The Common Wealth: Australia’s 2nd most owned stock reports on Wednesday, here’s what the experts are banking on

Via Getty

The country’s largest bank will reveal its full-year results tomorrow, Wednesday August 10. World Lion Day, as it happens. Lions are the second largest cats in the world, after tigers.

The Big Four are looking fragile on Tuesday.

NAB shares are 3.6% lower after it released its third-quarter results.

Westpac has fallen 1.2%, ANZ has slipped 0.9% and the Commonwealth Bank of Australia (ASX:CBA) is 1.5% lower.

I’ve largely ignored the nation’s second most widely held stock, everyone else seems to have it covered.

But after a little digging, I got interested and thought I’d share what the experts reckon is on the cards for CBA’s full year, dropping about 11am (Sydney time).

Past earnings

First up, the major Aussie bank shares initially sold off sharply following the Reserve Bank of Australia’s (RBA) big June 50-basis point increase to the cash rate target. Global US recessionary paranoia has also weighed on equity markets.

According to Morningstar, the potential for the banks’ larger-than-expected loan losses is real, but not yet and not materially.

“We think the market is now overemphasising the downside risk.”

Azeem Sheriff, senior market analyst with CMC Markets, says CBA’s first half-year result was a corker – a 23% increase in net profit after tax (NPAT) to $4.75 billion; a fully franked interim dividend of $1.75 per share; and a $2 billion share buyback.

“But with a very uncertain backdrop amid an aggressive monetary tightening policy that saw the Reserve Bank of Australia (RBA) raise interest rates for four successive months totalling 175 basis points, analysts and investors are more interested in the lender’s forward guidance for the year ahead as opposed to the results from the year that was.”

The bank attributed its profitability thusly:

“Higher cash profits were a result of continued volume growth across the business in home lending, business lending and deposits lower loan impairment expense due to the improving economic outlook, and a reduction in remediation expenses.”

Nice one. New ball game though.

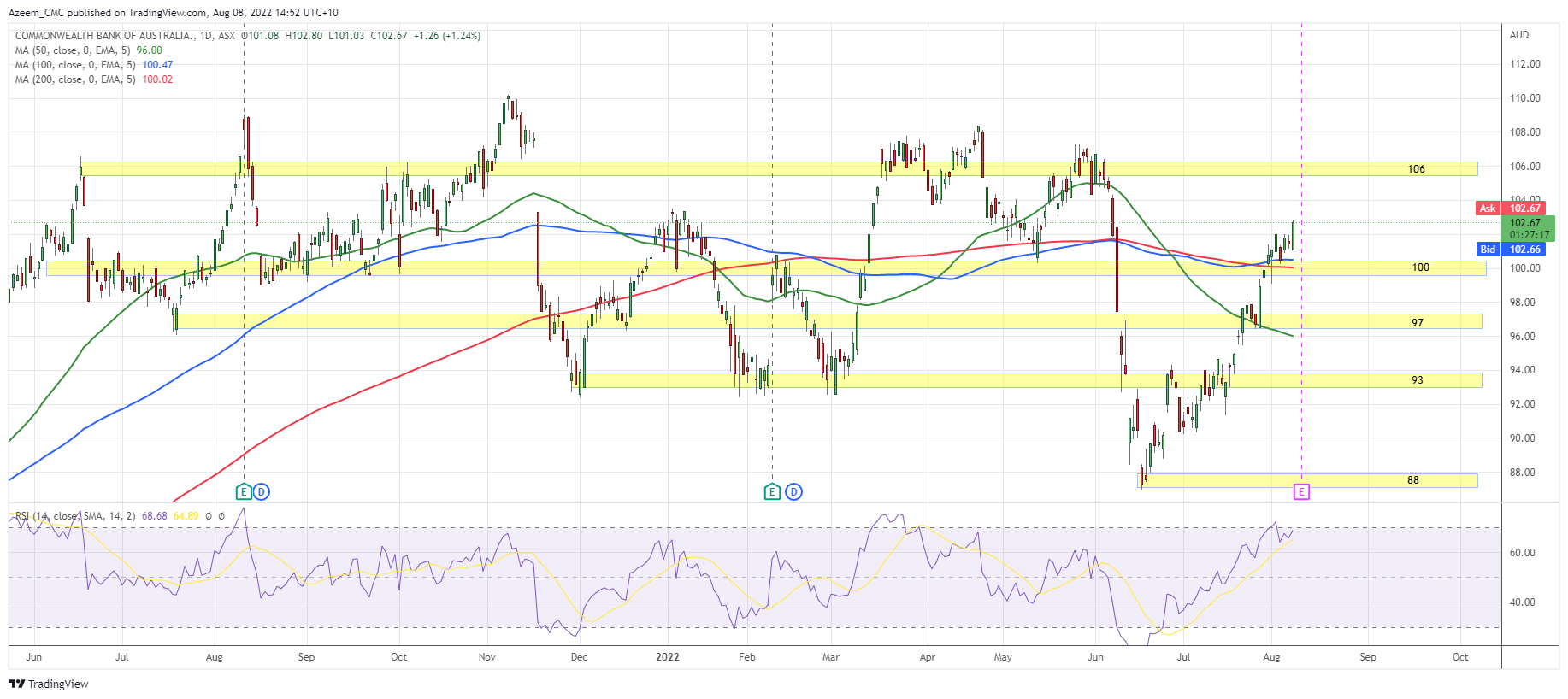

ASX:CBA with key levels

Macro Environment: New headwinds

“To understand how CBA may potentially fare this season, it’s essential to understand the macroeconomic environment in the preceding months,” Azeem says.

“These general macro themes include high inflation, aggressive monetary policies, a tight labour market and adjusted discretionary spending.

“However, investors need to remember that markets are forward-looking. Therefore the results released by CBA will be retrospective; although still necessary, what will be more critical is CBA’s forward guidance for the next 6-12 months which will dramatically impact the direction of the stock’s price.”

Key factors include CBA’s credit growth, signs of stress from rising rates, demand for credit and other business ventures.

As COVID-border closures stopped up the flow of skilled migration, the labour market is “now as tight as it’s been”, and inflationary wages pressures are pushing soaring energy costs higher while supply disruptions are compounded by China’s dogmatic pursuit of Covid Zero.

Headline inflation is now at 6.1% YoY – the highest since the early 2000s.

Market Matters: CBA six months with volumes (below):

Aggressive Monetary Policy

To alleviate these issues, the RBA began the withdrawal of its emergency monetary policy settings in May. Following an expected 50 basis point increase at its Board Meeting in August, the RBA’s new cash rate will be 1.85%.

The interest rate market expects the RBA to continue raising rates to 3.50% by April 2023.

The tightening cycle has triggered crashing house prices and helped chip apart consumer confidence.

More broadly, the global outlook is uncertain. War in Europe has hit energy and commodity markets, supercharging inflation and subsequent, aggressive global central bank interest rate hikes.

Azeem says this aggressive form of tightening has placed immense pressure on household expenditure from rising rates weighing on discretionary spending, where customers allocate a larger portion of their household/business income towards housing & business credit.

“As a result, Australia, more specifically the eastern coast of Australia, is now experiencing a rapid downfall in house prices, weighing on consumer confidence and affecting those highly leveraged customers the most.

“In saying that, Aussies have saved more than $200 billion to service their household expenditure as they start to rebalance their spending patterns.”

With a $175 billion market cap, CBA led the Big 4 and passed on all the rate rises to its circa 16 million customers whilst limiting the increase in deposit rates, providing them with what will become a handsomely improved net interest margin (NIM).

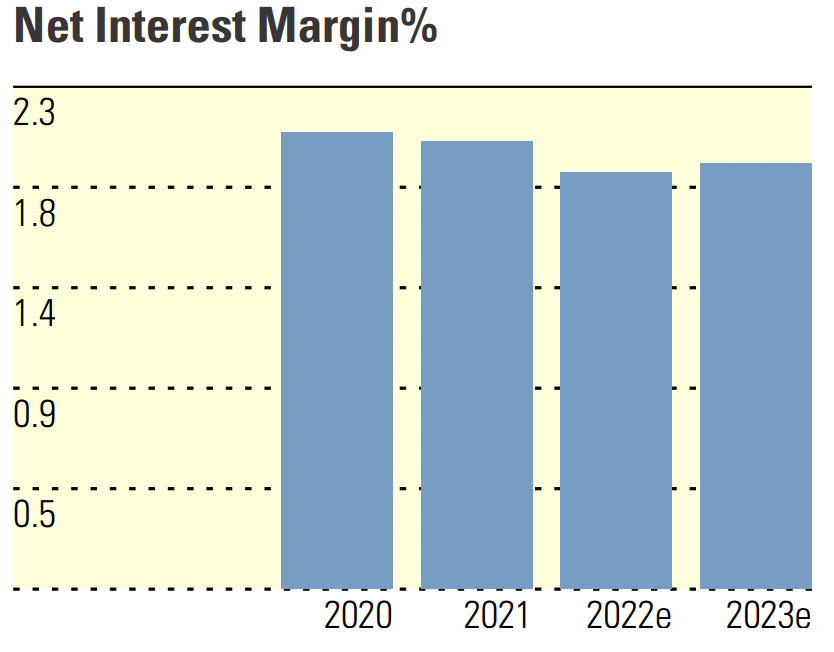

Net Interest Margin (NIM)

Azeem puts guidance on CBA’s NIM right at the top of CBA’s report tomorrow. He says this is what’s likely to “drive the share price dramatically”.

To provide some context, an incremental increase in the NIM (even 0.1%) could increase the bottom line by $3-4 billion.

Analysts at Jarden forecast CBA’s NIM to contract by 18 basis points to 1.9%, as does Morningstar.

Jarden expects the trend to start unravelling in the fourth quarter as the full brunt of the RBA’s rate hike exertions start to kick in.

Morningstar’s CBA NIM forecast:

With banks passing on the full rate hikes to variable loans and limiting the increase on deposit products, both analysts at Morningstar and at CMC expect CBA’s NIM to increase over time, driving further profitability.

“On the positive side of the rate increase(s), the banks should be able to reprice loans and capture net interest margin, or NIM, upside sooner than we previously expected… our expectations for bank margins is to expand over time,” Morningstar’s Nathan Zaia says.

“Cost and switching cost advantages should help the banks reprice loans upward in a rising rate environment, while deposit funding costs are unlikely to increase at the same rate, leading to margin expansion.”

Credit Losses

“With an aggressive monetary policy leading to higher rates over a short period, this obviously places pressure on households as mentioned above, which impacts serviceability, especially those highly leveraged customers,” Sherrif says.

“This gives rise to potential bad loans or defaults from those highly leveraged customers, increasing default risk on the bank’s balance sheet.

“On a positive note, AU employment is solid with a 3.5% unemployment rate, meaning more Aussies have jobs and money to spend and manage their debt, so we can expect a reduced expectation in the near term.”

CBA has already told everyone it was heavily into the Swedish Buy Now Pay Later company Klarna with a $2 billion investment… which collapsed 85% in its valuation due to the excitement in the BNPL space, reduced discretionary spending and the competitor landscape.

CBA also got in early on another one-off – the sale of its 10% shareholding in the Bank of Hangzhou delivered a pre-tax gain of $516 million, recognised in its cash NPAT and included within other banking income.

Commonwealth Bank: Analyst Expectations

“Overall,” Azeem says, “CBA will fare well and beat analysts’ expectations this earnings season.

“More importantly, it is expected to provide strong forward guidance given that the market landscape is now less uncertain than 6-12 months ago.”

JP Morgan/Ord Minnett:

This stock is not covered in-house by Ord Minnett, but it white labels research by JP Morgan where the expectation for 2H cash net profit from continuing operations is $4.805bn (to be exact). JPM expects a final dividend of $2.05 per share.

Much like Azeem, the broker expects commentary around CBA’s NIM outlook “will be key, given the dynamics for higher interest rates and deposit market rates”.

JP Morgan has a Hold rating on CBA and its $83.80 price target is unchanged.

Credit Suisse:

Brokers at Credit Suisse has updated its projections across the board for Australian banks, this time incorporating a more aggressive rate hike path as indicated by the RBA.

The bottom line: more benefits for banks’ Net Interest Margin (NIMs) to be fully enjoyed by FY24. There is partial offset via higher bad and doubtful debts.

The broker’s updated FY24 margins now sit above market consensus, Credit Suisse has whacked on CommBank a Neutral rating with a price target of $102.80, both unchanged since around June.

Market Matters:

James Gerrish at Market Matters says CBA has continued to perform strongly.

“It’s currently only 10.2% below its all-time high before we take into account dividends – the bank’s forecast to pay a $2.31 fully franked dividend next month which is likely to be rapidly garnering attention by local investors.

“CBA has been a classic case of a quality company being able to remain expensive for a long time compared to its peers if it keeps delivering, plus a fully franked 3.8% yield leaves most investors comfortable to simply stay long.”

“Previously we had been looking for CBA to rotate between $85 and $95 but fortunately we’ve adopted the ‘if in doubt don’t sell CBA philosophy’.”

Tribeca:

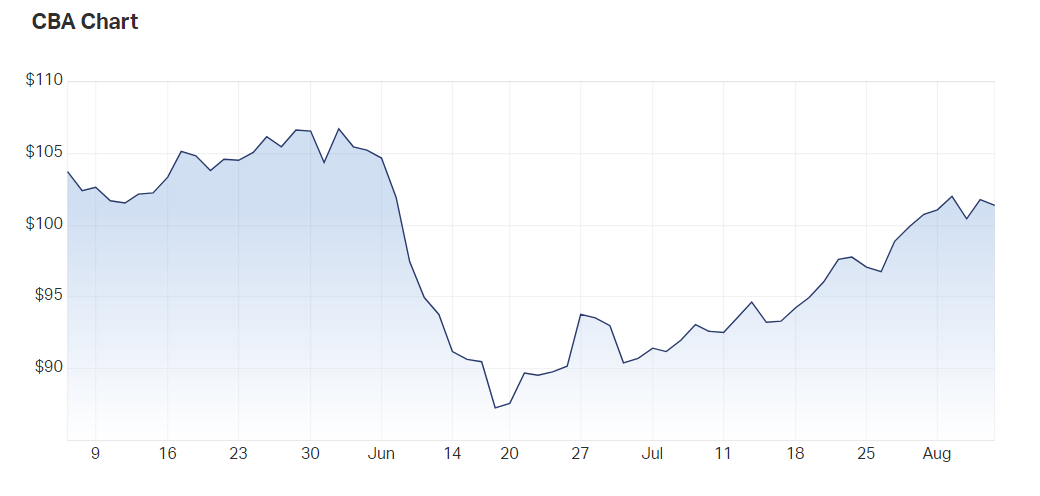

CBA shares had a difficult FY22, finishing 9.5% lower at $90.38. The current CBA share price of $101.12 has the bank trading at a premium to its competitors.

Jun Bei Liu at Tribeca estimates CBA is now trading at a P/E (price-to-earnings) ratio of x19.

“Now clearly, there’s flight to quality. So, for this business to maintain its premium, it’s incredibly important for it to demonstrate leadership,” she told the Sydney Morning Herald on Tuesday, adding the bank needs to demonstrate that “it’s above the system growth”.

“If they disappoint on some of those growth stats, the share price will come off quite meaningfully because it is at such a premium,” Jun Bei said.

Goldman Sachs:

Brokers at the global investment giant Goldman Sachs are maintaining their rating of CBA stock at a Sell – the price target is $90.45.

Goldman expects a 9.7% increase in CBA’s FY22 cash earnings to just shy of $9.5bn.

The investment bank sees a fully franked FY22 dividend of $3.80 per share, an 8.6% lift year-on-year.

Morgan Stanley:

The broker sees a stronger near-term earnings outlook thanks to significant volume growth, upward margin trends and sound credit quality.

But due to high bank valuations and the possible hurdles thrown up by aggressive RBA hikes, Morgan Stanley has cut its recommendation to Neutral from Overweight. the target is raised to $82 from $79.

Morgan Stanley notes while earlier and larger rate rises and a steeper yield curve underpin a better margin recovery in the near-term, “they are also likely to eventually lead to higher deposit betas, more expensive wholesale funding, a weaker housing and mortgage market, and greater recession risk”.

UBS:

UBS says it’s worth highlighting the ‘notable differences’ among the major Aussie banks’ exposures and approach for the environmental component of ESG, which is a new thought.

The resource and agriculture focus of Australia is considered to introduce specific climate change risks for the sector.

CommBank, National Australia Bank and Macquarie Group are more advanced than peers, in the opinion of UBS.

A Neutral rating is maintained and a price $105 target CBA is unchanged. UBS forecasts a full year FY22 dividend of $3.50, which used to be the price of a coffee.

But no longer is.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.