Tech-Heavy: There’s too much temptation out there for Wall Street to stay faithful to The Fed

Via Getty

Wall Street is having its own moment of courage as the week moves toward the pointy end of a terrific swoon of overconfidence.

Because The US Federal Reserve meets to call the next shots vs inflation at the end of January (and on February 1), there’s the blessed relief of no maudlin speeches from the seemingly endless parade of dour Federal Reserve officials for the rest of the month.

And so, Wall St traders appear to be flush with an optimism around the possible slower pace of Fed tightening, easing inflation and despite the enormity of some pretty massive earnings reports about to drop.

The tech-heavy Nasdaq has led a recent charge higher including the last two sessions which IG Market’s Tony Sycamore reckons is its best two-day run since November.

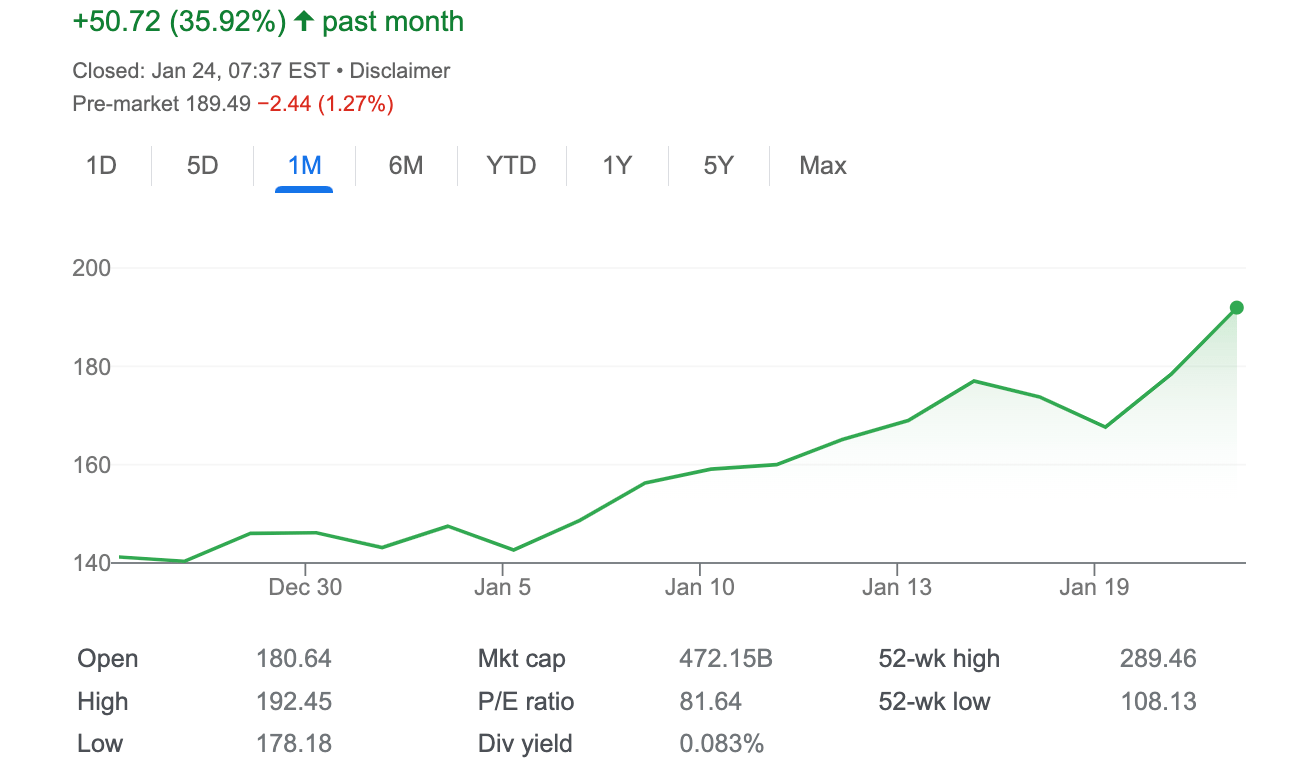

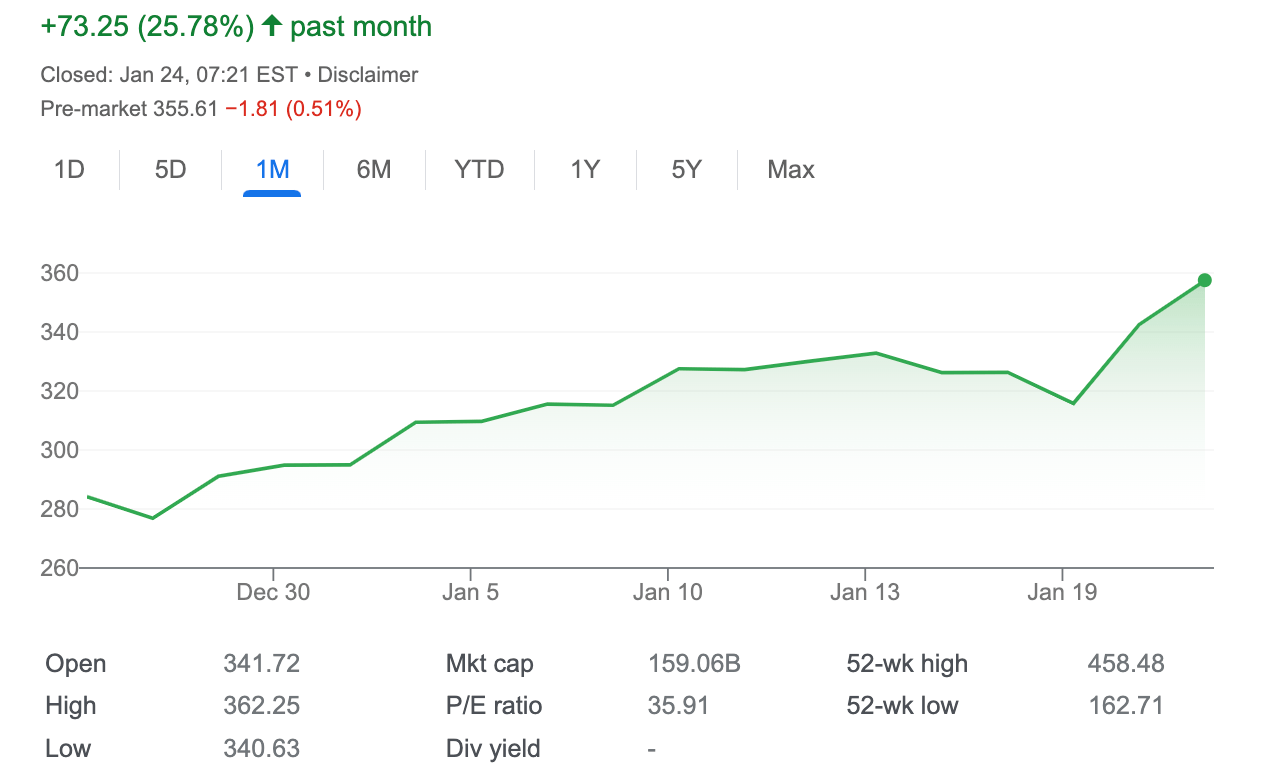

Tesla gained almost 8%, taking its 2-day rally to over 13%, NVIDIA added 7.6% and looking a lot more content, Netflix found another 4.4%.

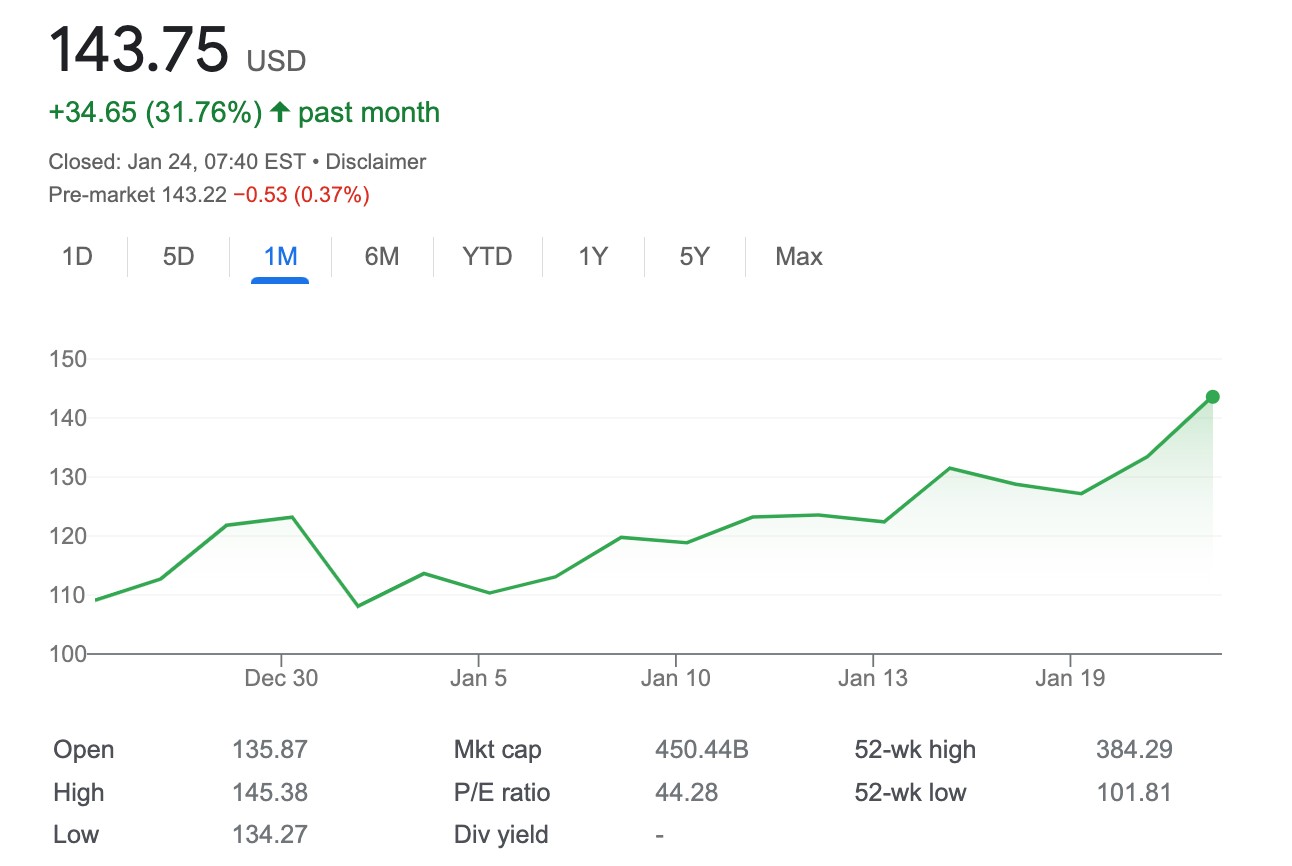

This is what a month has looked like at Tesla Inc NASDAQ: TSLA

A busy few days

Earnings news will keep investors busy and markets volatile in the coming week, as the Federal Reserve’s next rate hike gets closer.

Big tech is also starting to roll out numbers, with earnings due from Tesla which releases its results post-market on Wednesday NY time.

As does a few other heartstoppers in IBM, Intel and Microsoft.

Elsewhere around the S&P 500 there’s circa 75 companies sharing their Q4’s including some familiar brands like Visa, MasterCard, and Johnson and Johnson, as well as some influential industrials, such as Boeing, Union Pacific and Southwest Air

January sets the platform?

“On the other hand, for those who take a more bearish view of the world, there remains a lot to ponder.

“Despite the Fed’s rhetoric that it will raise rates by 75bp above 5% and keep rates on hold for an extended period, the market is not convinced.

“An expected slowdown in growth during the second half of this year has the interest rate market pricing 55bp of rate hikes before the Fed turns in the second half of this year and cuts rates by 210 bp, taking the Fed Funds rate back to 2.75% by December 2024.”

The question now is how to convince the street.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.