The big chill: Barrenjoey now says Sydney house prices could fall up to 30%

The Overland Trail, Tassie. Warmer than Sydney's property market. Via Getty

As the Aussie housing downturn spreads across all corners of the property market, one investment bank is warning house prices could fall harder and faster than almost anyone expects – especially in Sydney.

After touting renewed interest in national auction activity, CoreLogic is saying buyer and seller business is on the wane, while a top mortgage broker warns the volume of first home buyers has already fallen below the decade average.

A barren outlook for Sydney home values

First up though, the investment bank Barrenjoey (it means young kangaroo) says Aussie housing affordability is at record lows but that’s something which rising interest rates and might help sort out, especially in Sydney.

In a note to clients, Barrenjoey has warned of “significant pain” in the post for some key property markets as highly-leveraged home loan borrowers begin to feel the weight of what are seismic interest rate shifts.

The bank says it now expects a full 25% fall for Sydney house prices, but has added that if the RBA is stung into higher-than-expected moves, then this could take house price declines in the Harbour City to as much as 30%.

So far both inflation and the rates used to fight it have largely overshot expectations here and elsewhere around the globe.

Barrenjoey’s projected crash for Sydney values is a full third again more than the one AMP Capital chief economist and ultimate housing realist Shane Oliver has been warning of since July.

“I do believe it’s a great time for first home buyers to purchase right now,” Louisa Sanghera, principal broker at Zippy Financial Group told Stockhead.

“Especially in Sydney because we have seen such a significant softening in prices since last year.”

And perhaps the fun has not yet even begun.

In preliminary auction data released on Monday, CoreLogic notes there were some 2,190 auctions held across the combined capital cities, up from 1,918 over the previous week and 1,672 this time last year – making it the busiest auction week since late June.

But at the same time, the Australian Bureau of Statistics Lending Indicators for July shows the number of new loan commitments for first homebuyers was 8338 – falling well below the decade average of 8787 and representing almost half the volume of participation since new loan commitments for first homebuyers peaked in January 2021.

In fact Sanghera says in a little under 10 months, first home buyer activity deteriorated at a rapid pace and is already back below pre-pandemic levels.

According to Sanghera the Morrison Government’s, fight-the-pandemic HomeBuilder scheme changed the scenario of timid first-home buyer participation.

“A significant proportion of the 113,000 applications were likely to have been first-time buyers, keen to make the most of the financial grants that were available,” she says.

Sanghera also warned of softer owner occupier and investor activity with the higher interest rate environment creating “plenty of opportunities” for prospective property owners ahead of a very different looking key spring sales season.

“Now that might sound counterintuitive, but would-be property owners are the ones facing the fewest lending troubles at present, because they are borrowing ‘clean-skins’ so to speak,” she said. “Borrowers with existing portfolios are often experiencing lending challenges at present, but not so much for people who are applying for their first-ever home loan.”

However, CoreLogic reckons that demand for housing finance across owner occupiers that are not first homebuyers (i.e., subsequent buyers defined as upgraders, movers and downsizers) appears to be fairly resilient in the rising rate environment.

“Using ABS housing finance data to July, we can see how different buyer cohorts are reacting to the market downturn.

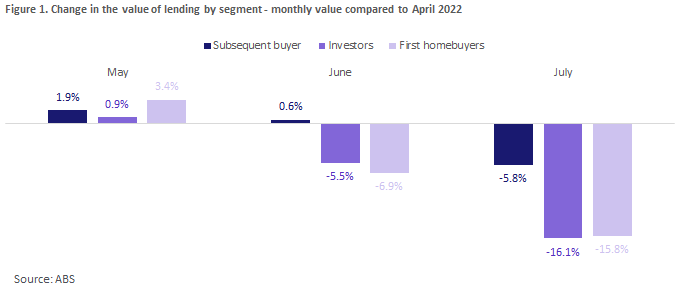

Comparison of housing finance for first homebuyers, subsequent buyers and investors:

The chart shows housing finance secured by each group relative to April 2022, when national home values peaked.

Since the rate tightening cycle started in May, investors and first homebuyers have been contending with much faster declines in housing finance secured than subsequent buyers.

“This may be because subsequent buyers are less sensitive to lifts in interest rates. Using the sale of an existing home to fund their next home purchase, subsequent home buyers would likely need to take out less debt than first homebuyers, thus being less affected by rate rises,” CoreLogic’s head of Australian research Eliza Owen says.

At the same time, your garden variety investor is also likely to be more sensitive to a lift in rate rises.

“Although investors can offset the expense of higher interest rate payments as a tax deduction, investors are typically more leveraged than owner occupiers, and have inherently higher mortgage rates.”

A quick trip down monetary lane

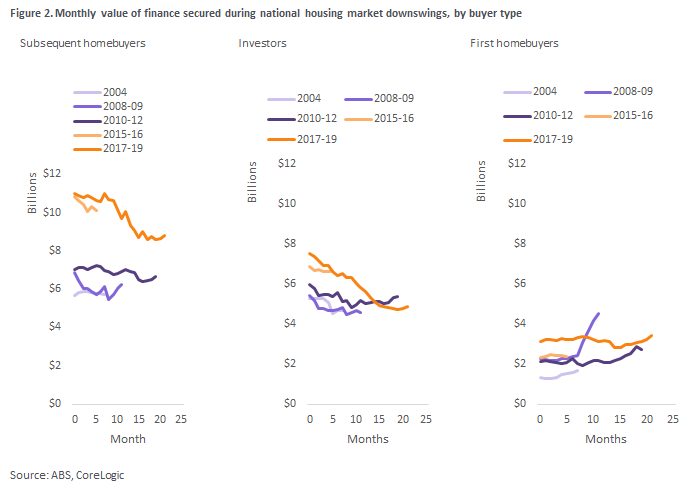

This is how lending volumes among the different cohorts have changed compared to other really cracking downturns since 2004 (the ABS lending data series started in 2003).

“The main difference between the buyer types over historic downswings is that first homebuyer demand for finance has traditionally been more resilient through downswings, with subtler declines in demand, and during some periods, increases,” Owen says.

Owen argues that subsequent homebuyers and investors in the Aussie property market have seen “a more distinct decline” in demand for housing finance initially through downswings.

But she agrees that this time for first homebuyers the market downswing is shaping up a little differently.

“That’s because the current downswing has largely been the result of higher mortgage rates, which impacts housing affordability (from the perspective of paying off a mortgage). Mortgage repayments for first home purchases may actually be higher than what they were when values peaked in April, due to the cash rate rising 225 basis points since then,” Owen says.

Unless there’s a sudden urge on the part of the Albanese Government to retrofit some property price engines on the local market, the conundrum for first-home buyers is pretty straightforward.

“Though there are ongoing schemes available such as the ‘Help to Buy’ program and the ‘First Home Guarantee’ – these schemes are unlikely to create the rush in first homebuyer demand that temporary schemes have done in the past. This is because the current first homebuyer programs in place have limitations on the number of places per year, and income caps.”

Owen says the pandemic’s HomeBuilder scheme was far from a federal government’s first dalliance with incentivising first homebuyers during these kind of market declines.

“Notably, the ‘First Home Buyer Boost’ from October 2008 to December 2009 provided up to an additional $14,000 for eligible first homebuyers. With unlimited numbers for the scheme, the boost to the first homeowner grant led to the biggest monthly surge in loans secured for first homebuyers on record, at 16,753 loans secured in the month of April 2009.”

The second reason first homebuyer borrowing has held firm or even risen through previous downswings is because price falls also lower the ‘deposit hurdle’ for first homebuyers.

“The deposit hurdle is an issue largely confined to people purchasing real estate for the first time, and as property prices fall, this initial savings hurdle for first homebuyers also falls,” Owen told Stockhead.

Speaking yesterday morning, Jonathan Kearns, the RBA’s head of Domestic Markets, warned that while higher interest rates tend to depress property prices – “there is considerable uncertainty about the magnitude” and even the timing.

These are his red flags:

- Increases in interest rates reduce the current value of future income and tighten borrowing conditions, and so higher interest rates reduce the value of residential and commercial property, just as they do for other assets that have future income streams

- The response of property prices tends to be drawn out, occurring over years rather than months, and so given other drivers of prices also change in the interim, we can’t really disentangle the final impact on prices of changes in interest rates

- Property prices are influenced by many other factors – such as future rents and buyers’ risk aversion – that can also be affected by interest rates

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.