Tech-Heavy: Major US retailers to report as consumer sentiment crashes and credit card debt nears US$1trn

Via Getty

American markets lacked direction, cohesion and conviction last week. They have unresolved issues, there’s little doubt.

Actually, doubt is one thing they have in spades.

The latest University of Michigan consumer sentiment read dropped like a tonne of roofies Friday, dragging the fan favourite index all the way back to November 2022, when it was around 57.7.

Doesn’t sound awful, yet compares woefully to general expectations of a Ritalin-laced 63.0.

The Dow Jones Industrial Average posted its second straight week of losses. The previous weeks’ heroes the new villains – Messrs Apple (AAPL), Salesforce (CRM) and Microsoft (MSFT) – all turning to the dark side without much pressure applied.

Next door, the S&P 500 index also endured a second straight week of declines, while the tech-heavy Nasdaq Composite slipped 0.4% on Friday, but stayed aloft for the week by about the same.

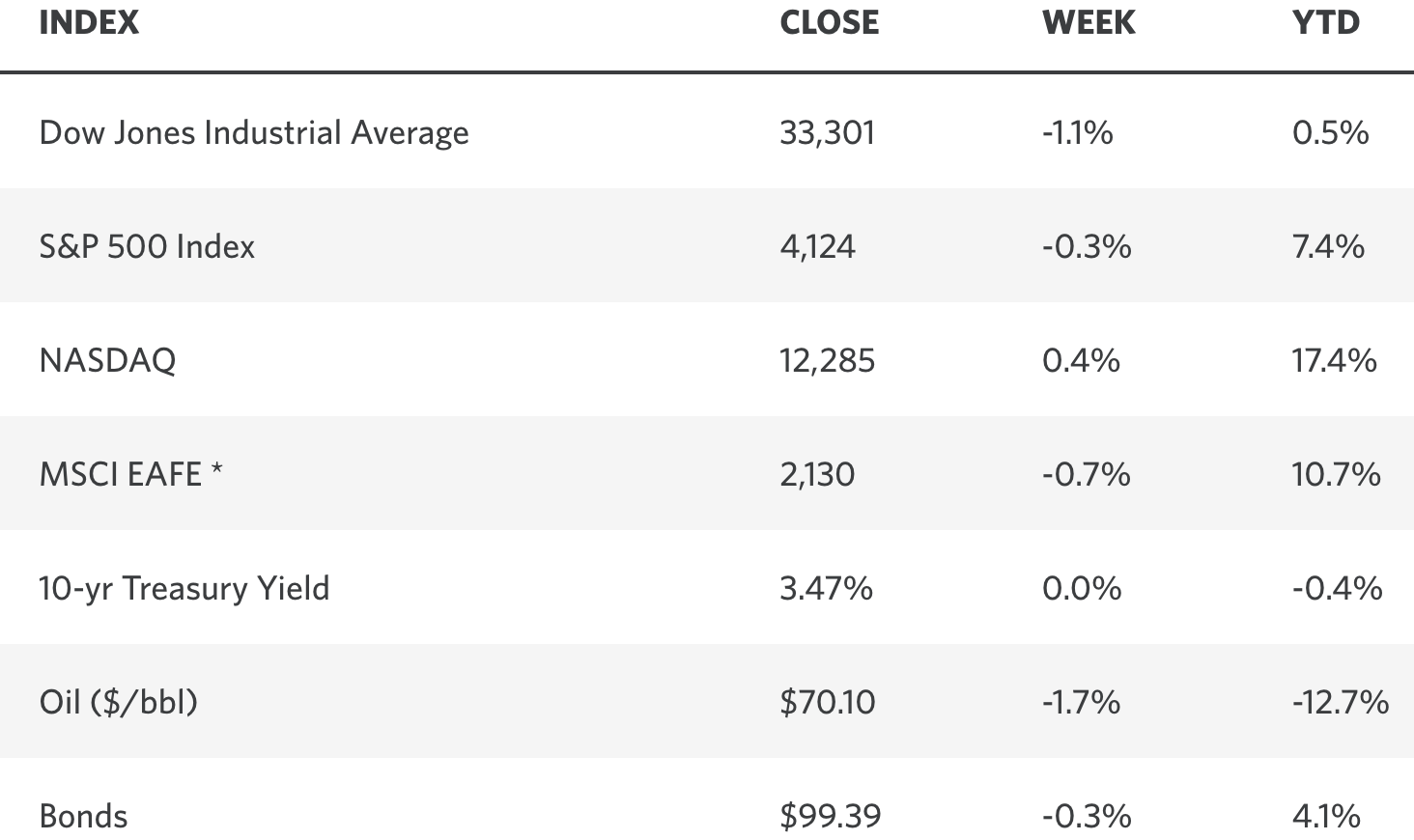

Tale of the tape

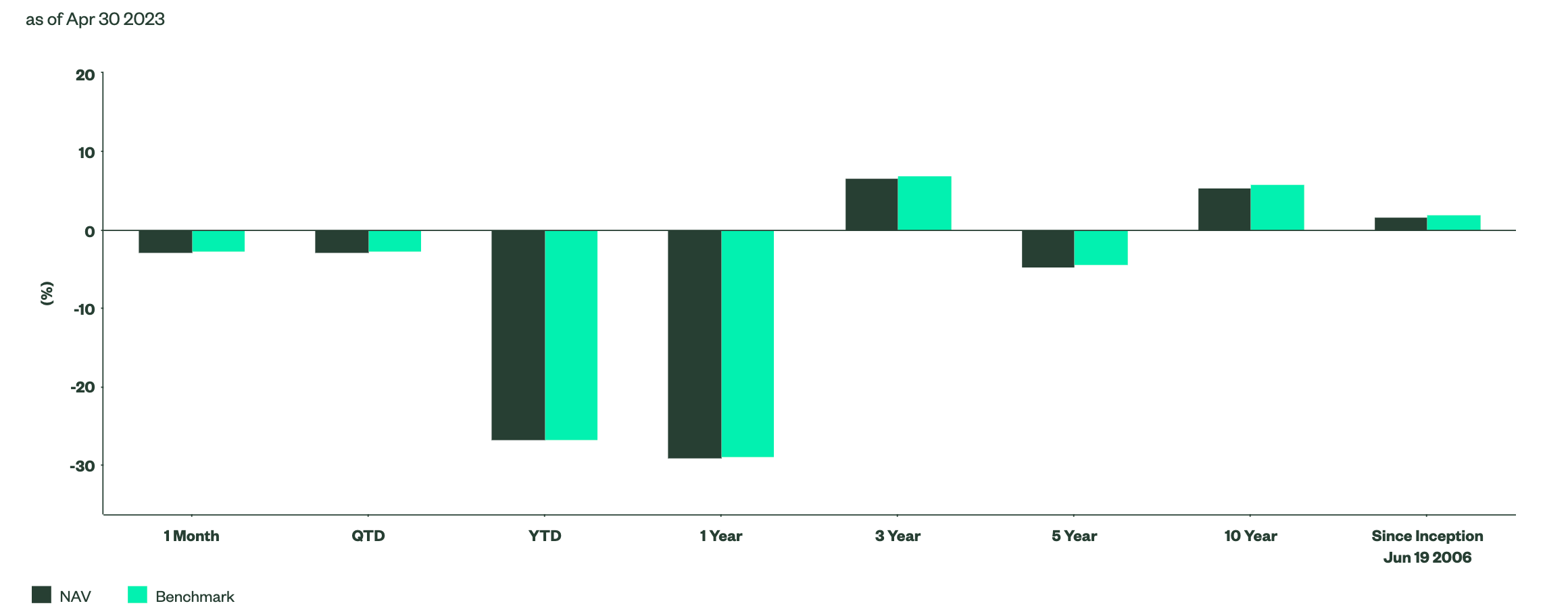

The lack part of the S&P 500 lustre was led by ongoing bleeding from the regional banks, inflation and fears about just how many bullets are left in the guns of The Fed still haunt, if not hinder the urges of US investors. I thought a measurement of the SPDR S&P Regional Banking ETF (KRE) (or the spider as ppl should call it) would help.

The KRE Spider dropped 0.4% on Friday to take its 12 month losses to 38%.

Qtr Fund Performance: SPDR S&P Regional Banking ETF

Last week the Fed thought: why bloody not? And hoisted the US interest rates to its most painful price in 16 years or so.

“To fight rising costs, one must also become rising costs.” I think that was Nietsche.

The Federal Reserve increased its key interest rate by 0.25 percentage points – its 10th hike in 14 months.

The US benchmark rate is now between 5% and 5.25%, up from circa nothing (near zero) back in March 2022.

“When you look into the abyss, the abyss also look into you.” That one’s definitely Nietsche. But while it sounds cool, unfortunately it contains no useful or applicable philosophical or financial value.

In the US, higher rates have sharply raised borrowing costs, spurring a slowdown in sectors such as housing and playing a role in the recent abyss-staring of over stretched regional US banks.

Federal Reserve chair J Powell dropped a lead during the post match conference that this might be the last rate rise for a while.

Not that I expect Wall Street to listen to my advice, but it’s a string I wouldn’t tug at.

The bank started raising interest rates aggressively last year when prices in the US were soaring at the fastest pace in decades.

Higher interest rates make money cost more. More expensive to buy, borrow or build. So when The Fed lifts these costs, the payback is The Fed expects demand to cool, so other costs are less expensive. Kapiche. Also unemployment should go up, which is now great.

The European Central Bank believes in the plan too. It raised rates last week, but by a smaller amount than in its previous months of savagery.

Disney’s missing streams of blood

The wonderfully evil American multinational mass media and entertainment conglomerate we call The Walt Disney Co, admitted its flagship streaming service Disney+ lost 4 million subscribers during the first three months of 2023.

Disney copped some stick in mags like Variety as well as a decline in its share price after revealing it was playing second fiddle to Netflix which can boast some 232.5 million streaming subscribers at the end of Q1.

Exciting, but not to watch.

Disney’s streaming business cut operating losses to US$660m. That’s somehow a win because everyone thought it’d lose over US$850 million, but actually it’s less than half of the losses recorded over the last two quarters.

All this comes not even a year after Disney won the so-called streaming war by sucking in over 221 million subscribers in like 20 mins or so.

But anyway, this all begs the question: why?

Disney’s streaming platform is boring, pointless and a cash vortex sucking up everything fiscal nearby and it’s doing it while the sector – nay, the entire economy – is in financial chaos. Now it’s removing films and TV shows from its the platform (to make it emptier?)

As a cost-cutting measure it sounds great, only that it won’t cut costs, but analysts crunching numbers predict this all smacks of amortisation and such of near US$1.8 billion in further penalties.

Personally, I find Disney content lacking in explosions and human body parts, which stakeholders are likely hoping will be an issue addressed at the upcoming AGM.

Meanwhile, shares of Upstart Holdings Inc (UPSH) vaulted 40% higher on Tuesday after the under pressure US lender delivered an upbeat outlook for the current period even as its revenue for the latest quarter came in at a third of what it was a year before.

“Despite the headwinds facing our industry, we secured multiple long-term funding agreements, together expected to deliver more than $2 billion to the Upstart platform over the next 12 months,” Chief Executive Dave Girouard said.

Elon Watch

Tesla will hold its annual meeting at Gigafactory Texas on Tuesday. Optimism is improving that Elon will return his terrifying energy back into Tesla after finding someone to oversee his ongoing destruction of Twitter.

Wall Street Earnings

Sadly for me, Q1 is far from done. The season continues unabated this week with US retailers showing their hands.

US retailers have struggled over the past several months amid rising inflation and rising interest rates which have adverse impacts on consumer spending. The likelihood of a recession is another reason for concern when investing in retail given the fear that consumers will spend less.

Home Depot (HD) reports on Tuesday, and before the market opens Chinese giants Baidu and Tencent Music Entertainment drop.

On Wednesday it’s Target (TGT).

Walmart (WMT), Alibaba (BABA) and Ross Stores (RS) publish their results on Thursday.

Wall Street expects Walmart to earn US$1.19 per share on revenue of US$135.23 billion. Vs a year ago when earnings came to US$1.30 a share on revenue of US$141.57 billion.

Deere (DE) does Q1 on Friday.

The economic week ahead

It’s a good one for fans of Fedspeak. As for Fed speeches, Federal Reserve Bank of Cleveland President Loretta Mester, Federal Reserve Bank of Atlanta President Raphael Bostic, Federal Reserve Bank of Chicago President Austan Goolsbee and New York Federal Reserve President John Williams will also spill beans.

Economic releases will include retail sales and housing-market data. The economic-data highlight of the week will be the Census Bureau’s retail sales data for April on Tuesday. Consumer spending forecast to rise 0.7% from a month earlier, Vs a decline of 0.6% in March.

Other funky US data highlights are several indicators of the US housing market: The National Association of Home Builders’ Housing Market Index for May on Tuesday, the Census Bureau’s new residential construction data and the National Association of Realtors’ existing-home sales for April on Thursday.

Initial jobless claims, the Philly Fed business index, existing home sales and the Conference Board’s Leading Economic Index for April on Thursday are all handy indicators to keep an eye on.

Finally, Fox Business is reporting that Americans are drowning in credit card debt as chronic inflation makes the cost of everyday necessities more expensive.

The New York Federal Reserve Bank’s Quarterly Report on Household Debt and Credit, due last night our time (on Monday morning in the US), is expected to show credit card debt exploded to an insanely historic US$1 trillion in the first two months of the year.

That’ll make the previous high of US$986 billion appear like change of the loosest kind.

“The credit card is the cigarette of the financial world,” someone on Fox Business said while I was listening.

So good.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.