Tech-Heavy: Wall St facing big bank truth bombs; Delta not the force it was; Elon throws entire country under passing bus

US bank CEO's are preparing their Q3 earnings reports. Via Getty

US futures are down ahead of the Monday morning open in New York.

Frankly, you’d be down too after another week of scary central bank posturing choked off a surprise rally, lifted global interest rates and gave the dirty greenback more carte blanche to annihilate currencies and just further depress Wall St as much as humanly possible.

On Friday the S&P 500 index dropped 2.8%, the Dow Jones Industrial Average fell 2.1%, while short shrift as some familiar blue chips –

like Messrs Apple (AAPL), Microsoft (MSFT), Salesforce (CRM) and the retail bellwether Nike (NKE) – came under some intense selling which in turn left the tech-heavy Nasdaq a gloriously volatile 3.8% short of parity.

All three major US indices somehow posted weekly gains and sidestepped a fourth straight weekly loss.

But despite beginning the week with a brutal surprise rally, the sentiment just kept souring Stateside, happy jobs numbers making for sad investors, wary of the Fed’s next move to keep inflation in check.

Seema Shah, chief global strategist at Principal Asset Management (PAM) reckons almost all the elements of US the September jobs report were moving in the wrong direction for the Fed.

“Payrolls were broadly in line with expectations but, importantly in this ‘good news is bad news’ period: markets were hoping for a downside surprise today.

“Instead, the number only confirms that the Fed needs to hike rates by a fourth consecutive 0.75% in November,” Shah said.

More significantly, with unemployment back down to 3.5% and participation falling again, where is the evidence that tighter Fed policy is having any impact on the US labour market?

“Job openings may be coming down, but if that isn’t combined with greater numbers of job seekers, wage pressures will remain still at their elevated level.

“With the Fed’s dot plot pointing to policy rates closer to 5% than 4% next year, we have a market that is wishing for the economy to slow quickly. That’s when you know there is only one path ahead: risk assets have further to fall,” Shah added.

Banks: Really, really interesting

The most interesting thing about rising rates is of course bank earnings and the American lenders are lining up this week to spill the beans on their various third quarters.

The season opener is a big one and features a round robin of major US banks all vying for the Mega Bank Crown on Friday, October 14 NY time.

Banks everywhere really should be riding a wave of revenue rising in line with the rising cost of money as central banks tighten, with higher interest rates boosting their net interest income (NII) and net interest margins (NIM).

NII is a bank’s earnings on its lending activities and interest it pays to depositors, while the benchmark bank earnings measurement, the NIM, is what you get when you divide net interest income by the average income earned from interest-producing assets. (Just in case someone asks you.)

Wall Street concensus suggests the volatile markets have scuppered most dealmaking and ranging macro uncertainty will offset any expected boost from higher NIIs and NIMs.

Bank of America and Goldman, for starters, have been trimming profit forecasts for both banks and brokers in anticipation of any trouble, although analysts at Oppenheimer are still upbeat on bank stocks due to cheap valuation aligning with the accelerating credit cycle.

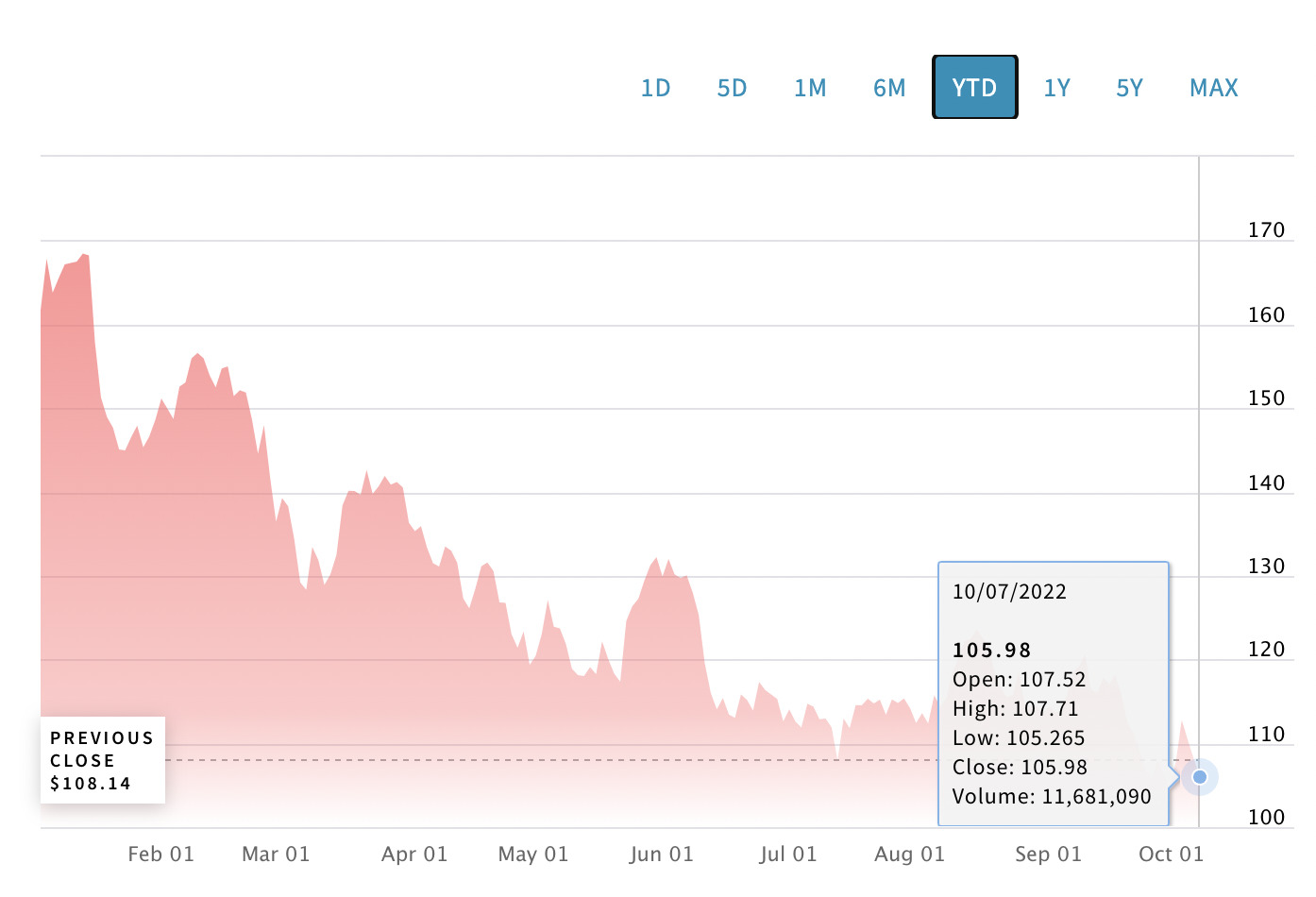

Citigroup – themselves up for scrutiny – are predicting some strong earnings beats and at least a share price pop for JPMorgan Chase (JPM) off better-than-expected net interest income.

This is JP Morgan, year-to-date, (looking cheap to many)

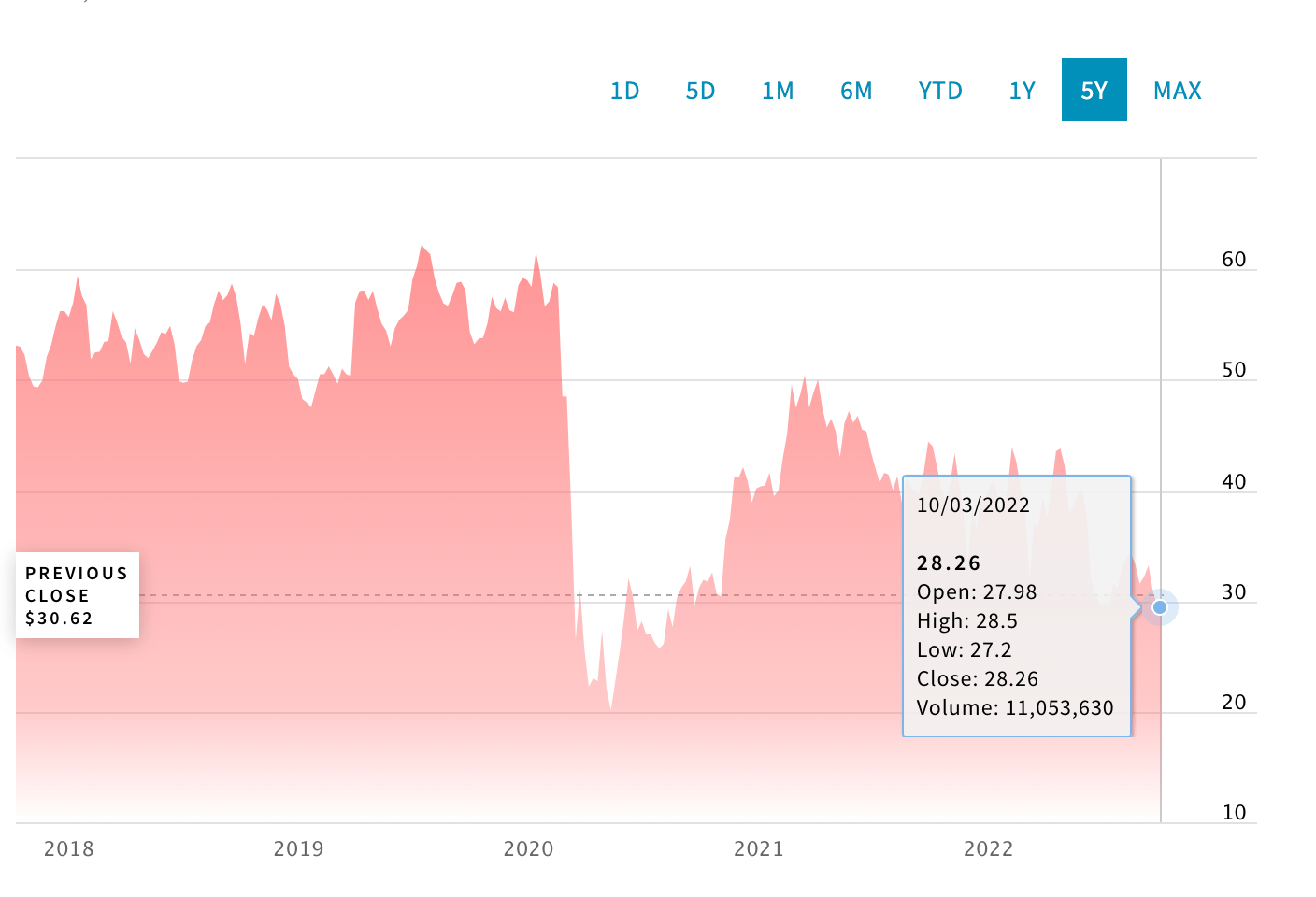

Meanwhile, Wall Street expects Delta Airlines to earn $1.55 per share on revenue of $12.89 billion.

Delta Airlines over five years, (say hi to the dip):

This compares pretty damn well to the same period last year, the peak of travel restrictions when earnings were just 30 cents per share on $9.15 billion in revenue.

Delta and the force that used to be US airline stocks have been unable to get off the ground at all really in 2022 (there were some high hopes). The International Air Travel Association (IATA) boosted its 2022 forecasts back in July and that was a mistake, projecting that global air traffic will grow 98% this year compared to last year — reaching 82% of 2019 levels.

Unfortunately the runway has been anything but smooth with mass flight cancellations, widespread travel disruptions and chaos across the US and Europe. The latest data shows booking trends for air travel are back below pre-pandemic levels.

Then there’s this take from Harry Gowers, European transport & logistics analyst at JP Morgan

In the U.S., a chronic shortage of pilots is contributing to flight cancellations — in part due to the high cost of training, which can amount to more than $150,000 per pilot and is not typically covered by federal student loans. In May 2022, Alaska Airlines canceled around 50 flights per day, citing a lack of available pilots. And in September, American Airlines canceled services to Toledo, Ohio; Ithaca, New York; and Islip, New York following the Labor Day holiday weekend, due to what it describes as a “regional pilot shortage.”

Meanwhile, on Elon Watch: The Reverse Twitter

Elon Reeve Musk FRS is a business magnate and investor. We watch him.

He’s the founder, CEO, and chief engineer of SpaceX; angel investor, CEO, and product architect of Tesla, Inc; founder of The Boring Company; and co-founder of Neuralink and OpenAI.

The Chief Course Direction Changer changed course once again last week, taking us all back, whether we wanted to or not, right back to his initial cunning plan: buying Twitter at $54.20 a share.

A lot has happened in between, as you can see below.

This is Twitter, year-to-date, (major moves May/Oct in line with His moves)

…but in short, He’s been trying to nix the US$44 billion deal, putting that on the Twitter leadership for telling apparent fibs about the volume of spam accounts that spam Him on thre soon-to-be-His platform.

The hoo-haa was set to hit the Delaware Chancery Court this month and looked promising for sales of popcorn.

The judge has agreed since to stall giving His lawyers three weeks to just buy it, but as the New York Times notes: as with all things Musk, the situation could become more complicated still.

And in ElonGeopolitics: I can fix this

I would like to thank @elonmusk for his call for peace across the Taiwan Strait and his idea about establishing a special administrative zone for Taiwan. Actually, Peaceful reunification and One Country, Two Systems are our basic principles for resolving the Taiwan question… https://t.co/KYH1Gsu3Um

— Qin Gang 秦刚 (@AmbQinGang) October 8, 2022

US Earnings and IPO Watch

Tuesday, October 11 – VOXX International (NASDAQ:VOXX).

Wednesday, October 12 – PepsiCo (PEP) and Duck Creek Technologies (DCT).

(IPO: biopharma Genelux Corporation – GNLX)

Thursday, October 13 – BlackRock (BLK), Delta Air Lines (DAL), Domino’s Pizza (DPZ), Taiwan Semiconductor (TSM)

Friday, October 14 – Citigroup (C), JPMorgan Chase (JPM), Morgan Stanley (MS), Wells Fargo (NYSE:WFC), U.S. Bancorp (USB)

(IPO: tech firm Beamr Imaging Ltd – BMR)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.