The Ethical Investor: Australia to issue green bonds in 2024 to accelerate transition

Australia is set to issue the first green bonds in 2024. Picture Getty

- Australia will start issuing ‘green bonds’ in 2024

- Experts are confident the bonds will boost investment into clean energy projects

- Stockhead reached out to Kristy Graham, the Executive Officer of ASFI

Australia is set to start issuing ‘green bonds’ from the middle of 2024 in an effort to accelerate our transition to net zero.

This follows the recent government announcement which sets out a legally binding target to cut carbon dioxide emissions in Australia by 43% from 2005 levels by 2030.

The size of the bond program was not specified, but experts are confident that it will boost investment into our clean-energy infrastructure.

Treasurer Jim Chalmers said the bonds would allow big funds like superannuation and banks to finance and tap into the much-required public projects.

“We need to give as many opportunities for people to invest as we can,” Chalmers said.

Back in December, Chalmers acknowledged that issuing such bonds would pose a problem for global investors, given the coupons would likely have to be paid from the government’s fossil fuel tax revenue.

“Treasury will work with the Australian Office of Financial Management to consider the merits in more detail,” Chalmers had said.

The global market for sovereign green bonds is growing fast.

Poland became the first country to issue one in 2016, and since then, about 40 countries have followed suit. According to the World Bank, the total outstanding green bonds out there is around US$300 billion, representing about 13% of all outstanding thematic bonds.

What are green bonds?

Sovereign green bonds are fixed-income instruments designed to raise funds for projects that have positive environmental or climate benefits.

These include projects such as renewable energy, energy efficiency, clean transportation, and sustainable agriculture, among others.

Yields on sovereign green bonds can be lower than traditional bonds, but they can also vary and in Australia’s case, it isn’t clear yet if they would command a lower or higher coupon.

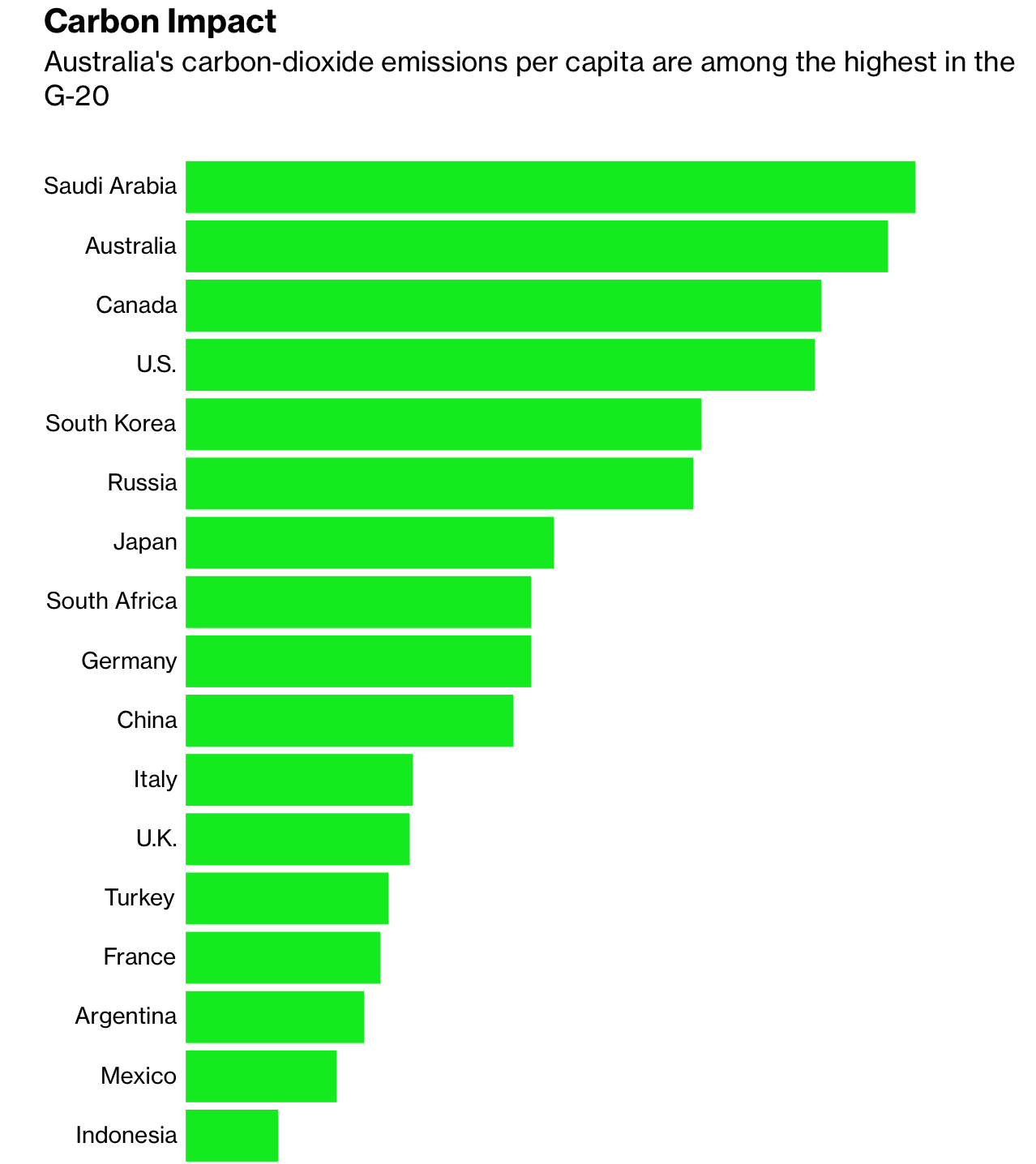

Regardless, the program launch will help to end Australia’s reputation as a climate laggard, given that we’re one of the world’s biggest per-capita polluters.

Kristy Graham, the Executive Officer of ASFI (Australian Sustainable Finance Institute), said the news of Australia’s green bond launch is a positive one.

“The Government’s announcement on green bonds is a welcome indication of its commitment to supporting the growth and integrity of green capital markets in Australia,” Graham told Stockhead.

However, Graham noted that investors will consider not only the sustainability credentials of activities that are funded by a green bond, but also the overall climate credentials of the issuer – which in this case is the Australian government.

“Investors are likely to expect that overall, Australia is on a responsible and appropriate trajectory towards net zero emissions, and that there are policies and frameworks in place or under development to support that transition,” she explained.

“This would include things like science aligned emissions targets, a comprehensive and ambitious sustainable finance strategy including indicative sector pathways and disclosure requirements, and effective and well-coordinated mechanisms that use public money to crowd in private capital for the transition.”

A clear taxonomy is required

Since its establishment in July 2021, ASFI has been working on developing Australia’s sustainable finance taxonomy aimed at mobilising more capital towards the country’s energy shift away from fossil fuels.

In October last year, ASFI released a new report that outlines key considerations that could become the backbone and standard for what activities and assets are considered sustainable.

Some experts believe that Australia’s green bond program will struggle to lift off without a taxonomy in place because investors want to have maximum confidence before they invest.

Graham said this lack of a sustainable finance taxonomy in Australia had been a significant barrier to investment in climate solutions.

“A sustainable finance taxonomy is an important tool to establish a common approach to determining what economic activities are aligned with Paris Agreement decarbonisation pathways,” Graham said.

The Government has announced it will co-fund ASFI to lead development of an Australian sustainable finance taxonomy. This process will take place over the next 18-24 months.

“It’s too early in the taxonomy development process for Government to make decisions on how they might use an Australian taxonomy in their green bonds program,” she added.

Graham says the Government’s green bond framework will need to establish the parameters for their sovereign green bond issuances including use of proceeds, the process for evaluation and selection of investments, management of proceeds, and reporting.

“Taxonomy alignment is one metric that could be used to guide decisions regarding use of proceeds.

“There are various credible frameworks that have been developed in other jurisdictions that the Government can draw from in developing its own green bond framework. Investor feedback will also be an important part of developing this framework.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.