The best asset class in 2021 could be one that’s been ignored for ‘nearly a decade’

Picture: Getty Images

After 10 years in the wilderness, the MSCI Emerging Markets (EM) Value Index could be the best asset class in 2021, T.Rowe Price said.

In its December 2020 markets update, the global asset manager outlined its 2021 strategy as the global economy emerges from the COVID-19 crisis.

And the group’s focus is on the shift back into cyclical ‘value’ stocks that emerged in the wake of positive vaccine results in November.

It sparked a rebound in a number of previously “unloved” sectors — such as materials, energy, financials, and industrials.

And it reignited the ‘growth vs value’ debate, after high-growth tech names put value stocks on the mat for the better part of the last four years.

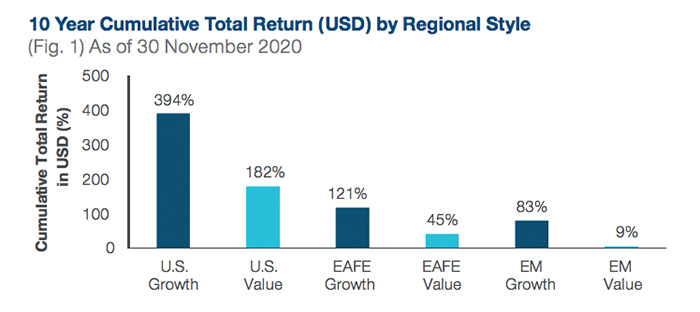

This chart from T.Rowe Price illustrates the trend on a 10-year scale:

Over that time, the performance of the US Russell 1000 Growth Index has more than doubled that of its counterpart – the Russell 1000 Value Index.

But it’s the right end of the chart that’s caught the fund manager’s eye, where the MSCI Emerging Markets Value Index has returned close to nothing over the last 10 years.

And if the November trend extends into next year, that could be about to change.

“Unleashed pent-up global demand, increased fiscal spending, aggressive monetary policies, and higher energy prices could provide a strong backdrop for cyclical companies in EM,” T.Rowe Price said.

As the world recovers, The MSCI Emerging Markets Value Index could also benefit from broad downward pressure on the US dollar.

In terms of its price-action, the USD often acts as a ‘safe-haven’ currency. For example, it rose sharply during the economic shock caused by COVID-19.

However, other currencies (such as the Aussie dollar) have since risen to multi-year highs against the greenback.

“Ignored for nearly a decade, EM value companies may finally see more interest from investors as they dig for cyclical opportunities with very attractive valuations,” T.Rowe Price said.

The investment team also addressed the escalating trade tensions between Australia and China, which have generated “no shortage of negative headlines”.

However, they are not of the view that recent Chinese bans on a number of Australian industries will have a material effect on broader corporate earnings.

While coal exports were the latest to cop a ban, most of China’s trade constraints are focused on agricultural commodities.

Collectively, these make up “only a very small proportion” of Australia’s trade with China, T.Rowe Price said.

Conversely, “China would not be able to replace its iron ore imports easily either, given the high quality of Australia’s minerals and supply constraints in other global markets”.

For his part, the company’s head of Australian equities, Randal Jenneke, has taken some profits on Aussie iron ore miners following the recent rally.

While the fund’s global team is focused on EM Value stocks, Jenneke still likes the look of some high-growth tech names on the ASX, in an environment of low rates and low inflation.

T.Rowe Price favours Resmed (ASX:RMD) as one such play, with the medical device manufacturer “well placed to return to strong growth in its sleep apnea business over the next six to 12 months”.

Other stocks Jenneke said have similar tailwinds are Seek Group (ASX:SEK) and Aristocrat Leisure (ASX:ALL).

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.