Tech-Heavy: US retailers in focus as crypto has little to give thanks for this holiday week on Wall St

Via Getty

Stateside, and we’re going to squeeze a lot into a curtailed Thanksgiving week in America after stocks and investors ended the last one on an uncertain but ever-so-slightly positive accord.

While Wall Street will be closed on Thursday, and the New York exchange from 1pm on Friday, the expectation is for lower activity, volumes and liquidity in the days around the whole giving of thanks thing.

I’m not talking turkey around volatility though – that’ll likely be around in spades; just that the economic calendar is easier and the investors usually are too.

On Friday in the States, typically uncertain trade led the the Nasdaq, the S&P 500, and the Dow Jones Industrial Average to creep marginally higher, but with little to no conviction, ending lower for the week, and still down for the year-to-date.

By the numbers, the tech-heavy Nasdaq lost about 1.6%, the S&P 500 ended lower by about 0.7%.

For a rare moment of initiative, EU indices looked positively robust in the bathroom mirror. The DAX 40 and FTSE 100 climbed 1.5% and 1%, respectively.

At home the bag was as mixed as poss – the Japanese Nikkei 225 fell by 1.4%, while in Honkers a reinvigorated Hang Seng returned serve, ahead by 3.9%.

US retail stocks were the best performers to close out last week, and they’ll be strongly in focus Stateside this week. On Friday the fashion – and I use the term fashion in its purely technical form – retailer Gap Inc (GAP) jumped 8% following a forecast beat on both Q3 top and bottom line results.

After seeing Target and Walmart last week – and learning nothing – investors will be watching closely during what’s a historically quiet few days ahead of Thanksgiving. The key focus are the latest group of retail earnings timed nicely ahead the post-holiday/pre-Christmas shopping season.

The largely economic week ahead

Another busy week is coming up featuring such favourite hits as the minutes of the latest FOMC meeting.

Fed’s Susan Collins noted on Friday that a 75 basis-point rate increase is still on the table as there is no clear evidence that inflation is coming down.

And let us speak frankly when speaking of Fed speak, as the board, meanwhile, remains united in sticking to the hawkish script. Markets OFC don’t appear to be listening, but neither do children who at least can hug.

According to OANDA’s Edward Moya, the steadily hawkish tones from policymakers just ain’t finding an audience.

“Wall Street remains convinced that they will pivot and probably cut rates at some point around the end of next year.”

We’ve also got a bunch of business surveys from several major economics which should tell a bit more of a tale around whether US inflationary pressures are really, truly-ruly cooling off and whether maybe those cheese-munching Europeans are already in recession.

So yes, financial markets are closed Thanksgiving Thursday and followed by a shortened trading session Friday with a 1pm ET close, which I think is because of the Macy’s Parade in New York made famous (to me) by this magical moment in ’80s cinema courtesy of John Hughes:

The end of USD rampage?

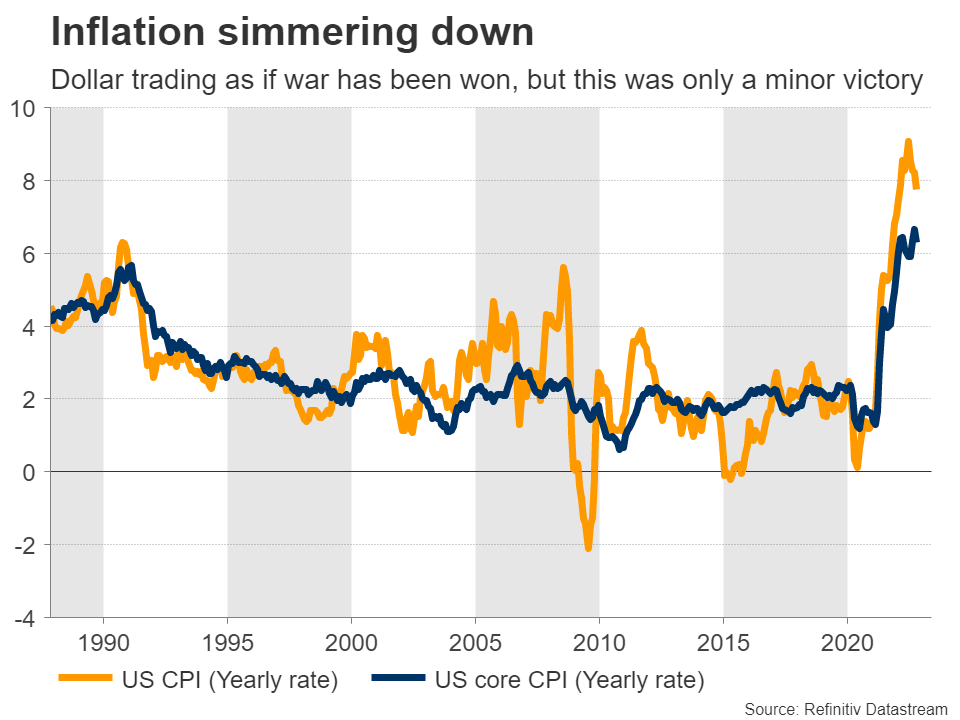

Signs that US inflation is finally simmering down has dealt a heavy blow across the cheek of the US dollar. Peter McGuire CEO of XM says traders unwound bets that the Fed will raise rates beyond 5%.

“Admittedly though, the sharp FX moves seem like an overreaction, driven by one-sided positioning in ‘long dollar’ bets,” he told Stockhead.

“In a nutshell, the story around the Fed hasn’t changed enough to warrant such dramatic moves. The dollar is trading as if the war against inflation is about to end, but Fed pricing and US yields suggest this was only a minor victory. Inflation is still running at nearly four times its target, the labor market is in good shape, and consumption hasn’t slowed yet.”

In other words, it’s still premature to be trading a Fed pivot. While inflation has likely peaked, there’s no telling how quickly it will come down. Fed officials have been adamant that even when they stop raising rates, they’ll keep them high until they are certain inflation has been crushed.

Markets will get an update on how inflationary pressures and the broader US economy are evolving on Wednesday, with the S&P Global business surveys for November. In recent months, the story has been that inflationary forces are retreating but mostly because demand is collapsing.

Later on Wednesday, the minutes of the latest FOMC meeting are out.

They’re outdated, (the meeting took place before the bombshell inflation report) and the Fed’s been rolling out almost every FOMC official since then, but as Edward Moya suggested, markets always find a way to react to this release, however “determined” the messaging is.

Overall, Pete says the US dollar is at a crossroads.

“Most of the elements that fuelled this stunning rally over the last two years seem to be losing their kick, with inflation cooling off and the Fed shifting into lower gear, yet it’s still too early to call for a proper trend reversal.”

McGuire reckons while it might have one ‘last hurrah’ left, the US dollar steroidal rally is likely in its last ripple.

But:

“Even though the narrative around other major currencies has improved somewhat lately, for instance with European energy prices falling sharply, most foreign economies are likely to fall into recession long before America does.”

Crypto vs Charlie

In what looks like a really tough week ahead, Bitcoin shed circa 3% over the past 24 hours, somehow maintaining its recent US$16K support for a 12th straight day.

Last week, the largest cryptocurrency by market cap did a great job of surviving the calamities of the FTX’s collapse, although Joe DiPasquale, CEO of crypto fund manager BitBull Capital, wrote in an email to CoinDesk that investors should gird themselves for a rocky week ahead.

“The last week saw Bitcoin trading in a very tight range, unable to breach $17k conclusively,” DiPasquale wrote. “However, given the sideways action, we can expect volatility in the coming week.”

Now, according to a court filing out of Delaware, it also looks like the former cryptocurrency exchange FTX owes its 50 largest creditors way over US $3bn.

That’s double the circa US$1.45bn FTX has formerly said it owes its top creditors.

The collapse of the world’s No. 2 largest crypto exchange has torn the arse out of crypto’s once confident pants, and reminds me of the many times Warren Buffett and his top man Charlie Munger took their sticks to the overall cryptocurrency market.

#CharlieMunger, vice chairman of Berkshire Hathaway, is an outspoken critic of the #cryptocurrency #market. He has described #Digital currencies as “a terrible mix of deception and illusion.” pic.twitter.com/bMAO1x042b

— Kapital Crypto News (@kapital_news) November 16, 2022

After the cryptocurrency started crashing and burning due to the FTX-induced crisis, a video of Buffett and Charlie Munger variously trashing crypto has been going viral on social media.

In the vid Buffett says crypto attracts a lot of charlatans who take advantage of people “trying to get rich because their neighbour’s getting rich.”

Buffett has been a particularly consistent and full-throated crypto critic. Once referring to it, I believe as … rat poison squared.

To emphasise the disgust, Buffett piped up earlier this year, saying he wouldn’t pay $25 for all the existing Bitcoins in circulation.

Meanwhile, in bad cop, bad cop routine of great authority, Charlie Munger offered this generous forecast of where the price of Bitcoin would end up: zero.

The largely corporate US week ahead:

Monday

- JM Smuckers will report earnings before markets open, offering a taste of inflation vs name-brand food prices

- Dell Tech (DELL) and the read that’ll give on PC demand

- Urban Outfitters URBN for retail insights

- Zoom ZM for WTF is happening stateside with WFH

Tuesday

First legal proceedings begin in Delaware, fallout from calamity of FTX Cryptocurrency Derivatives Exchange and its founder and chief executive officer of Sam Bankman-Fried.

Also providing some retail earnings updates:

- Abercrombie & Fitch ANF

- American Eagle Outfitter AEO

- Nordstrom JWN

- Dollar Tree DLTR

Wednesday

Wednesday the maker of John Deere tractors, Deere & Co (DE), to report before the bell.

The Federal Reserve will also release the minutes from its October meeting which will hold more clues on the pace and size of future rate hikes.

Also expecting US mortgage applications, building permits, durable goods, initial jobless claims, the Uni of Michigan consumer sentiment index, new US home sales, and the Energy Information Administration’s (EIA) weekly crude stocks.

Thursday

US markets closed for Thanksgiving

Friday

More retail stock juice as US holiday shopping season kicks into high gear.

The New York Exchange closes on Friday at 1pm NYT.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.