Tesla Investor Day Wrap: OK for anyone ‘invested in Earth,’ utterly crapola for anyone invested in Tesla

Tesla CEO Elon Musk contemplates during the official opening of the new Tesla electric car manufacturing plant on March 22, 2022 near Gruenheide, Germany. The new plant, officially called the gigafactory Berlin-Brandenburg.(Photo by Christian Marquardt - Pool/Getty Images)

The Tesla Investor Day did actually happen as foretold at Elon’s Austin gigafactory which I will not capitalise, although almost all reporters do in apparent unconscious deference to sometime CEO Elon Musk who spoke for ages at the event and yet said nothing.

Wait. No he did kind of outline ‘the next phase’ of Tesla’s growth – otherwise known as Elon’s Master Plan 3 – but that will apparently revolve around sustainable energy.

Not an entirely shocking revelation for an Electric Vehicle maker, a more sceptic scribe than I might hazard.

Sadly, rather than unveil a new product, Tesla Inc (NASDAQ: TSLA) will instead be slashing at production costs (by half Elon has vowed). This move is reminiscent of the good work the Twitter owner has been doing at the social media toy he bought where scalped employees are already on the bread line.

Costs on the other hand, will not be going down. Elon mentioned somewhere in his gargantuan monologue that Part 3 of his Master Plan – the sustainable energy bit – would probably need a further cash investment of US$10 trillion.

As that tidbit sinks in Tesla shares are continuing to capitulate in after business trade, down some 5.6% to US$191.40.

TSLA did actually accelerate a little into the day, but then slammed into reverse as the 4 hour Texas event progressed and it became apparent there would be no actual news. And nada on the prospect of a new car, a cheaper car, a cooler design or even a new design – any hint of the so-called Project Juniper.

Tesla engineers told investors and largely Wall Street analysts their future generation of electric vehicles “will be fully electric and autonomous.”

Investors and analysts for some reason did not reply “they already are.”

I watched most of it. Well, I had most of it on while the kids struggled into consciousness for school and while Musk didn’t get anywhere near unveiling the long dream of affordable everyman EV, he did offer rhetorical flourishes saying a Tesla Investor Day isn’t just for Tesla Investors but for Anyone Invested “in the Earth.”

But really it was for investors and they weren’t thrilled.

Tesla did manage to confirm the development of its lithium refinery in Corpus Christi was underway and also announced that a new factory is planned in Mexico, but other than that it was a day for the devout.

Like the brokers at Piper overnight who gushed with their usual true-believer’s fervour that Tesla remains ‘central to their investment thesis’, even as the fireworks in Austin were just beginning.

“We are as excited as anyone… and we continue to view TSLA as a core holding within our coverage.”

Taking stock

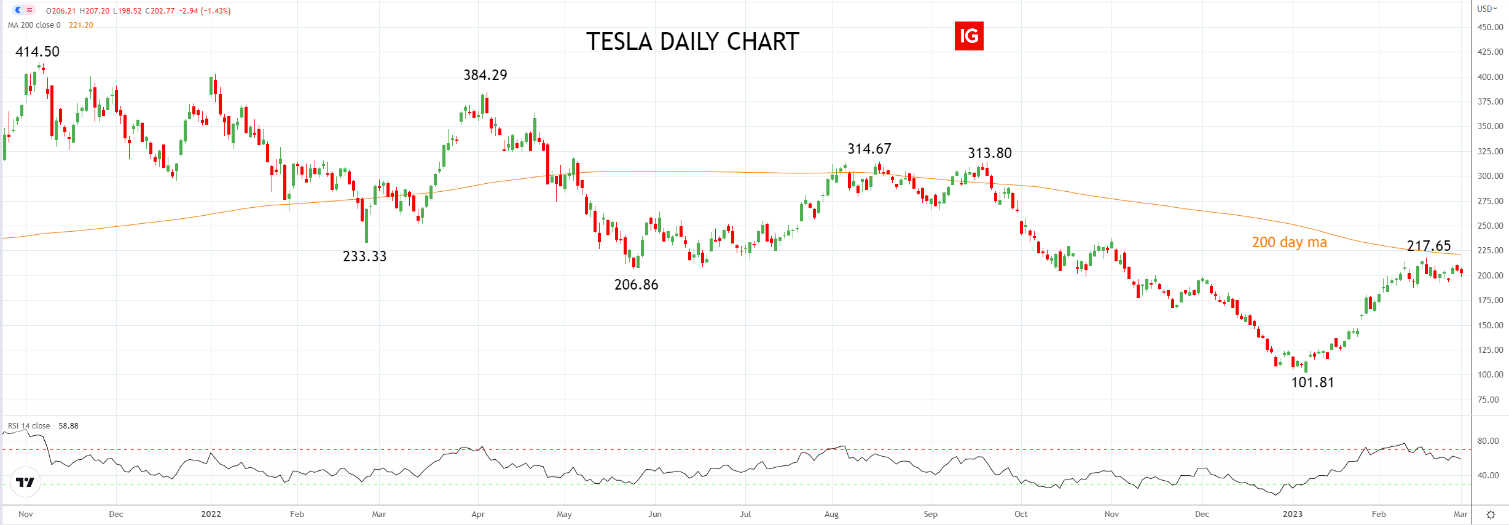

Looking at the TSLA stock price, Tony Sycamore at IG reckons it’s sideways for now after the share price came back into favour earlier this year.

“Following its earnings report on January 25, Tesla’s share price surged over 50%, from $144 to a high of $217.65,” Tony says.

“Since then, its share price has been in a holding pattern, consolidating recent gains below the resistance from the 200-day moving average at $221.20 and above support near $190.”

Tesla (TSLA) daily moves with volumes, peaks and troughs

“If the Tesla share price were to see a sustained break above $221, it would indicate that the rally from the January $101.83 low has started its next leg higher towards the $314 double high from August/September last year.

Tesla (TSLA) daily moves, coming off circa US$400 in 2021, $US314 in August ’22

“Until then,” Tony says, “we look for more sideways to corrective price action with scope back towards support at $175.00.”

Life: Not easy for EVs

To reinforce to TSLA investors just how upbeat and focused he is on Investor Day. Musk paused to tweet about the accelerating finality of things.

Twice as many people died in Japan last year as were born. Population freefall.

Rest of the world is trending to follow.https://t.co/JDHiFviua5

— Elon Musk (@elonmusk) March 2, 2023

Meanwhile, the major Wall St indices ended lower overnight after yet another dose of hawkish Fed Speak and a little more German inflation than Germany wanted.

US 2yr Treasury yields didn’t mind and nor did that guy from The Big Short, who literally said this week that he didn’t mind parking his clients’ money into them at 4.9%.

Because they just began a fresh cycle high of 4.90%.

“Unsurprisingly, in an environment of higher interest rates and inflation concerns, the Nasdaq was the worst-performing index falling -0.87%. However, this masked a brutal session for EV makers,” Tony told Stockhead.

And it was.

A tough quarter of earnings has made total mugs of Rivian (NASDAQ: RIVN) down 18.3%, Workhorse Group (NASDAQ: WKHS) which lost 15% while Nio (NYSE: NIO) fell 6%.

And NIO’s latest hit makes it a loss of -24% for the month and -50.4% over the last six months.

Not electric.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.