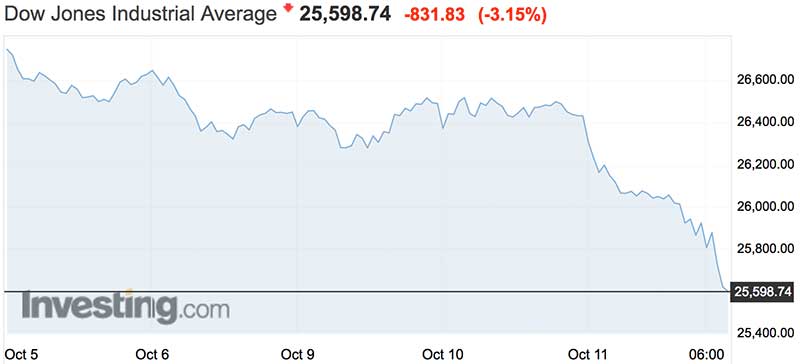

The Dow tumbles more than 800 points as US stocks get the wobbles

Resi Stiegler of the US crashes during Slalom Alpine Skiing at the Winter Olympics. Pic: Getty

US stocks took a beating overnight as concerns about global economic growth and ongoing trade tensions continued to hang over Wall Street and after the bond market resumed a sell-off that started last week.

Technology companies were among the biggest losers, with the Nasdaq Composite falling 4%.

In its steepest decline since March, the Dow Jones industrial average dropped 830 points or 3.2% to 25,598 (see graph below).

The S&P 500 fell for a fifth straight session, down 3.3% to below its 50-day moving average.

Following reports that retailer Sears could file for bankruptcy protection as soon as this week, shares of the cash-strapped retailer plummeted as much as 37%.

Investors sold off US government bonds, with the two-year yield touching its highest point since June 2008.

The Federal Reserve is expected to continue tightening after increasing rates three times this year and eight times since the financial crisis.

On Tuesday, the International Monetary Fund downgraded its outlook for the world economy. Citing concerns about trade and emerging markets, the international lender lowered its global growth forecast for this year and next in a report.

An ongoing conflict between Washington and Beijing weighed on large-cap industrial stocks, including Boeing (-4%) and Caterpillar (-3%).

When asked by a reporter Tuesday if he was ready to place additional tariffs on Chinese goods, President Donald Trump replied, “Sure, absolutely.”

A closely-watched inflation measure in the US rose for the first time since June, according to the US Labor Department.

Partly driven by a jump in transportation costs, the producer-price index rose a seasonally adjusted 0.2% in September from a month earlier. The rebound was in line with expectations.

On the commodities front, oil prices fell as supply concerns took a backseat to warnings of dampened global growth.

Bloomberg reports Hurricane Michael, one of the worst US hurricanes on record that is making landfall in Florida, has veered east of oil and gas platforms.

West Texas Intermediate was trading down more than 2% at around $US73 per barrel.

US markets mirrored risk-off sentiment around the globe, with European stocks having also ended sharply lower.

Italy’s ruling coalition has been clashing with EU officials over its budget, saying Wednesday it wouldn’t “backtrack” on plans to increase deficit spending.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Read the original article. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.