TECH-HEAVY: Wall St needs a break, ARM IPO could give it a shot

Via Getty

THE WALL ST WEEK THAT WAS

Messed-up, mixed-up and turned-around was Friday’s attempt by Wall Street traders to climb out of the hole they’d dug us all over the previous few sessions.

US stocks managed a modest ascent on Friday, capping off a turbulent week, much of which was driven by concerns over the Federal Reserve’s tightening plans.

As of Friday, Wall St was booking an anticipated pause in September, followed by a greater-than-40% probability of a rate hike in November.

The S&P 500 and the tech-heavy Nasdaq Composite found about +0.1% of courage to barely break the losing streak, ultimately ending the week -1.3% and -2% short of parity – their first weekly descent in three attempts.

The Nasdaq couldn’t find its feet after earlier losses from Apple and rate hike quivers which saw selling in fan faves Tesla (TSLA) and Nvidia (NVDA).

The Dow Jones Industrial Average closed the week circa -0.8% lower, after adding +0.2% on the Friday.

Staying positive, the S&P500 Index has only slipped -1.1% so far in September, which means the blue chip measure is still ahead circa +16% in 2023.

Apple (APPL)

Apple (AAPL), copped a fierce two sessions of selling but saved the Dow’s bacon with a 0.5% rebound late in the day.

Apple’s demise blindsided Nasdaq traders last week, after Bloomers and then Reuters released word that Chinese government flunkies have been banned from using iPhones.

APPL’s stock market valuation crashed circa 6.3%, which, let’s remember, is almost US$200bn worth of investing in just two meets.

China is APPL’s third-largest market, worth some 18% of FY23 total revenue and it’s still where most of the iThings are made by its biggest supplier Foxconn.

Of the 11 S&P sectors, eight finished higher, led by a 1% rise in Energy.

ARM gets a leg up

Reuters is reporting that the Pommy chip designer owned and hoarded over by SoftBank Group – Arm Holdings – is seeking circa US$5bn to ice its anticipated its debut on the Nasdaq this week.

It’s the IPO Wall Street wants and needs to inspire a little confidence and, yes, even optimism.

So far, according to reports on Monday very early in New York, ARM’s already seen investor demand for a piece of the pie up over six times the amount it’s asking for.

While the oversubscription does not guarantee a strong performance for Arm’s blockbuster US initial public offering (IPO), it does bode very well for SoftBank and other stakeholders coming out of the listing rubbing their hands – and should see ARM over the line on its targeted price range of US$47 to $51 a pop.

WHERE TO THIS WEEK?

And keeping upbeat, here’s the good view from Market Matters’ James Gerrish:

The US Tech Sector continues to follow the MM roadmap, and if we are correct, it’s commenced the next leg to fresh all-time highs, but it’s important to remember that MM is planning to reduce our tech exposure into such strength.

The current interest rate concerns have slowed the ascent. Still, some tepid economic data over the coming weeks &/or a bounce by Apple (AAPL US) and our target could easily be achieved before the end of October. Still, it’s important to note the risk/reward is no longer exciting for the bulls.

We remain bullish on the NYSE FANG+ Index (tech), initially targeting the ~8500 area, only 6% above Friday’s close, even after Apple’s wobble last week.

The main question OFC, for Wall Street’s Captains of Industry will be what might put an end to sailing these tides of uncertainty?

On the bright side, recent economic data, including lower-than-expected initial jobless claims, continues to be strong. But the market continues to grapple with the “good news can be bad news” scenario.

Too much good economic news means the Fed could maintain its hawkish stance towards interest rates, which is bad news for stocks.

However, weak economic data can pressure the consumer, which means bad news for corporations. Given the resilience we have witnessed in the economy and labor data, staying invested in the market is the best way to counter inflation.

On the earnings front, here are the stocks I’ll be watching this week.

ELON WATCH

Showing his Trumpian penchant for a good bit of litigation, Elon’s X sued the State of California late last week challenging the constitutionality of California’s new transparency requirements for social media companies.

Elon’s been copping much stick personally and on behalf of once-Twitter-now-X, when it comes to amplifying fake news, hate speech and extremist doctrines.

In a complaint filed in Sacramento, X, the social media platform once called Twitter but still called Twitter by most of its users alleged California’s “true intent” was to bully social media into self-censoring all the content California doesn’t like.

Twitter-X says this is a violation of its free speech rights.

Meanwhile, the virile progenitor of Tesla, Space-X, (plain) X, Starlink and The Boring Co and father to 11 offspring, (sired with three different fillies) has also apparently welcomed his third progeny with the startlingly-named chantuese, Grimes.

The new arrival has reportedly been confirmed in the highly-anticipated Walter Isaacson Elon biography, which we’ve already touched on in this column and hits the shelves stateside this week.

The biography says Elon’s named his son Tau, according to excerpts in the New York Times.

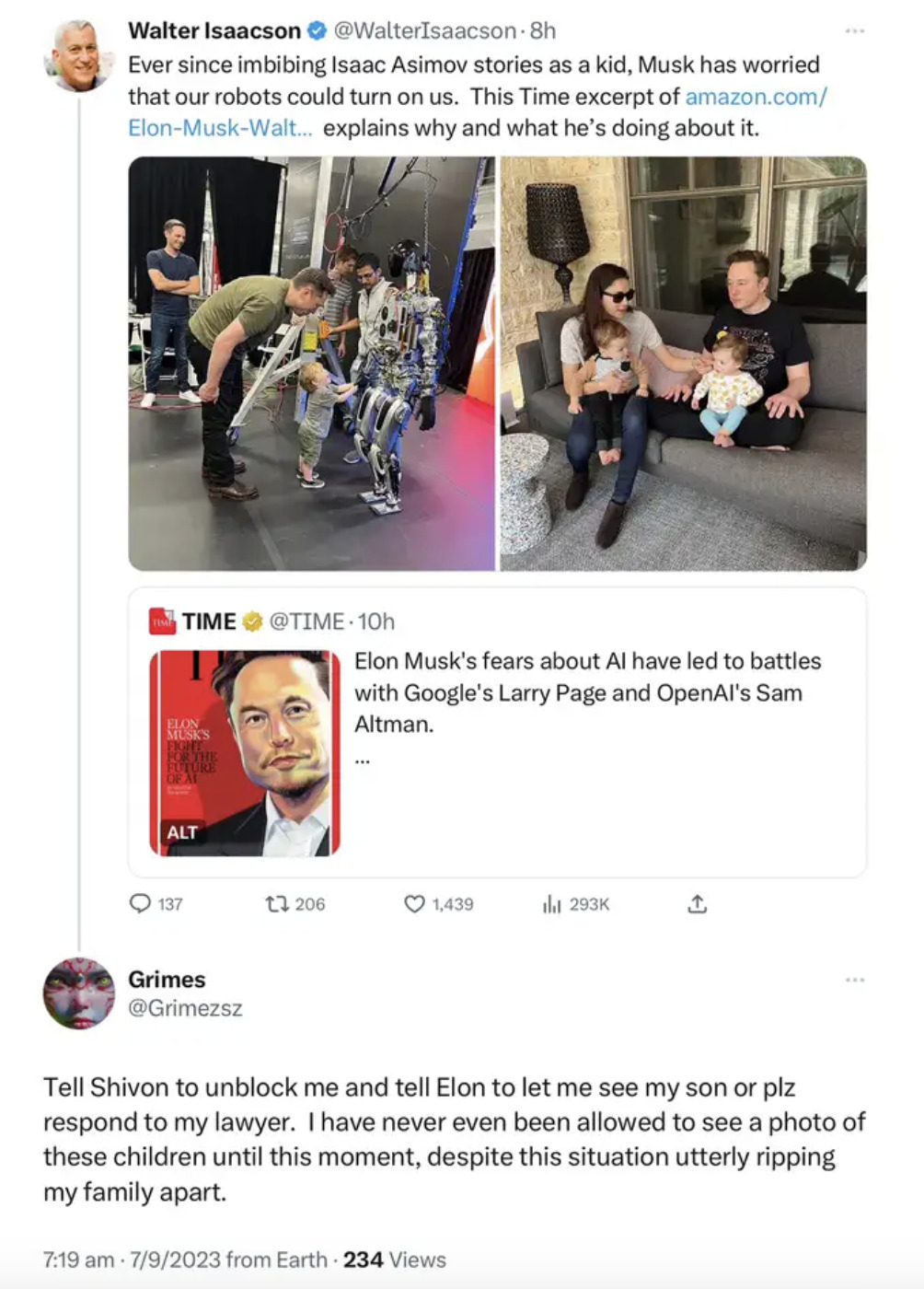

However, according to the breathless editors of Hello Magazine, sadly Grimes says she’s been unable (blocked in X-terms) from seeing her eldest son, whose name might be Shivon.

Grimes responded to an X-Tweet sent by Isaacson, which shows happy snaps of Elon and his newby son as well as one of Elon, Shivon and their other startlingly named kids Azure and Strider.

Not so happy the reply from Grimes:

“Tell Shivon to unblock me and tell Elon to let me see my son or plz respond to my lawyer. I have never been allowed to see a photo of these children until this moment, despite the situation utterly ripping my family apart.”

The offending X has since been deleted but the good stickybeaks at Jezebel screen grabbed it and luckily I grabbed that:

ThE WEEK AHEAD

The US economic calendar this week is rich with inflation-indicating updates on retail sales, producer prices, and jobless claims.

If the Fed is done with rates, then at least the terminal rate is still up for debate.

Wednesday’s headline August Consumer Price Index (CPI) report could provide a key ingredient particularly as all the smoke-signalling Fed speakers are in a blackout period ahead of the FOMC meeting next week (September 19-20), which could give the economic reports extra weight.

On the US corporate front, Oracle reports Q1 fiscal 2024 on Monday.

Apple is having a big presser at its Cupertino HQ in California which looks like being all about the iPhone 15 and some new Apple Watches.

Bristol Myers Squibb and Moderna are having their respective R&D Days.

Adobe, Copart, InnovAge and Lennar drop some earnings, while Brown & Brown, Ecolab, and Laboratory Corp of America have investor days.

US Earnings Spotlight

Monday

Oracle (ORCL), Casey’s General Stores (CASY), Bowlero (BOWL).

Tuesday

Cognyte Software (CGNT), InnovAge Holdings (INNV).

Wednesday

Cracker Barrel Old Country Store (CBRL), REV Group (REVG).

Thursday

Adobe (ADBE), Lennar (LEN).

US & Everyone Else Economic Calendar

Monday September 11 – Friday September 15

The Census Bureau reports retail sales data for August. Consensus estimate is for 0.2% increase month over month. Excluding autos, retail sales are seen rising 0.5%. This compares with gains of 0.7% and 1%, respectively, in July.

The BLS releases the producer price index for August. The PPI is expected to increase 1.4% year over year, while the core PPI is seen gaining 3%. They rose 0.8% and 2.4%, respectively, in July.

The Uni of Michigan is back at with their Consumer Sentiment index for September. Economists forecast a 69.4 reading, roughly even with August where expectations for the year-ahead inflation was 3.5%.

The European Central Bank announces its monetary-policy decision. Traders are pricing in a one in three chance that the central bank will raise its key short-term interest by a quarter of a percentage point to 4%. The ECB has raised its target rate from negative 0.5% to 3.75% in a little more than a year.

Monday

United States Consumer Inflation Expectations (Aug)

China (Mainland) M2, New Yuan Loans, Loan Growth (Aug)

Tuesday

US Federation of Independent Business’ Small Business Optimism Index for August

UK Labour Market Report (Jul)

Eurozone ZEW Economic Sentiment (Sep)

India Industrial Production (Jul)

India Inflation (Aug)

Brazil Inflation (Aug)

OPEC Monthly Report

S&P Global Investment Manager Index (Sep)

Wednesday

United States CPI (Aug)

Japan PPI (Aug)

United Kingdom monthly GDP (Jul)

Eurozone Industrial Production (Jul)

Thursday

United States Retail Sales (Aug)

United States Jobless Claims

United States Business Inventories (Jul)

Japan Machinery Orders (Jul)

Japan Industrial Production (Jul, final)

South Africa Inflation (Aug)

India WPI (Aug)

Eurozone ECB Interest Rate Decision

Friday

United States Import and Export Prices (Aug)

United States Industrial Production (Aug)

United States Capacity Utilisation (Aug)

United States UoM Sentiment (Sep, prelim)

S&P Global Investment Manager Index (Sep)

South Korea Trade (Aug)

China (Mainland) House Prices (Aug)

China (Mainland) Industrial Production (Aug)

China (Mainland) Retail Sales (Aug)

China (Mainland) Unemployment Rate (Aug)

China (Mainland) Fixed Asset Investment (Aug)

US IPOs

The SoftBank-owned Brit Chip designer Arm (ARM) is expected to price its highly-anticipated IPO and start trading anytime now. This one is expected to cost an arm and a leg, and the listing could well be the biggest on the bourse since Rivian Automotive’s (RIVN) $13.7B offering back in November ’22.

The stem cell upstart Vitro Biopharma (VTRO) is also scheduled to start trading in the States.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.