Tech-Heavy: It’s Tesla time as Q3 earnings drop and Elon faces Federal investigation

Via Getty

US stocks had another head-slapping, teeth-rattling, edge-of-your-seat red-hot-go at staying above water last week and one can say, without hyperbole, that it went as well as swimming with sharks in turbulent waters without the right inflationary tools.

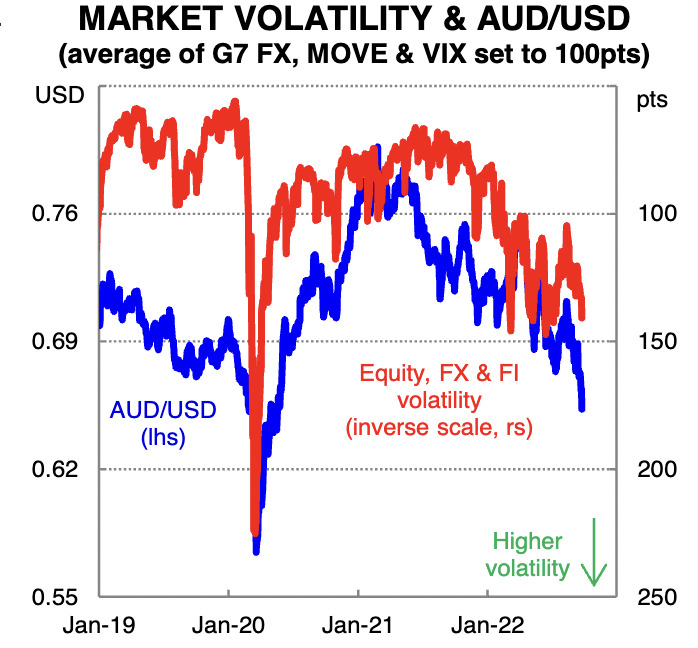

If I were to check the market’s fear gauge, I can see the VIX volatility index hasn’t even looked like slipping below the psychological 30 for the last five straight sessions, telling me these are indeed volatile times.

To oil prices, which plummeted again the stupid strength of the US dollar helping reverse the previous week’s gains.

No one seems to mind, but the Hang-bloody-Seng cracked a more than decade low last week after 3 or 4 days of brutal selling. Chinese tech shares suffered most particularly under the fresh onslaught of Washington’s checkmate on Chinese chipmakers.

Global Indices until Friday 15th, October:

US-listed Chinese shares slinked to more than 1-year lows.

Now, many of America’s biggest and ugliest banks delivered earnings on Friday – among them the big lenders and investors like JPMorgan, Wells Fargo, Citigroup, and Morgan Stanley.

By the time this motley crew cracked open their mixed bag of numbers, Wall Street’s wettest has been paddling in a directionless whirl from the Monday set piece before sinking Tuesday and Wednesday under the burden of interest rate and recessionary fears, culminating in a terrifying intraday Poe-like pendulum swing for all 3 indices on Thursday, only to regain it all and then lose it all and more on the altar of yet another technical bounce before finally US markets, US traders and the adolescent US optimism within which they so often ensnare themselves sank silently into the obscure depths of a US Friday/Sydney morning teeming with shonky bank earnings, a US 10-year bond yield above 4% and the consequent machinations of rebooting inflation expectations.

The Nasdaq led the Friday falls, down over 3%; the Dow Jones, adding to the confusion, finished higher for the week.

All of this spent energy left the combined US markets down a total 1.6% for the week. EU shares rallied like EU shares do, up 0.1%, and then closer to home Japanese markets lost interest and 0.1% while Chinese mainland markets found a full percent.

Given the difficulty of successfully locating the anus of the *ursus marketus and with major US indices snuffling around at 12-month lows, there’s a few trigger events which might upset the maudlin macro mood further.

At 4pm US Futures were pointing to a positive open to the trading week:

In the bank

US banks en masse reported the joys of revivifying consumer trade: There’s still money to be had from flogging credit and debit cards to Americans determined to keep spending until the world ends or everything just costs too much in an inflationary economy.

At JP Morgan, America’s biggest bank grew its overall revenue by 10% on the same time last year, higher interest rates making Q3 a net interest income bonanza, with the money it makes from lending money minus the money it loses by paying interest up over 33%.

Investment bankers are less chuffed as revenues crashed on the absence of the things which make investment banking fun – lot’s of money needing help, mergers, acquisitions … mergers and acquisitions.

Morgan Stanley reported investment banking revenue was down well over 50%, overall revenue 12% lower.

The week ahead

First we’ve got some major US tech company earnings this week.

Netflix is to report its third-quarter earnings on Wednesday, followed by Tesla on Thursday.

On the economic data front, investors will take in industrial production and the National Association of Homebuilders’ housing market index.

Other highlights for the states include housing starts and building permits, weekly mortgage applications and the Energy Information Administration’s weekly crude stocks.

Minneapolis Fed president Neel Kashkari will do a Q&A on “Inflation, Interest Rates and the State of the US Economy.

Chicago Fed president Charles Evans will talk to current economic conditions and monetary policy on Wednesday.

China won’t bother to hit pause on its fulsome party congress when its zero-COVID flavoured Q3 GDP numbers rattle global investors. later this week either.

(For full macro event details, see below.)

Currency Affairs

The greenback is a monster.

It’s roaming free. It could eat the Yen first. The USD/JPY hit a 33-year high on Friday.

The pair accelerated surging to 148. 75 after the BOJ reiterated its preferred policy, referred to as ultra-loss monetary policy. Seems the said exchange rate intervention by the BOJ had little impact on the Yen.

Meanwhile, the little Aussie dollar has picked up ground against the USD but only after some heavy losses.

According to our mates at the CBA, the Aussie outlook remains ordinary until at least Christmas.

US Q3 earnings highlights:

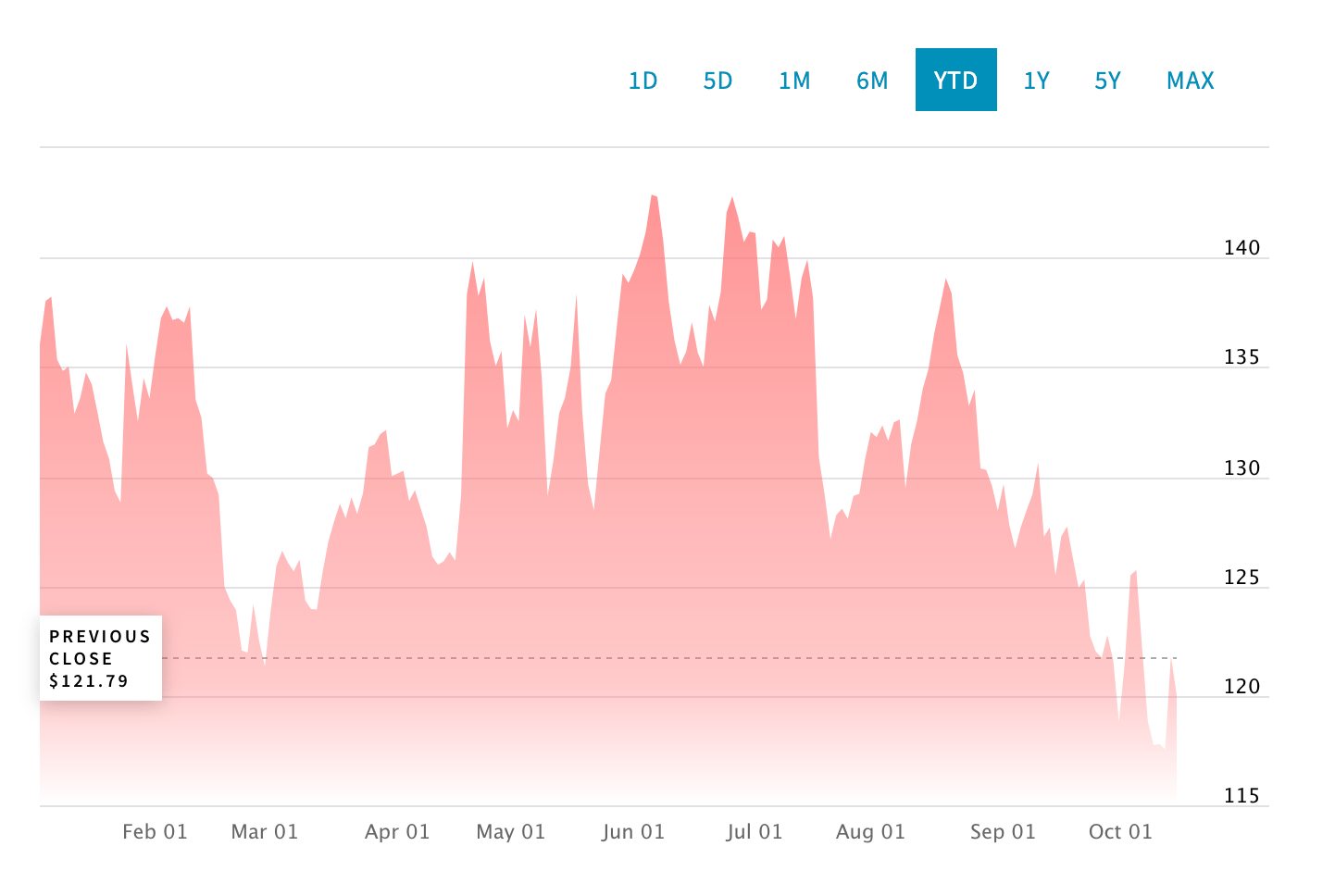

The streaming service Netflix will be dropping its earnings after the close on Tuesday. The value of NFLX stock jumped after its Q2 results thanks to a less-disastrous-than-expected subscriber bleed and on news it has plans for the lower-cost, ad-rich tier to its roster in November.

We’re watching Netflix (NFLX)

As for Netflix’s Q3 results, Wedbush analyst Michael Pachter is targeting subscriber growth of 1.45 million, higher than management’s forecast for 1.0 million new subscribers. Additionally, “we expect Netflix to maintain guidance for 2022 free cash flow of roughly $1 billion, with annual positive free cash flow going forward, and substantial free cash flow growth in 2023 vs. 2022,” Pachter says.

The street has NFLX down for a Q3 earning of $2.13 per share, down 33.2% year-on-year, revenue at $7.8 bn, up 4.8% over the year-ago figure.

IBM is up

Wall Street analysts reckon IBM will hit $1.78 per share on revenue of $13.5 bn.

Last year it was $2.52 on $17.6 bn.

IBM’s latest results reveal operational improvements are delivering decent revenue growth across the ever-evolving computer maker’s diversified bag of business tricks.

Add in a 4.9% dividend yield and we can understand why dad’s put IBM in both growth and divvy bags for the kids.

While the company has struggled to grow revenues over the past decade vs a field featuring the likes of Amazon (AMZN) and Microsoft (MSFT) IBM’s cloud progress is good to grow following the Red Hat acquisition, but analysts say IBM will need to show some continued operating leverage and revenue growth to nail it this week.

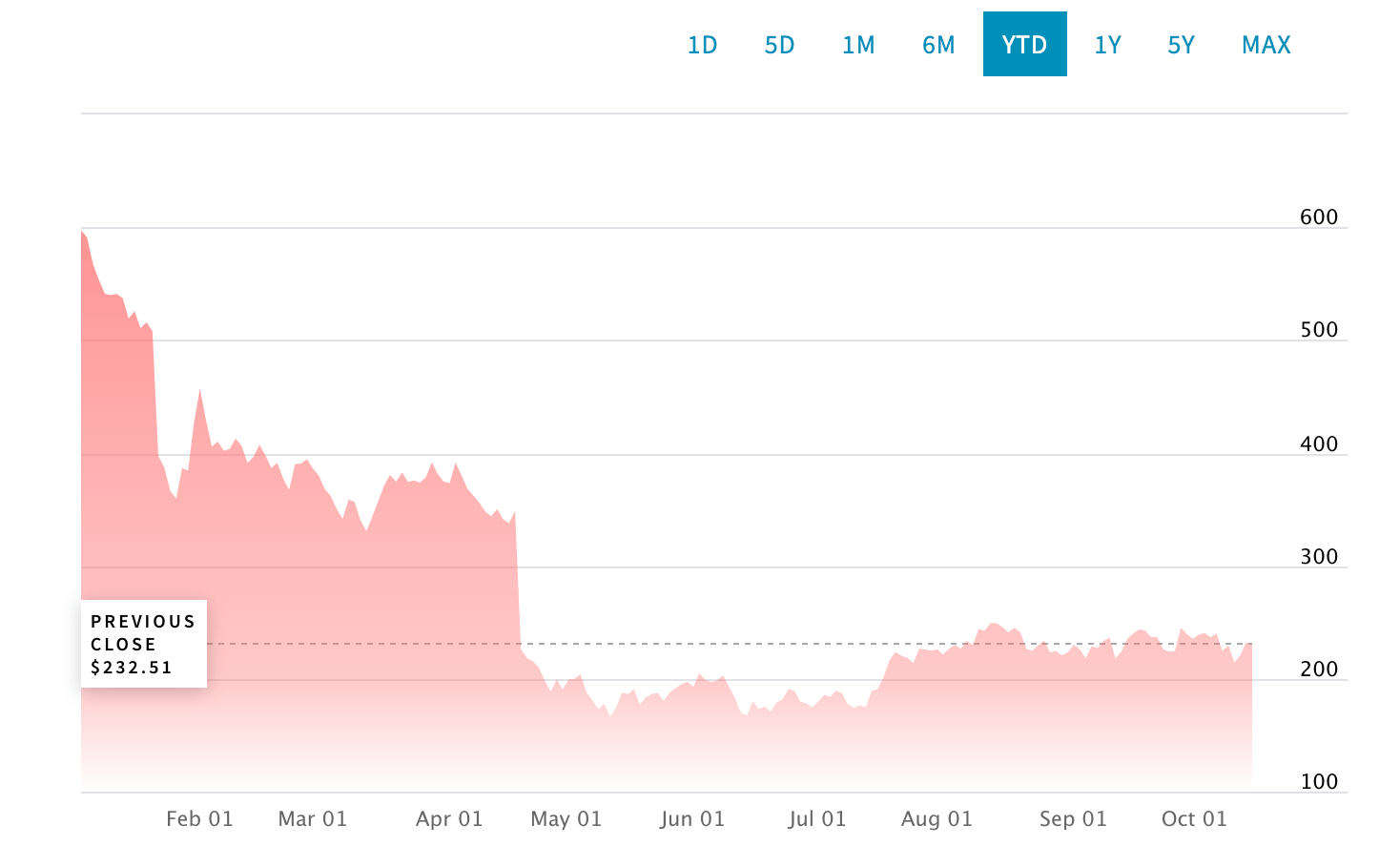

Time for Tesla

Tesla (TSLA) CEO, extrovert and founder Elon Musk has been distracting one and all with his headline stealing antics and his on-again, off-again dance with tech-frenemy and sometimes absurd social media platform Twitter (TWTR).

For once this week, the focus of financial markets will be laser-like-linked to his EV maker when it lifts the hood on its third-quarter earnings on Wednesday.

The company already reported lower-than-expected Q3 deliveries earlier this month, which sent shares tumbling nearly 9%. Still, Wells Fargo says that the third-quarter likely focuses on the Inflation Reduction Act, with Tesla being “the biggest beneficiary” of the legislation thanks to its generous expansion of tax credits.

The street predicts earnings of $1.00 a pop for Tesla’s Q3, down 46.2% from last year. Revenue is projected to touch $22.1 billion (+61.3% YoY).

And some Elon Watch

Elon could be in for some more legal spillover now the feds are keen to investigate his antics over the $44 billion deal for control of Twitter.

The investigation was revealed in a US court filing made public on Thursday about the latest in ongoing legal disputes between the billionaire and the social network.

As the man himself said on Saturday in some space-X stuff quite unrelated:

Main parachutes have deployed pic.twitter.com/VctlKDAraT

— SpaceX (@SpaceX) October 14, 2022

The Week in Macro

MONDAY

US Empire State manufacturing index for October

TUESDAY

China GDP for September quarter

US industrial production for September

US NAHB housing market index

WEDNESDAY

EU monthly CPI for September

China new home prices

US housing starts and building permits

US Fed Reserve Beige Book (update on regional US economic activity)

THURSDAY

China loan prime rates

US Philadelphia Fed manufacturing index for October

US exisiting home sales

EU current account for August

EU leaders’ summit

FRIDAY

EU consumer confidence

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.