The ASX could soon break its all-time high despite economic warning signals

Pic: Getty Images)

The Australian Stock Exchange (ASX) looks to be within a whisker of its record high.

Before the session open on Monday, the index of its top 200 companies sat at 6,751 points — just 77 points shy of its 6,828 peak.

Meanwhile, the All-Ordinaries Index — made up of the country’s largest 500 companies — was trading just 23 points lower than its all-time high.

Both were marked on 1 November 2007 just before the global financial crisis (GFC) sent stock markets around the world tumbling.

Indeed, it’s taken the Australian market more than a decade to return to those levels.

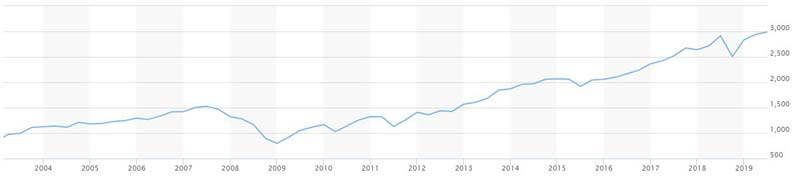

Contrast that with the US market, which eclipsed its pre-GFC peaks years ago.

The S&P 500 Index, made up of the largest 500 listed companies in the US and generally considered the best indicator of the US stock market’s health, is trading at almost twice its 2007 levels for example.

The reasons for this are many, according to AMP Capital Chief Economist Shane Oliver, including the tendency of the US Federal Reserve to run more expansionary monetary policy than the Reserve Bank of Australia (RBA).

Oliver also points to the proclivity of Australian companies to pay out dividends — a factor that isn’t included in the Index.

Aust shares almost at 2007 all time high. All Ords just 0.8% away. Took a long time v say US shares because because of tighter m policy in Aust, end of mining boom & 2007 being a very high hi v for global shares.

Total return index (ie with divs) got there back in 2013 pic.twitter.com/miw5ZEq6kU— Shane Oliver (@ShaneOliverAMP) July 4, 2019

Interestingly, it comes as growth in the underlying Australian economy approaches GFC levels.

The Reserve Bank of Australia (RBA) has slashed the official cash rate to a record low of 1 per cent in an effort to encourage spending and stimulate the economy, with many economists forecasting another cut later this year.

Meanwhile, the embattled retail sector continues to struggle on, business confidence remains weak, as consumers spend less and less.

As the ASX looks to drive higher in coming weeks, an ailing economy means the low-fuel light might well be on.

This article first appeared on Business Insider Australia, Australia’s most popular business news website. Follow Business Insider on Facebook or Twitter.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.