Tech-Heavy: Twitter and Elon Musk have merged

Via Getty

The big three cheeses of American markets – The broad-based Chedder, the blue chip Blue Vein and the tech-smelly Pont L’Eveque…

View this post on Instagram

… all ended the Saturday morning (our time) session up around 2.7% I guess, on average.

The S&P and the Nasdaq strung together second straight weekly gains. The blue-chip Dow posted its fourth straight and ate October like a seasonal treat.

The benchmark index is up over 8% from its most recent low, a move that has been accompanied by a sharp rally in US Treasuries and a weakening of the mighty US dollar, if only momentarily reversing a monstrous 2022 for the greenback.

This morning in Sydney, Dow Jones futures lead the charge, surging 5.9% to the highest since late August. Meanwhile, the S&P 500 and Nasdaq 100 futures rose 2.6% and 3.3%, respectively.

Tech stocks have been a feature all week, the Nasdaq climbing to a 3.36% gain. However Meta Platforms (META) weighed on the tech-heavy, with the Facebook stepmother crashing some 25%.

The sell-off by shares of Meta came after the company reported weaker than expected third quarter earnings and provided disappointing guidance.

October has been a revolution for many Wall Street inhabitants. Sector by sector – energy has had another standout, up circa 24%, then the industrials, up about 14%.

Tech has gained almost 9%.

The Dow Jones Industrial Average has taken a 14.4% ride skywards this month; it could be the Dow’s best monthly gain since 1976, according to CNBC.

The S&P 500 was up more than 8.8% for October.

NASDAQ Composite Index (COMP)

The feckless US traders, sensing a shift back toward the reckless, chose to ignore some horror Q3 earnings from the the smelliest cheeses of all on the tech-smelly index – Messrs Amazon (AMZN), Microsoft, Google (GOOGL) mum and/or dad Alphabet and Facebook … whatever weird relationship Meta is to Facebook.

Of the MAANG stocks, only Apple Inc (AAPL) came out apples.

Apple on a good day (up 7.56%)

APPL on an unrelenting 2022 of uncertain days down (volatile enough for ya?)

Apple Juice

-

For the first time since the beginning of COVID, iPhones units came in below consensus (49mn units vs consensus at 51mn units) while Average Selling Price mix (~7.5%) was in-line with estimates.

-

Overall, the iPhone results were saved by pricing and strength in emerging markets like India.

-

However, UBS checks indicate the US was down low single digits, China up mid-single digits with Europe softer as macro cross currents weighed on consumer demand.

-

In aggregate, revenue beat UBS expectations by 3.7%.

-

Despite the puts and takes (better wearables, softer iPads), product gross margins of 34.6% beat estimates by 120bps.

-

However, softer services revenue growth of just 11% in constant currency (that was below UBS’ ~15% estimate), pressured services margins to 70.5%, 150 bps below UBS estimates.

-

UBS analysis suggests risk to FY23 street estimates, and management’s commentary is likely to result in negative EPS revisions for both for FY23. UBS street FY23 EPS estimates to trend lower from $6.48, closer to UBS’ updated $6.11 estimate.

-

Although estimate revisions are disappointing, UBS believe Apple shares should outperform on a relative basis compared to large cap tech and the market over the next 12 months. As such, they reiterate their Buy rating on the shares.

- UBS Recommendation: Buy / Price Target US$185

- CS Recommendation: Outperform / Price Target US$184 (from US$190)

- Consensus Recommendation: Buy / Price Target US$179 (Share Price US$155.74; +7.6%)

Last week’s US$370 billion big tech selloff amid a broader rally in the market did nothing to change the view that the stocks are still too expensive. The near 8% rebound in Apple helped offset the 7% dive for Amazon shares, post results.

Microsoft, Amazon and Alphabet are all down 30% year-to-date, far outstripping the 18% slide on the S&P 500.

Refinitiv says it’s the Q3 half-time show and some 260 of the S&P 500 have spilled their beans, with almost three-quarters of them laying down a funkier beat than expected.

And talking of Q3, stateside GDP numbers have the economy growing at a better than expected annual clip of 2.6%, even though there’s signs pointing to a slowdown.

That’ll be the first quarter of positive growth this calendar year for the States, something which may’ve assuaged trader doubts about this shadowy recession angst.

Both the US Commerce and Labor Departments delivered robust September consumer spending and easing wage growth, respectively. What US workers earned and spent is closely watched by the US central bank.

The week ahead

The Wall Street of Worry US investors face this week, according to a note from UBS, is that the big name Nasdaq stocks might look a little cheaper, but following on from a slew of corporate earnings downgrades, still rising inflation and its resultant constricting financial outlook are all combining to make those earnings forecasts fundamentally too high.

Despite an acceleration with inflation, strong consumer spending data, and a robust labor market, much of Wall Street is growing confident that the Fed will pause tightening once they take the funds rate to 4.50-4.75% next quarter.

In addition to the FOMC decision, traders will also be poring over the latest non-farm payrolls.

The hardy US jobless rate is expected to continue its ascent, albeit at a slower rate, while wage gains are expected to slow. That’s not to say the strong US labor market is stumbling, as economists still expect to see some 200,000 new jobs for October, (down from September’s 263,000).

Financial markets have now priced in an 84.5% chance of a fifth straight 75 basis point interest rate hike when Fed’s Nov 1-2 policy meet breaks, while CME’s FedWatch tool calculates a pinpoint 51.4% likelihood that The Fed will surprise to the downside with a gentler 50bp whack for December.

It will be another busy week filled with earnings that will likely confirm the slowdown being seen across the economy. After the Q3 festival of FAANG, Wall Street will focus on a rather massive week of earnings with some major consumer stocks, energy comapanies, healthcare and some random tech-aligned platforms.

Elon Watch

We’ve got a new job.

Entering Twitter HQ – let that sink in! pic.twitter.com/D68z4K2wq7

— Elon Musk (@elonmusk) October 26, 2022

We’re hawking our new toy.

To be super clear, we have not yet made any changes to Twitter’s content moderation policies https://t.co/k4guTsXOIu

— Elon Musk (@elonmusk) October 29, 2022

We’re delicately informing staff who’ll no longer be needed.

Ligma Johnson had it coming pic.twitter.com/CgjrOV5eM2

— Elon Musk (@elonmusk) October 28, 2022

We’re denying it’s a move to save money.

This is false

— Elon Musk (@elonmusk) October 30, 2022

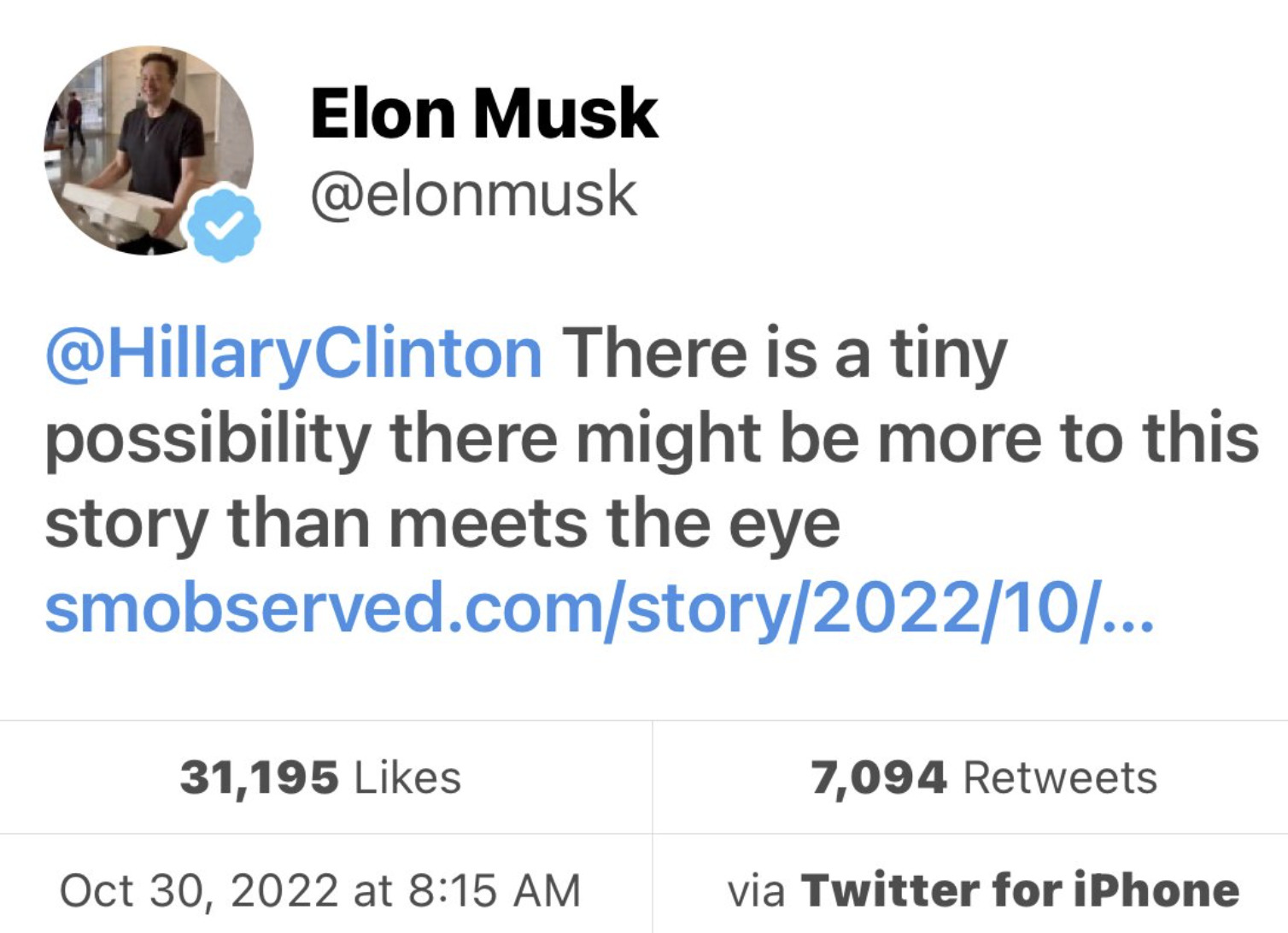

And we’re spreading fake news, ‘cos.

After some epic, unseemly wrangling, our fav billionaire apparently completed the deal to make Twitter more like Elon Musk, whereupon the chief twit sacked several top executives and had them do the escorted walk of shame out the front and toward gathered media.

What does it mean for the stock?

Not a lot now the US$44 billion deal to become Twitter is done and Elon can take it to a private island bunker. A private Twitter, unlike its public version, will be very closely held.

It’ll have few shareholders – perhaps just one.

Taking a company private, as Musk did, reverses the IPO. The best of the billionaires paid Twitter shareholders $54.20 a share, which he did because it’s a 64% premium over the price Twitter stock was trading at a few weeks ahead of the revelations on April 14, 2022. He did this because he cares.

Nw, it’s usually not possible to buy shares of a private company. And when it is possible, according to Erik Gordon Professor of Business at the University of Michigan, it is difficult because shares don’t trade on exchanges. You have to find someone who is willing and able under restrictive securities laws to sell you their shares.

“In addition, a private company is not required to file disclosures or anything else with the SEC.

“Another key difference is the power the chief executive has. While public company CEOs have a lot of power, that power is constrained by things like a board of directors and rules on compensation,” Prof Gordon writes in a very nice explainer on The Conversation.

Well, as Elon’s suggested there’s going to be huge change on the free speech content front, just difficult to say what and it seems most important for Mr Musk to just reassure everyone that while change is coming, there’s no change in anyway to Twitter’s free speech content front.

Elon’s announced a cool sounding content moderation council. A new body, obviously functioning a lot like the Justice League’s Watchtower would bring together widely diverse viewpoints…

…and no decisions on content policy or account reinstatements will be taken until the council has convened.

Musk has also indicated that Twitter could be split into different sections where users give their posts content ratings and take part in online rows in a specially created space on the platform. But when he tweets stuff it might not be true.

What he’d probably like to do is turn it into a Western WeChat. Something which not only provides 360-degree payment services but is also a wonderful, wonderful data harvester.

Tencent Holdings Ltd. ADR (TCEHY) owns WeChat.

Tencent is down 41% year-to-date. So barring any further random takedowns from Emporer Xi Jinping, traders might be seeing a buying opportunity.

Q3 US Earnings Highlights

Monday:

Lattice Semiconductor, NXP Semiconductor, Avis Budget, IMAX, Goodyear Tire, ON Semiconductor, PriceSmart, Marriott Vacations

Tuesday:

Advanced Micro Devices, Pfizer, Eli Lilly, Airbnb, Uber, Cirrus Logic, Denny’s, Devon Energy, Edison International, Mondelez, Caesars Entertainment, Fox Corp., Toyota, BP, Sony, Yum China, Chesapeake Energy, Liberty Global

Wednesday:

Qualcomm, Booking Holdings, CVS Health, Paramount Global, Etsy, eBay, Roku, Robinhood, NuSkin, Hostess Brands, Glaxo SmithKline, Estee Lauder, Apollo Global Management, The New York Times, Cognizant Technology MGM Resorts, APA

Thursday:

Amgen, PayPal, ConocoPhillips, Starbucks, DoorDash, Block, Marriott, Peloton, Amerisource Bergen, Shake Shack, Crocs, Datadog, Moderna, Barrick Gold, Bausch Health, Spirit AeroSystems, Kellogg, Dropbox, Expedia, Allscripts Healthcare, Carvana, Schrodinger, Murphy Oil, AmerisourceBergen, Restaurant Brands, Regeneron Pharmaceutical

Iron Mountain, Dun and Bradstreet, Hyatt Hotels, Papa John’s, GoDaddy, Lions Gate Entertainment, WW International, Twilio, GoPro, Yelp, Rocket Companies, EOG

Friday:

Hershey, CBOE Global Markets, FuboTV, Liberty Broadband, DraftKings, Duke Energy, Fluor, AMC Networks, Cardinal Health

Saturday:

Berkshire Hathaway

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.