Tech Heavy: ‘We are extremely overbought… but the tailwinds are tremendous’

Nasdaq Wrap

First things first, mes amis:

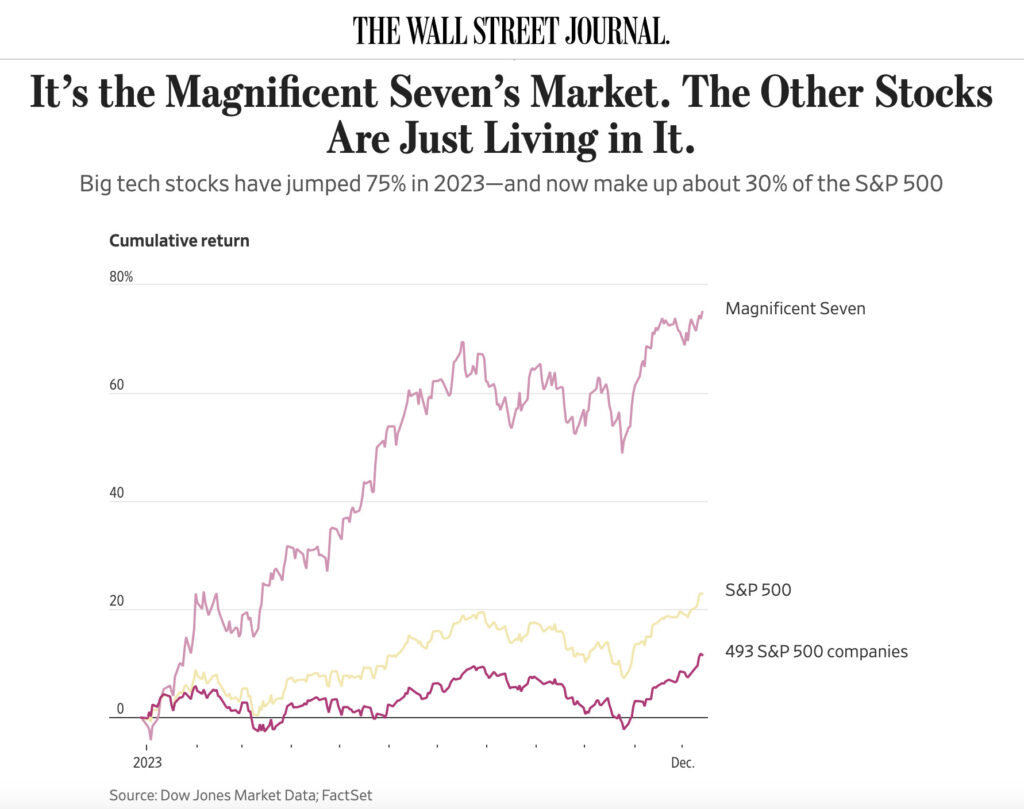

As a unit, the US tech stocks currently known as the Magnificent Seven – Messrs Apple, Microsoft, Alphabet, Amazon.com, Nvidia, Tesla and Meta Platforms – have added circa +75% year-to-date, leaving the other members of the US benchmark (the remaining S&P493) almost entirely forlorn in their wake.

Theese S&P493 (Spectators) Index have risen merely +12% over the same time.

The actual S&P500 is currently up +23%.

In 2023, the so-called Magnificent Seven have been pretty damn magnificent if magnificent means absurdly over-powered.

This company of 7 ensemble now represents circa 30% of the entire US benchmark’s market value, as per to Goldman Sachs Global Investment Research.

Ann Miletti, head of active equity at Allspring Global Investments described it thusly:

“It’s a mind-blowing number to me when I think about an index that’s supposed to represent such a broad group of companies.”

The Dow a few times last week, cracked wide open its previous record high and the 10-year US Treasury yield collapsed below 4.3% last week as punters took the US Fed’s (Thursday morning Sydney time) forecast for as many as x3 rate cuts next year as an example of what they now believe is Fed Underspeak – they were late on raising, and traders are betting on J. Powell et al to get the knives out and cut rates deeper than just thrice, according to Fed funds futures.

Futures markets also reckon the Fed could start cutting rates as soon as March, while the consensus on Wall St is for 6 (six!) cuts, as per the widely-favoured CME Fed Watch Tool.

It seems no one trusts the Fed to stay on target going down as much as going up.

Even Goldman Sachs is now leading the cut-rate vanguard:

“We expect the FOMC to cut earlier and faster”, with their view formed on the back of Fed comments plus last week’s downward revisions to inflation.

New York Federal Reserve President Williams last week tried to insist that the FOMC isn’t “really talking about rate cuts” right now. But his late vain attempt to tame the animal spirits unleashed after last Thursday’s pivot-marking FOMC meeting pretty much fell on deaf ears.

US stocks on Friday logged a seventh straight week of wins.

Last week, the Nasdaq Composite added +3.35%, the Dow Jones, +2.9%, and the S&P500 gained +2.5%.

For the S&P 500, that’s the best winning streak since 2017.

For the Dow, it’s the best going back to 2019.

Despite the terrifying euphoria, US investors heartily expect stocks can rally into the final part of the year in the prized Santa Rally.

This chap from aptly named Freedom Markets on CNBC recently:

“We’ve got the broadest rally where the tide is lifting all boats… We are extremely overbought, but the tailwinds are tremendous.”

Jay Woods, chief global strategist at Freedom Capital Markets.

Hear, hear.

The Wall Street Journal said it best, as we near the demise of 2023…

A tough year for anyone outside of this game:

Friday just past in the States is known as Wall Street’s Triple Witching Day, a sort of fiscal eclipse when stock options, stock index futures, and stock index options contracts all expire on the same day, which can see trading and volume more elevated than usual.

That also bothered no-one.

US stocks led by the mega tech names just kept surging last week as US Treasury yields did the opposite. The 10-year Treasury yield broke below the 4% level for the first time since August.

The Dow closed above 37,000 points for the first time on Thursday.

The best corporate tech news last week happened inside the courtroom.

The epic creator of horrendous tweenage gaming thingy Fortnite – Epic Games – accused Google of abusing its dominance and taking too deep a cut from in-app purchases (between 15% and 30%), and won.

Fascinating, not least ‘cos exactly the same argument was lobbed at Apple back in 2020 and the tech giant laughed that one off.

Google is awaiting orders – which might include making it easier for other app stores to be loaded onto Android phones.

But certainly the first flickers of the great decentralising may’ve just begin in earnest.

Well, Tesla’s recalled more than 2 million Teslas after the American regulator found Tesla’s driver assistance system, Autopilot, wasn’t working and was, actually, a bit defective.

It’s not the disaster it sounds like – old schoold recalls actually involved cars getting recalled, fixed and sent back. Tesla does it with a patch of some sort.

Elon just sends a software update which happens automatically – no visit to a dealership or some such and no need to restart windows.

All this follows a two-year investigation into Tesla crashes and the recall – yes, it’s still referred to as one by the US regulator – applies to almost every Tesla sold in the US since the Autopilot feature was launched in 2015.

WEDNESDAY

China loan prime rate announcement

Germany GfK Consumer Climate data and producer price index (PPI) inflation rate figures

UK November CPI and PPI inflation rate data. Also, October House Price Index US Conference Board Consumer Confidence measure.

Results: General Mills Q2, Micron Technology Q1, Winnebago Industries Q1

THURSDAY

Turkey interest rate decision

UK November public finances update

US final Q3 GDP figures

Results: CarMax Q3, Carnival Q4, Nike Q2

FRIDAY

UK November retail sales figures and final Q3 GDP data.

Financial markets close early for the Christmas break

US November durable goods orders and new home sales figures

Results: Kernel Q1