Tech-Heavy: This is the week we discover how sharp the FAANGS really are

Via Getty

If it’s action you’re after, Wall Street might just have the week ahead adventure seekers are looking for.

It’s a Cannes-like festival of blockbuster and indy Q3 earnings. It’s FAANG time ahead of Halloween and just as the silly Q3 earnings season ramps right up.

Heaps of companies are set to report, but they’re playing on the sidelines compared to the giant electric shadows cast by the Houses of Jobs, Bezos/Mrs Bezos, Gates and the Google guy.

And in the background but certain to be playing on the lizard brains running Wall Street this week, all the latest data on Stateside GDP, US home prices and the usual pot shot measurements of consumer confidence.

But first…

Excited by watching Netflix (add subscribers) or just reinvigorated with false optimism that the Fed might be a little less hawkish after its November meeting, US traders began last week with a burst of bravado, and ended it with a very strong final session on Friday – led by the materials companies and a few of the big financials.

All 11 S&P sectors finished ahead, a bullish response following the previous week’s 12-month lows.

Gotta hand it to those plucky Wall Street traders – they don’t need much encouragement to get their kit off and jump back into the roiling ocean of US risk assets.

By the end of Friday in New York, all of the major US benchmarks took home their biggest weekly bags of bacon since the stutter-crash back of early June, rising circa 5%.

Tech-heavy took the reins, the Nasdaq Composite ending with a gain of 5.2%, spurred by among a solid lineup, an 8% weekly gain for Netflix (NFLX) and an 3.5% recovery in Tesla (TSLA).

The S&P 500 took 4.9% home, and the Dow Jones Industrial Average added 4.8%.

There’s murmurs afoot that tech could merit a momentary revival of fortunes. If so this is the week, as Messrs Apple (AAPL), Alphabet (GOOGL), Amazon (AMZN) and Mr Microsoft (MSFT) are all dropping their quarterly numbers after pricing in some pre-season profit warnings.

Elsewhere, the ticking time bomb of yields on the 10-year Treasury settled at 4.212%. As US officials intervened all over the place, West Texas Intermediate rose 0.5% for the week to US$85.05 per barrel.

Q3 Earnings: Netflix jumps on earnings beat

Netflix added more than 2 million subscribers in the third quarter after stumbling into 2022 with two consecutive quarterly declines — a rebound which sent shares more than 15% higher in after-hours trading Tuesday.

The company expects to win over 4.5m new subscribers in Q4, a bunch more than Wall Street’s forecast of 4m, alth0ugh a conservative target of $7.78bn Q4 revenue is well under the $7.97bn concensus.

Tesla earnings beat estimates, but revenue of $21.45bn for Q3 was the first time TSLA missed quarterly revenue estimates since this time last year. The 56% revenue improvement on Q3 2021 also smashed TSLA’s previous revenue record of $18.76bn in the first quarter.

In some typically snappy repartee, Tesla CEO Elon Musk said he thought the real value of the carmaker was probably worth more than Apple and Saudi Aramco combined.

Snapped!

“As of September 30, 2022, Snap had $4.4 billion in cash, cash equivalents, and marketable securities. Revenue increased 6% to $1,128 million, compared to the prior year. Net loss was $360 million, including restructuring charges of $155 million, compared to $72 million in the prior year.”

That’s putting the problem gently. As Snap stock crashed more than 30% Friday all the above was way beyond weaker-than-Wall-Street expected.

Snap sales grew at its slowest rate since IPO as falling ad revenue, and privacy-policy changes intro’d by Apple complicated ad targeting and performance.

Elon Watch: We’re slashing staff and losing money

According to documents which somehow made their way into the hands of Washington Post journos, claws-out tech-genius Elon is going to start cutting staff he doesn’t like at Twitter just as he did during an earlier rampage at Tesla this year. Elon is sharpening the blade for circa 75% or just over 2000 Twitter employees.

It’s not shocking. A stabby Elon told investors back when he was looking for funding that he’d target the bottom line by taking the scalpel of austerity to the bloated staff situation at Twitter.

Meantime, Elon’s gone and lost around US$110bn according to Forbes. Liquidating some $31bn of TSLA stock to brain Twitter within his ill-advised April (US$44 billion) takeover attempt isn’t at fault.

Forbes included the US$31 billion in his net worth, minus taxes, since the wonderfully pear-shaped deal remains airborne.

It’s not a competition, but the great news for lovers of money and farce is that he’s still richer than all the others – Bernard “l’Heritier” Arnault, Jeff Bezos, Bill Gates – possibly Vlad P, probably not Xi JP.

From his happy place back in November of 2021, when Elon’s bank book topped out at US$320bn, the now less happy net worth of Elon, closely tied to the Tesla stock price, is about US$210bn, TSLA shedding almost half its value from when it became the first company to hit the trillion dollar market cap in late October last year.

Tesla stock ended Friday at US$214, giving it a market value of US$672 billion.

Meantime, here’s some TSLA Tweeting:

10 years of Supercharging.

46 countries.

35k+ stalls.

20 billion miles charged.— Tesla (@Tesla) October 20, 2022

Tech heavy crunch time, Q3 edition

It’s a big week for fans of big tech.

Alphabet (GOOGL)

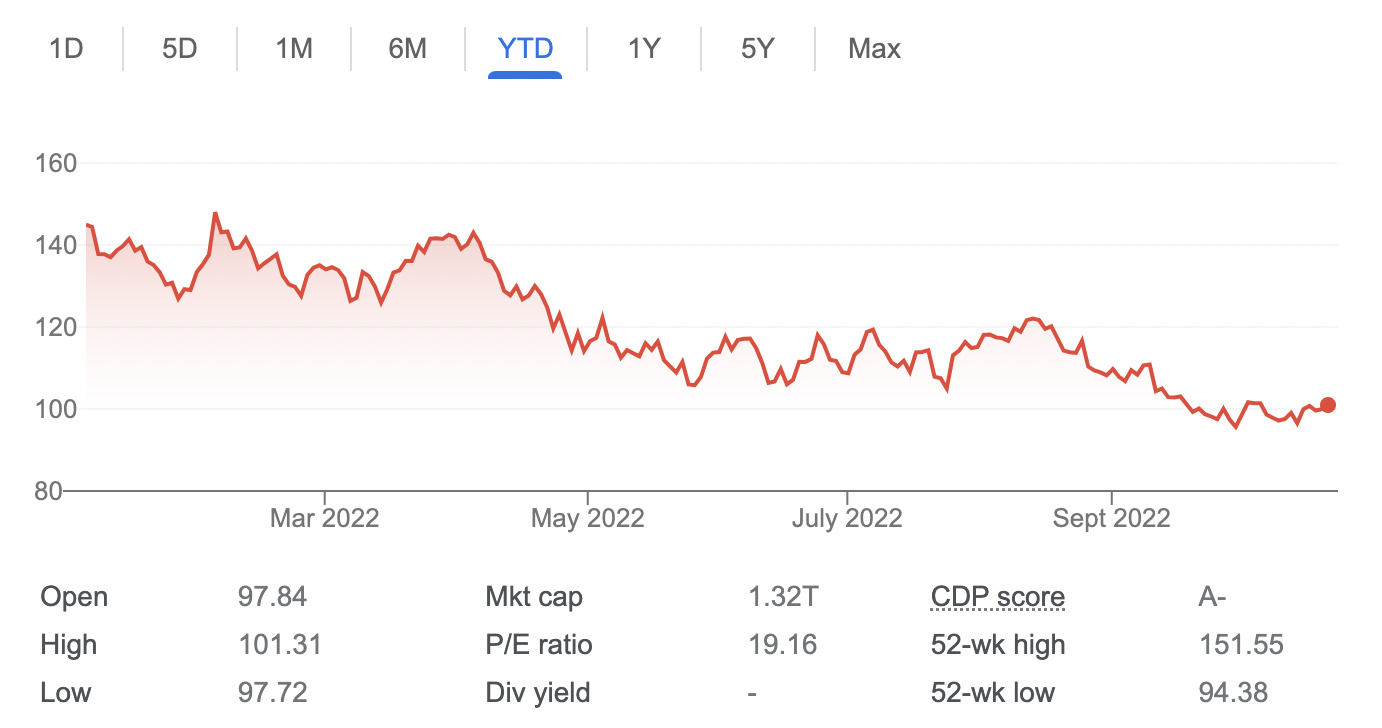

- Alphabet Inc Class A (NASDAQ: GOOGL)

- $101.13 USD -$43.86 (-30.25%) year to date

- Reports after the close, Tuesday, Oct. 25

Wall Street expects (all prices USD):

Alphabet to earn $1.26 per share on revenue of $70.68bn vs Q3 2021 of $1.40 per share on revenue of $65.12 billion.

While the fading cash cow of digital advertising – YouTube ads, Search ads etc – are still the company’s revenue bread and profitability butter, investors will want to see if Google’s cloud business (still less than 10% of GOOG total revenue) can start coming on strong.

Microsoft (MSFT)

- Microsoft Corporation (NASDAQ: MSFT)

- $242.12 USD -92.63 (-27.67%) year to date

- Reports after the close, Tuesday, Oct. 25

Wall Street expects:

Microsoft to earn $2.31 per share on revenue of $49.73bn vs last year’s $2.27 per share on $45.32bn.

Wall Street’s still pretty upbeat and largely bullish on Microsoft, and why not? There is form here. Analysts expect more strength in the quarter ahead of its fiscal 2023 Q1 earnings report; the Azure cloud platform and the Intelligent Cloud business earmarked for growing greatness.

MSFT’s guidance is a referendum of the executive’s sense for growth potential and the company’s ability to navigate through these challenges.

Meta Platforms (META)

- Meta Platforms Inc (NASDAQ: META)

- US$130.01 USD -208.53 year to date

- Reports after the close, Wednesday, Oct. 26

Wall Street:

Meta to earn $1.89 per share on revenue of $27.41 bn vs last year, same time of $3.22 on revenue of $29.01 bn.

Tech sell-offs, Meta doubts and just an uncertain and outgunned looking Facebook founder has seen Meta shares whoop-assed in the vulgar local vernacular.

Meta’s lost 35% since and 61.6% year to date.

On the plus side, Meta stock is listed among Citigroup’s top picks in the Internet space – with a “compelling” risk/reward opportunity at current levels.

Apple (AAPL)

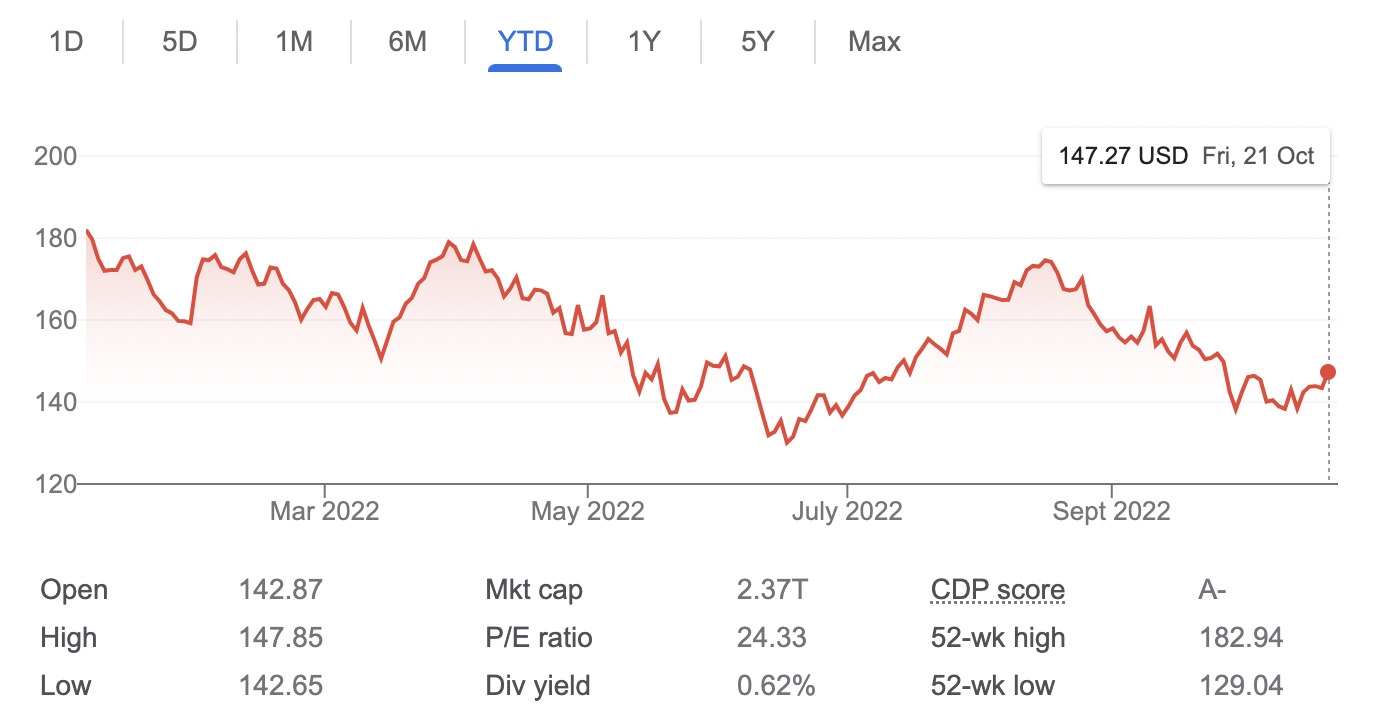

- Apple Inc NASDAQ: AAPL

- $US 147.27 USD -34.74 (-19.09%) year to date

- Reports after the close, Thursday, Oct. 27

Wall Street says:

Apple to earn $1.27 per share on revenue of $88.9 billion vs last year of $1.24 per share on revenue of $83.36 billion.

Last week APPL reportedly cut production of its iPhone 14+ less than two weeks after it debuted on October 7 at a price of $899. However, the iPhone 14 Pro and iPhone 14 Pro Max aren’t seeing production cuts. Apple’s done pretty well this year, considering – it’s done better than the S&P 500 – but investors are seeking direction.

Amazon (AMZN)

- Amazon.com, Inc. (NASDAQ: AMZN)

- $US119.32 USD -51.08 (-29.98%) year to date

- Reports after the close, Thursday, Oct. 27

Wall Street says:

Amazon to earn 22 cents per share on revenue of $127.57 bn vs 31 cents per share on revenue of $110.81 bn.

Amazon’s slowing down on the profit front. That’s adding to share price woes. So are big cap-ex moments – from workforce, research and development, building out data centers and logistics capabilities. That’s behind the Q1 loss of circa $3.8 billion, its first quarterly loss in seven years.

The American economic week ahead

As for any lurking US economic data which might upset the APPL cart… early on, US investors will be all over the Chicago Federal Reserve’s activity index and the S&P’s US manufacturing and US services PMIs. Tuesday features the FHFA monthly home price index, the Case-Shiller home price index and silly consumer confidence; then it’s US home sales, building permits, weekly mortgage applications and the Energy Information Administration’s (EIA) weekly crude stocks.

Thursday will include durable goods, the advance reading on third quarter GDP, and the latest in initial and continuing jobless claims. For a giggle the European Central Bank will also hold a presser following the release of its decision on interest rates. Meanwhile, personal income and consumption, the University of Michigan’s consumer sentiment index and pending home sales will finish out the week for economic data. Thanks to always on duty Eddy Sunarto for the leg up:

MONDAY

US manufacturing, services PMI

China GDP for Q3

China industrial production for Q3

China retail sales for Sep

China unemployment rate

TUESDAY

US house price index for Aug

US Treasury Secretary Yellen speaks

WEDNESDAY

US MBA 30-year mortgage rate

US goods trade balance

US retail inventories

US crude oil inventories

US gasoline production

China industrial profit

THURSDAY

EU’s European Central Bank interest rates decision

US GDP for Q3

US initial jobless claims

US PCE prices

US real consumer spending

FRIDAY

US core PCE price index

US personal spending and consumption

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.