The empire is struck back as Indian billionaire Adani accused of ‘brazen’ fraud

BRISBANE, A Young Adani protester is seen holding a placard in Brisbane Square on July 5, 2019 in Brisbane, Australia. The protesters were calling on the Queensland State Government to withdraw its approval of the Adani coal mine in central Queensland. (Photo by Glenn Hunt/Getty Images)

Looks like everyone was right about the Carmichael open-pit coal mine all along.

Wrong time, wrong place. Wrong man.

Certainly that’s the view from a great many computer screens on this Australia Day after Hindenburg Research LLC revealed a hidden Wednesday (US time) thermal detonator in its mercenary grip: not only does it hold generous short positions in the mine’s Indian conglomerate owner Adani Group, but then dumped a truckload of data eviscerating Adani and its billionaire owner.

Hindenburg says it has evidence that the INR 17.8 trillion (US $218 billion) Group has ‘engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades.’

Shares linked to Adani’s flagship firm Adani Enterprises Ltd. its Adani Ports stock and Special Economic Zone Ltd assets all began falling sharply on Wednesday.

The activist investor must be having a day of it out there itself – it’s no small thing to come right out and accuse Asia’s richest man by a country mile of being a genuinely bad piece of work.

So who are these guys?

First, we’ll look at the target, then (just as exciting) where the missile was fired from.

The prominent American short-seller’s list of Adani’s improprieties is a long one and follows the group’s magnificently colourful background of doing as it pleases to get what it wants.

Top of the list for Hindenburg are Adanai’s allegedly “extensive” use of improper entities in dodgy offshore tax havens and a nigh Ponzi-scheme shaped myriad of high debt levels.

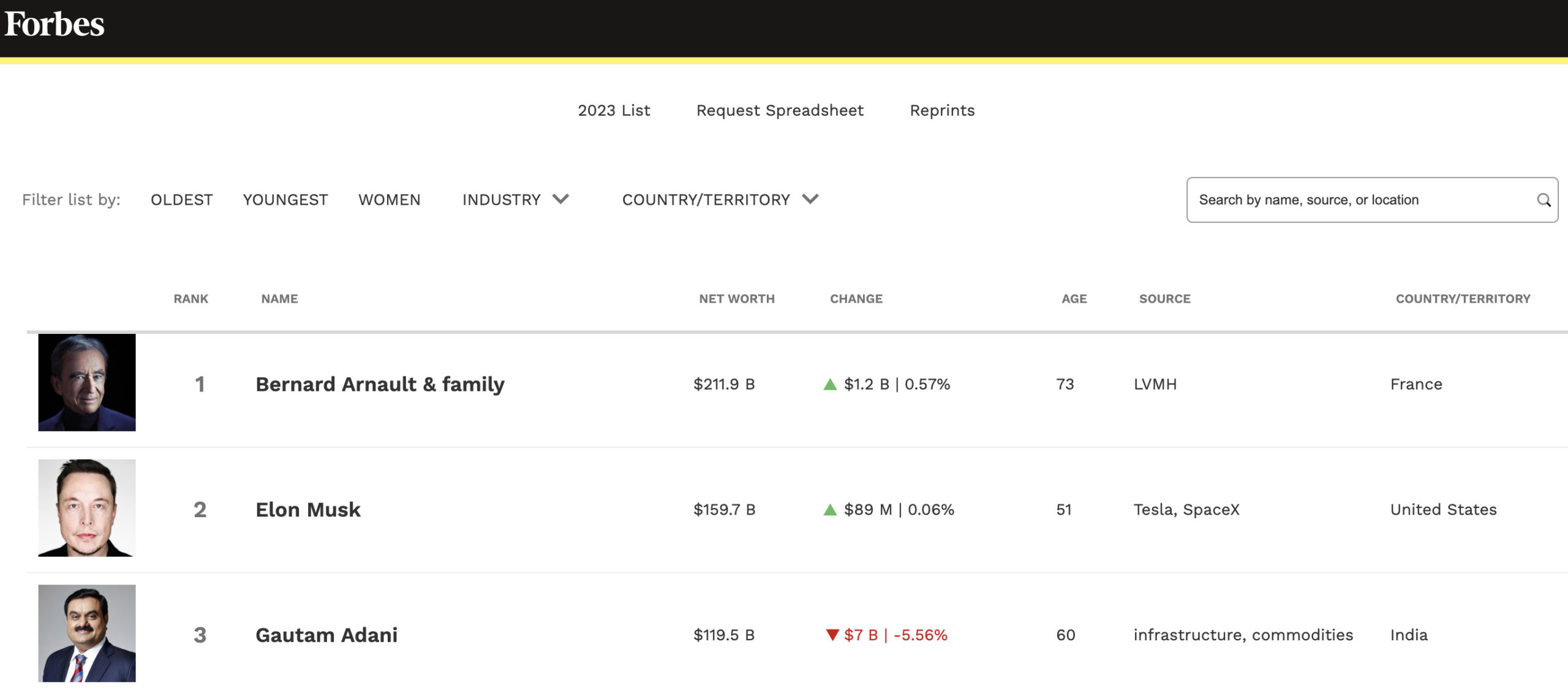

The group, which is led by Gautam Adani – the world’s 3rd richest human according to Forbes – laughed off the Hindenburg claims as ‘baseless’ and fired back that it was timed to do maximum damage to Adani’s (sparkling) reputation, just in time for a share offering which is due in a day or so.

The aim and the timing were on the money.

Shares in all of the 10 various publicly listed Adani Group stocks – including another recent acquisition NDTV – were trading well down after Hindenburg’s accusations as well as the revelations that it had been enthusiastically short-selling Adani Group companies through US-traded bonds and non-Indian-traded derivatives, along with other non-Indian-traded reference securities.

The Emperor blinks

Gautam Adani’s personal wealth took a direct hit – of sorts. He lost as much as circa US$7 bn in 24 hours after the conglomerate’s share price dwindled on Wednesday.

The 60 year old Gujurati businessman is now only worth around US$119.5 billion today, according to Forbes Real-Time Billionaires List.

Adani, however, remains the world’s 3rd richest person, a few bucks ahead of Jeff Bezos (US$119.5 billion) and some dude called Warren Buffett (US$108 billion) and his wide highways of influence extend way beyond India.

And Gautam’s empire is a vast one

Here’s a guy who’s a Gujurati college dropout and mayve three years later is busy making an absolute gang-busting fortune in the highly sought after plastic granule trade. By the late 90’s this guy has overseen the creation of what’s now India’s largest port, at Mundra.

The ex-PM Nahrendra Modhi and Adani got real cosy in Gujurat around the time of – first an appalling earthquake and then some really abominable race-rioting. The two came out of those very well. Adani had prime position on all the fled investments and soon had all kinds of power – both actual – natural gas distribution, oil exploration, real estate and the like, as well as the unseen power of influence and networks.

In 2007, he began his maiden coal-fired power plant in Gujarat. The next thing you know, he’s everywhere.

In Queensland, Adani is behind the developed Carmichael open-pit coalmine, an obscenely controversial project built on land environmentalists are married to and First Nations groups says was obtained without permission

More recently, Adani became the focus of fury in Britain, after the London Science Museum announced that it’d be opening an Energy Revolution gallery, focusing on green energy, in 2023, with sponsorship from an Adani subsidiary.

Not green, quite mean

This is a quick few pars from a great read, which came out just before Xmas in The Guardian thanks to some backing from the Pulitzer Center. It’s written by Ankur Paliwal and Lalan Singh Dhurve, a journalist based in Surguja in Chhattisgarh.

Criminal and journalistic investigations into alleged corruption seemed to have little impact on Adani’s growth.

In 2011, an anti-corruption office in the southern state of Karnataka found Adani to be one of a number of companies involved in a scam to trade iron illegally – though Adani denied that this finding was accurate.

Apparently untroubled by these findings, in early 2014 Modi used Adani’s private jet while campaigning to become India’s prime minister.

He won the election in May.

Two months later, Adani was given environmental clearance to continue running a Special Economic Zone – where companies can enjoy perks such as tax exemptions and duty free imports – near Mundra port, putting an end to almost a decade of legal disputes surrounding the project…

Almost everywhere I ask the internet to take me on Gautam Adani ends in the destruction of forests on behalf of the global climate.

As I write, the fallout of the US-based investment research and activist short-seller’s work – a 2-year deep dive investigation into Adani’s companies – there’s seemingly no end of the co’s linked to the Adani machine – recently acquired cement makers ACC Ltd. and Ambuja Cements Ltd to Adani’s flagship Adani Enterprises and it’s slightly mad renewable spin off, Adani Green Energy Ltd (AGEL) .And they’re all hurting.

Just like the Hindenburg…

Key listed Adani companies have also taken on substantial debt, including pledging shares of their inflated stock for loans, putting the entire group on precarious financial footing. 5 of 7 key listed companies have reported ‘current ratios’ below 1, indicating near-term liquidity pressure.

Even if you ignore the findings of our investigation and take the financials of Adani Group at face value, its 7 key listed companies have 85% downside purely on a fundamental basis owing to sky-high valuations.

Hindenburg Research is a US-based investment research and reporting firm which specialises in activist short-selling and has done some absolutely cracking work on corporate malpractice.

Founded by Nate Anderson, Hindenburg uses all the CSI of forensic financial research and is probably best known for getting inside and running amok with the electric vehicle boom.

It was the ‘driving force’ in running down the wayward e-truck company Nikola Corp. and its rockstar, but actually quite dodgy founder Trevor Milton

In 2020 Nikola was on a tear before Hindenburg accused the company of being built on a complex wen of lies upon lies. Milton was fried (not fired) as chairman and found guilty of securities fraud.

So when Hindenburg announced late Tuesday it had taken a short position in Adani’s companies then the fight was on.

The firm says there’s all kinds of red flags around how the Adani Group has manipulated all kinds of entities in the preferred offshore tax havens favoured by crypto-thieves, like say the Mauritius and the Caribbean.

The US short-seller also laid out key listed Adani companies which were wallowing in “substantial debt” going on to suggest that the entire conglomerate is on a wonderfully “precarious financial footing.”

Even more exciting: As per the above shares in seven Adani listed companies have an 85% downside on a fundamental basis due to what its researchers are gleefully calling “sky-high valuations.”

But Gautum Adani will be very, very difficult to shirtfront.

The Empire will strike back.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.