announced they will issue new investor guidelines for 2022 that will heighten focus on ESG issues.

The two proxy firms represent some of the biggest investors in the world, providing them with voting recommendations by researching governance, business, legal, political and accounting risks.

Glass Lewis (GL) says it will refrain from voting for a board that has not addressed the lack of diversity on its seats.

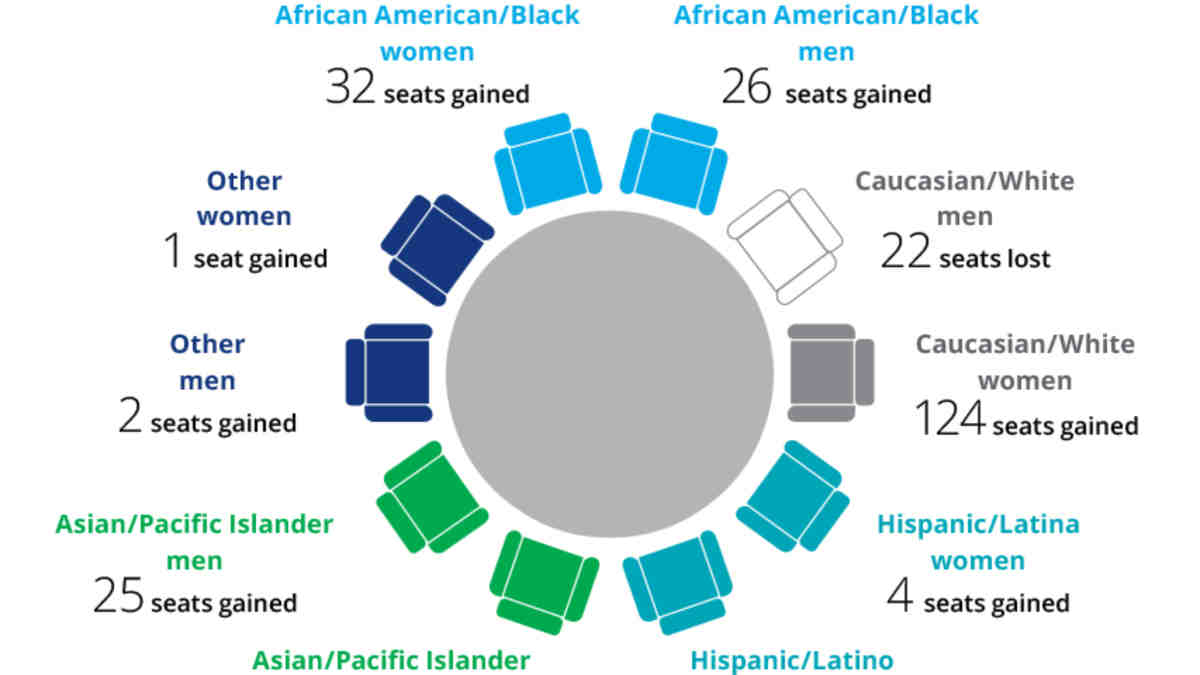

Apart from gender diversity, GL said it will also begin to address board composition in terms of racial and ethnic diversity.

“Beginning in 2022, for companies in the S&P 500 index with particularly poor disclosure on racial/ethnic diversity, Glass Lewis may recommend voting against the Chair of the nominating governance committee,” the company said in its statement.

But does an ethnically diverse board really translate to better stock performance?

Not according to a research from Calvert Research and Management, which runs one of the biggest ESG funds in the world.

Calvert acknowledged the value of having an ethnically diverse population in talent sourcing and nation building, but said those results don’t necessarily translate across to better returns in companies.

The Calvert study concluded that on average, large-cap Australian, Canadian, UK and American corporate boards have become more ethnically diverse, with American boards being the standouts.

However, it found no direct link between the monthly equity returns of those large caps, and the diversity of the boards.

What it did find was a direct link between monthly equity returns and the level of board ethnic diversity factors, relative to the company’s home country demographics.

In other words, companies that have ethnic percentages on its board higher than the national average tend to do better.

The bottom line is, investors should recognise the value of diversity, equality and inclusion as a driver of performance over the long term, the study concluded.

What’s happening in Australia

The Commonwealth Bank (ASX:CBA) announced that its new IFM term deposit (TD) product has been seeded with $200m in fresh funds from investors, which it will use to invest in sustainability-linked loans.

The CBA said the TD is the first of its kind in Australia, and allows investors to receive a fixed rate return.

“The financial system has a critical role to play in supporting Australia’s decarbonisation journey by directing capital to projects and assets that will drive our transition to a more sustainable future,” said Andrew Hinchliff, executive director of markets for the CBA.

CBA says the TD has been certified by the Responsible Investment Association Australasia (RIAA).

Sustainability-linked bonds have become popular recently, as they give investors an extra yield pickup on the coupon payment if certain sustainable targets aren’t met.

Meanwhile, a new ESG investment product has been released recently in Australia – Fidelity’s Global Demographics Fund (ASX:FDEM) ETF.

This ETF invests in 50 to 70 different stocks that aim to outperform the MSCI All Country World Index.

In particular, the fund aims to exploit market inefficiencies by targeting the beneficiaries of demographic trends early, seeking out companies with innovative products and services that will address evolving demographic needs.

Fidelity says the fund adheres to a transparent sustainability framework that leverages Fidelity’s proprietary ESG research, and won’t invest in companies that cause harm or undermine a more sustainable economy.

Management fee for the fund is disclosed at 0.89% per annum.

ESG interview with Tony Adams, head of Sustainable Investment Research at Lonsec Research

Lonsec provides financial advisers, fund managers and superannuation funds with practical insights that add real value to their investment and advice solutions.

The company rates over 5000 investment funds and equities, and 500-plus superannuation products, assessing funds against the UN’s 17 development goals.

Stockhead caught up with Lonesec’s Tony Adams to talk about ESG insights.

How does Lonesec work and how do investors benefit?

“Lonesec is essentially a funds rating business, and we review managed funds.”

“We give funds a rating: ‘investment grade’, ‘recommended’, or ‘highly recommended’. Those ratings are then used by financial planners when constructing portfolios for their clients.

“The ratings build over a whole range of factors. For example, we look at the overall organisation, the team and their experience, as well as their investment process.”

“We also look at the people performance, fees, and ESG when we come up with the overall rating.”

What specific factors do you look at in ESG?

“In the ESG context, we’re talking about their investment process, not their actual portfolio.”

“So we’re looking at how they think about and integrate ESG into their investment decisions.

“In terms of our process, we look at the firm’s positioning on ESG, we read their ESG policies, and we review their proxy voting policies.

“Importantly, we determine whether they actually do what they say they’re doing.

“We also have a separate product which we call our sustainability reports, and these are really more aimed at what mum and dad investors think about when they think about ESG.”

How do you maintain independence?

“Obviously, we have internal policies and procedures in place, and we’re also a licensed entity.

“I don’t think there’s any natural conflict of interest that builds up there, as we don’t get any benefits from rating a fund highly.”

Notable ASX ESG-related news during the week

St Barbara (ASX:SBM) has just released its Modern Slavery statement for 2021.

The company said that during the year, it developed and implemented a modern slavery procedure, held modern slavery workshops, provided training, and established a modern slavery working group as part of its governance framework.

St Barbara’s operations include three operating gold mines, exploration activities in operated and non-operated joint ventures and equity investments in Australia, Canada, and PNG.

Mincor Resources (ASX:MCR) has released its inaugural sustainability report, marking an important step in the company’s ESG journey as it prepares to recommence nickel concentrate production at its Kambalda Nickel Operations in WA in the June quarter.

The company says FY22 will see Mincor move to alignment with GRI (global reporting initiative), in addition to the UN Sustainable Development Goals.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.