Tech Heavy: HSBC calls Musk ‘a charismatic CEO with a cult-like following’ just in time for Elon, The Movie

Via Getty

News is out about Elon, The Movie.

We have the opening 5 seconds:

first scene of that elon musk movie leaked pic.twitter.com/KfGzuQPrfe

— Mike Scollins (@mikescollins) November 11, 2023

Meantime, the major US averages will begin their week tonight, coming off a second straight week of gains after Wall Street got its groove back on Friday night in New York. Big time.

The S&P 500 rose +1.3% last week, while the Dow Jones and tech heavy Nasdaq improved circa +0.7% and +2.5%, respectively.

Among the benchmark sectors, Tech took topline honours, rising sharply thanks to Microsoft’s 2.5% sprint, which sent the tech giant to an all-time highs during the session.

As ever, Wall Street’s been itching for any reason to leap back into the nearest mega-cap tech stocks.

Friday presented an ideal opening, with Apple (APPL), Alphabet (GOOG), Amazon (AMZN), Meta Platforms (META) and Tesla (TSLA), all ensuring the rally was all about the tech, baby. Thanks in part to the flat-assedness of toppy US bond yields, in the wake of a disrupted and poorly received 30-year Treasury auction. (QED: local futures were up only 25 points after our benchmark index closed Friday still well under the 7,000 mark at 6976.)

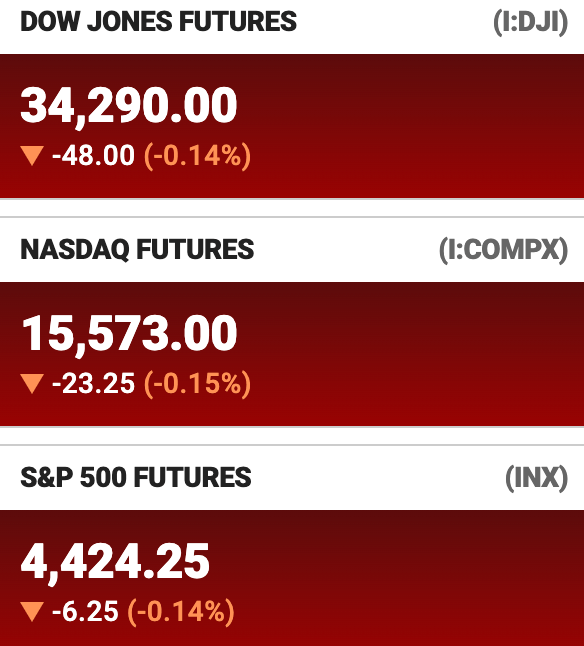

Futures on Wall Street were lower on Sunday night after the ratings agency Moody’s lowered its US credit rating outlook to Negative from Stable.

Futures tied to the S&P 500, the Dow Jones Industrial Average and the Nasdaq were all around 0.15% lower in New York.

Moody’s expects America’s “fiscal deficits will remain very large, significantly weakening debt affordability” for some time to come.

Meanwhile, according to October data from trading platform SelfWealth, in the US, Tesla (NASDAQ: TSLA) remained the favourite among traders on Selfwealth.

On US stocks, Selfwealth CEO Craig Keary says Tesla maintaining its position as the platform’s preferred stock despite the company’s recent price dip and earnings miss reflects the resilience apparent in the US economy.

October’s most traded US stocks

“This kind of robust trading activity, which increased by 80% month-on-month, along with a rising buy-to-sell ratio, is a testament to the confidence our investors have in the EV market’s long-term potential.

“Similarly, Bank of America’s (BAC) performance impressed Selfwealth investors, evidenced by its climb to become the fourth most traded US stock and the significant uptake in buying interest post-earnings.”

Elsewhere in US tech, Rivian (RIVN) trades surged, even as its valuation fell by a third, following a US$1.5 billion bond offering, with investors buying into the dip, and popular ‘Reddit’ stocks like IONQ (IONQ), AMC (AMC), and Marathon Digital (MARA) also caught traders’ interest.

Elon Watch

Space X on X

Falcon has delivered over 1000 tons to orbit this year, a world record https://t.co/ieJFOeaAdY

— Elon Musk (@elonmusk) November 11, 2023

Elon: The Movie

We’re betting on Leo to land the plum role of Elon in ‘Midsommar’ director Darren Aronofsky’s upcoming Elon biopic announced to the world on Friday.

As we slept in Sydney on Saturday morning, NBC News reported that the super-cool, super-indie studio A24 had just snagged the rights to Walter Isaacson’s salacious, if slightly obedient biography of the man who made Tesla and SpaceX and X.

NBC says a deal was struck ‘after a highly competitive bidding war involving multiple studios and filmmakers.’

So the man who gave us Brendan Fraser in The Whale could do worse than give us Leonardo DiCaprio as Elon. The only better choice would be Elon.

Tesla: The Coverage

Tesla stock crashed on Thursday largely because HSBC Global initiated coverage on the carmaker with a “Reduce” rating and a measly US$146 price target.

At one stage the share price was more than -6% down after the bank suggested the stock was overvalued and that Elon himself was a major problem.

The surprisingly bearish note, likely to be a collectors item regardless of its accuracy, began this way:

“Tesla is more than a very expensive auto company…. Elon Musk’s global fame has afforded the group a customer awareness that far outweighs the money it has spent on marketing and advertising, which is therefore a tangible benefit to the [profit-and-loss]… Leaving aside the current legal issues Elon Musk faces, we think his prominence presents a considerable ‘singleman’ risk at the group.”

HSBC called Elon Musk both an asset and a risk – ” a charismatic CEO with a cult-like following” who “feeds into the innovator narrative, which underpins (TSLA’s) value”.

HSBC says much of Tesla’s hype is baked into the share price already – ignoring the downside risk of its ambitious future tech projects, be it Artifical Intelligence, trucks, batteries, driverless systems, humanoid robots or supercomputers.

“Arguably the ideas need to become reality to support the current share price,” HSBC warned. “Significant delays or developments that show lack of technological and/or regulatory feasibility for a commercial launch of these projects pose a significant risk for Tesla.”

And goodness me, the short interest in Tesla is piling up.

Investors worldwide are placing bets against Elon’s toy cars at almost US$19 billion, or 3.03% of the stock’s entire float, according to data from S3 partners.

The Week Ahead in the US

It’s actually a bit of a festival of diplomacy this week, which could easily come back to bite or boost US markets.

The American and Chinese leaders, Joe Biden and Xi Jinping, will meet and greet on the sidelines of the Asia-Pacific Economic Cooperation (APEC) forum in San Francisco on Wednesday for their second in-person get together as respective presidents – they only met face to face for the first time last year at the Bali G 20.

There’s a lot at stake. They’ll want to get the official communication channels back open for one. Then there’s China’s horseplay in the South China Sea, with Russia, in the Philippines over the weekend and of course, China’s scary military behaviour in, around and over Taiwan. Beijing, meanwhile, will want to turn around some of the crippling tech conditions being placed upon it by the White House’s isolation from American technology.

Meanwhile, the Israel-Gaza conflict continues. It’s Palestine Independence Day on Wednesday, so brace for some global organising.

Rupert Murdoch steps down as News Corp chair following today’s annual shareholders meeting, becoming chairman emeritus.

On the economic front, the October consumer price index US CPI and PPI figures will be closely watched in the coming week for assessment of the Fed’s ongoing fight with inflation.

US CPI will be especially important as investors wonder aloud if inflation has cooled enough for the Federal Reserve to ease its tightening grip after keeping US rates on hold for a second straight time in November.

According to consensus, October’s headline CPI is expected to slow from September’s 0.4% month-on-month (m/m) print while core CPI may show some signs of stickiness around 0.3% m/m. S&P Global

S&P Global Intelligence says the US PMI selling price index – which preludes the trend for official CPI – further fell at the start of October, ‘reinforcing the consensus for the lowering of inflationary pressures.’

There’ll also be some excitement around the US retail sales and industrial production data this week and the direction these figures are likely to provide both the US central bank and the Wall St traders watching it.

US Earnings

The earnings calendar for the week ahead includes reports from retail giants Walmart (WMT), Target (TGT), and Home Depot (HD), while investor events scheduled for DraftKings (NASDAQ:DKNG), Roblox (NYSE:RBLX), and Guidewire Software (NYSE:GWRE) have the potential to jolt shares.

Alibaba (BABA)

Wall Street consensus has Alibaba earning US$2.12 per share on revenue of US$30.79bn vs US$1.81 per share on revenue of $28.95bn for the PCP.

In and out of favour, the Chinese tech giant is smack bang in the middle of its mega annual 11/11 Singles Day sales festival. The stock is currently trading at around US$82, uo circa +40% from its most recent low of $58.

However Chinese tech names remain mired in uncertainty – thus the 33% fall BABA’s endured since June and let’s recall that the Jack Ma-less giant remains a shadow of ita former self. It’s still short about -70% in the three years since China’s began its tech crackdown, a period in which the S&P 500 index has gained more than +20%.

The company is poised to catch up amid China’s more relaxed regulatory scrutiny of big tech platforms, which is something that has impacted BABA’s operations for the past three years.

The rubber is hitting the road on the company’s looming breakup – the hefty conglomerate will become six individual segments, including splitting off its cloud division.

Adding to the uncertainty factor is the news ex-CEO Daniel Zhang is getting offloaded to run BABA’s cloud unit, although he resigned from that post in September.

Monday, November 13 – Tyson Foods (TSN) and Tower Semiconductor (TSEM)

Tuesday, November 14 – Home Depot (HD), Sea Limited (SE), On Holding AG (ONON), and Vipshop (VIPS)

Wednesday, November 15 – Cisco (CSCO), TJX Companies (TJX), Palo Alto Networks (PANW), Target (TGT), JD.com (JD), Babcock International HY, Coface Q3, Foxconn Q3, Getty Images Q3, Home Depot Q3, Sumitomo Mitsui Financial Group HY and XPeng (XPEV)

Thursday, November 16 – Walmart (WMT), Alibaba (BABA), Applied Materials (AMAT), and Macy’s (M)

Friday, November 17 – BJ’s Wholesale Club Holdings (BJ) and Spectrum Brands (SPB)

The Everyone Else Economic Calendar

Monday November 13 – Friday November 17

Source: Commsec, Trading Economics, S&P Global Research, AMP

MONDAY

Singapore, Malaysia Market Holiday

Japan PPI and Machine Tool Orders (Oct)

Turkey Current Account (Sep)

India Inflation (Oct)

Germany Current Account (Sep)

United Kingdom Regional PMI (Oct)

United States Consumer Inflation Expectations (Oct)

Global Business Outlook (Oct)

TUESDAY

India Market Holiday

New Zealand Food Inflation (Oct)

India WPI (Oct)

United Kingdom Labour Market Report (Sep)

South Africa Unemployment (Q3)

Eurozone Employment Change (Q3, prelim)

Eurozone GDP (Q3, 2nd est.)

Eurozone ZEW Economic Sentiment Index (Nov)

Germany ZEW Economic Sentiment Index (Nov)

United States CPI (Oct)

WEDNESDAY

Brazil Market Holiday

Japan GDP (Q3, prelim)

South Korea Trade (Oct)

China (Mainland) Industrial Production, Retail Sales, Fixed

Asset Investments (Oct)

China (Mainland) Unemployment Rate (Oct)

China (Mainland) 1-Year MLF Announcement

Indonesia Trade (Oct)

Japan Industrial Production (Sep, final)

Germany Wholesale Prices (Oct)

United Kingdom Inflation (Oct)

Eurozone Industrial Production (Sep)

Eurozone Balance of Trade (Sep)

United States PPI (Oct)

United States Retail Sales (Oct)

United States Business Inventories (Sep)

THURSDAY

Japan Trade (Oct)

Japan Machinery Orders (Sep)

China (Mainland) House Price Index (Oct)

Philippines BSP Interest Rate Decision

United States Industrial Production (Oct)

FRIDAY

Singapore Non-oil Domestic Exports (Oct)

Malaysia GDP (Q3)

United Kingdom Retail Sales (Oct)

Eurozone Inflation (Oct, final)

United States Building Permits (Oct, prelim)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.