Tech Heavy: Some stellar earnings could mollify mega tech’s rotators

Lots of money will solve big tech's conundrum. Via Getty

“Fair is foul, and foul is fair.”

This is the week Wall Street earnings really get cracking – and the swing into company results couldn’t happen soon enough for US traders rattled by the sudden smacking of US mega tech.

The Nasdaq 100 finished last week 4% lower – its worst week of business since about Easter.

Elsewhere, the S&P500 lost 2%, while the Dow Jones ended the week 286 points (0.7%) higher, and the suddenly relevant small cap Russell 2000 gained 1.7%.

A decent set of corporate results over the next week or so could even cauterise the bleeding that was inevitable once the Wall Street rally had narrowed to a handful of stocks.

Last week global equity investors really hit the emergency rotate button – bestowing upon the Magnificent Seven stocks (Alphabet (GOOGL), Apple (APPL), Amazon (AMZN), Meta (META), Microsoft (MSFT), Nvidia (NVDA) and Elon’s Tesla (TSLA) – the dubious honour of enduring the greatest 5-session sell-outs per market cap for a handful of companies in history.

On Thursday alone, the Magnificent Seven saw its aggregate market cap drop by circa US$600bn.

Together, according to Dow Jones market data, the seven tech majors were clipped of a collective US$1.13 trillion, while the S&P500’s Tech index has lost circa 6% during the last week of tempestuous rotation.

A few stonking Q2 earnings could help stop the rot for both Wall Street and the seven companies that have more or less driven it.

Tesla, Alphabet, Microsoft and Apple are the first of the biggest guns to storm the battlements this season.

This week, five heavyweight tech names report their earnings, creating some short-term uncertainty: Microsoft (MSFT US) and Alphabet (GOOGL US) on the 23rd, Apple Inc (AAPL US) and Meta (META US) on the 24th, and Amazon (AMZN US) on the 25th.

All five of these household names have surged higher in 2024: AAPL +23%, MSFT +25%, AMZN +32%, GOOGL +37%, and META +53%, making profit-taking an “easy option” for investors – note these were their respective gains before recent dips.

However, all of these companies generate huge profits and have bank balances that make many countries envious. For example, in its first-quarter 2024 earnings report, AAPL announced the largest stock repurchase in US history, a whopping buyback of $110 billion.

Ed Clissold: Something bullish this way comes

T’was the June CPI report of a few weeks back which solidified the odds of an earlier start to the Fed’s easing cycle and changed the market mood enough to think: rotate.

Trump’s sore ear and the Republican nominee’s subsequent widening lead in presidential polls effectively reduced the other major 2H 2024 unknown: political uncertainty.

The combo triggered a shift from the narrow mega tech rally of the past year, to small cap and value stocks.

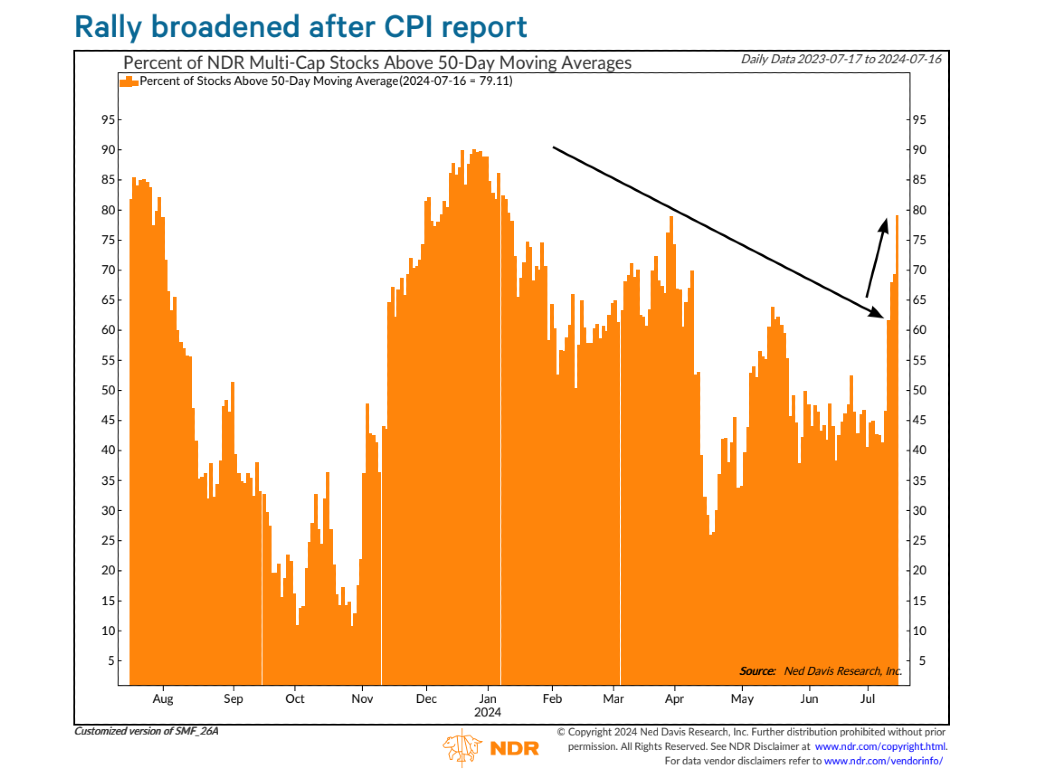

And over the past week, says Ed Clissold, Chief US strategist for Ned Davis Research, the breadth of equity buying in the US has “improved sharply”.

“One of the bears’ most common arguments was that the rally has been driven by a handful of stocks… the more pertinent question is whether underperforming stocks are falling in price or merely rising at a slower pace.

“For most of the year, the answer was the latter, but by early July objective breadth measures indicated the rally had narrowed.”

Clissold notes that for every peak in the S&P 500 in 2024, the percentage of stocks above their 50-day moving averages was lower than the previous high.

The broad nature of the rally in the past week just broke the breadth downtrend, Ed says.

Exhibit A:

The current percentage of stocks above their 50-day averages is at its highest level since January, according to NDR.

So that’s a win. We’re sharing the love beyond seven stocks.

Or is it?

David Rosenberg: a manic market becoming unglued

Yet, the dark and stormy trading of last week re-awoke in some the formerly buried Trauma of 2000 when the dot-com bubble went kaput.

Famed American strategist David Rosenberg told clients on Friday that there’s now a few similarities linking today with what was happening back in 2000 – namely overheated investor sentiment baked into an overvalued market.

“The massive daily swings reflect a manic market becoming unglued. The action is highly reminiscent of what happened in the immediate aftermath of the Nasdaq rolling off the bubble highs in March 2000,” the founder of Rosenberg Research said.

Rotational wounds are hard to close and by late in the week the blood loss for mega tech was hard to miss.

The Nasdaq lost circa 3.65% for the week as Nvidia and friends accelerated lower. The chipmaker lost more than 8% last week, while Microsoft dropped 3.6% and Alphabet a 4% tighter shrinkwrap.

The week ended at Stockhead Central as it did for anyone near a windows operating system, following what anyone older than the internet knows (in their bones) is the single worst “malfunction” of a routine software update. Ever.

Delivered with the love and tender care of a DC supervillain and the cosmic irony of Catch-22 by the cybersecurity outfit CrowdStrike (CRWD) the ordinary update did to everyone exactly what everyone’s been paying the cybersecurity outfit to stop from happening… but on a wonderful, terrifying new scale.

The ensuing global IT meltdown left governments, airlines, banks et al staring at the “blue screen of death” on inert computers in the historic faux pas.

“This is basically what we were all worried about with Y2K, except it’s actually happened this time,” Aussie internet security boffin Troy Hunt suggested via X.

This is basically what we were all worried about with Y2K, except it’s actually happened this time ☠️

— Troy Hunt (@troyhunt) July 19, 2024

Ahead of the world-beating outage, the good Dan Ives at Wedbush Securities tagged at least four of the Mag 7 to deliver standout earnings in the next days.

Citing Microsoft, Alphabet, Amazon, Meta Platforms and Palantir (PLTR), Dan said Wedbush believe US 2Q earnings will be a ‘major positive’ catalyst for the tech sector.

“We expect tech stocks to be up another 15% for the year adding to the robust tech gains in 1H 2024 as now the broader tech growth story takes centre stage led by software, cyber security, digital advertising, and semis,” Ives wrote.

In the coming quarters Ives reckons US AI-leaning mega tech stocks remain likely to accelerate both growth and earnings as the “AI Revolution” outperforms Wall Street expectations.

“In a nutshell, our tech field checks globally show cloud deployments and enterprise AI spending is tracking nicely ahead of Street expectations which bodes well for Big Tech names into this key earnings season.”

Elsewhere – and remember this note was circulated a day or so ahead of MSFT/CrowdStrike circus – (so with weird prescience) Ives highlighted cyber security firms amid the prime standouts for earnings season on Wall Street.

Those were Zscaler (ZS), Palo Alto Networks (PANW), Cyberark (CYBR), Checkpoint (CHKP), Tenable (TENB) and CrowdStrike… which is about 20% cheaper on Monday.

The economic calendar for the week will be relatively light, with the focus on the latest personal income and outlays update for June. That report will contain a reading on the Federal Reserve’s favourite inflation gauge. For more on the economic calendar see below.

Spotlight: US earnings

Welcome again to peak quarterly earnings in the States, with some rather large and significant names releasing quarterly figures.

On the tech side of Wall Street, Alphabet and Elon Musk’s Tesla will probably grab the most attention alongside Spotify on Tuesday.

Midweek, it’s back to the banking heavyweights like Deutsche Bank.

Comms Services are led out by AT&T, a week after its announcement of a hack that exposed information on “nearly all” of its customers.

Vanilla Coke inventor Coca-Cola (KO) drops numbers Tuesday.

Exciting.

Q2 earnings and IPO highlights:

Monday

Verizon (VZ) and NXP Semiconductors (NXPI).

Tuesday

Alphabet (GOOG) (GOOGL), Tesla (TSLA), Visa (V), Comcast (CMCSA), The Coca-Cola Company (KO), Texas Instruments (TXN), Philip Morris (PM), United Parcel Service (UPS), Lockheed Martin (LMT), General Motors (GM)

Wednesday

Likely IPO – OneStream (OS), Likely IPO – Actuate Therapeutics (ACTU), IBM (IBM, AT&T (T), Chipotle Mexican Grill (CMG), General Dynamics (GD), and Ford (F)

Thursday

The Nasdaq (NDAQ), AbbVie (ABBV), Northrop Grumman (NOC), Union Pacific (UNP), AstraZeneca (AZN)

Friday

Bristol Myers Squibb (BMY), Colgate-Palmolive (CL)

The Economic Calendar

Monday July 22 – Friday July 26

MONDAY

Thailand Market Holiday

China (Mainland) Loan Prime Rate (Jul)

Mexico Retail Sales (May)

United States Chicago Fed National Activity (Jun)

Germany Retail Sales (May)

TUESDAY

South Korea PPI (Jun)

Canada New Housing Price Index (Jun)

Eurozone Consumer Confidence (Jul, flash)

United States Existing Home Sales (Jun)

WEDNESDAY

Australia Judo Bank Flash PMI, Manufacturing & Services

Eurozone HCOB Flash PMI, Manufacturing & Services

US S&P Global Flash PMI, Manufacturing & Services

South Korea Consumer Confidence (Jul)

Canada BoC Interest Rate Decision

United States New Home Sales (Jun)

THURSDAY

South Korea GDP (Q2, adv)

Turkey TCMB Interest Rate Decision

United States Durable Goods Orders (Jun)

United States GDP (Q2, adv)

United States Wholesale Inventories (Jun, adv)

FRIDAY

United States Core PCE Price Index (Jun)

United States Personal Income and Spending (un)

United States UoM Sentiment (Jul, final)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.